Adjust: The Mobile Market of Türkiye in 2025

Turkish gamers are much less sticky compared to the global audience. Curious why!

To prepare the report, Adjust analyzed data from 5,000 partner apps collected between January 2023 and July 2025.

Mobile Market Overview

By the end of 2024, Turkey ranked 8th globally in mobile app downloads (3.66 billion) and total time spent in apps (101.5 billion hours).

By 2029, Turkey’s mobile app revenue is projected to reach $1.65 billion.

Mobile Games Market in Turkey

In 2025, mobile game revenue in Turkey will reach $427.5 million, nearly half of the country’s total video game revenue.

A word from our sponsor

Xsolla recently released the global gaming market map, which covers more than 200 regions.

This is a gigantic work, see what’s inside:

Main market numbers (population, gaming revenue, distribution of revenue by platform, and much more).

Top video game genres.

Recommendations for game localization.

Largest game development studios & games from the region.

Cultural considerations & local holidays.

Top streaming platforms, influencers,and local shows.

Salary benchmarks for the gaming industry.

Payment data, tax information, and legal considerations.

So far, it is the most comprehensive database of the gaming market I’ve seen so far (excluding my newsletter, of course, ha-ha).

200+ countries covered, and there is a very sweet opportunity to download the data for the pitch in the .pdf format (based on the market).

Games from Turkish studios attract over 30 million local players and hundreds of millions worldwide. The country’s most prominent developer is Dream Games (Royal Match).

Installs and Sessions

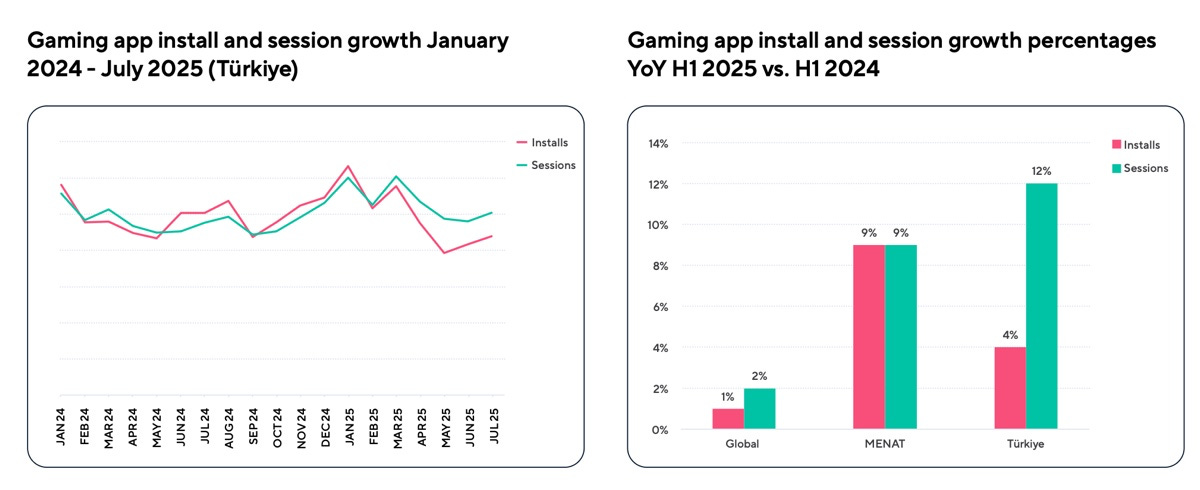

Mobile game installs in Turkey grew 12% YoY in 2024, while sessions increased 8%.

In the first half of 2025, installs rose 4% YoY, and sessions grew 12% YoY.

For comparison, the global market saw +1% growth in installs and +2% in sessions, while the MENAT region grew 9% across both metrics.

Peak months were January (+23% installs, +9% sessions) and March (+12% and +10%, respectively).

