Weekly Gaming Reports Recap: October 21 - October 25 (2024)

Southeast Asia started to spend more time in games after 2023; Circana released a September report of the US market; subscription services don't affect the way games are made.

Reports of the week:

Famitsu: The Legend of Zelda: Echoes of Wisdom tops Japan's physical sales chart in September 2024

Wall Street Journal: PlayStation 5 sales outpace Xbox Series sales by more than 2 times

Mariusz Gąsiewski (Google): Mobile Market in the first 3 quarters of 2024

Omdia: Subscription Services don't impact the way games are designed

Niko Partners: Gaming time increased by 53.2% in the 6 largest gaming countries of Southeast Asia

MIDiA Research: Most PC and Console gamers prefer single-player games

Circana: The U.S. Gaming Market Declined by 6% YoY in September 2024

Mordor Intelligence: The African gaming market will reach $3.72B by the end of 2029

StreamElements & Rainmaker.gg: Game Streaming in September 2024

Famitsu: The Legend of Zelda: Echoes of Wisdom tops Japan's physical sales chart in September 2024

Game Sales

The Legend of Zelda: Echoes of Wisdom sold over 200,000 physical copies in its first four days of sales in September. It outsold its nearest competitors by more than twice as much, even considering that many other titles had been on sale for the entire month.

Gundam Breaker 4 secured second place. The Nintendo Switch version sold 68,000 copies, with nearly 62,000 more added from the PS4 and PS5 versions. This is better than the 2018 release New Gundam Breaker (106,000 physical copies lifetime) but lower than Gundam Breaker 3 (190,000 physical copies in its first month). However, back then, digital versions were less popular.

18 out of the top 30 games were new releases. Umamusume: Pretty Derby – Party Dash had a strong start with over 50,000 copies sold, as did Visions of Mana (54,000 copies on PS4 and PS5) and Astro Bot (35,000 copies).

Mario Kart 8 reached a significant milestone, surpassing 6 million physical copies sold in Japan.

Hardware and Accessories Sales

50% of September's sales were for the Nintendo Switch OLED model, with 193,647 units sold.

The PlayStation 5 was purchased 60,427 times, accounting for 15.6% of the total volume.

Wall Street Journal: PlayStation 5 sales outpace Xbox Series sales by more than 2 times

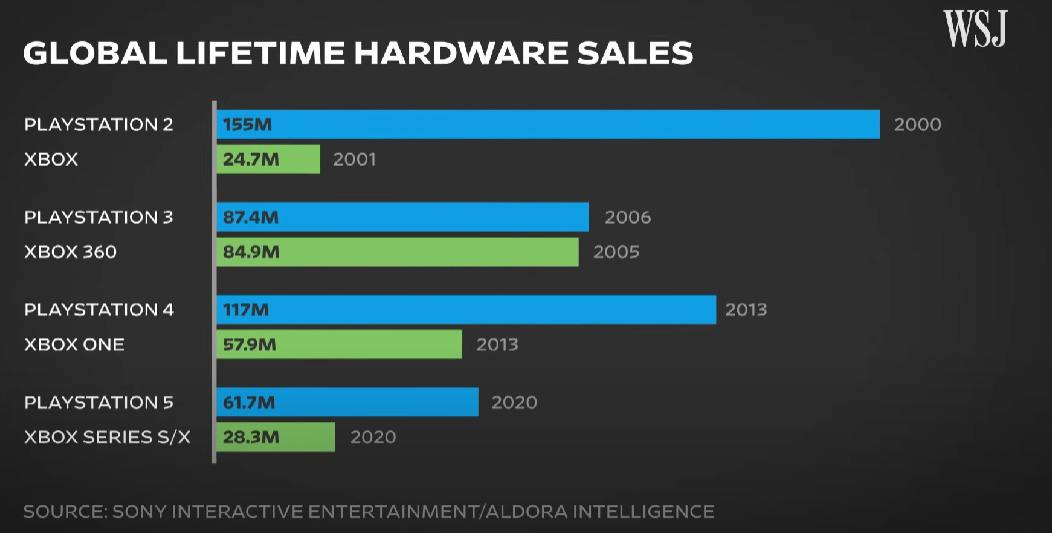

WSJ used data from the analytics company Aldora.

Aldora reports that by mid-2024, 28.3 million Xbox Series S|X consoles had been sold.

At the same time, Sony reported 61.7 million consoles sold as of June 30 this year, resulting in a sales difference of 2.18 times.

In the previous generation, the PlayStation 4 outsold its competitor by 2.02 times (117 million PS4s compared to 57.9 million Xbox Ones).

Mariusz Gąsiewski (Google): Mobile Market in the first 3 quarters of 2024

Mariusz often shares insights into the mobile market on his LinkedIn page.

Overall gaming market situation

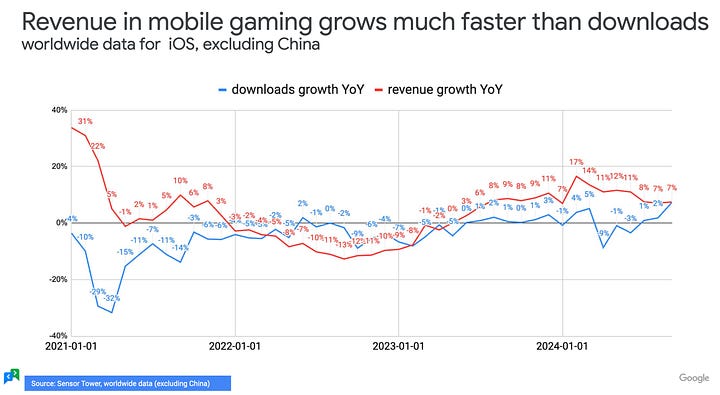

Revenue on iOS has been growing since the beginning of the year. Although the growth rate has slowed to 7% per month, the positive trend has continued since mid-2023.

