Weekly Gaming Reports Recap: October 7 - October 11 (2024)

Gaming IPO overview by InvestGame; US/UK September results (inspiring) & India market report by Niko Partners.

Reports of the week:

InvestGame & GDEV: The History of Gaming IPOs

Ampere Analysis: PlayStation 5 Pro will sell worse than PS4 Pro

AppMagic: Hypercasual Market in Q3 2024

Niko Partners: India Gaming Market in 2024

GSD & GfK: UK PC/Console games market grew in September'24 amid new releases

GSD & GfK: PC/Console game sales in Europe increased by 20% in September'24

InvestGame & GDEV: The History of Gaming IPOs

In this material, the InvestGame team examines how the landscape of gaming IPOs has changed, which gaming companies have benefited, and how companies from different segments have fared after going public.

A total of 87 companies were analyzed, each of which had a post-IPO valuation that exceeded $100 million at least once.

InvestGame is the leading source of the gaming industry investment news. Subscribe here.

History of Gaming IPOs

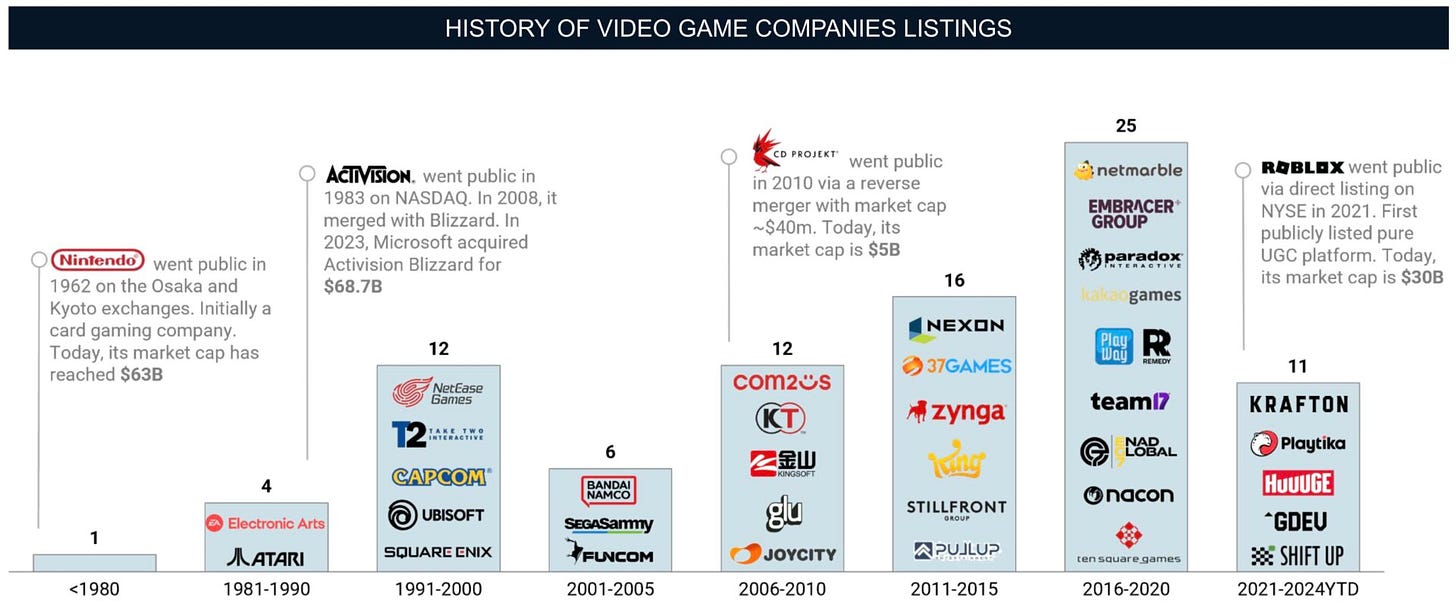

Before 2006, 23 gaming companies went public. Most of them were already in the gaming business, but the first—Nintendo—initially went public on local stock exchanges in Kyoto and Tokyo as a playing card manufacturer (hanafuda). The gaming division came later.

Between 2006 and 2010, 12 companies went public. From 2011 to 2015, another 16 companies did the same. IPOs reached their peak between 2016 and 2020, with 25 companies going public during that period.

Since 2021, companies' interest in IPOs has declined, with only 11 companies going public. Only one of these—Shift Up (July 2024)—happened after 2022. Market corrections, rising interest rates, and weak multipliers have all affected business owners' interest in going public.

