AppsFlyer: State of Mobile Gaming Marketing in 2023

Everything you should know about mobile gaming marketing trends and numbers is here.

The data was collected from January 2021 to December 2022. 38B installs were counted; 18.6k thousand apps with not less than 10k quarter installs participated; $13.9B of spend was considered.

General numbers

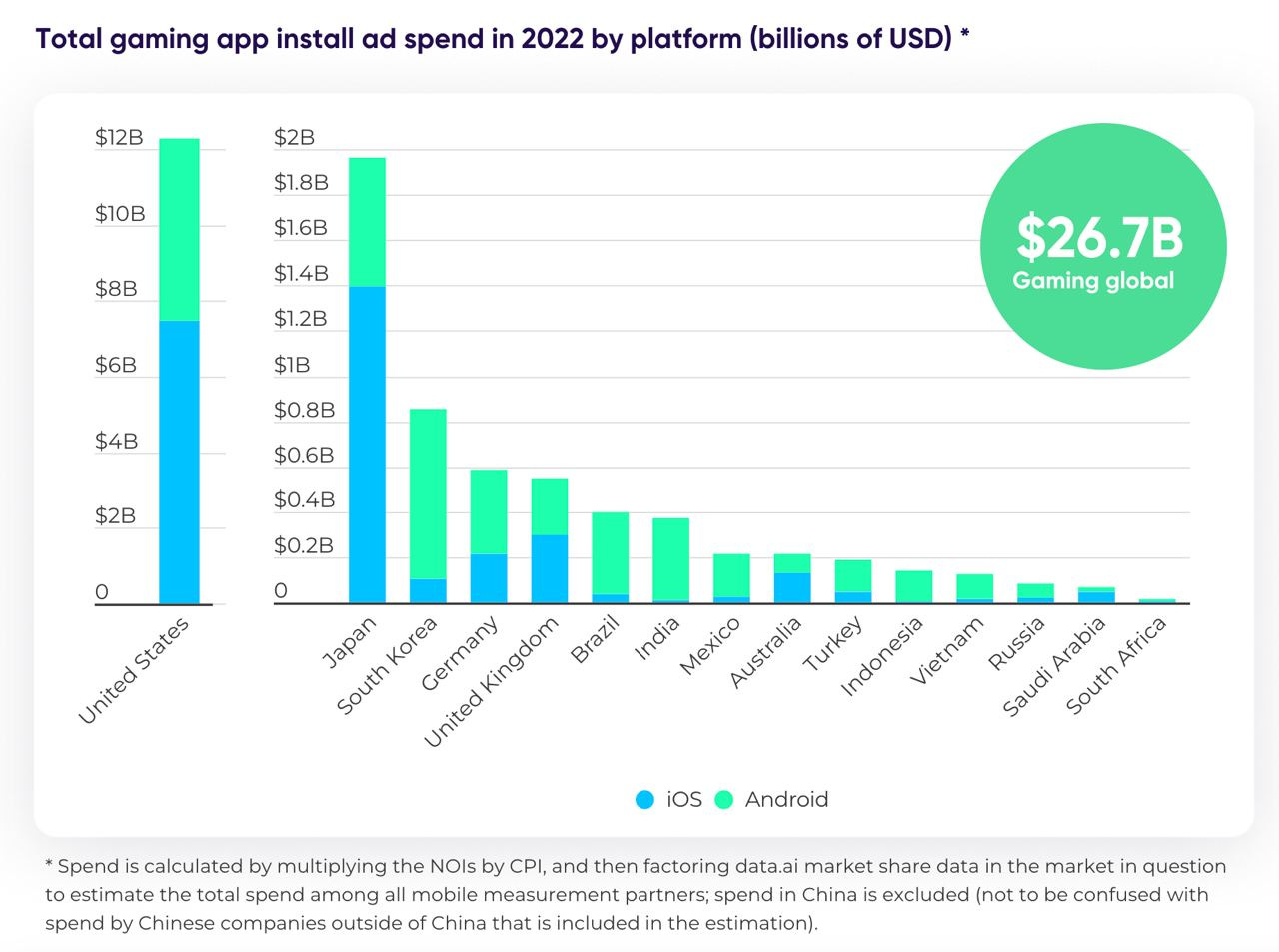

$26.7B was spent on mobile gaming ads in 2022. The US market is the first with $12.2B of spend. Japan is second with about $2B spent.