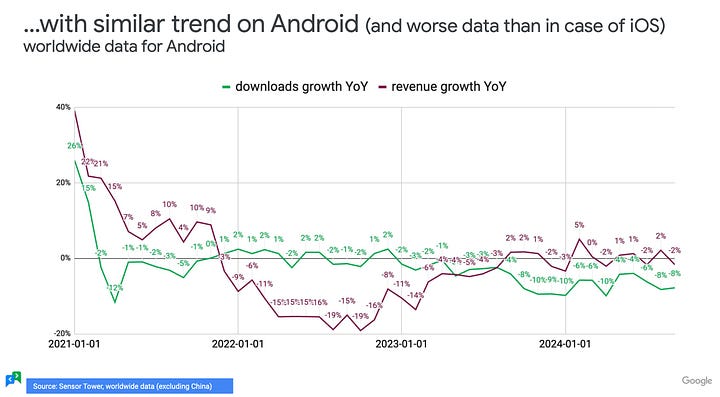

At the same time, revenue growth on Android is struggling. Periods of slight growth are followed by periods of slight decline. Overall, game revenue on Android has remained at the same level throughout 2024.

As for downloads, the situation is more clear-cut. On Android, there is a consistent decline in downloads that has been ongoing since early 2023. On iOS, audience growth is in the negative zone, but there are signs of a potential increase.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

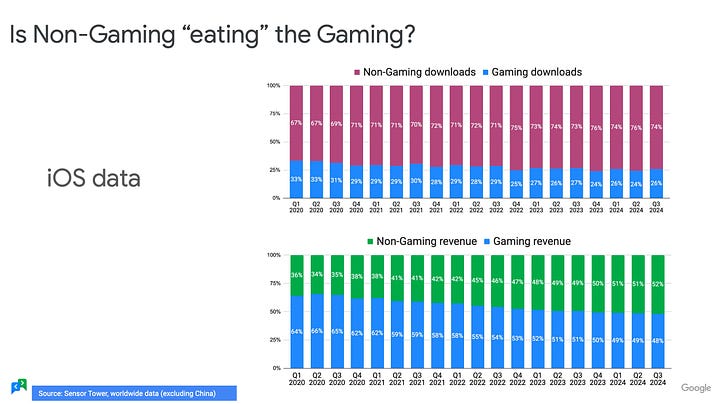

Gaming Apps vs. Non-Gaming Apps

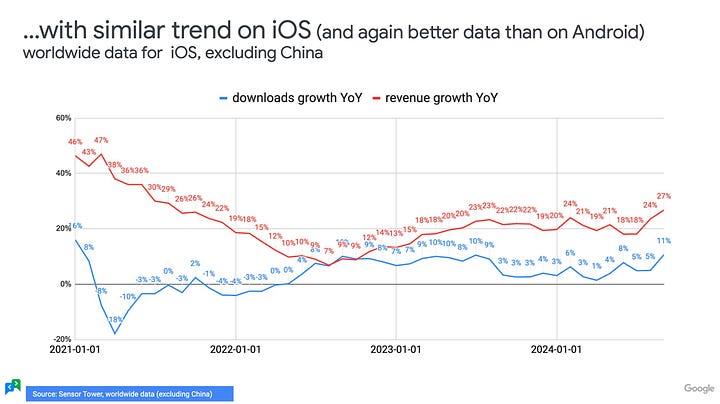

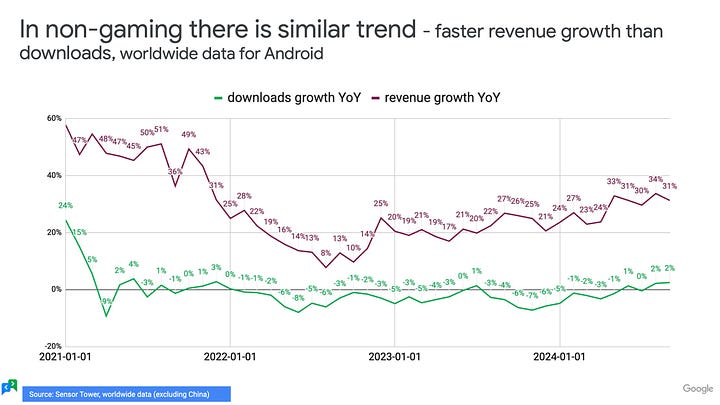

Non-gaming apps are seeing revenue growth on both iOS and Android.

Downloads on iOS are slightly decreasing, while on Android, they are growing.

Many in the industry are discussing how non-gaming apps are taking revenue away from games. The share of non-gaming app revenue has been steadily increasing over the past four years. However, the share of downloads has not grown as significantly over the same period.

It's hard to say whether the growth of non-gaming app revenue is hurting games. But it is clear that non-gaming apps are growing faster than the gaming market.

