Aream & Co.: Gaming Investment Market in Q1'25 | Sponsored by Neon

Early-stage investments are on a 5-year minimum. It's a challenging market.

Aream & Co. collaborated with InvestGame to release this report.

Overall market condition

In Q1'25, 42 M&A deals were made, totaling $6.6 billion. This amount includes the sale of AppLovin's gaming division and Niantic's acquisition.

There were 12 deals involving public companies in Q1'25, with a total volume of $5.1 billion. This includes the Tencent and Ubisoft transaction.

In Q1'25, 81 private investments were made — the worst indicator in the past five years. The deal volume — $0.4 billion — is also at its lowest since early 2020.

M&A in Q1’25

The situation in the M&A market is gradually improving, with an increasing number of deals.

A word from our sponsor

At Neon, customer satisfaction is at the heart of everything we do. We are committed to providing our clients with not only top-tier technology but also the hands-on support they need to succeed. Our dedicated team works closely with studios like Metacore, PerBlue, and Space Ape to ensure they get the most out of their direct-to-consumer strategies. With transparent pricing, 24/7 player support, and a focus on performance, it’s no wonder our clients rave about their experience with Neon. If you want a partner who delivers results and a truly supportive relationship, visit Neon to learn more.

Most major M&A deals over the past year were focused on mobile studios.

The number of medium and large deals (where upfront payment exceeds $100M) has surpassed pre-pandemic figures.

Private equity funds are showing interest in the gaming market. Over the past year alone, they participated in several major deals.

Public Market transactions in Q1’25

The number of various types of deals conducted by public companies reached 12 in Q1'25. The most notable ones include Asmodee's public spin-off and the transaction between Tencent and Ubisoft. Additionally, the number of deals over the past six months is a record for three years.

Gaming companies indexes in Q1'25 are performing better than S&P and NASDAQ indexes. Both international gaming companies and Chinese gaming indexes show similar growth. However, the effect of U.S. trade tariffs will materialize in upcoming quarters. Nintendo has already announced a pause to pre-orders for Nintendo Switch 2, while Chinese companies are cautious about operating within the US.

