AppMagic: Top-10 Hybrid-Casual Games in Q2’25

Rollic & Voodoo dominate the chart.

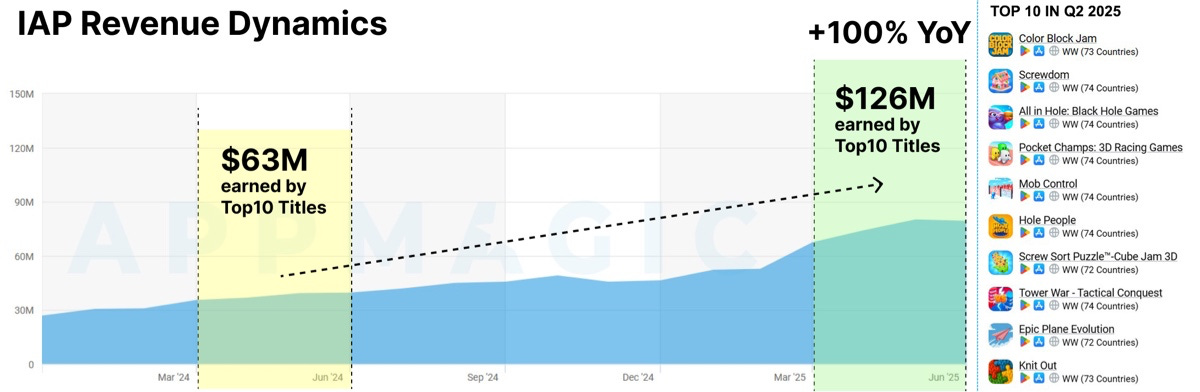

AppMagic notes that the hybridization of the hypercasual market is in full swing. IAP revenue is actively growing. To avoid limiting the sample in terms of taxonomy, AppMagic sorted the top 10 among hypercasual and hybrid-casual projects by revenue. Data is presented for Q2’25.

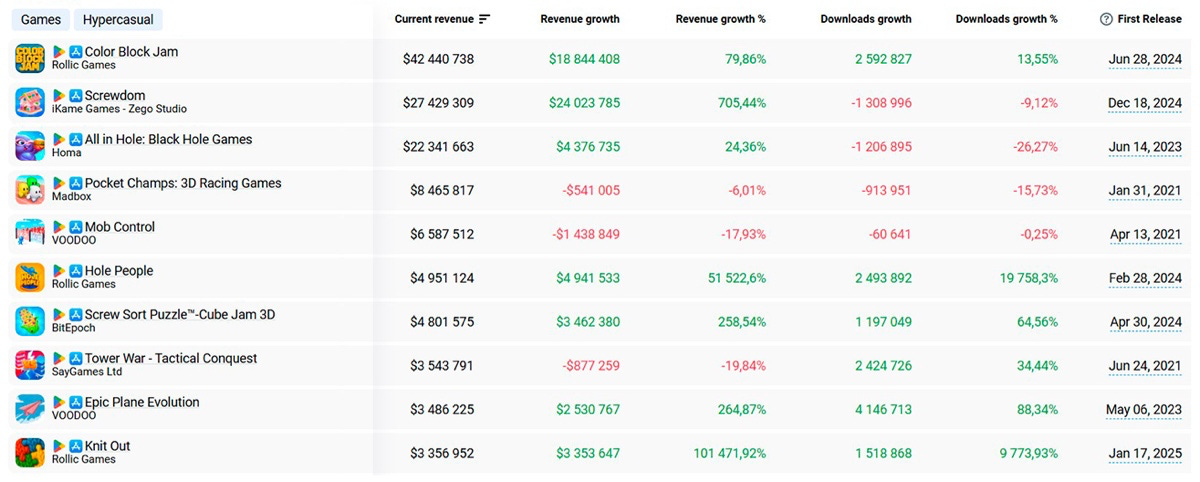

Top-10 highest earning hybrid-casual games in Q2’25

In Q1’25, hybrid-casual projects grew 67% YoY in IAP revenue. In Q2’25, the trend accelerated — growth doubled (+100% YoY), with the top-10 projects generating $126M in Q2 2025.