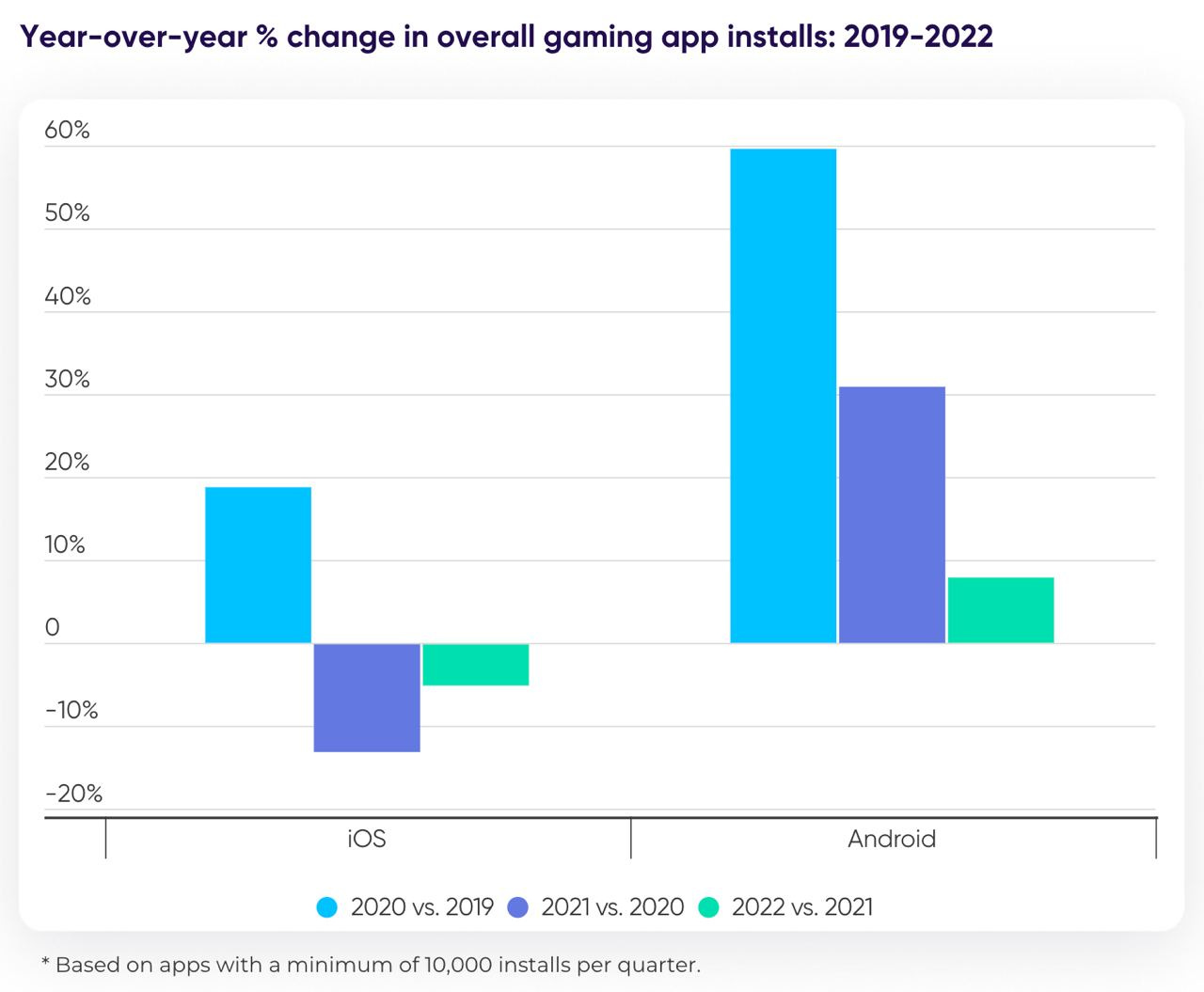

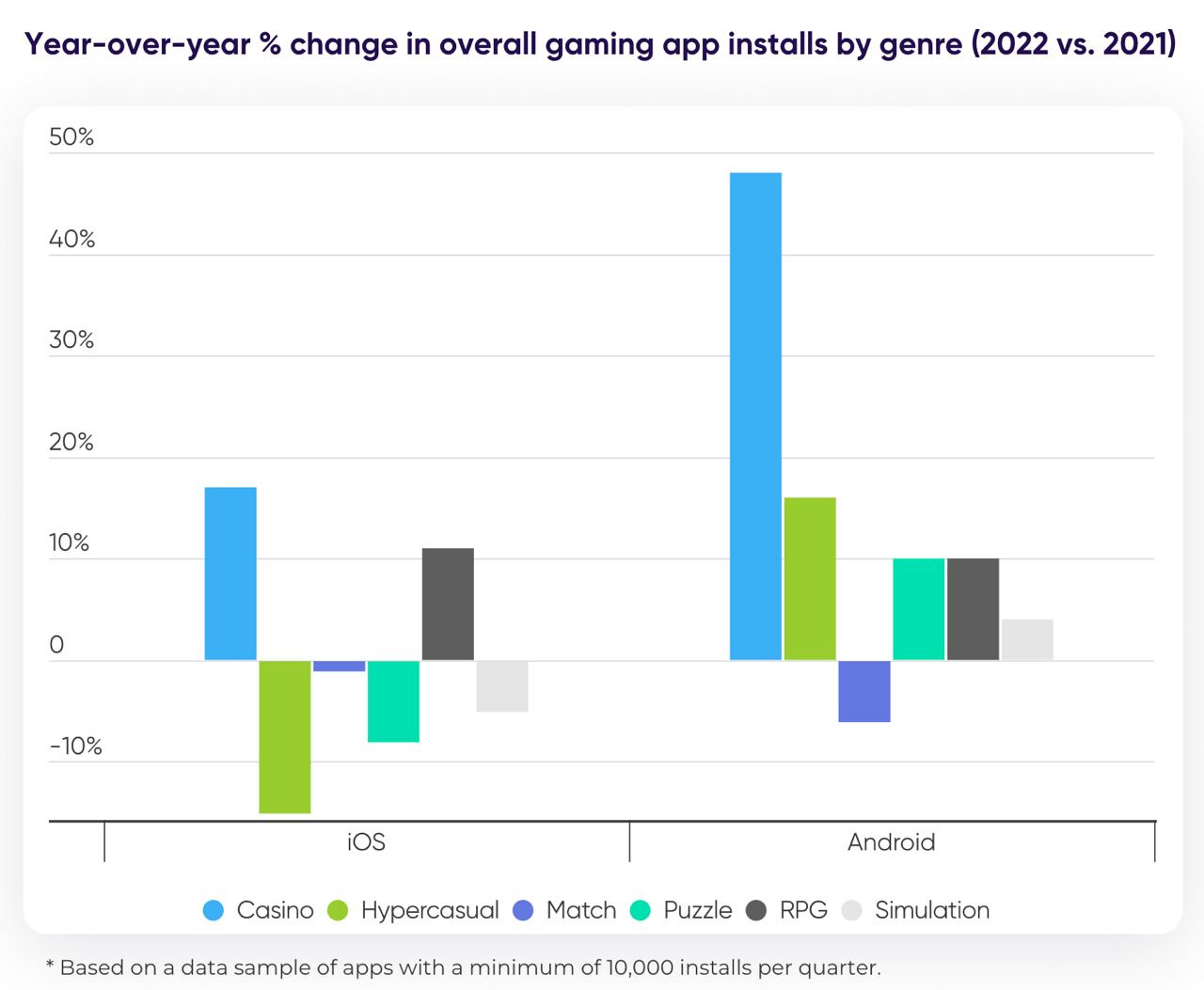

Android downloads increased by 8% worldwide. iOS downloads dropped by 5%.