Public Offerings by Region

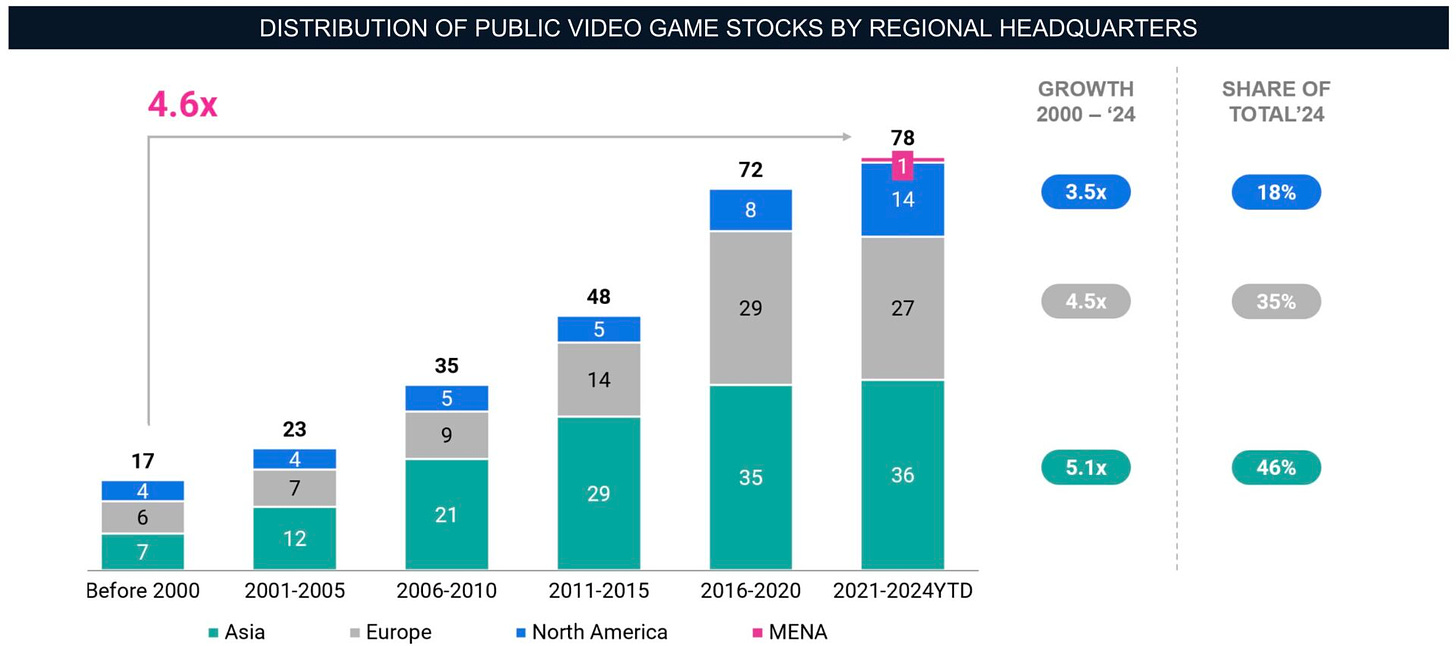

Asia is the leader in public offerings. As of 2024, 46% of all public companies are from Asia. Another 35% are from Europe, 18% from the U.S., and 1% from the MENA region (Playtika).

In Asia, the number of public companies has grown by 5.1 times over the past 24 years. In Europe, it has grown by 4.5 times, and in the U.S., by 3.5 times.

Platform Distribution

PC/console companies dominated IPOs until 2000. Currently, 46% of all public companies specialize in this segment. The number of companies has increased by 2.8 times since 2000.

The most significant growth has been in the mobile segment. The number of public companies has grown by 9.3 times since 2000, and now 47% of all public gaming companies specialize in mobile games.

Historically, diversified companies make up 6%. However, more companies are now trying to expand to new platforms. From 2021 to 2024, 46% of all public companies were diversified.