Omdia: Subscription Services don't impact the way games are designed

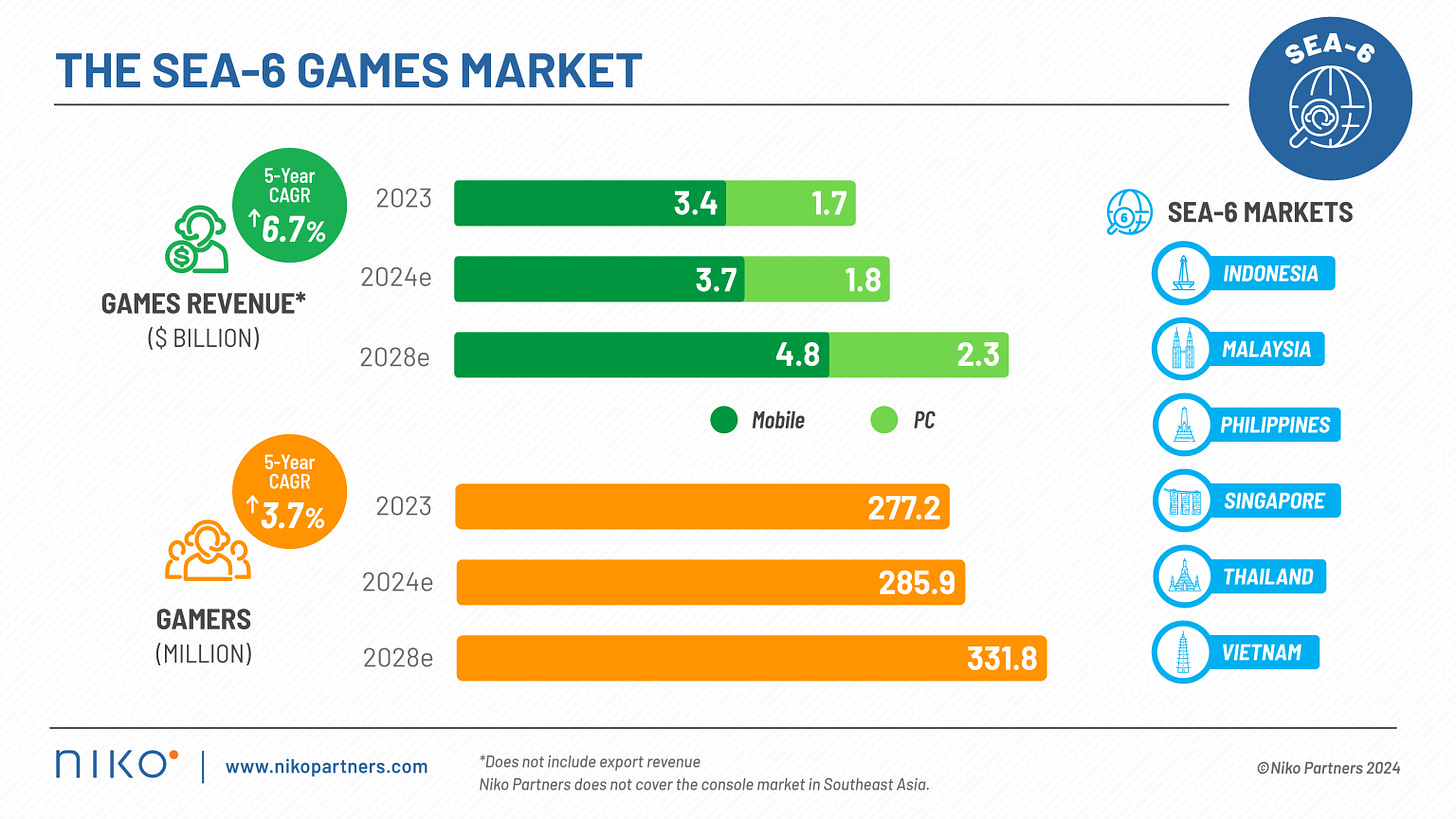

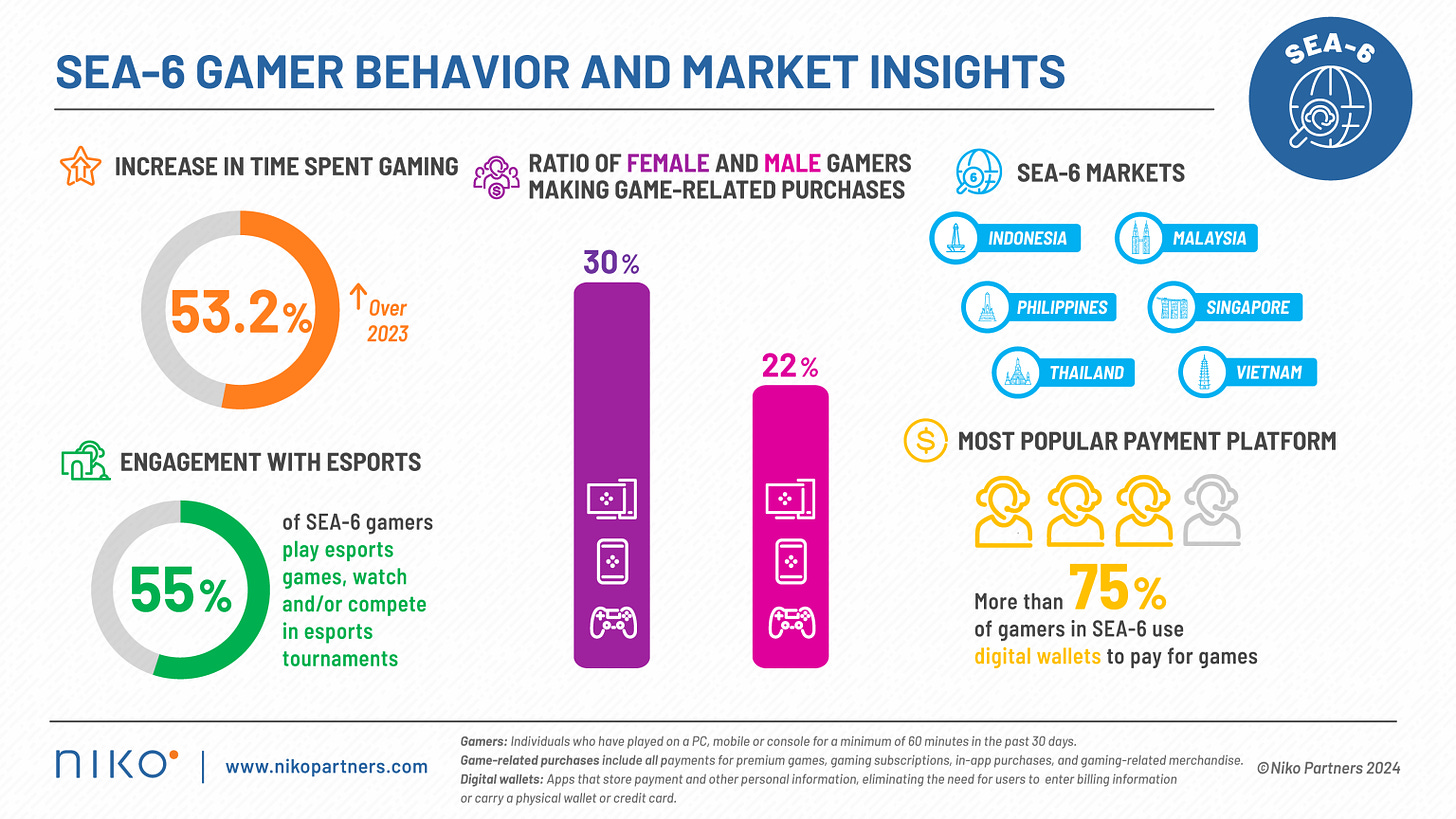

Niko Partners uses the abbreviation SEA-6, which refers to the markets of Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

Overall markets condition

By the end of 2023, the gaming market volume in these six countries reached $5.1 billion (+8.8% YoY). In mid-2023, Niko Partners predicted it would grow to $5.8 billion.

In 2024, the market volume is expected to increase to $5.5 billion, and by 2028, it could reach $7.1 billion, with a projected annual growth rate of 6.7%.

Niko Partners anticipates that by 2028, there will be 332 million gamers in these six countries—equivalent to the entire population of the U.S. today.

By the end of 2024, SEA-6 will have 285.9 million gamers (+3.2% YoY).

Thailand and Indonesia have the highest growth rates in gaming revenue. Niko Partners also advises including localization for these languages, and it is important to localize for Vietnam as well.

Games developed by local studios are actively supported by players and the local press.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Player Behavior in SEA-6 Countries

In 2024, players spent 53.2% more time in games than in 2023, with the biggest increases in Thailand and Vietnam.

More than half of the gamers in SEA-6 countries engage with esports. The most popular games in the region have esports components.

Women are more likely to make in-game purchases (30%) than men (22%).

Issues of representation and accessibility are important to players in the region.

Payments in SEA-6 Countries

More than 75% of gamers use digital wallets for in-game payments.

Players over 25 years old tend to use cards, while younger players (under 21) prefer to pay in cash (e.g., through retail outlets).

Play-to-Earn and Crypto Games in SEA-6

Play-to-earn mechanics are appealing in the region, except in Singapore. These models are particularly popular in Malaysia, the Philippines, and Thailand.

Overall, the Web3 market is actively developing in the region.