In the US Android downloads increased by 19%; iOS downloads decreased by 1%.

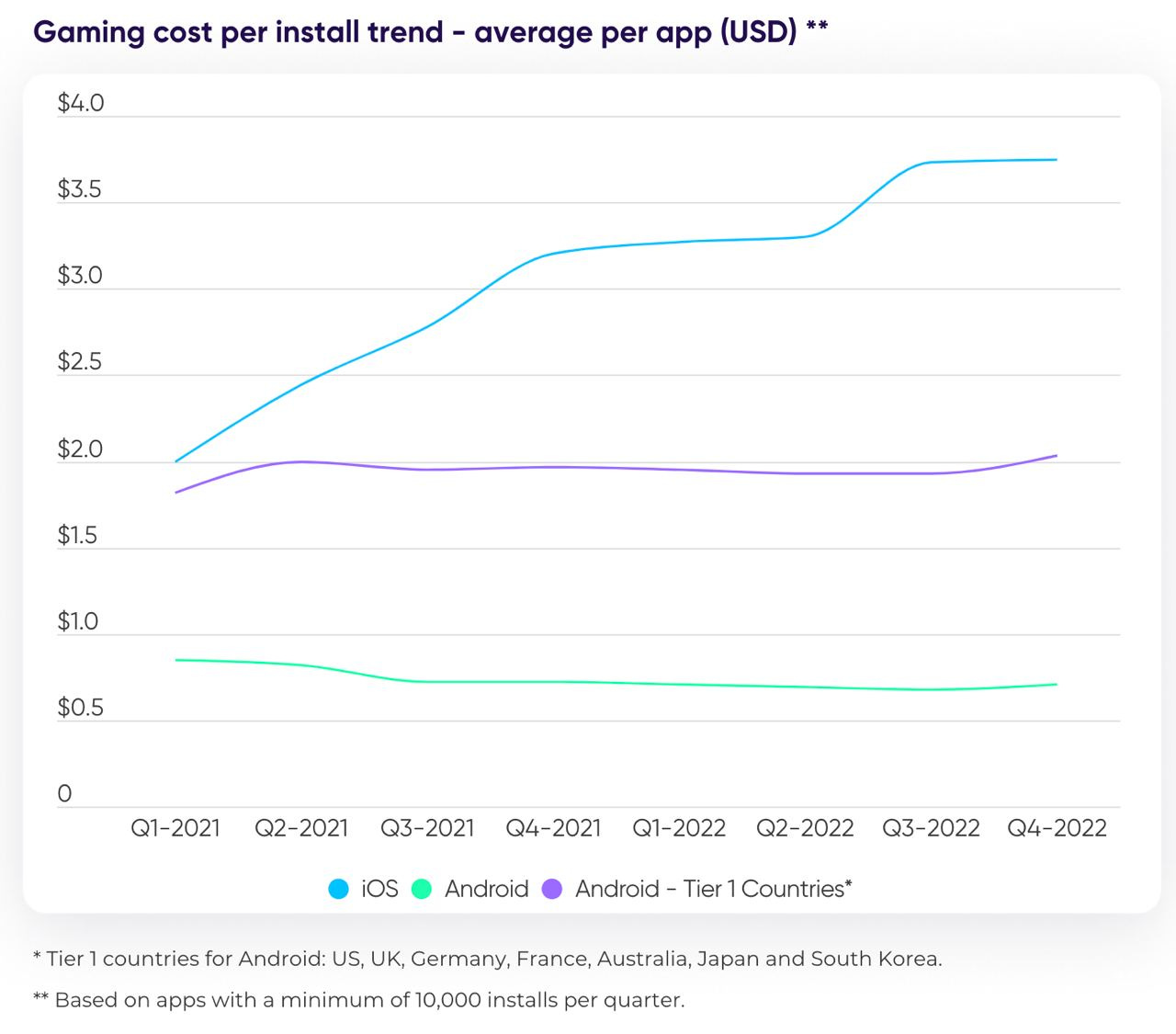

An average CPI on iOS increased by 88% when comparing Q1 2022 with Q4 2022 and reached $3.75.