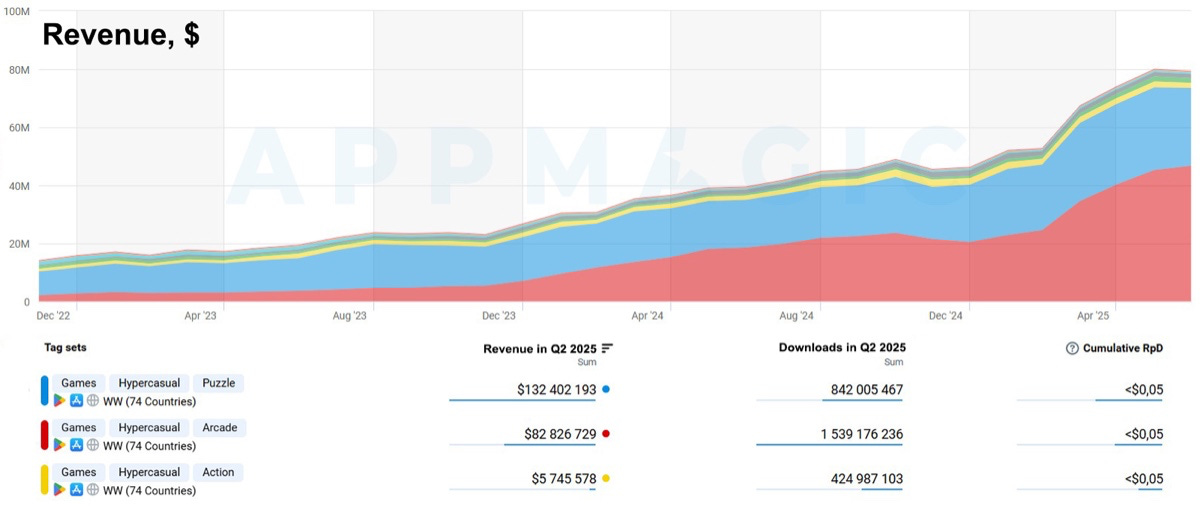

In Q2’25, hybrid-casual puzzles accounted for more than 50% of all revenue in the top-10. The second largest revenue segment is arcade (35%+). Next are action games (2% of total revenue).

All 3 genres (or subgenres) are growing. Hybrid-casual projects in Q2’25 saw 137% YoY growth in revenue; arcade grew 67%.

9 out of 10 projects in the top 10 are either puzzles or arcades. Block Puzzle - Color Block Jam; Screw Puzzle - Screwdom, Screw Sort Puzzle™ - Cube Jam 3D; Sort Puzzle - Knit Out, Hole People; arcades - All in Hole, Pocket Champs, Mob Control, Epic Plane Evolution. And Tower War represents hybrid-casual strategies.

Hybrid-Casual Segment Leaders

The top earners in Q2’25 are Color Block Jam ($42M | 21.8M installs); Screwdom ($27.1M | 13.1M installs); All in Hole ($22.3M | 3.4M installs); Pocket Champs ($8.2M | 4.9M installs); and Mob Control ($6.5M | 24.3M installs).

Among all projects, AppMagic highlights Homa’s All in Hole. The project has active live-ops (not typical for the segment) and the highest RpD among all projects in the ranking.

Rank 6–10: Newcomer Zone

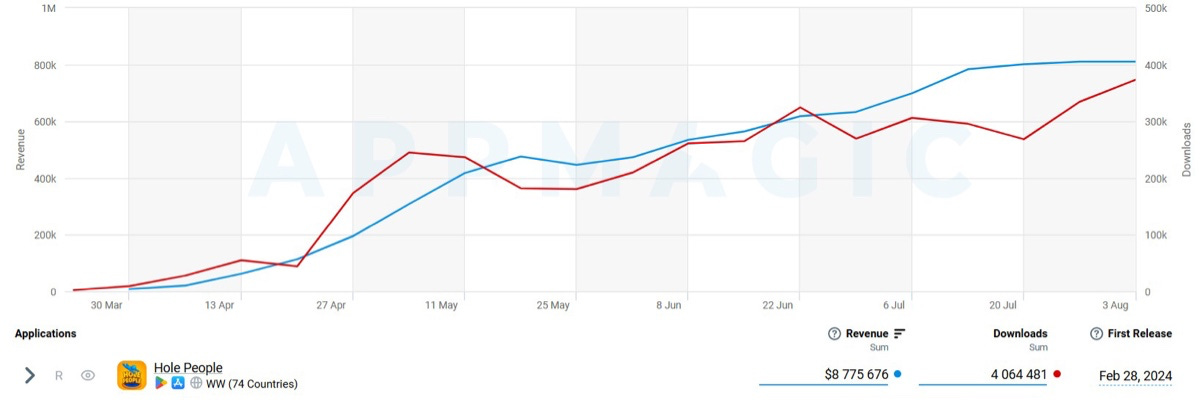

Hole People (Rollic) — $4.9M | 2.5M installs

A traditional Sort Puzzle, but Rollic added complexity to the core gameplay. Colors block each other, increasing the role of strategy.

