Anzu: Intrinsic In-Game Advertising Trends in Gaming

The market is growing, and it might be one of the viable ways to show ads in PC/Console titles without players' frustration.

The report uses data from 105 games and 333 direct advertisers who use Anzu.

❗️Anzu is a tool for placing in-game advertising. The report may be biased.

User Engagement in 2024

Games are a type of entertainment that lacks pronounced seasonality. This is a clear advantage over, for example, television, where viewership drops sharply in summer.

CPM in games peaks, on average, from September to December. This is the most competitive period. At the same time, the beginning of the year (the period of low CPM) is the best time for advertisers in fitness, travel, and healthy lifestyle sectors. People are ready to change their lives at the start of the year, and the market cools down after the holiday season.

Advertising Activity by Platform

Advertisers are roughly evenly split between iOS and Android throughout the year. However, in Q4, advertiser activity on iOS is significantly higher. This is largely due to the APAC region having many Android devices, and big holidays in these countries are not happening in Q4.

People spend more time playing on PC and consoles than on mobile devices. On average, session length is 3 times longer (4.3 minutes vs. 15 minutes), quarterly playtime per game is almost 5 times higher (20.2 minutes vs. 107 minutes), and the number of sessions per game per quarter is 1.5 times higher (4.7 sessions vs. 7.1 sessions).

However, there is another side to this. On mobile devices, the audience is 25 times larger and also more diverse.

Regional benchmarks

North America leads all markets in average session length (4.99 minutes), number of sessions per game per quarter (6.45), and CPM. Europe is not far behind in user engagement but lags by 33% in CPM.

Anzu notes that Q1 can be a favorable time for advertisers in North America in games-user activity remains high while CPM drops significantly.

For European countries, Q1 and Q3 are the best quarters for advertising activity. Competition is lower, and user activity is either at its peak (as in Q1) or without a dramatic drop (as in Q3).

The same logic applies to Latin American countries. Q1 is a good quarter for marketing campaigns.

In Asian and Middle Eastern countries, the CPM peak falls on Q2. Usually, Ramadan and Golden Week occur in this quarter. Advertisers actively compete for user attention.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Genre Benchmarks

Sports games are among the most popular genres for native in-game advertising. The audience is engaged, and in-game ads look organic in such projects.

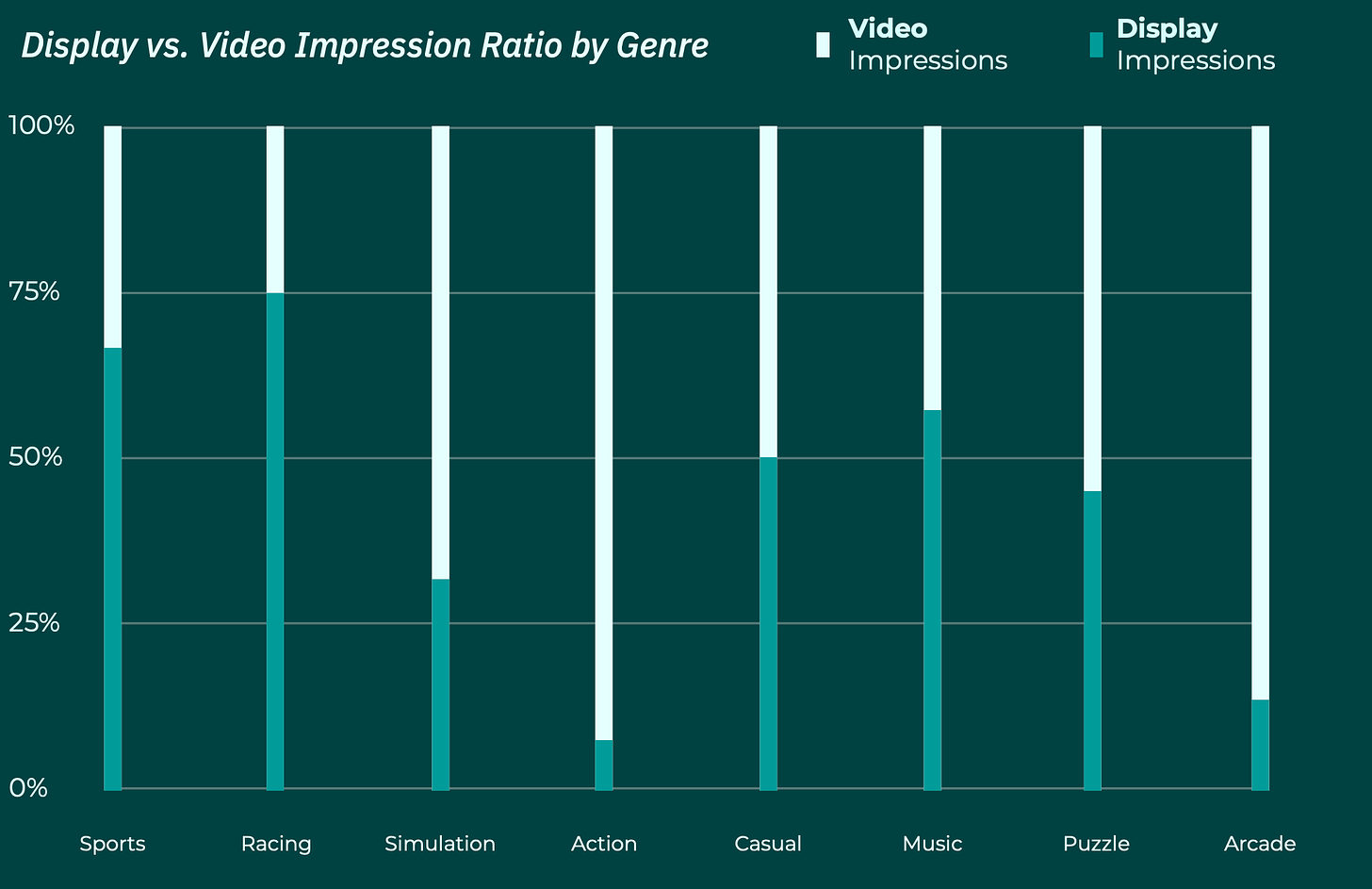

At the same time, in sports and racing games, static ads are more popular. The opposite is true for action games and arcades. Anzu believes that static ads are better suited for fast-paced genres, while video works well for slower genres.