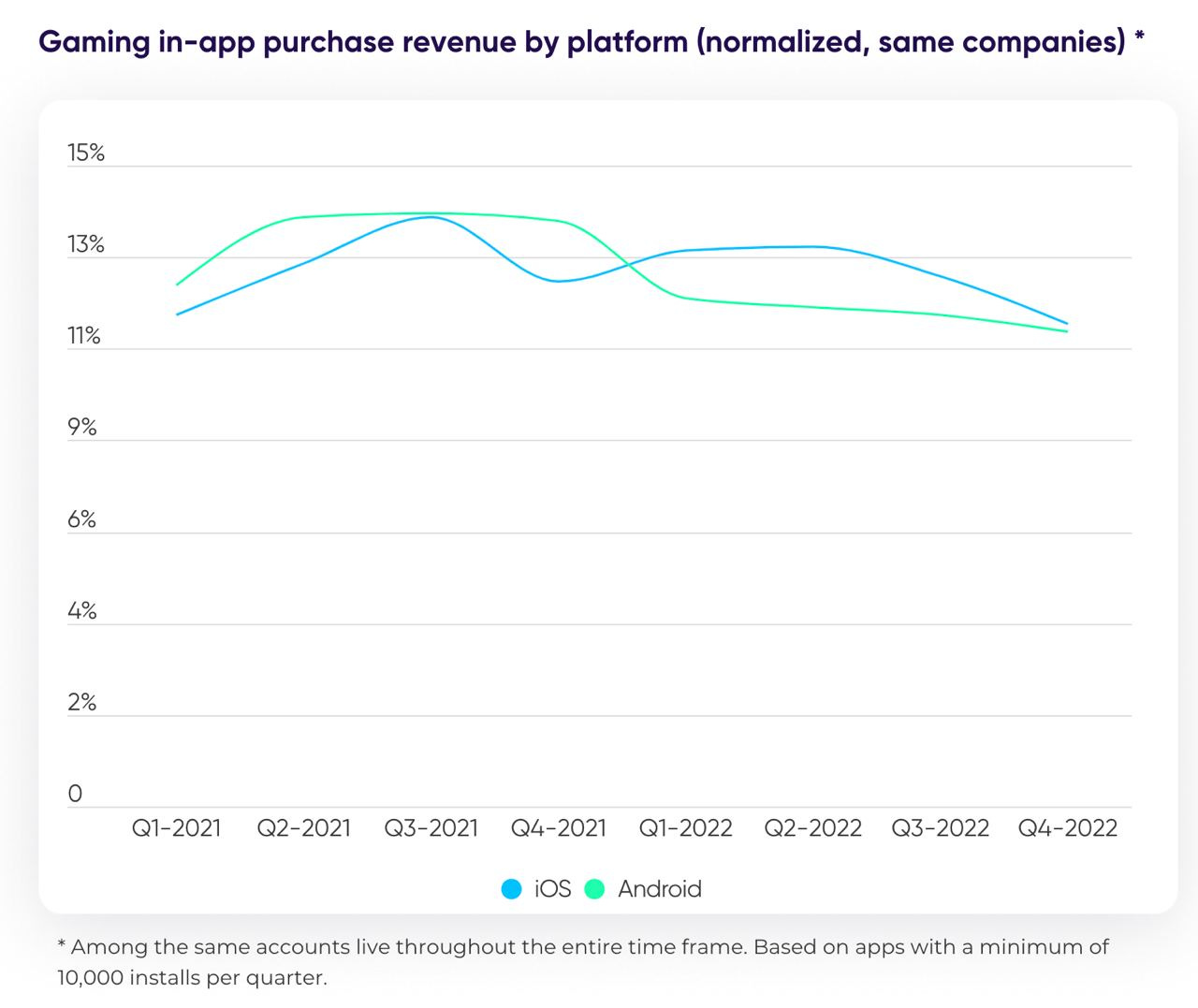

IAP dropped by 7% in H2 2022 compared to H1 2022. iOS payments declined by 13% (-1% YoY); Android - by 6% (-14% YoY). The decline is caused by the revenue drop of RPG and casino games.