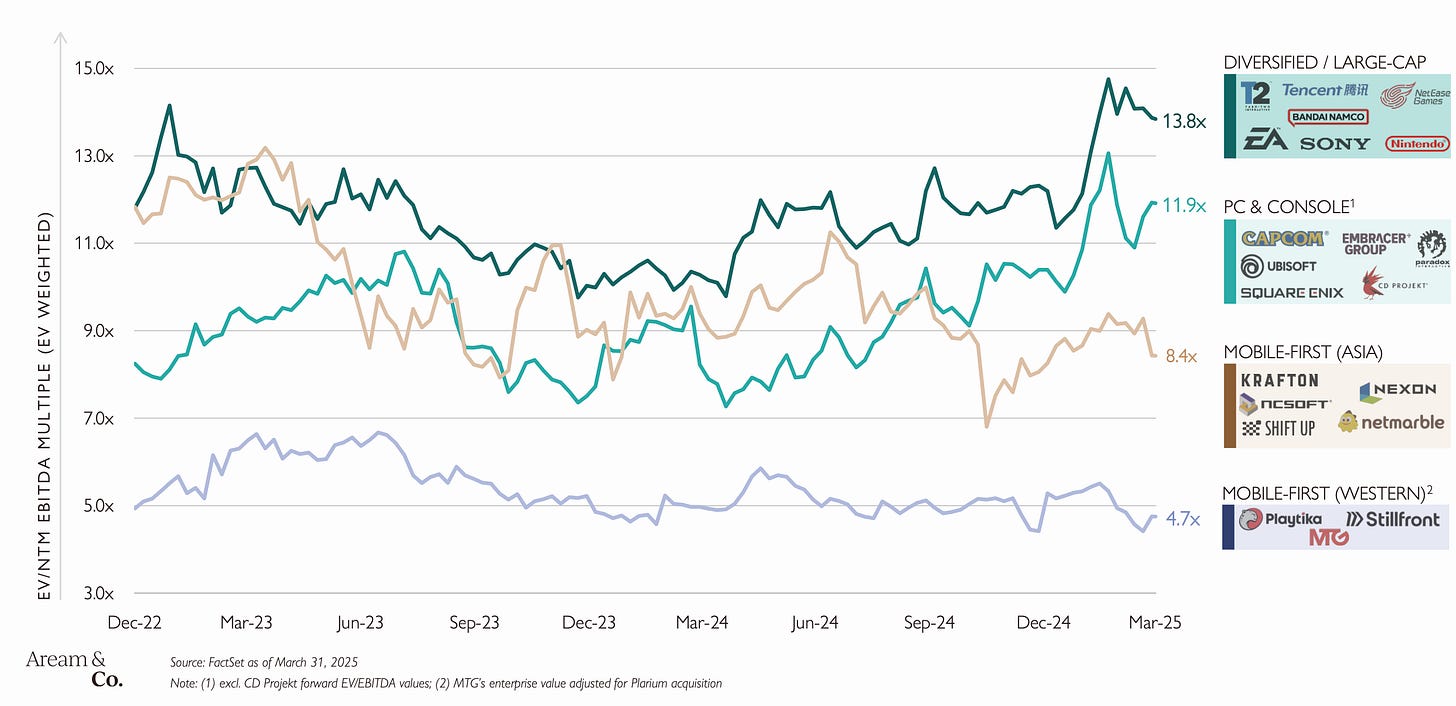

Looking at dynamics since December 2022, diversified large companies (Take-Two; EA; Sony; NetEase) showed the most significant growth. PC/console developers also ended slightly positive, while mobile developers from Asia and Europe lost value.

Accordingly, diversified large companies have the highest valuations based on NTM EBITDA - 13.8x. Western mobile developers have the lowest - 4.7x.

In Q1'25, stock prices of major holdings and PC/console developers increased. Mobile companies mostly remained in negative zone.

Most companies that saw a valuation increase did not report corresponding revenue growth in 2024. On the contrary, many showed worse results compared to 2023. There is cautious optimism for mobile companies.

Growth and profitability are key drivers for company valuation increases.

Private Investments in Q1’25

The volume of private investments reached a multi-year low (in terms of deal count, only Q2’20 had fewer). In terms of volume, it's a five-year minimum.

Early-stage deals show similar trends, with all metrics at their lowest since early 2020.

The largest rounds in Q1’25 mainly consisted of seed rounds.

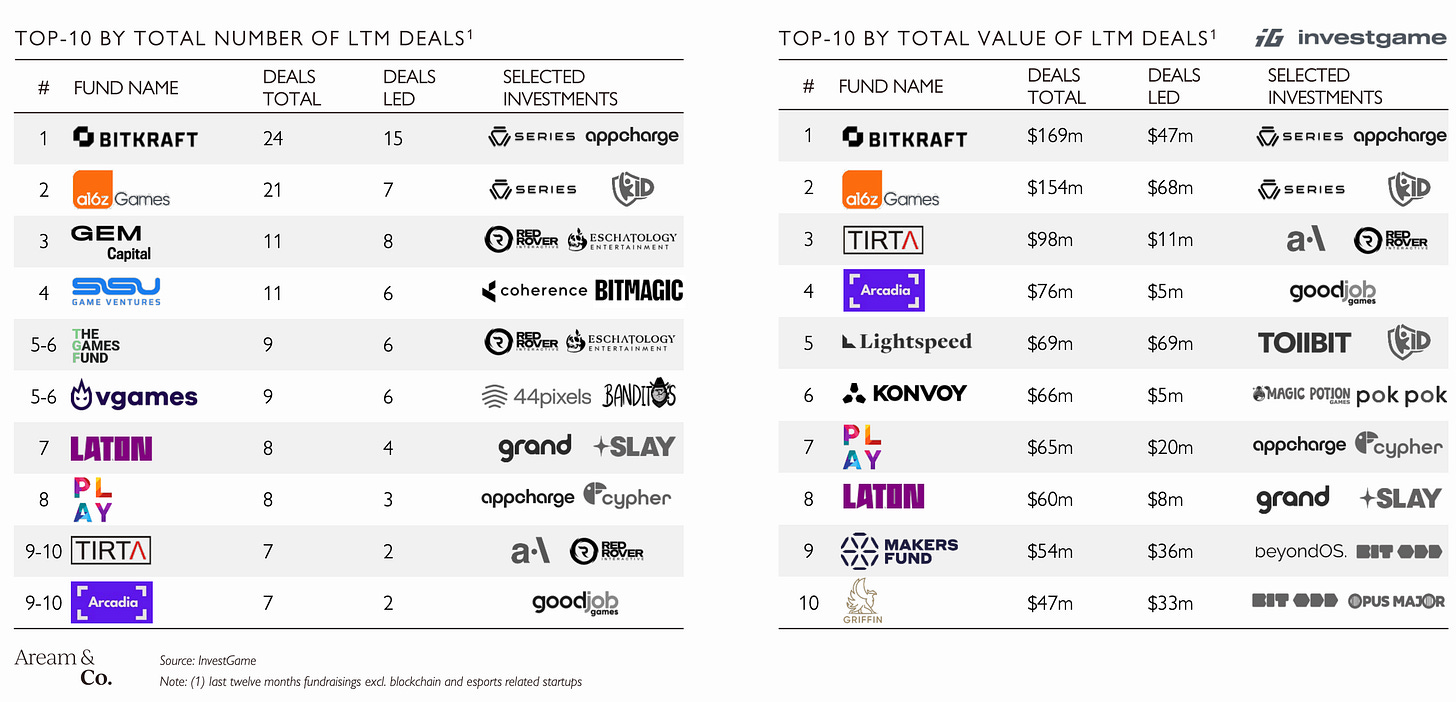

Bitkraft, a16z Games, and GEM Capital have been the most active early-stage investors over the past year. In terms of total investment over 12 months, Bitkraft, a16z Games, and Tirta lead.