Gaming Market Capitalization

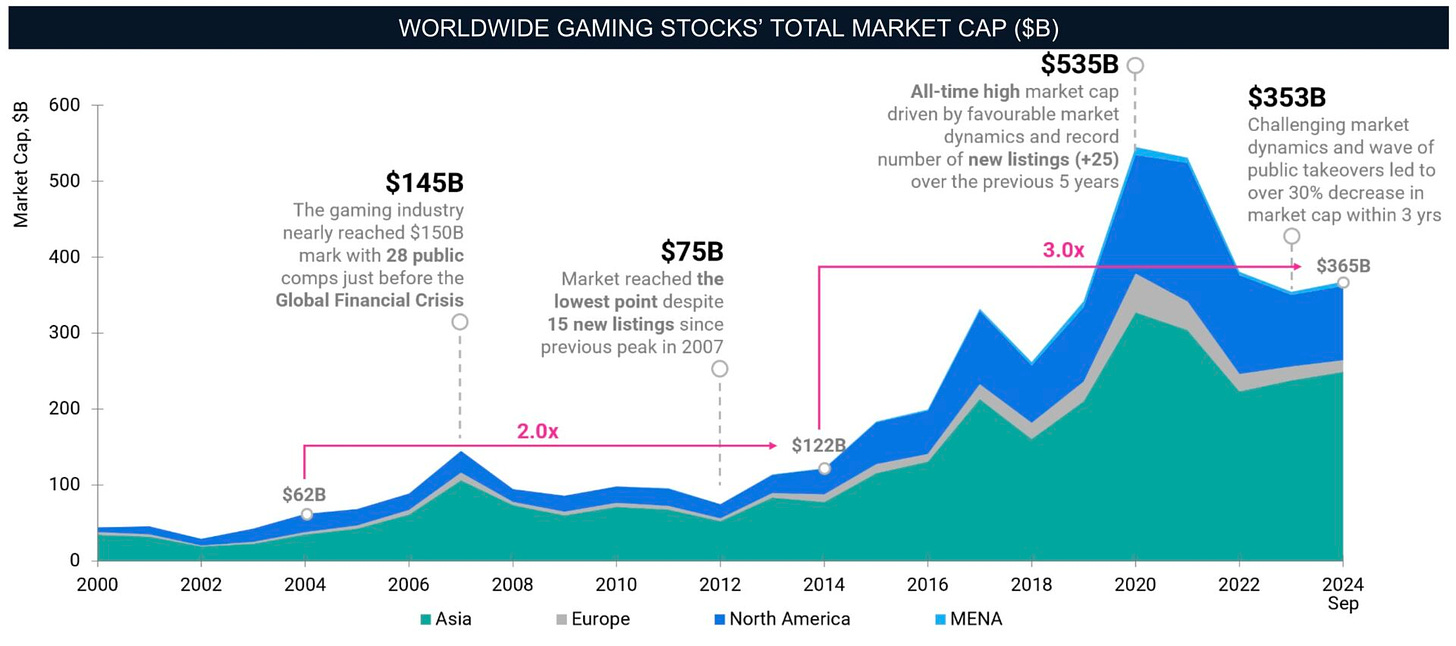

The capitalization of the gaming market gradually grew until 2007, reaching $145 billion. After the 2007 global financial crisis, it dropped to $75 billion but recovered to $122 billion by 2014.

The most significant growth occurred between 2014 and 2020, when gaming market capitalization skyrocketed to $535 billion, driven by favorable financial conditions and a record number of IPOs.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The consequences are well known. By 2024, the gaming market's capitalization has dropped to $353 billion, which is 30% lower than the peak years prior.

It's important to note that Asian companies contribute the most to gaming market capitalization—about 70% of the total.

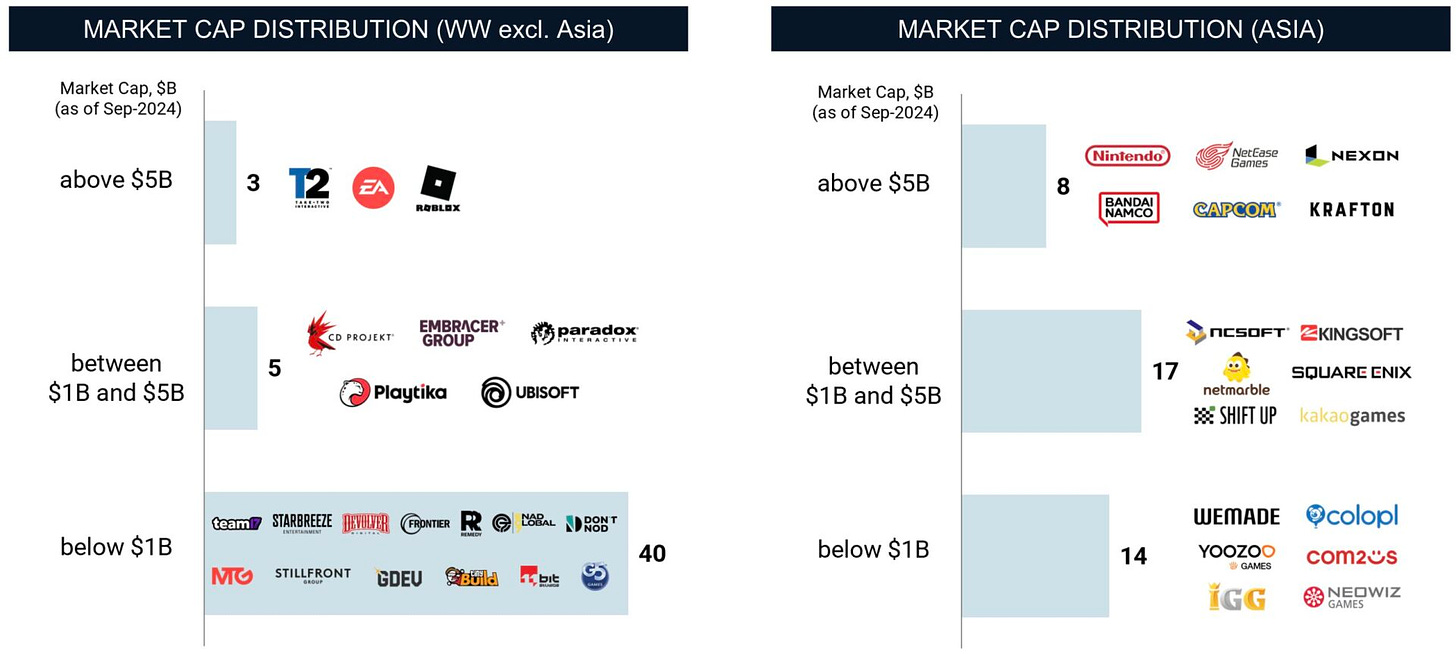

As of 2024, there are 13 companies with a capitalization of over $5 billion—8 of them are in Asia. There are 22 companies with a capitalization of over $1 billion but less than $5 billion—17 of them are in Asia. Among companies with a capitalization of less than $1 billion (those included in InvestGame's analysis), there are 54, and only 14 of them are in Asia.