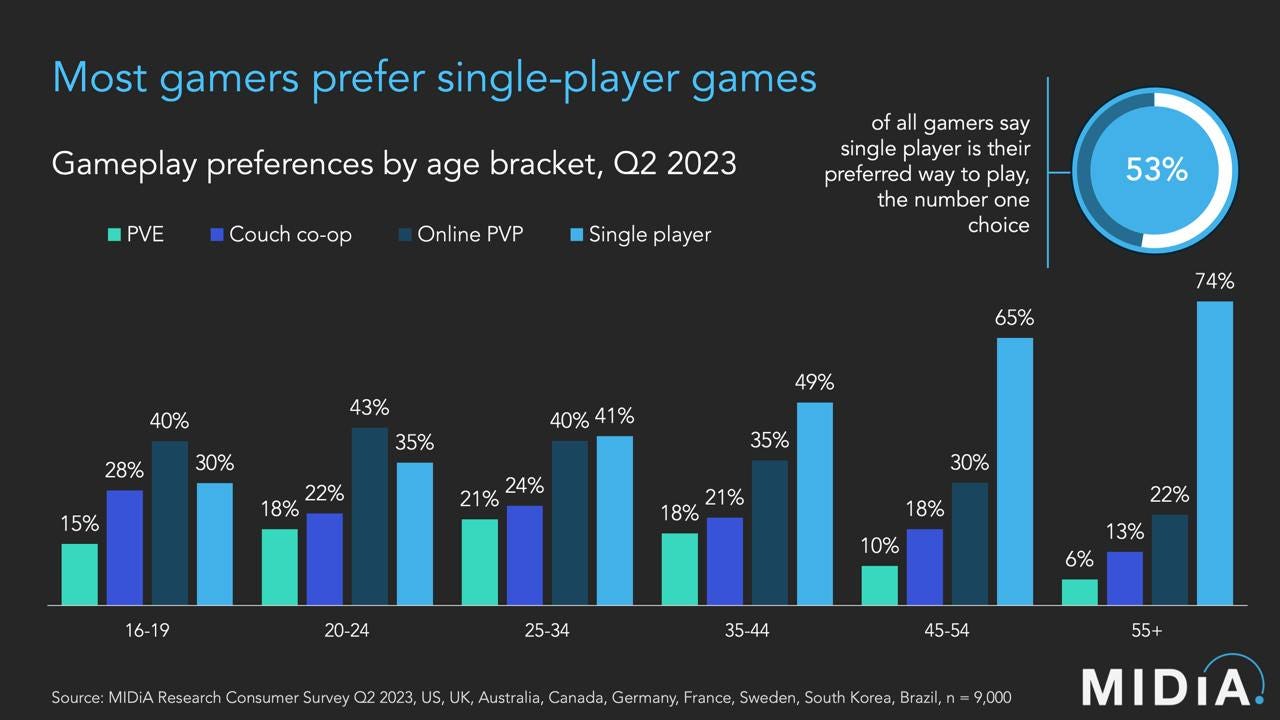

MIDiA Research: Most PC and Console gamers prefer single-player games

The company surveyed 9,000 gamers in the second quarter of 2023 across the U.S., U.K., Australia, Canada, Germany, France, Sweden, South Korea, and Brazil.

On average, 53% of gamers prefer single-player games.

There is a noticeable correlation: the younger the gamer, the more likely they are to play multiplayer games (especially online PvP). The older the gamer, the greater their interest in single-player games.

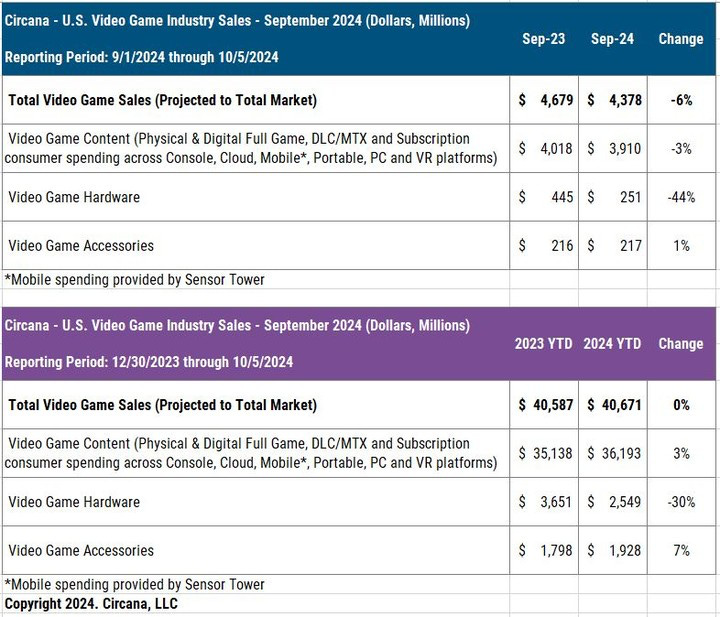

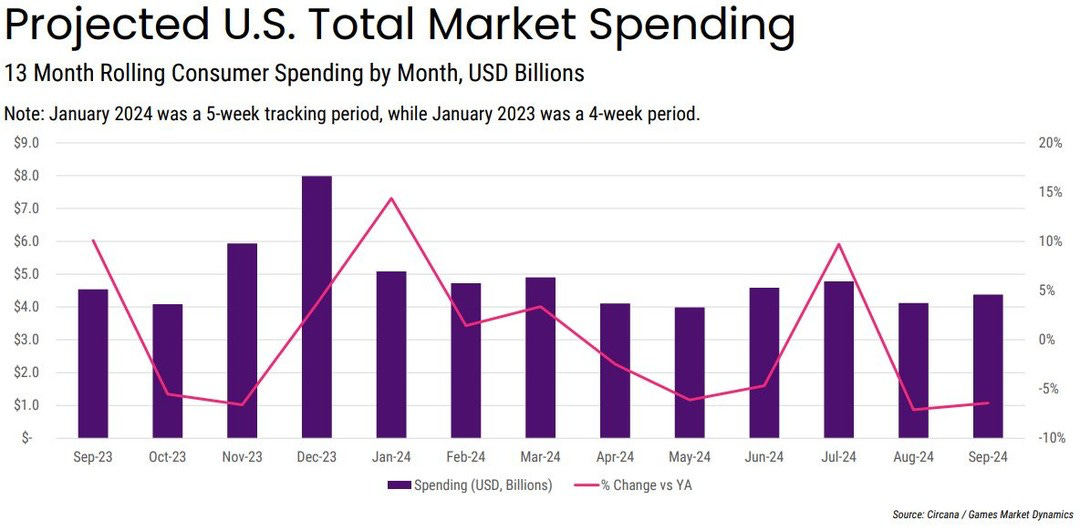

Circana: The U.S. Gaming Market Declined by 6% YoY in September 2024

Overall market status

Content sales in September dropped by 3% compared to last year, amounting to $3.91 billion.

Hardware sales plunged by 44%, falling to $251 million, marking the lowest figure since September 2019.

The biggest drop was seen in Xbox Series S|X sales (-54% YoY), followed by PlayStation 5 (-45% YoY) and Nintendo Switch (-23% YoY).

Despite the decline, PS5 still leads in both unit sales and revenue. In September, 40% of PS5 sales were for the digital version, accounting for 18% of overall U.S. sales.

The accessories segment showed a slight growth of 1% YoY, reaching $217 million. The PlayStation Portal remained the revenue leader. Currently, 3% of PS5 owners in the U.S. own this streaming system.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

By the end of the first 9 months, 2024 is nearly on par with 2023 in terms of total revenue ($40.671 billion vs. $40.587 billion in 2023). The start of the year was more active.

Spending on mobile games in the U.S. during the first 9 months of 2024 was $1.7 billion higher than in 2023. However, sales of console games fell by $0.8 billion.