World trends

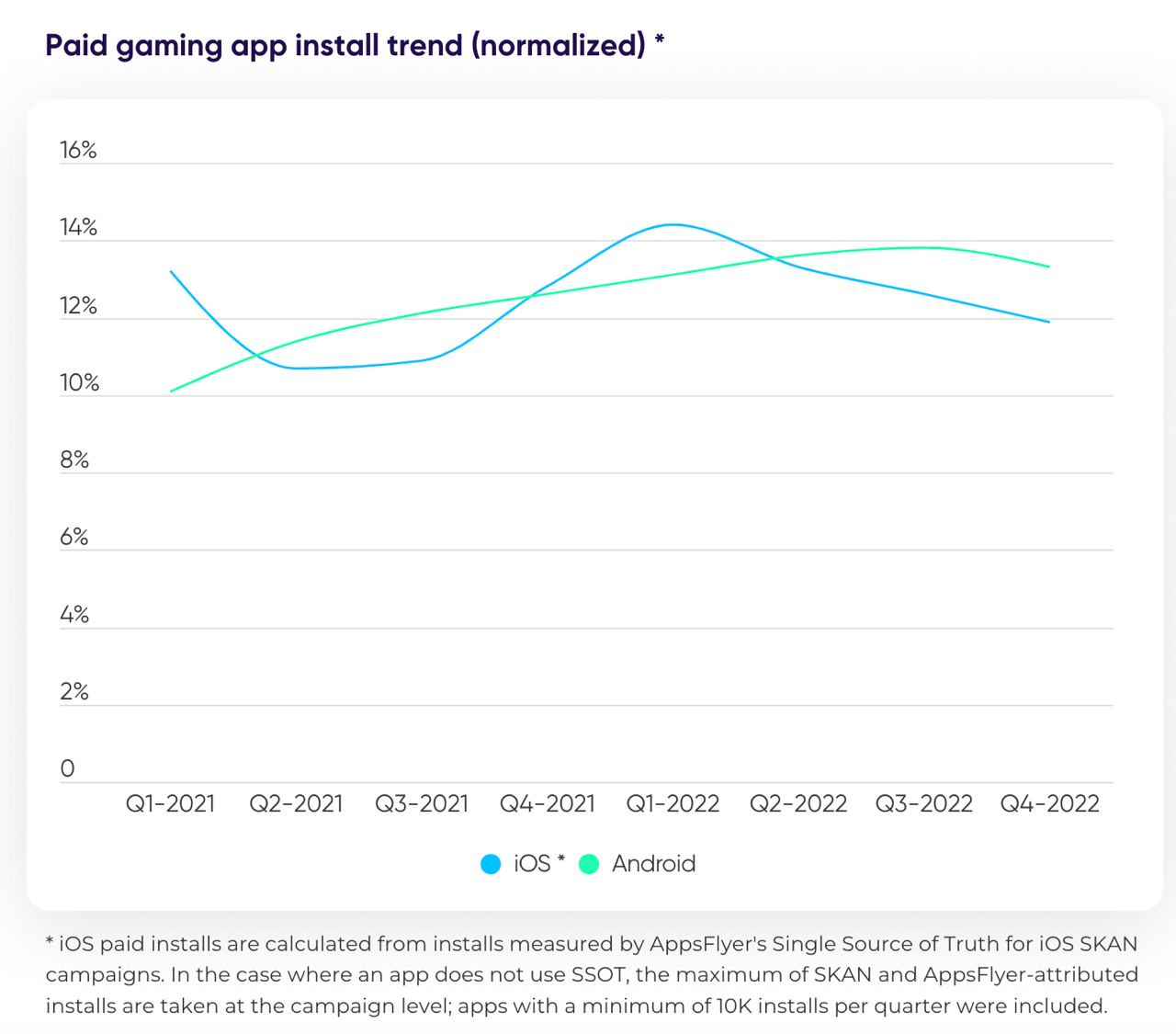

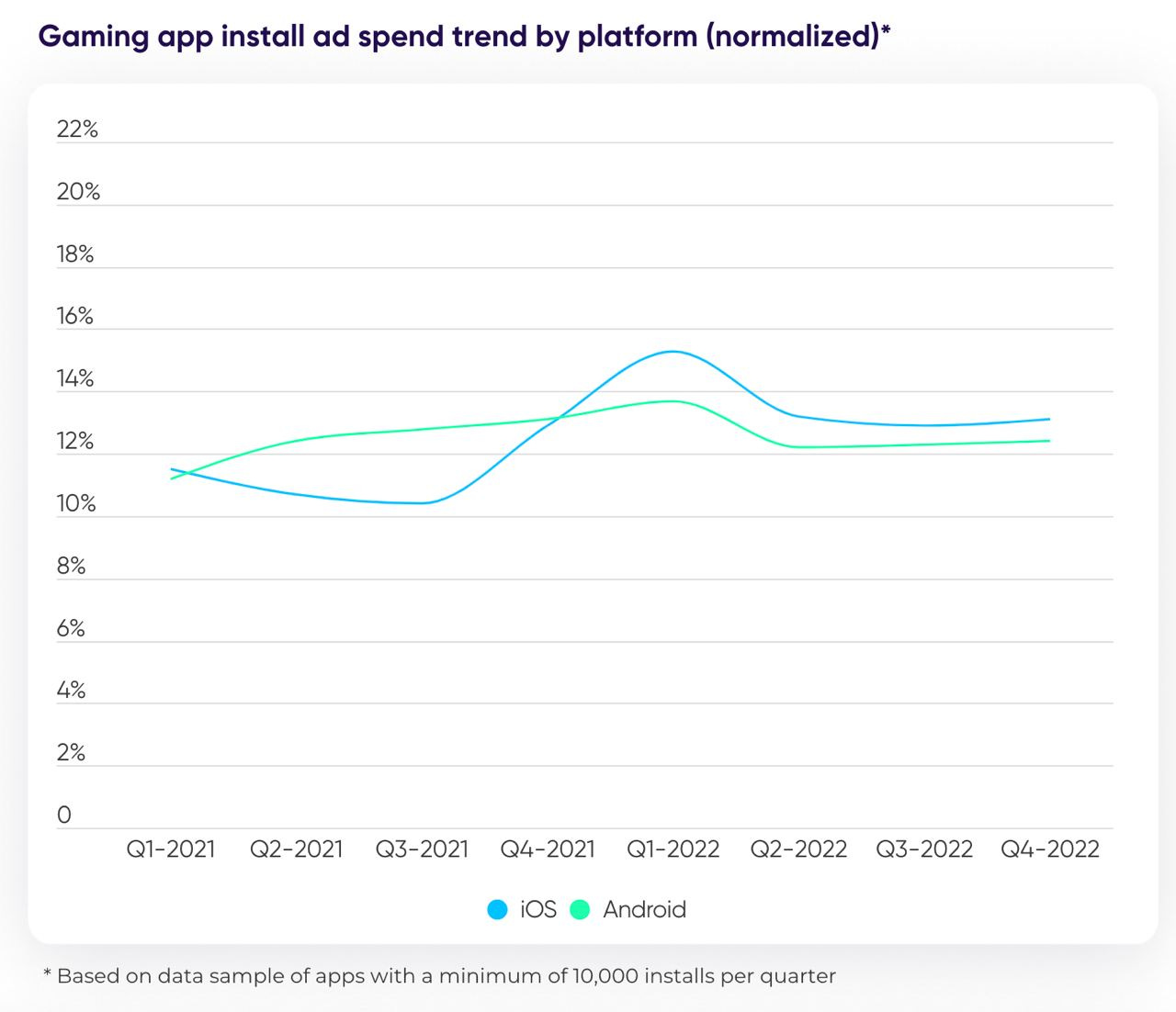

The speed of iOS downloads declining in 2022 slowed down, but the trend is still negative. Android downloads growth is slowing too.

Casino (+17% YoY) and RPG (+11%) downloads grew on iOS in 2022. On Android casino games were 48% more popular - it’s the fastest-growing genre on the platform overcoming the hypercasual games 3x times. Users from India, Brazil, and Turkey drove such dramatic growth.

The number of paid downloads on Android increased by 16% YoY. In spite of difficulties, iOS paid downloads increased by 10%. However, it’s important to note that iOS paid downloads have been declining throughout 2022.

A lot of countries in Southeast Asia showed an overall growth in downloads. China (-30%), Russia (-30%), Mexico (-31%) - are the largest losers by downloads on iOS. Russian Android downloads also decreased by 27%.