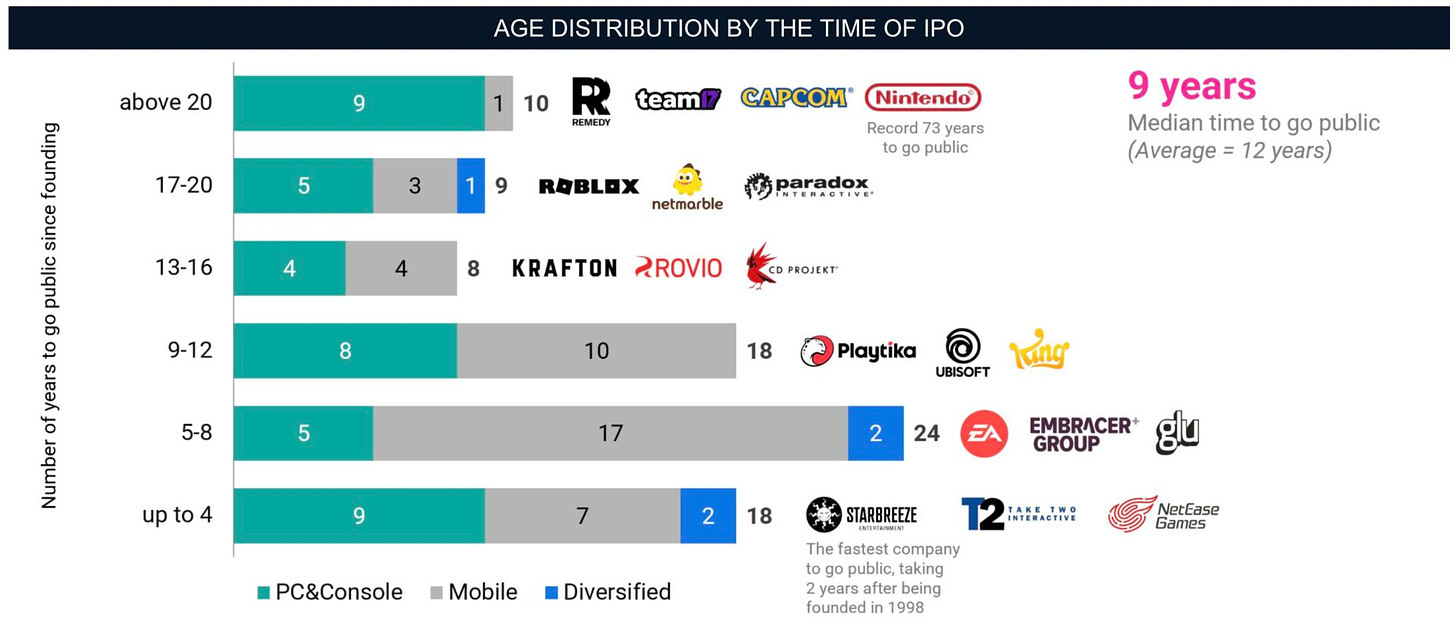

Age of Public Companies and Time to IPO

Most public gaming companies today are over 20 years old. Many well-known companies, such as Nintendo, Activision Blizzard, and Electronic Arts, are over 40. On average, Asian public companies are 28 years old, and Western ones are 23 years old.

The median time for a gaming company to go public is 9 years (with an average of 12 years) after their founding.

Between 5 and 12 years after being founded, 48% of companies from the analyzed sample went public.