The game follows Rollic’s traditions: increasing difficulty curve (though less than in Color Block Jam), replayable failed rounds, and active support.

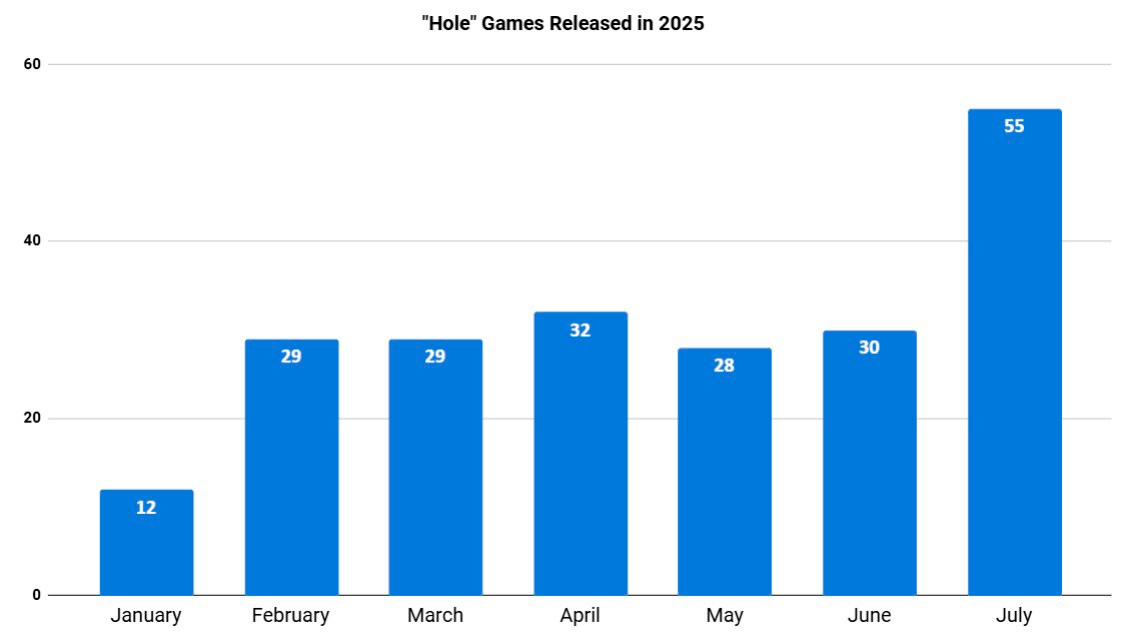

Competition in the genre is fierce. From Jan–Jul 2025, 215 new games launched with “hole” in their keywords (vs. 15 in the same period of 2024). Likely not all represent the genre, but many do.

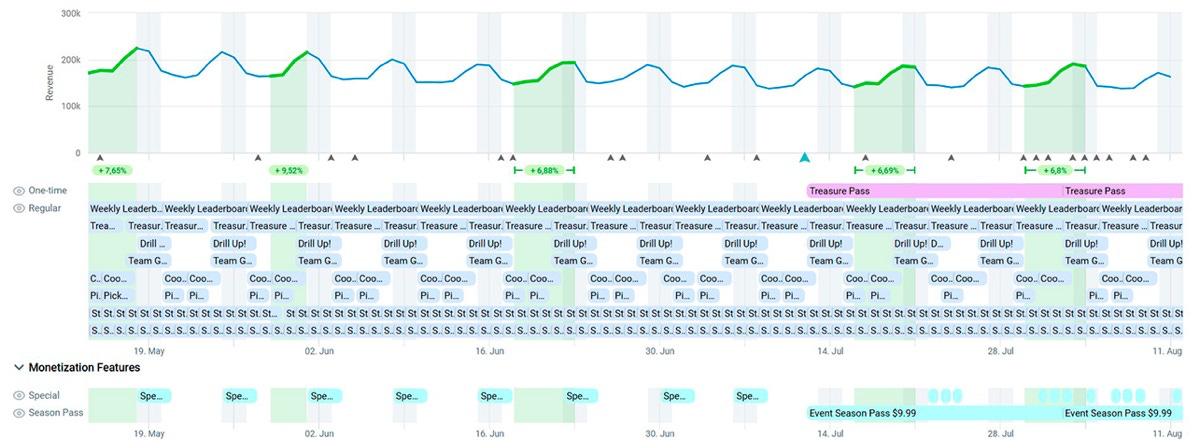

Monetization relies on Battle Pass, ad removal offers, and fail-level offers. The last two bring in ~30% of monthly revenue. In July alone, they generated ~$1M.