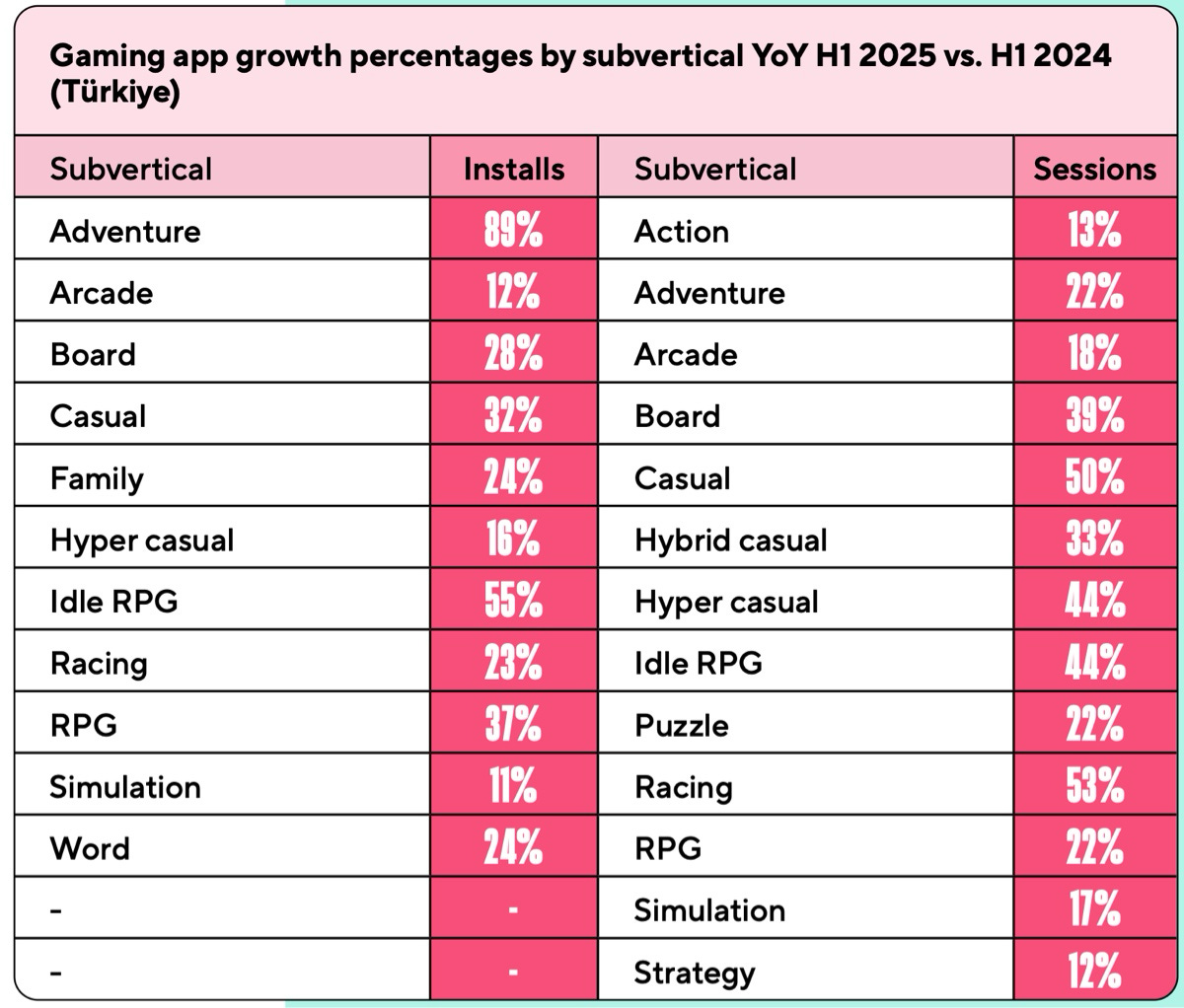

By downloads, the strongest growth came from Adventure games (+89% YoY), Idle RPG (+55% YoY), and RPG (+37% YoY). By sessions, the top gainers were Racing (+53% YoY), Casual (+50% YoY), and Hypercasual with Idle RPG (+44% YoY each).