Ampere Analysis: PlayStation 5 Pro will sell worse than PS4 Pro

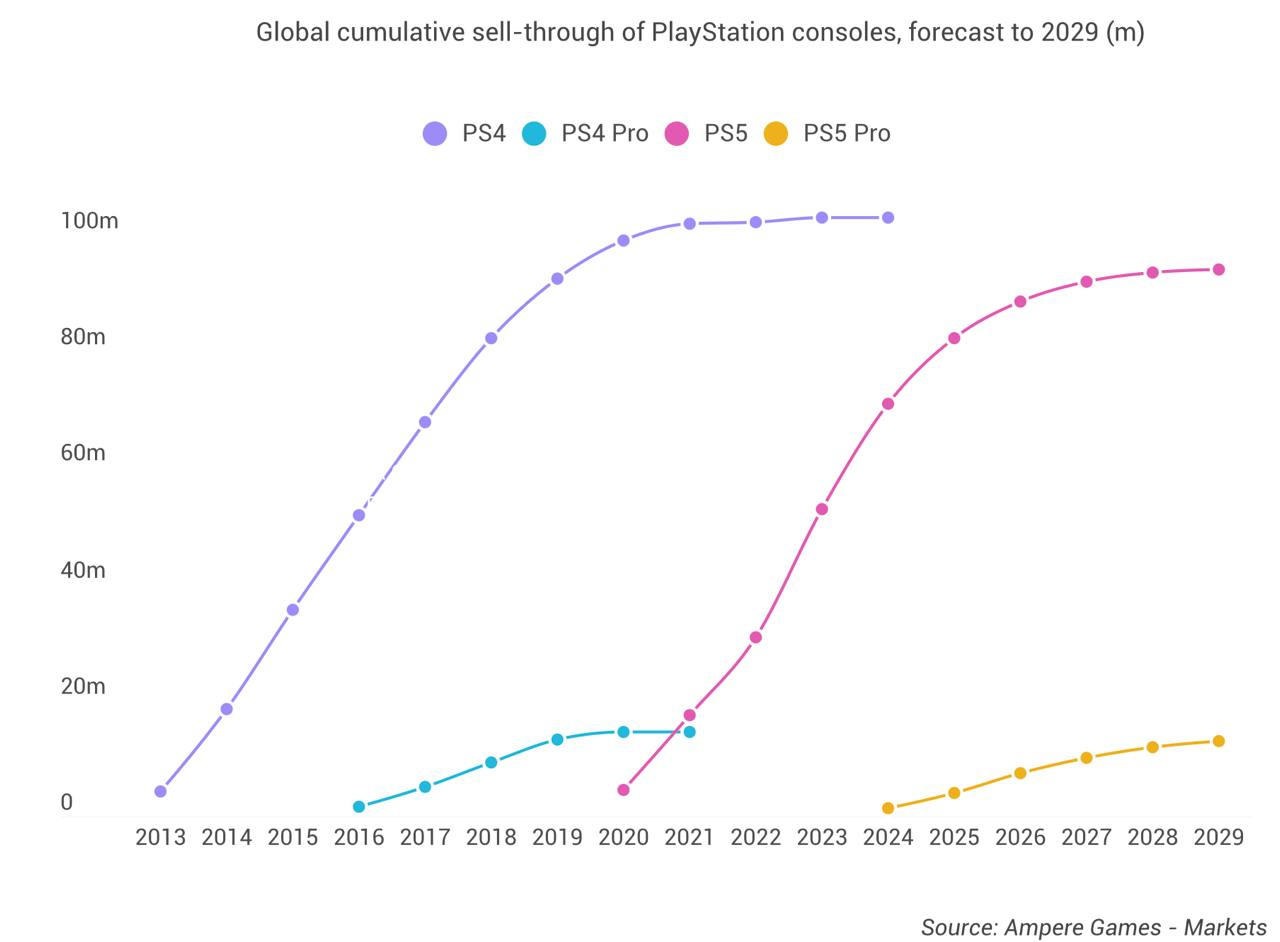

Analysts expect Sony to sell 1.3 million PS5 Pro units by the end of the year, compared to 1.7 million PS4 Pro units sold during its release window.

According to Ampere Analysis, total sales of the PS4 Pro reached 14.5 million units, accounting for 12% of all PS4 sales. It is anticipated that the PS5 Pro will achieve similar percentage, with an estimated 13 million units sold by the end of 2029.

The price difference between the PS5 Pro and the standard PS5 ranges from 40% to 50%, depending on the region. For the PS4 Pro, this difference was 33%.

AppMagic: Hypercasual Market in Q3 2024

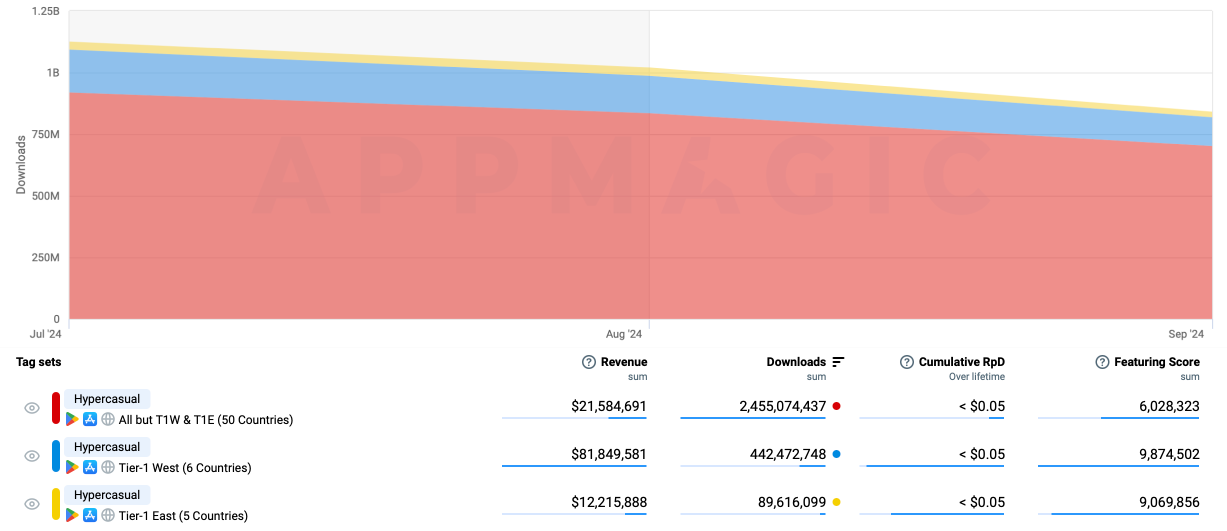

Market Data

In Q3 2024, hyper-casual games were downloaded 2.98 billion times, 12% less than in the previous quarter.

Comparing Q3 2024 to Q3 2023, there was an overall decline of 11%. Downloads in Western Tier-1 countries fell by 8%, while in Eastern Tier-1 countries, the numbers remained steady.