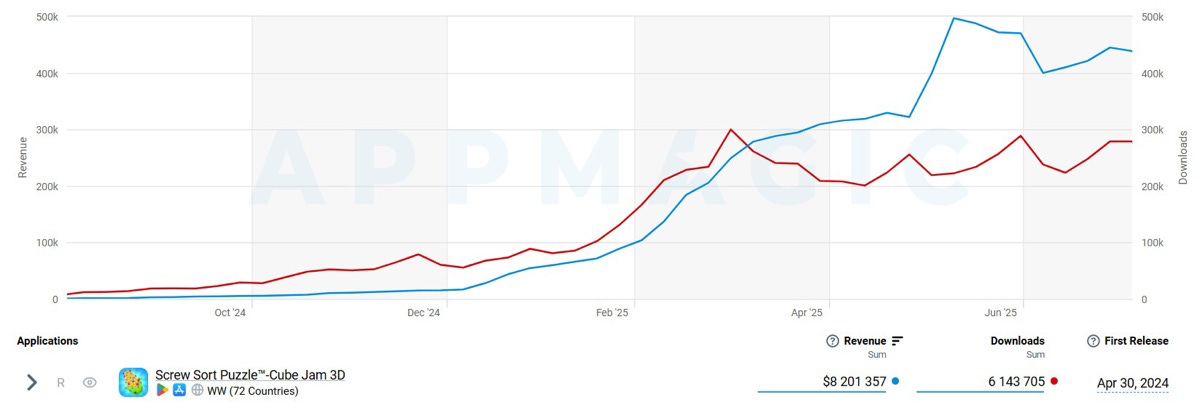

Screw Sort Puzzle - Cube Jam 3D (BitEpoch) — $4.7M | 3.1M installs

In Q2’25, revenue grew 258% YoY, while downloads plateaued.

The main differentiator is its 3D perspective.

The team experiments with both core gameplay (e.g., boosters like in Royal Match) and monetization. Recently increased the fail-offer price (from $4.99 to $5.99). Experiments with pricing include scaling piggy banks ($1.99–$14.99).

Economy is carefully tightened to grow ARPPU, but players are rewarded with lots of content via live-ops: leaderboards (daily/monthly), daily roulettes, milestone events, challenges, etc.

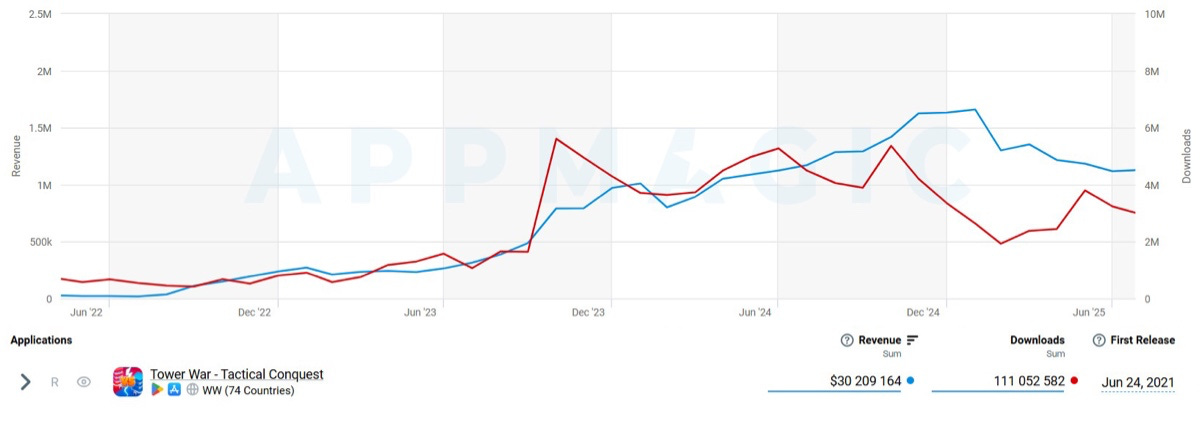

Tower War - Tactical Conquest (SayGames) — $3.5M | 9.5M installs

Launched back in 2021, but still relevant. Devs actively support and even update core gameplay to stay competitive.

