AppMagic: Casual Games Tier-1 West performance in 2024

Match-3 with Meta, Merge-2 with Meta, Match 3D, Casual Casino & Sort Puzzle genres overview.

In the study, AppMagic focuses on Western Tier-1 markets - USA, UK, Australia, Canada, France, and Germany. Five key genres will be examined: Match-3 with complex meta, Merge-2 with complex meta, Match 3D, Sort Puzzle, and Casual Casino.

❗️Hereafter, all metrics are only for the 6 countries mentioned above. IAA revenue is not included. Please, consider that some Asian-focused products might not appear in this research.

Market State

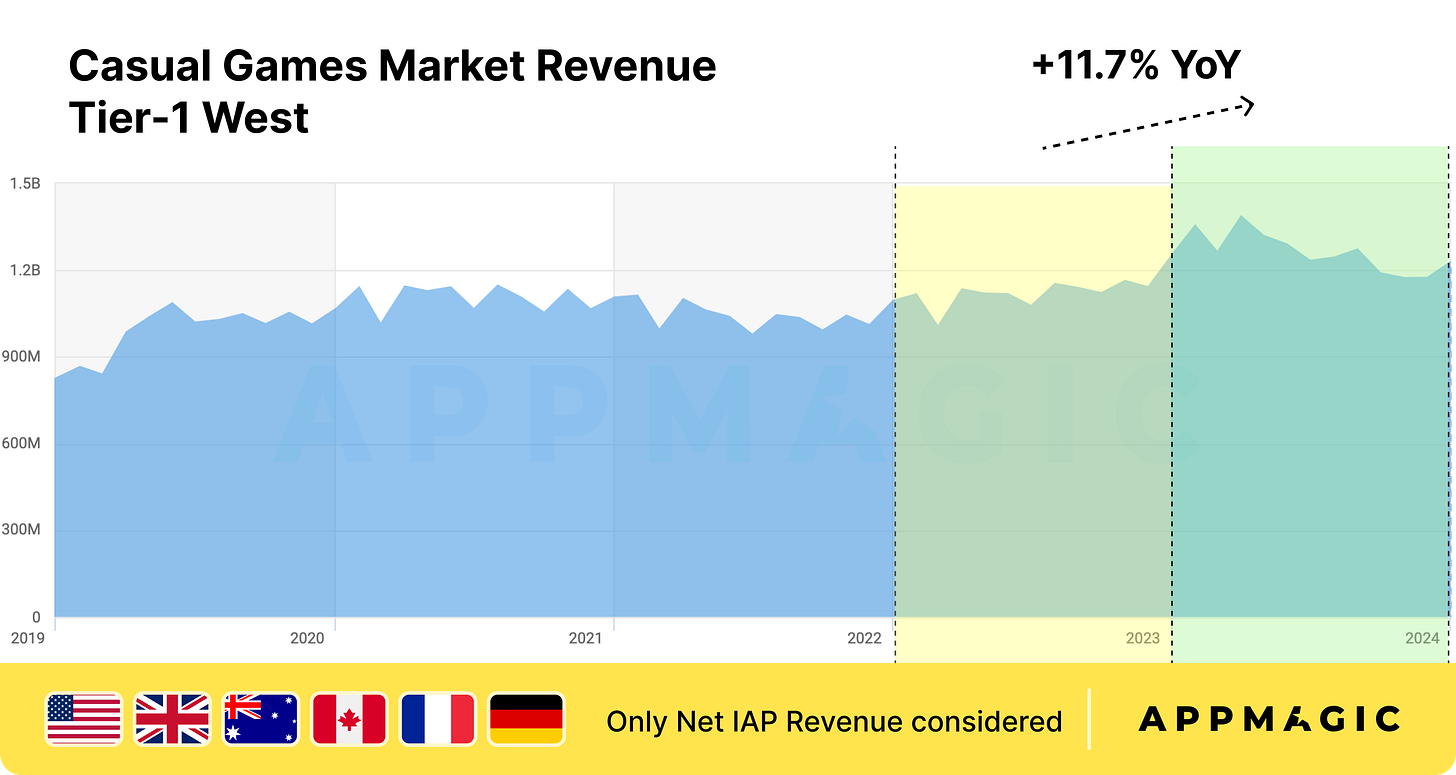

Casual game revenue in Western Tier-1 countries grew by 11.7% to $15.2 billion. Downloads for the same period increased by only 4.1%.