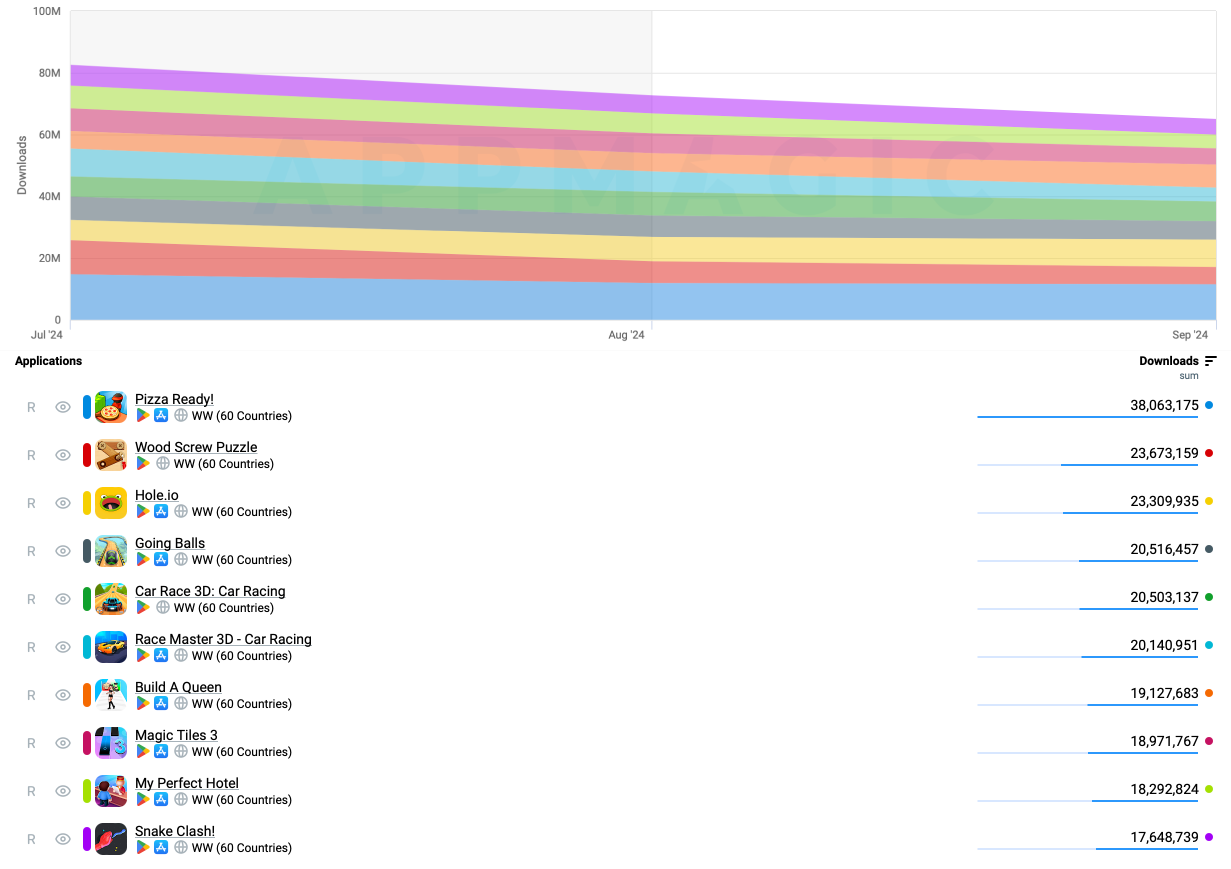

Top-10 Games by Downloads

The trend of declining downloads among the top 10 games is evident in Q3 2024.

Two new projects made it into the top 10. One is Hole.io by Voodoo, with 23 million downloads in Q3 2024. Interestingly, the game was initially released in 2018, when it was downloaded 25 million times. Its resurgence in popularity is largely due to a surge in downloads from India and Brazil.

Snake Clash! is the second newcomer in the top 10, with 18 million downloads in Q3 2024. It was released by Supercent in May 2023.