Best-selling Games

EA Sports FC 25 debuted at the top spot in September. It marked the biggest launch of a football game in U.S. history in terms of revenue.

Other notable releases in the month include Astro Bot, The Legend of Zelda: Echoes of Wisdom (excluding physical sales), NBA 2K25 (excluding physical sales), NHL 25, Marvel vs. Capcom Fighting Collection: Arcade Classics, and Warhammer 40,000: Space Marine II (excluding physical sales).

❗️Black Myth: Wukong is not included in the list because its developers do not share sales data with Circana.

EA Sports College Football 25, Helldivers II, and Call of Duty: Modern Warfare II have been the top-selling games on the U.S. market over the past 9 months. EA Sports FC 25 entered the list in 10th place.

The top mobile games in the U.S. by revenue are MONOPOLY GO!, Royal Match, and Roblox. Brawl Stars saw a 64% revenue increase thanks to a collaboration with SpongeBob SquarePants.

Mordor Intelligence: The African gaming market will reach $3.72B by the end of 2029

Analysts at Mordor Intelligence estimate that the market will reach $2.14 billion by the end of 2024. The average annual growth rate until 2029 is expected to be 11.62%, reaching $3.72 billion.

Revenue growth will primarily be driven by the mobile segment, influenced by improved access to mobile phones and connectivity.

According to UN forecasts, by 2050, half of Africa’s population will be under 24 years old, making it one of the youngest regions in the world.

❗️However, Africa is not homogeneous. Countries on the continent vary in language and economic capacity, meaning growth will be concentrated in developing countries like Nigeria, South Africa, and Egypt.

Internet penetration in Sub-Saharan African countries is expected to reach 50% only by 2030.