Match-3 with Complex Meta

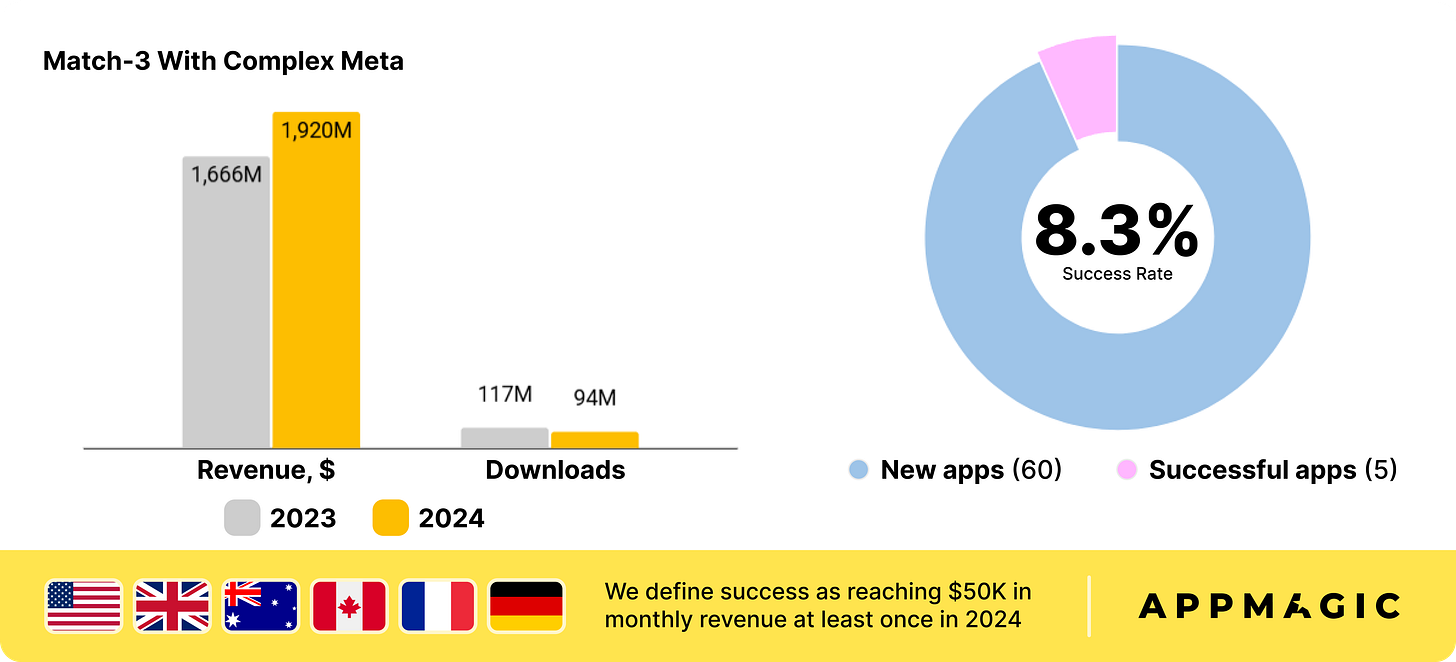

In 2024, games in this genre earned $1.92 billion in selected markets (13% growth). However, downloads decreased by 21%.