Niko Partners: India Gaming Market in 2024

Market Overview

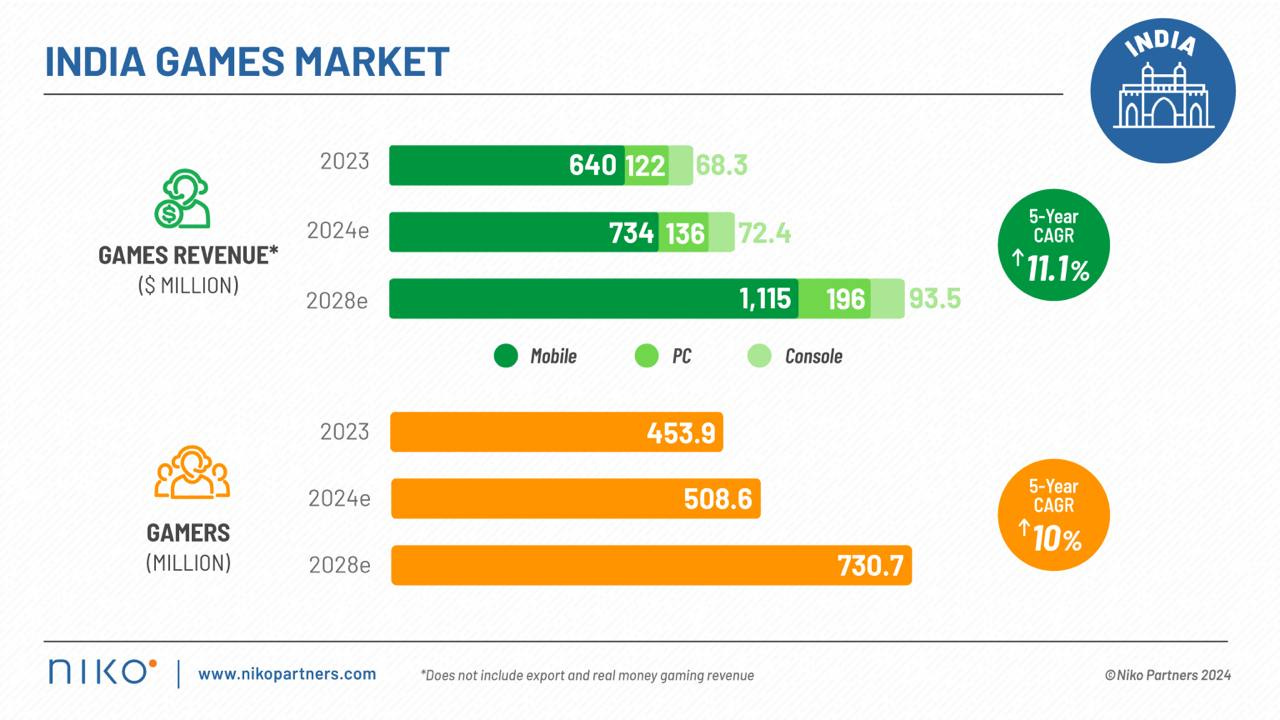

By the end of 2023, the Indian gaming market was valued at $830 million, representing a 15.9% increase from 2022.

Niko Partners analysts expect the Indian market to grow by 13.6% to reach $943 million in 2024. By the end of 2028, it is projected to reach $1.4 billion, with a compound annual growth rate of 11.1%.

Currently, the Indian market is the fastest-growing among all those tracked by Niko Partners.

Mobile games make up 77.9% of the market revenue, PC games account for 14.5%, and console games make up 7.7%.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The gaming audience in India reached 453.9 million people in 2023. This number is expected to grow to 508.6 million in 2024 and reach 730.7 million by 2028, with an average annual growth rate of 10%.

❗️Niko Partners does not include the Real-Money Gaming (RMG) segment in India, which accounts for more than half of the gaming revenue.

Indian Player Behavior

77.3% of PC gamers reported spending more time on games in Q1 2024 compared to the previous year.

Female players who make in-game purchases spend 8.5% more than male players.

Niko Partners analysts expect that as disposable incomes rise and high-end devices become more accessible, ARPU in India will increase.

57% of mobile gamers in India have played Battle Royale games in the past three months, with Battlegrounds Mobile India and Garena Free Fire leading the pack. Six out of ten paying users in these games purchase a Battle Pass.

65.4% of Indian gamers engage with esports, and these users tend to spend 12% more on games.

57.2% of Indian players discover new games through streamers and influencers.

Social features and the ability to play together are key factors for Indian gamers when choosing a game.

GSD & GfK: UK PC/Console games market grew in September'24 amid new releases

Game Sales

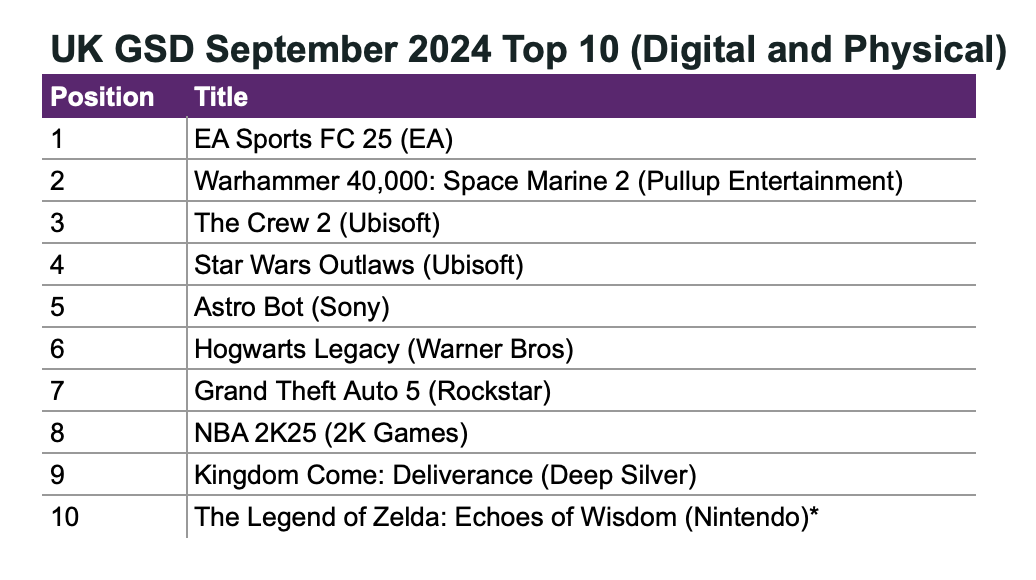

In September, 3.88 million PC and console games were sold in the UK, an 8% increase from last year.

Six new games entered the top 10 in sales.

EA Sports FC 25 is leading the chat. The game launched 4.6% lower than its predecessor in the series, but premium early access (which is more expensive) sold better. From a revenue perspective, EA might have still gained.

Warhammer 40,000: Space Marine 2 debuted in second place, just behind the football simulator. It is currently the third best-selling new game in the UK, following EA Sports FC 25 and Helldivers II.

The Crew 2 ranked third because Ubisoft been selling it for £0.99.