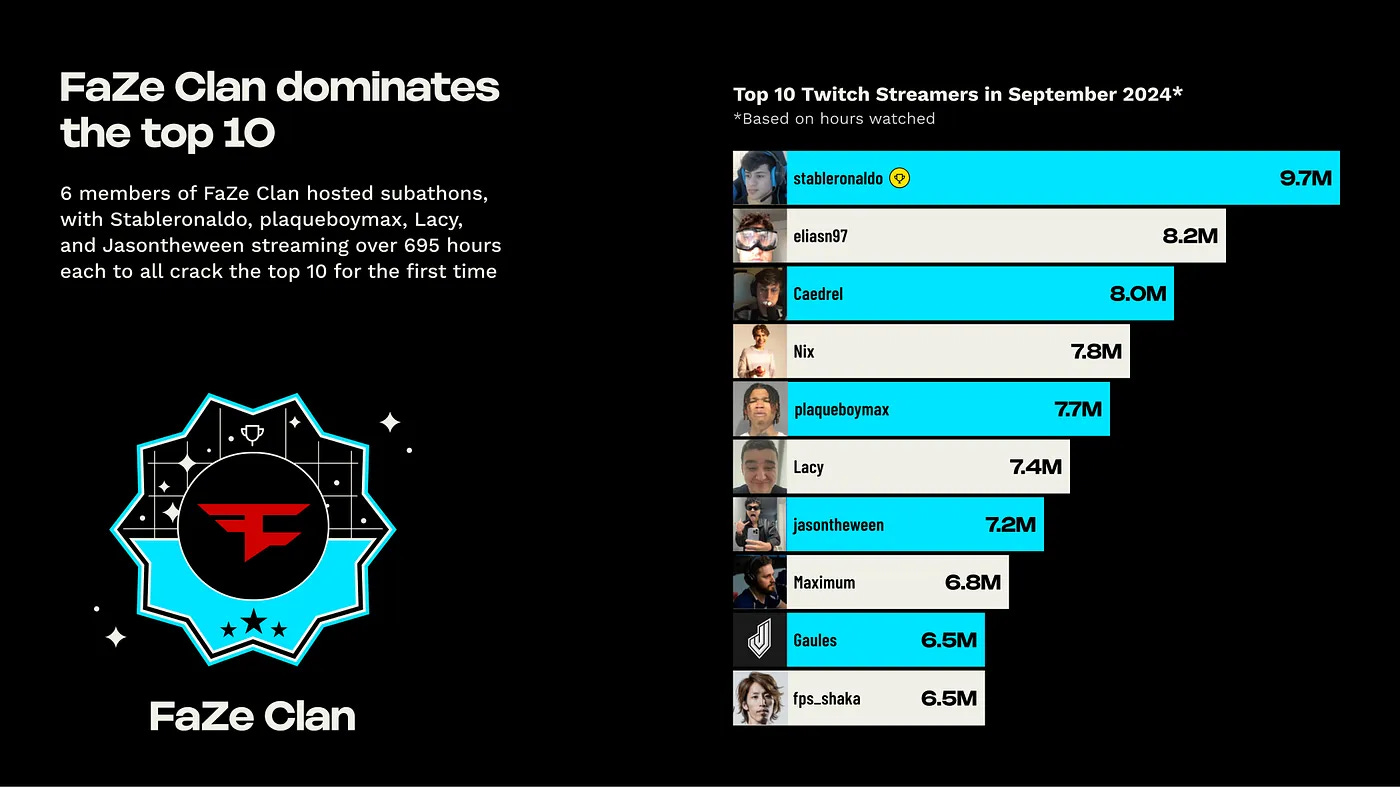

StreamElements & Rainmaker.gg: Game Streaming in September 2024

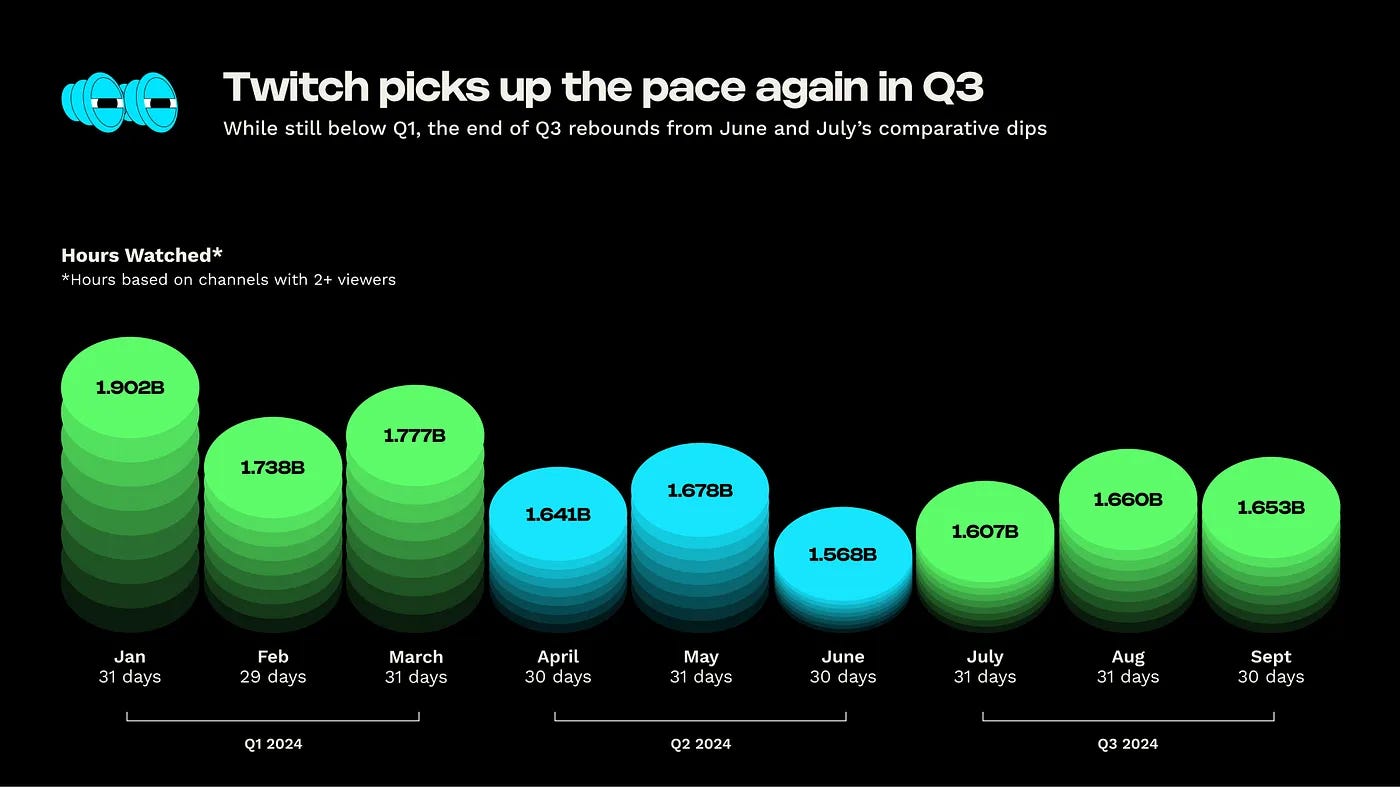

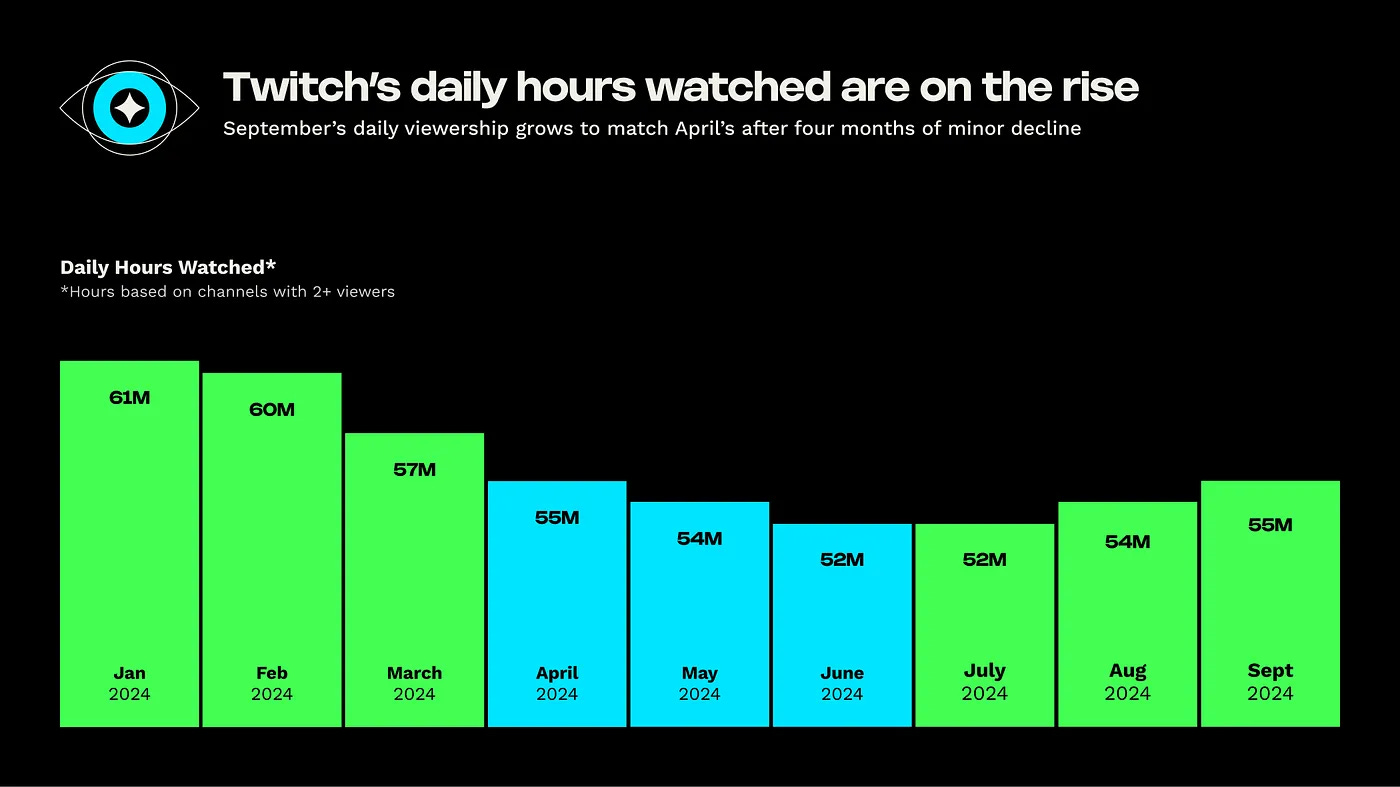

The number of views on Twitch in Q3'24 recovered after a dip in Q2'24.