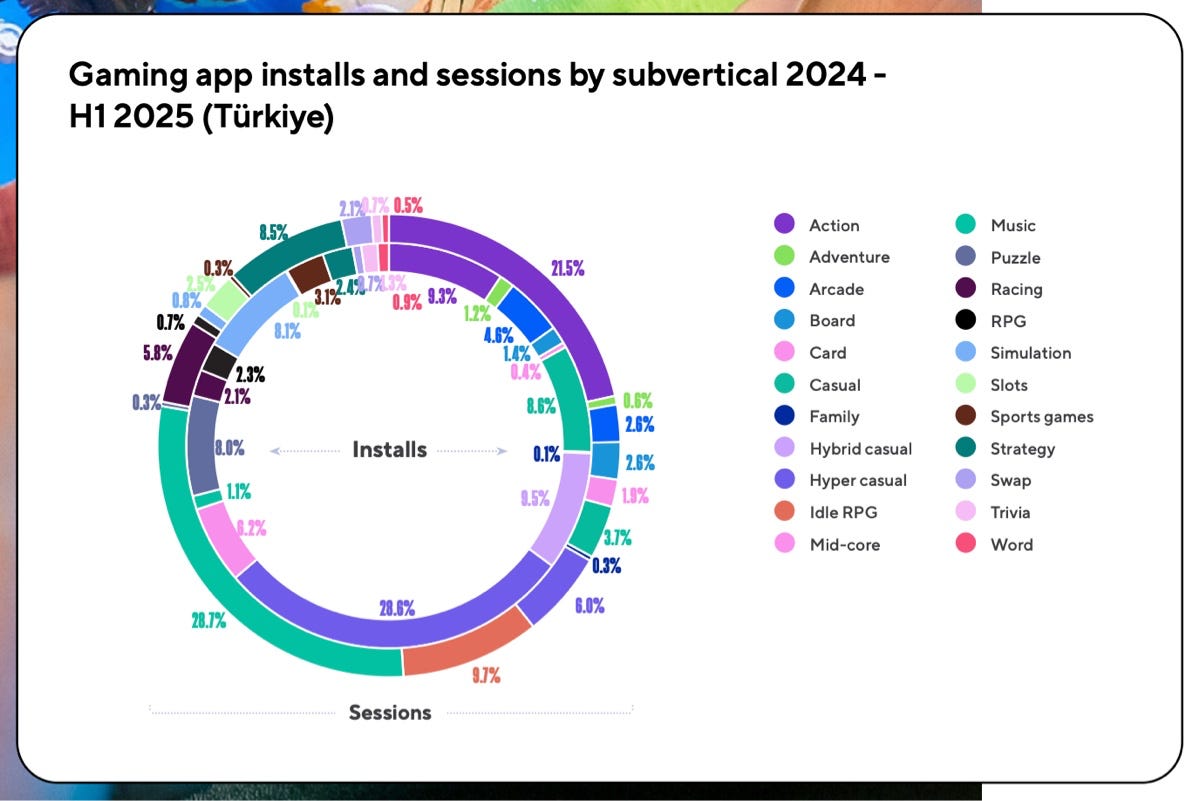

Leading genres by downloads: Hypercasual (28.6%), Hybridcasual (9.5%), and Action (9.3%).

Leading genres by sessions: Music (28.7%), Action (21.5%), Idle RPG (9.7%), and Strategy (8.5%).