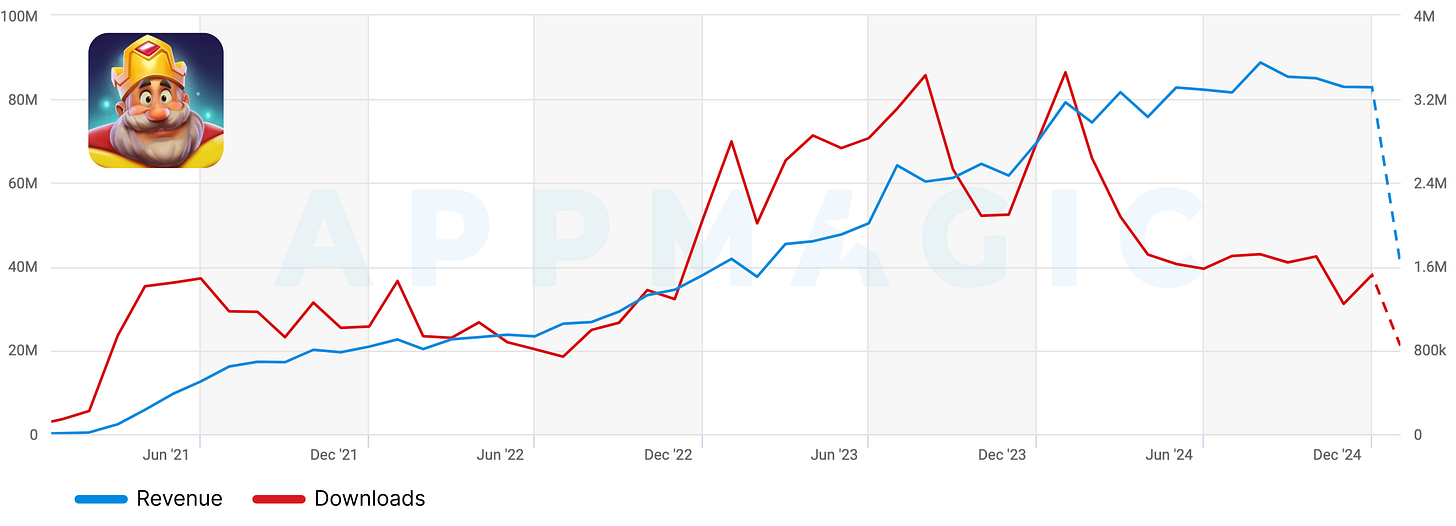

Royal Match is the genre leader. The game accounts for 51% of all genre revenue in T1 West countries.

If Royal Match is removed from the overall equation, the genre’s revenue will decline by 8% in 2024.

In 2024, Royal Match's audience growth mainly occurred in the first half of the year. Then, the dynamics slowed down, and the number of installs returned almost to 2022 figures. However, the project's revenue grew - the team actively worked on Live-ops and monetization. AppMagic notes that Dream Games also worked on the social component of the project.

The 4 largest projects in the genre's top 10 in 2024 remained unchanged - Royal Match, Gardenscapes, Homescapes, and Project Makeover. However, there are two newcomers: Matching Story - Puzzle Games (Vertex) and Mystery Matters (Playrix). Both projects were launched in 2023.

In total, 60 projects were launched in 2024, 5 of which managed to reach $50,000 in monthly revenue (which AppMagic considers the minimum mark for assessing success). These are Truck Star (Century Games), Hollywood Crush: Match 3 Puzzle (YOTTA Games), Ellen's Garden Restoration (Storm8), Christmas Match: Home Design (Narcade), and Roomscapes (Playrix). Work on the latter is likely suspended. 8.3% of all launched projects can be called somewhat successful.

AppMagic specifically notes Truck Star. The game has an atypical gender distribution for the genre - 74% men versus 26% female audience. Since its release in May 2024, the game has earned more than $10 million.

Formally, the Royal Kingdom can also be added to the list. But the game had been in soft launch since April 2023 and was already earning more than needed to achieve the minimum required "success" assessment.