Despite a rather grim market situation, 4 new VC funds were launched in 2024–2025. Additionally, several funds secured additional financing.

Market Trends

Mobile gaming has stabilized after its decline, although game downloads are at multi-year lows. Asian publishers lead revenue growth.

A word from our sponsor

At Neon, customer satisfaction is at the heart of everything we do. We are committed to providing our clients with not only top-tier technology but also the hands-on support they need to succeed. Our dedicated team works closely with studios like Metacore, PerBlue, and Space Ape to ensure they get the most out of their direct-to-consumer strategies. With transparent pricing, 24/7 player support, and a focus on performance, it’s no wonder our clients rave about their experience with Neon. If you want a partner who delivers results and a truly supportive relationship, visit Neon to learn more.

Steam shows steady growth — in Q1’25, the platform reached 41.2 million concurrent users.

Active audiences on PlayStation Network and Nintendo are growing. There is no data for Xbox metrics; however, judging by sales figures, if its audience is growing at all, it's not due to console sales.

Interest in UGC and games as platforms (Roblox, Fortnite) remains strong. Streaming trends are more intriguing — while the number of games featured on streams grows, viewership continues to decline steadily from pandemic peaks.

The number of new projects released on mobile devices hit a seven-year low in 2024. Preliminary indicators for Q1'25 suggest little change. Meanwhile, competition on PC (Steam) continues to grow yearly.

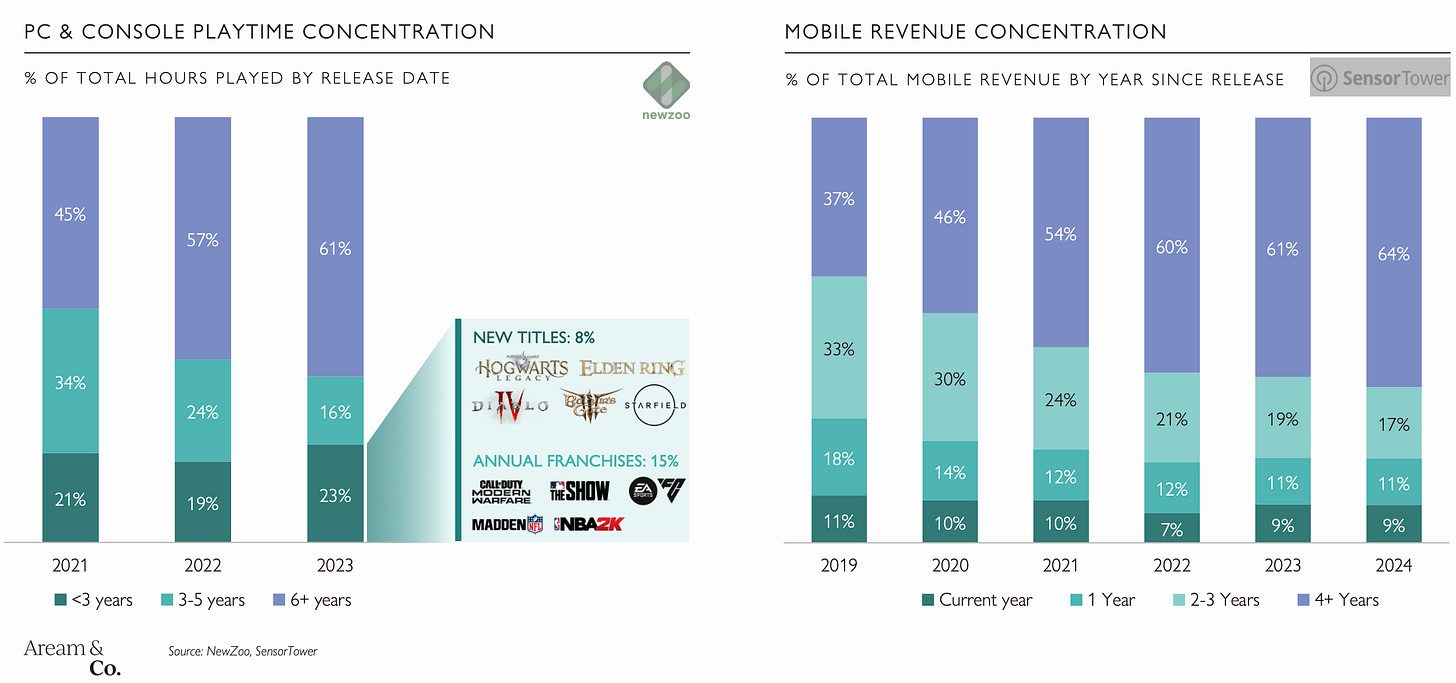

The share of older games in revenue structure remains high for both PC and mobile platforms. On mobile platforms especially, this trend has worsened over the past five years — players prefer established game projects and universes.