Session Length and Retention

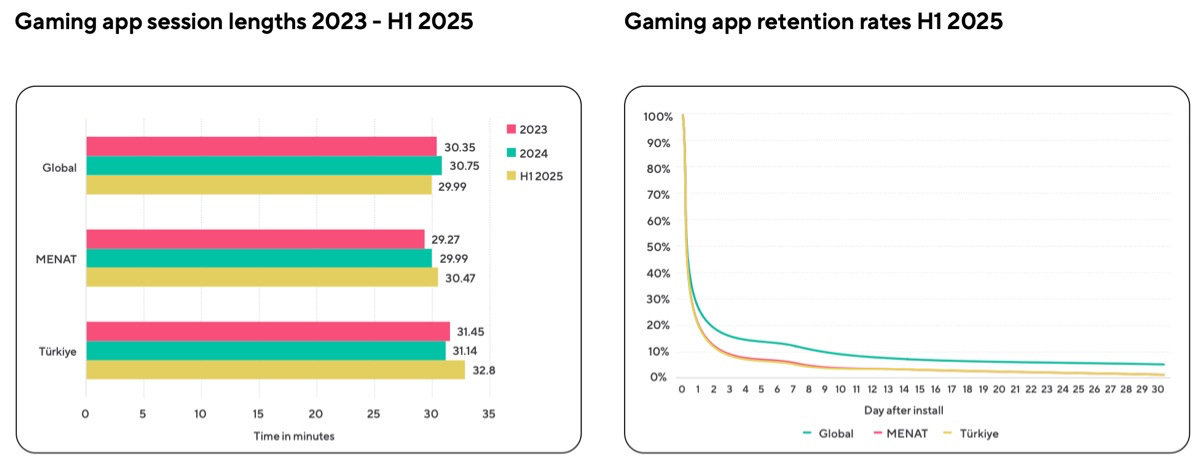

The average session length in H1 2025 was 32.8 minutes (31.1 minutes in 2024; 31.4 in 2023). This exceeds both the MENAT regional average (30.5 minutes) and the global average (29.9 minutes).

Retention rates in Turkey during H1 2025 were: D1 – 19%, D7 – 5%, D14 – 3%, D30 – 1%. By comparison, global benchmarks are D1 – 26%, D7 – 12%, and D30 – 5%. In other words, games in Turkey retain players less effectively than the global average.

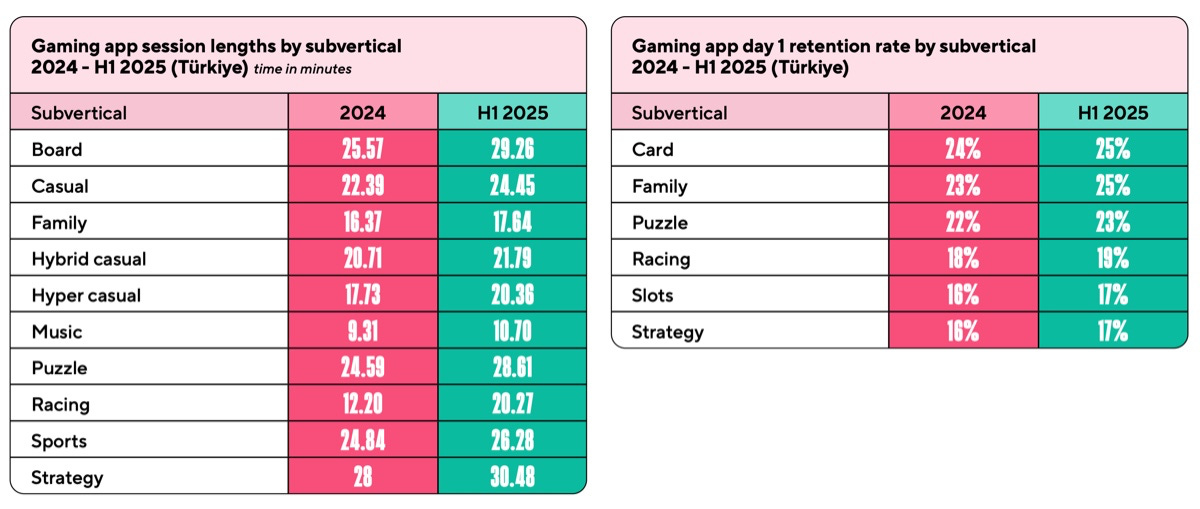

The longest average play sessions were in Strategy (30.5 minutes), Board (29.3 minutes), and Puzzle (28.6 minutes) games.

The best Day-1 retention was seen in Card games (25%), Family games (25%), and Puzzles (23%).