September 2024 was the leader in daily views (55 million per day), the highest since April of this year.

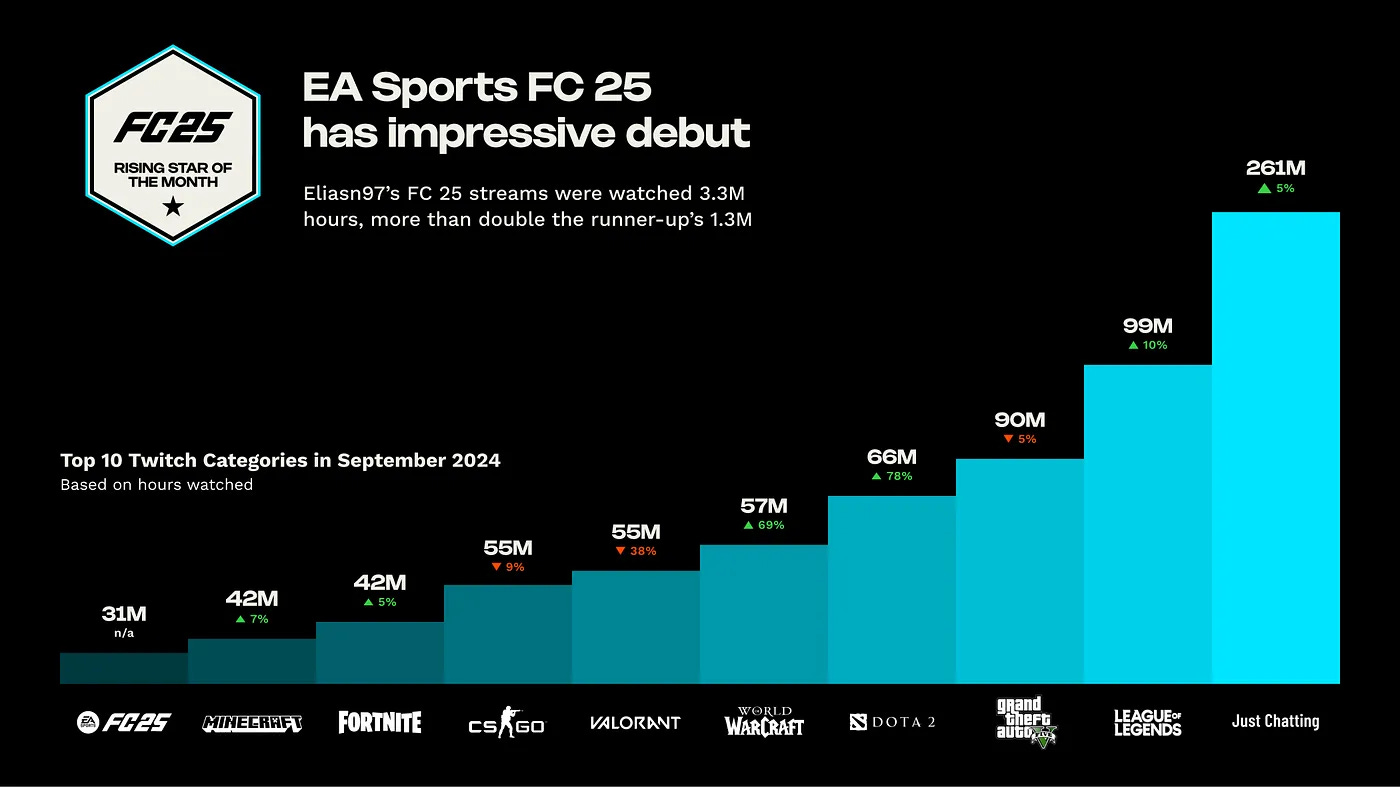

EA Sports FC 25 climbed into the top 10 most-watched games with 31 million hours viewed. The last new game to achieve this was Palworld in January.

The top spots remain occupied by the usual titles: League of Legends (99 million hours), Grand Theft Auto V (90 million hours), DOTA 2 (66 million hours—a 78% increase thanks to The International), World of Warcraft (57 million hours—a 69% increase).

This is amazing!!