Merge-2 with Complex Meta

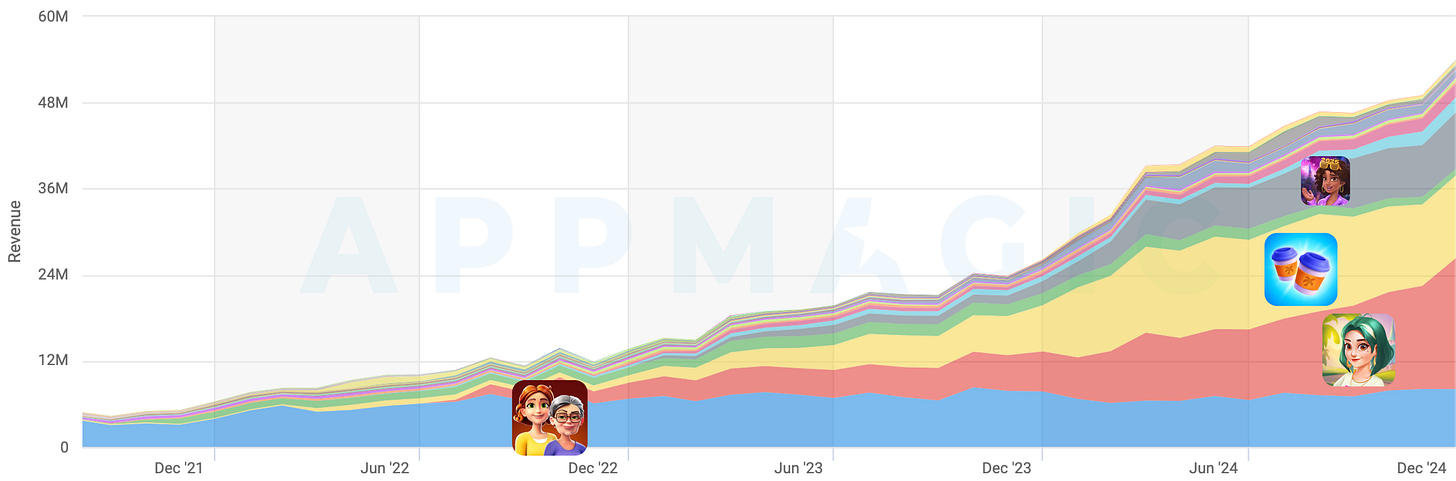

In 2024, Merge-2 grew in revenue by 106% (to $527 million), and downloads increased by 43%, reaching 60 million.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Unlike the previous genre, there is no clear leader in Merge-2 with meta. Merge Mansion, Travel Town, Gossip Harbor, and Seaside Escape compete for audience and revenue.

AppMagic notes that all projects in the genre have increased their expertise in operations. This can be traced, for example, by the frequency of live-ops events in Gossip Harbor.

Competition in the top 10 in the genre is active. Travel Town broke into first place, and 3 new projects appeared in the chart - Adventure Island Merge (FlyBird), Taylor's Secret: Merge Story (Merge Story), and Road Trip: Royal (Vizor Games).