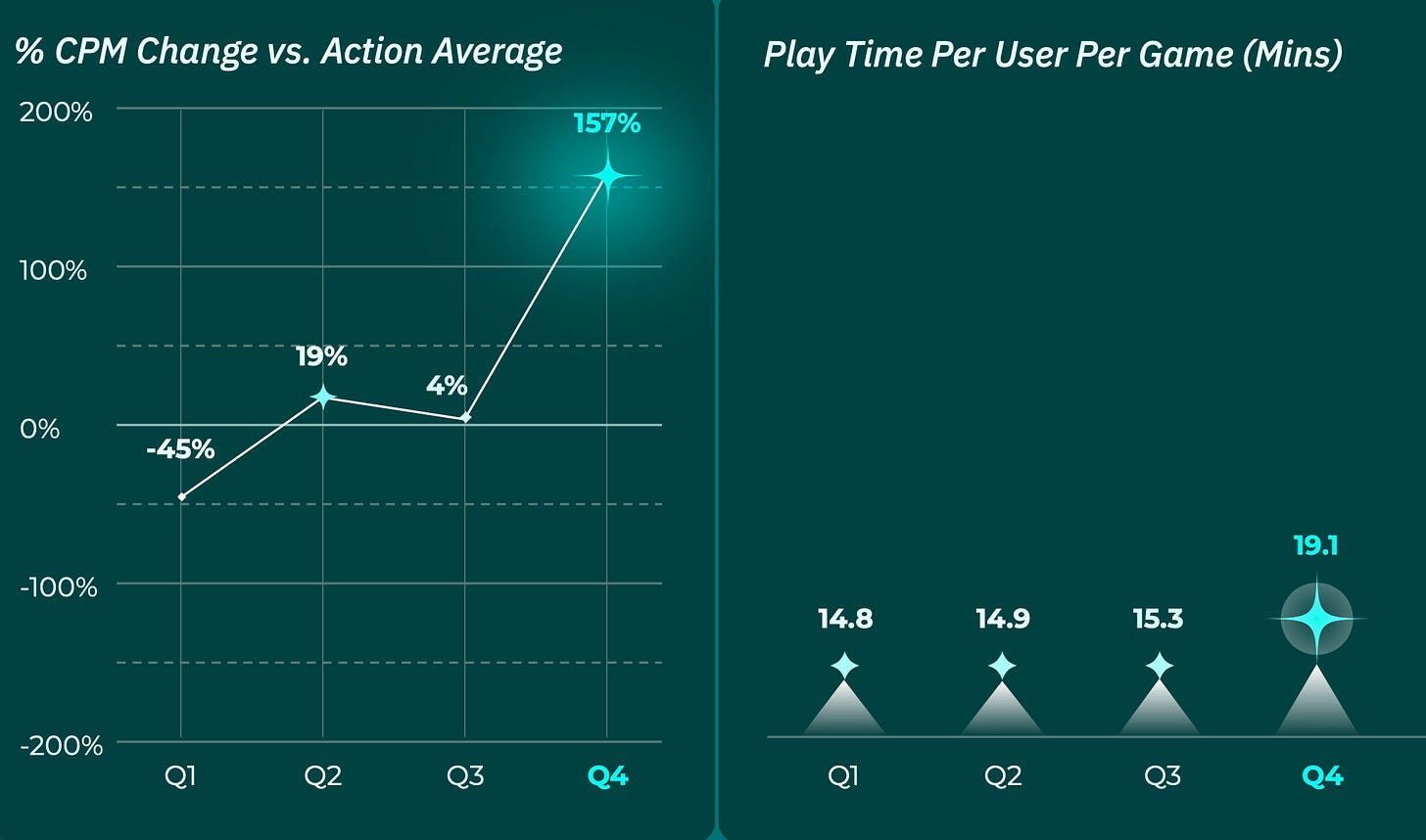

In sports games, CPM rises in Q3 and peaks in Q4. This is due both to the release schedule (new installments of sports franchises usually come out in Q3) and increased advertising activity.

In racing games, the situation is different. The CPM peak is in Q2, and there is a sharp drop in Q4. This is related to the start of many competitions in Q2. It would make sense for advertisers to reallocate part of their budget from overheated Q4 genres to racing projects.

In action games, the situation matches the market as a whole. The peak of user activity and CPM is in Q4.

Intrinsic In-Game Advertising Effectiveness Metrics

Ad viewability rates on mobile devices and consoles exceed 98%. The situation is slightly worse on PC. It's hard to say why.

According to Anzu, native in-game advertising attracts the most attention-several times more than banners on social networks or mobile devices.

Intrinsic in-game advertising, according to Anzu, has a positive effect on brands. Viewers remember the brand, have a better attitude toward it, and are more likely to make a purchase.

Anzu reports that the male audience remembers in-game ad campaigns and the brand better. However, women are more likely to convert to a purchase after such ad campaigns. Still, the sample is heavily skewed toward the male audience-Anzu is transparent about this.

Anzu notes that in-game advertising in games shows, on average, a CPA 21% lower than expected. The conversion from ad view to store visit is 6%.