Star Wars Outlaws launched in fourth place, which is hardly a success. The game's initial sales in the UK were weaker than Avatar: Frontiers of Pandora, released in December 2023.

In fifth place is Astro Bot, selling 24% better than Ratchet & Clank: Rift Apart, released in 2021.

NBA 2K25 launched 14% lower than its predecessor.

The last newcomer in the top 10 was The Legend of Zelda: Echoes of Wisdom. After a week of sales, it performed 14% worse than the remake of The Legend of Zelda: Link’s Awakening. However, it's important to note that Nintendo does not disclose digital sales figures for its games.

Hardware Sales

Over 126,000 consoles were sold in the UK in September, 35% less than last year.

PS5 was the best-selling console by a significant margin, followed by the Xbox Series S|X in second place, and Nintendo Switch in third.

The PS5 Digital had its second-best month ever in the UK (the best was in December 2023). It's unclear whether this is due to Astro Bot, the numerous releases, or just a coincidence.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Console sales in the UK fell 32% year-over-year in the first three quarters.

743,000 accessories were sold in September, an 11% increase from last year. The black and white DualSense controllers held the top two spots.

The PS5 disc drive ranked 8th among accessories in revenue and 21st in units sold.

The PlayStation Portal was the top-grossing accessory and ranked 8th in units sold in the first nine months of 2024.

GSD & GfK: PC/Console game sales in Europe increased by 20% in September'24

Game Sales

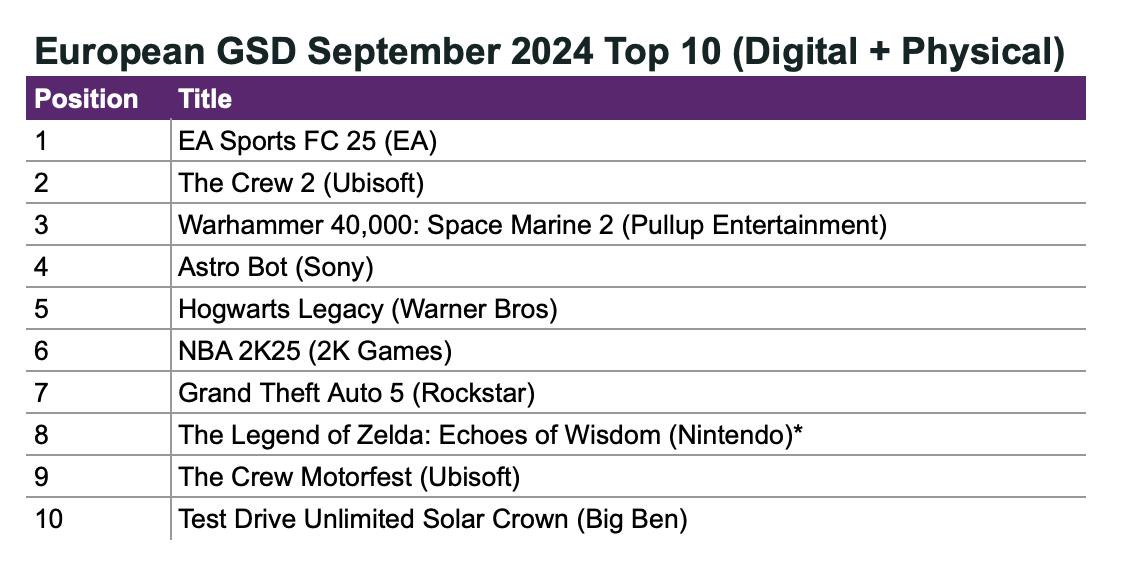

17.6 million PC and console games were sold in Europe last month, 20% more than in September 2023.

EA Sports FC 25 topped the chart, launching 2% lower than the previous installment in the series. However, sales of the premium (and more expensive) version of the game increased by 10% compared to last year, so EA likely benefited in revenue.

The Crew 2 ranked second due to a promotion where the game was sold for €1.

Warhammer 40,000: Space Marine 2 secured third place. Like in the UK, the game ranked 3rd in the 2024 new game sales chart. It surpassed Dragon's Dogma 2, The Last of Us Part 2: Remastered, and Final Fantasy VII Rebirth. It also became the fastest-selling game in the franchise's history in Europe.

Astro Bot had a strong start. Compared to similar titles, its launch sales were 34% higher than Sonic Frontiers and 52% better than Crash Bandicoot 4: It's About Time. The European launch also outperformed Ratchet & Clank: Rift Apart by 7.5%.

Other new entries in the top 10 include NBA 2K25 (with sales 1% higher than NBA 2K24 over the same period) and The Legend of Zelda: Echoes of Wisdom. For the latter, Nintendo only shares physical sales data, which is 15% lower than the 2019 remake of The Legend of Zelda: Link's Awakening. However, digital sales are likely to have grown significantly since then.

Harry Potter Quidditch Champions debuted at the 28th position in the chart.

Hardware Sales

335,000 consoles were sold in September in Europe, 18% less than last year.

The PS5 leads by a wide margin, although its sales were 17% lower than last year. The Nintendo Switch is in second place (with a 1.5% YoY sales increase), while the Xbox Series S|X is in third, with sales plummeting by 58% compared to September 2023.

1.1 million accessories were sold in September, down 2.4% from last year. The DualSense controller was a best-seller.