Bain & Company: The Gaming Industry in 2024

The general outlook is positive, yet there are some worrying numbers - console penetration is not growing, and a larger headcount doesn't lead to business performance.

Consulting company Bain & Company has prepared a comprehensive report on the gaming industry in 2024, analyzing player habits, distribution, marketing, and business aspects.

Players and Their Preferences

Bain & Company surveyed over 5,000 people from six different countries.

According to Bain & Company, the gaming industry in 2023 was valued at $196 billion. This is more than the combined revenue of video streaming ($114 billion), music streaming ($38 billion), and movie theater earnings ($34 billion). By 2028, the industry is expected to grow at an average annual rate of 6%, reaching $257 billion.

52% of respondents play games regularly.

Nearly 80% of young players (ages 2 to 18) spend 30% of their time on games. Among those older than 45, the percentage of such engaged players drops to 31%.

Young users spend a large portion of their budget on games. In absolute terms, players aged 25 to 34 lead in spending. This age group also spends the most on entertainment in general.

Gamers not only play games—they socialize, discuss games, buy game-related merchandise, and watch videos. The more involved a player is in these side activities, the more they tend to spend in the games themselves.

79% of users play content created by other players, while 16% participate in creating content themselves.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Almost 70% of gamers play on at least two devices. For 48% of the audience, it's important to be able to play with users from different platforms and carry over their progress. This is reflected in game development, as 95% of studios with more than 50 employees are working on cross-platform support for their games.

Game Distribution

Despite the growth in absolute sales, console penetration has not changed in the past 10 years, even though the gaming audience has significantly increased.

41% of users are interested and willing to pay for a single platform to consolidate all game content. Another 48% are also interested but are not willing to pay for this solution.

Marketing in Mobile Games

67% of players say they consume other forms of media (such as TV shows or movies) while playing games.

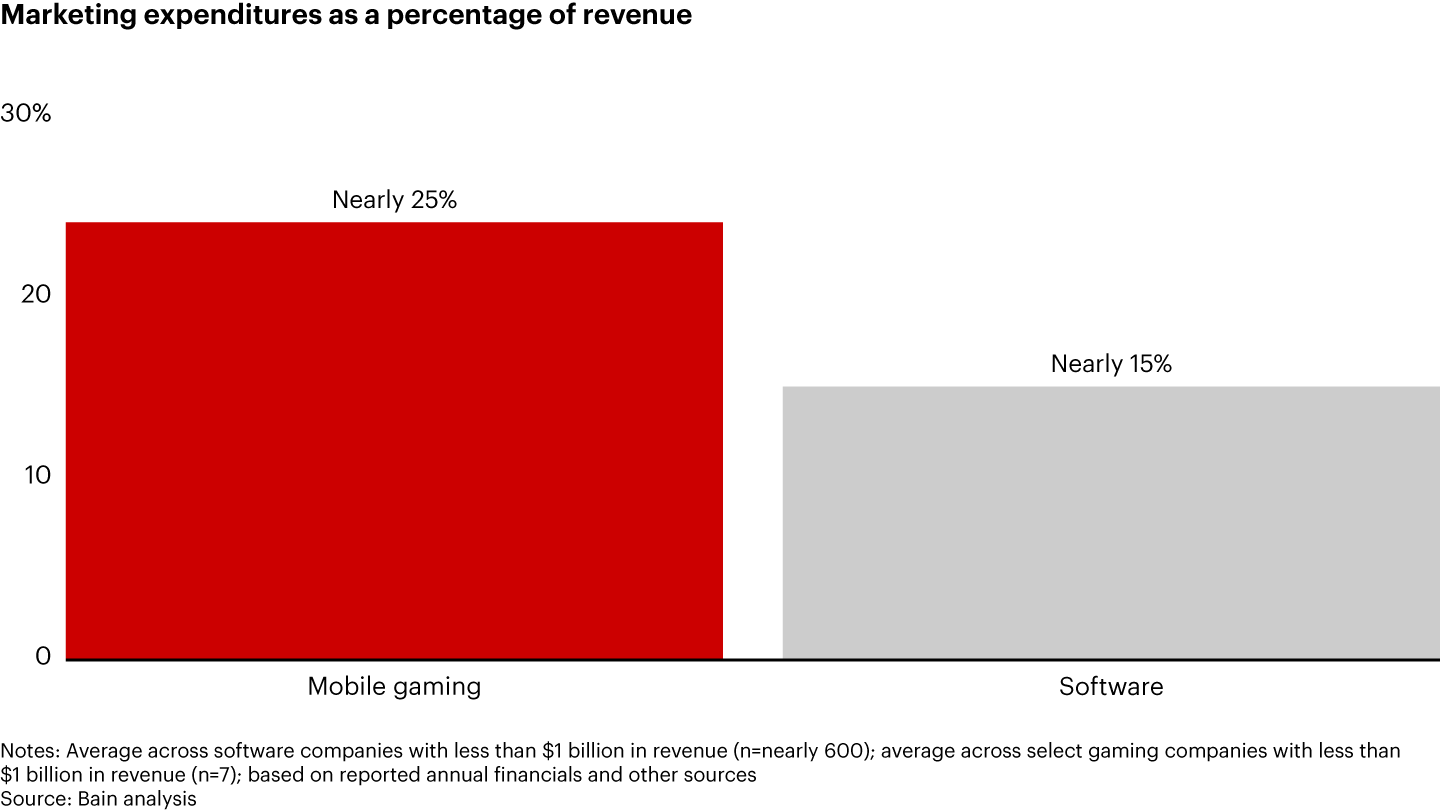

Gaming companies with annual revenues of less than $1 billion spend an average of 25% on marketing. Some companies spend even more. This is significantly higher than in software companies in general.

The mobile gaming market is a much riskier business for companies with annual revenues under $10 million. The likelihood of revenue decline over a three-year horizon is much higher here (55-70%) than in software development (10-20%) or retail (10-25%).

Changes in Gaming Companies Over the Last 10 Years

Over the past 10 years, the demand for specialists in security, data, animation, LiveOps, and project operations has grown significantly. These roles were hired, on average, twice as often as other types of specialists. This indicates changes in how games are developed and operated.

Large companies have grown by an average of 6% annually in revenue over the past 10 years, but their workforce has grown by 7% annually. This suggests a weak correlation between the number of employees and business efficiency.