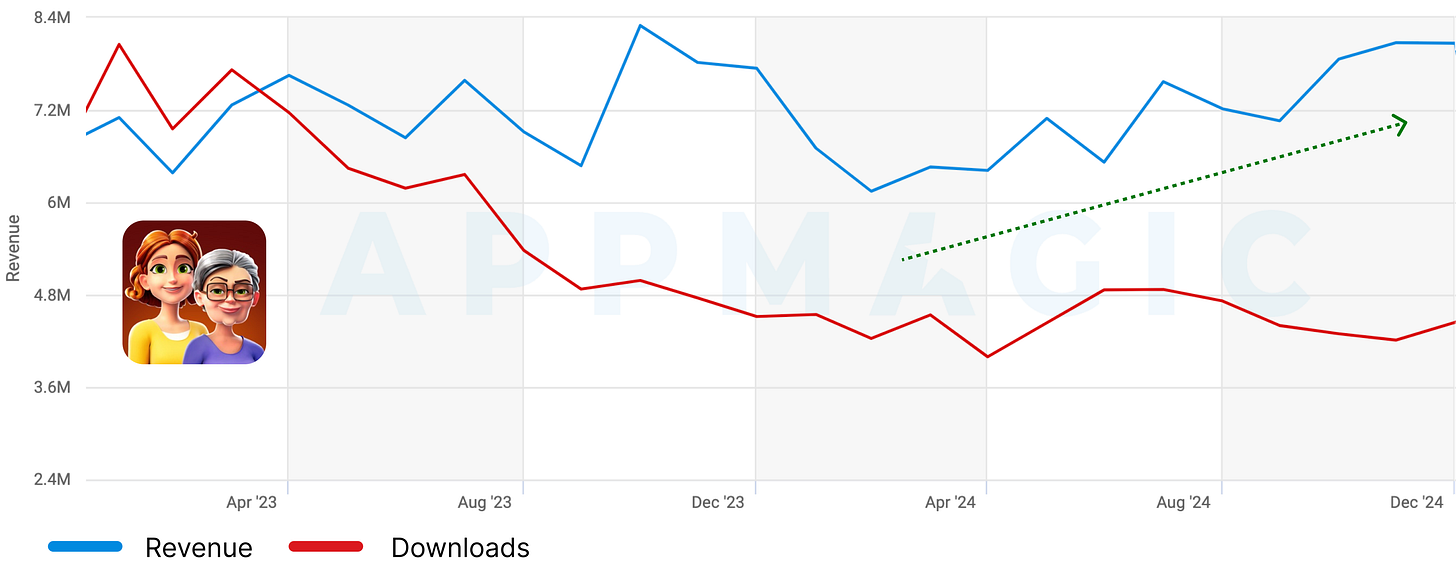

As AppMagic notes, the authors of Merge Mansion are not ready to accept the loss of the leading position. Throughout 2024, the team actively worked on increasing their revenue against the falling downloads and achieved certain successes.

This year, 2 out of 64 games released in the genre managed to exceed $50,000 in monthly revenue. These are Merge Prison: Hidden Puzzle (Blue Ultra Game) and Merge Adventure: Merging Games (Green Pixel. The success rate is 1.6%. In 2023, no project managed to cross this mark, so there is a progress.

Match 3D

Match 3D games revenue in the listed countries grew by 97% to $381 million. Downloads also increased by almost 59% - to 46 million.

The genre is actively developing, and most of the revenue is generated by new projects. The veteran - Triple Match 3D - started earning less in 2024. Match Factory! positioned itself as a leader and now generates 42% of the entire genre's revenue.

The top 10 is very active. Four new projects appeared in 2024 - Joy Match 3D, Match Villa: Makeup ASMR, Match Mania 3D - Triple Match, and Blitz Busters. AppMagic notes that two projects in the genre (Match Frenzy - ASMR Tycoon and Match Villa: Makeup ASMR) use the theme of "gross aesthetics," like popping pimples.

The same theme is used in one of the successful newcomers of 2024 - Match Rush 3D: ASMR Care (AlphaPlay). In 2024, the game earned $575 thousand. Two other projects that broke through the $50,000 monthly revenue mark are Match Party - Tile 3D and Triple Pile 3D.

Sort Puzzle

This is the fastest-growing genre among casual games. In 2024, revenue grew 5.6 times - to $112 million. Installations also almost doubled (178 million installations).

AppMagic correctly points out that the genre has long attracted an audience in the West, but the breakthrough is related to user monetization.

The revenue development dynamics of the genre resemble what happened with Match 3D.

The genre is developing. Therefore, in the top 10 by revenue, there are 5 newcomers at once, including the leader - Hexa Sort.

4 out of 10 games in the top 10 are dedicated to arranging various household items or products on store shelves. This is the most popular theme in the genre.

In 2024, 227 projects were released in the genre, 6 of which exceeded the $50,000 monthly revenue mark. 2.6% Success Rate, but it's important to consider that the genre has a large share of advertising monetization. Therefore, part of the revenue (quite substantial) is missed.

Casual Casino

The genre's revenue grew by 146% compared to the previous year, reaching $2.19 billion. However, downloads fell by 24% to 68 million. At the same time, the level of influence of Monopoly GO! on the genre is so high that when we evaluate the genre's performance, we are largely looking at the game's performance.

In 2024, MONOPOLY GO! generated 55% of the entire genre's revenue, Coin Master - 18%, Dice Dreams - 7%. This is one of the most monopolized genres in the industry.

The situation in the top 10 is stable. The only new project is Coin Tales. And 4 projects belong to Playtika - Coin Master, Dice Dreams, Animals & Coins Adventure Game, and Board Kings: Board Dice Games.

In 2024, 17 projects were released in the genre, and only 1 of them managed to exceed the $50,000 per month mark. Fishing Travel from Ark Game succeeded.