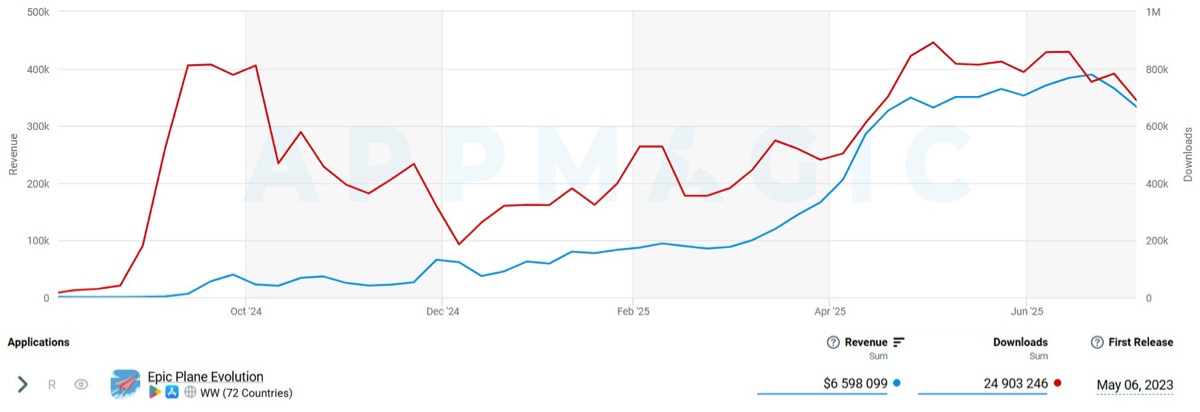

Epic Plane Evolution (Voodoo) — $3.5M | 8.6M installs

Grew 265% vs. last quarter, mainly from the U.S. market.

Voodoo transformed it from a hypercasual ad-driven game into an IAP-heavy project. Key change: ticket system, each plane launch costs 1 ticket.

Also revamped pricing, raising IAP pack prices by more than 2x.

Knit Out (Rollic) — $3.4M | 1.5M installs

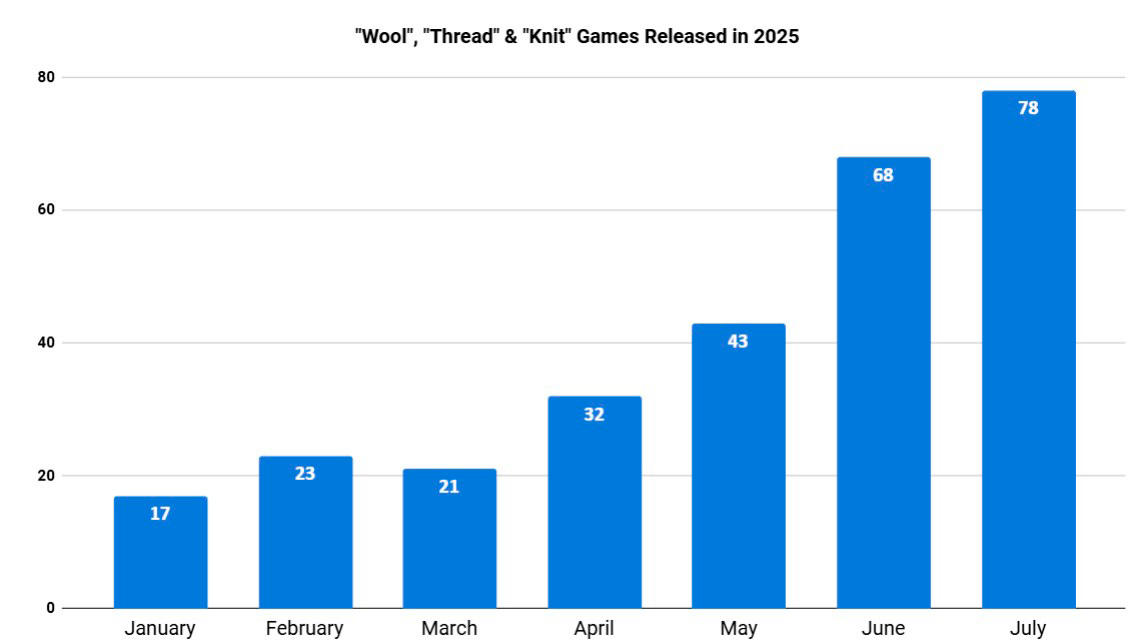

Despite fierce competition, Rollic pushed the game into the top 10. From Jan–Jul 2025, 280+ games launched with “wool,” “thread,” or “knit” in keywords.

Core gameplay hasn’t changed much. Strong execution of quality, balance, and live ops (publisher has big experience).

Recently launched Thread Pass (battle pass) already contributes 5–7% of monthly IAP revenue. Key money-maker is the fail-offer.