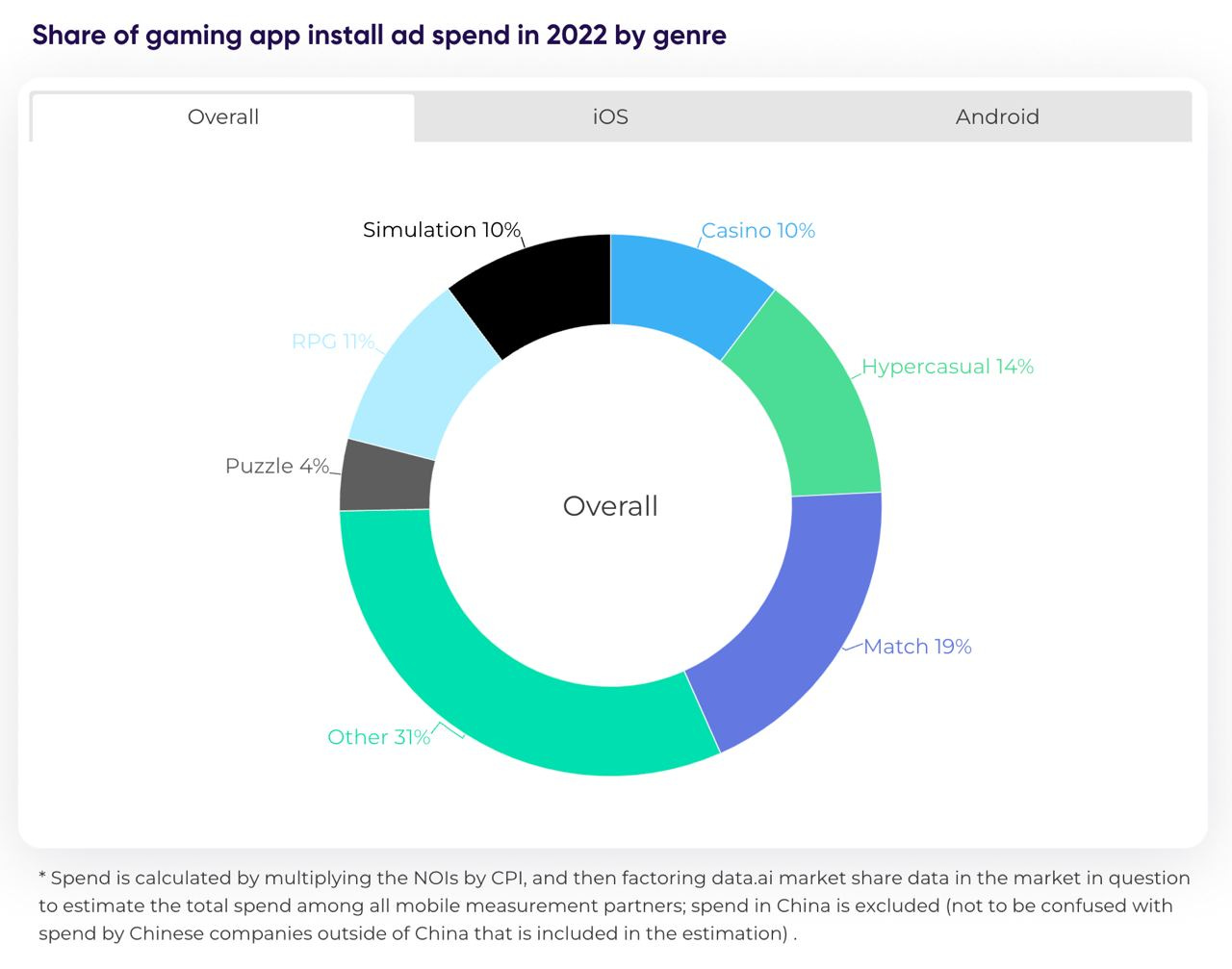

Match games (19%), hypercasual games (14%), and RPGs (11%) are responsible for almost half of the ad budget worldwide.

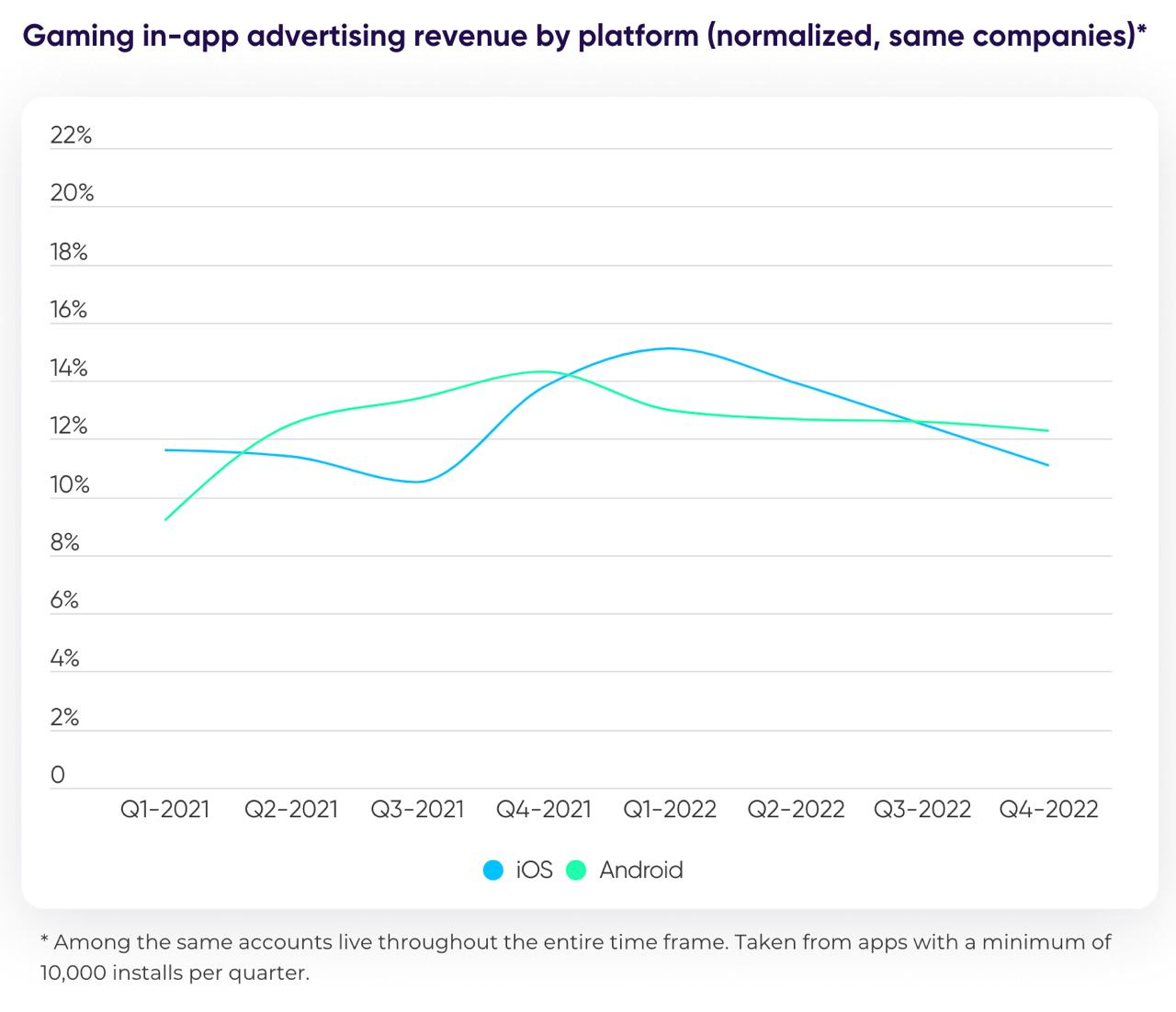

Ad monetization has been decreasing throughout 2022.

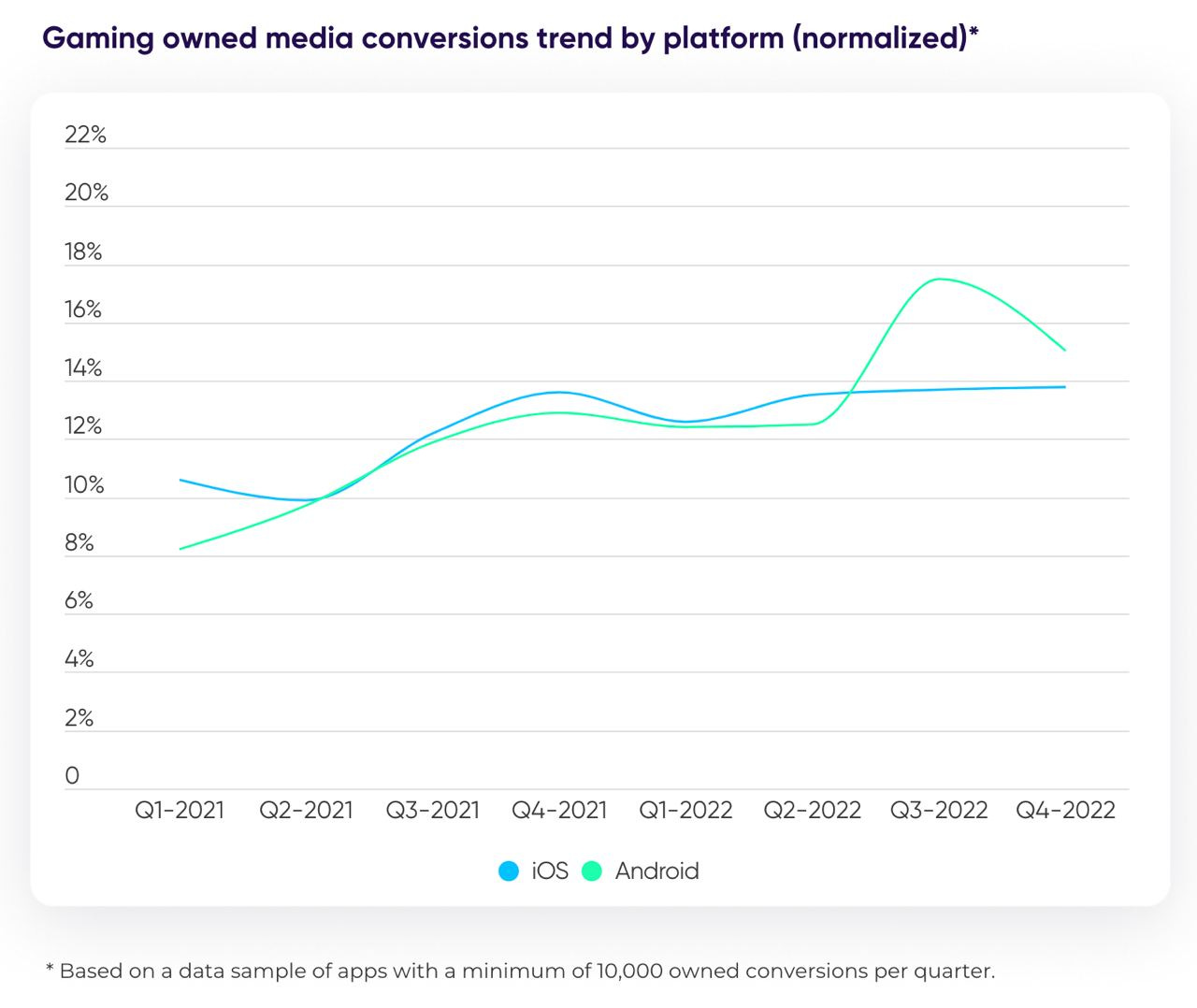

The impact of self-owned marketing instruments (push notifications; in-app messages; cross-promo) increased by 16% on iOS and 34% on Android.

Trends by genre

Hypercasual - CPI is decreasing; the number of downloads from India increased by 32% in 2022.

Match - CPI is growing on both iOS ($5.74 in Q4 2022) and Android ($1.45 in Q4 2022); China dropped by 41% in downloads on iOS.

Casino - CPI on iOS reached $11.45 in Q4 2022; ad revenues declined by 33% on iOS and 29% on Android; downloads in the US are growing.

RPG - downloads in the US grew by 90% YoY on iOS and 41% YoY on Android; despite such a growth - IAP and ad monetization declined; however ad spending on games of this genre is increasing.

Simulation - paid downloads on Android increased by 33%; IAP revenue is declining on both iOS and Android; in the US downloads dropped by 28% on Android but grew by 1% on iOS.

Puzzle - Android ad spending increased by 52% and iOS ad spending increased by 37%; CPI on iOS dropped to $3, on Android - contrary - it grew up to $3; CPI in India is less than $0.1.

General conclusions

Hybrid monetization is the key.

AppsFlyer is positive that the right usage of SKAN 4.0 will help to work more efficiently on the iOS market.

The US is being the main market, but AppsFlyer suggests paying attention to growing markets like Indonesia, India, or Vietnam.

Remarketing on Android is still working.

The right thing to do is to scale your own marketing channels.

Mobile games are turning more to community marketing. Players are reading Twitter, chatting in Discord, watching Twitch. And, of course, discussing their favorite games.