Circana: The U.S. Gaming Market in March 2025

The first 3 months of 2025 are worse compared to 2024; March'25 is not an exception from the trend.

Overall market status

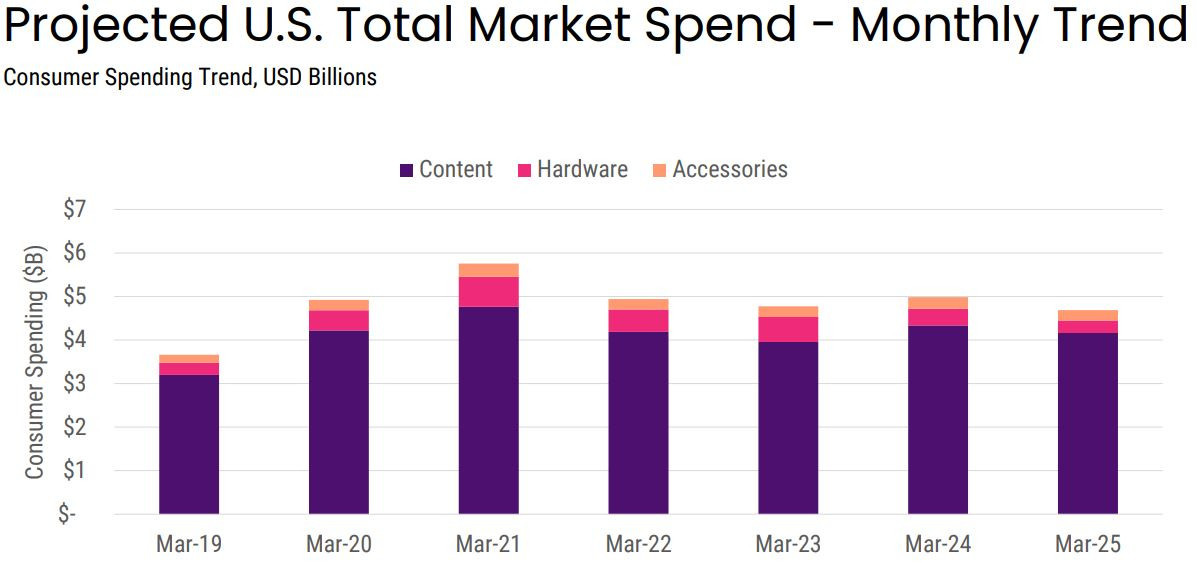

User spending on games in March dropped 6% YoY, down to $4.689 billion.

The sharpest decline was in console sales (down 25% to $286 million). This is the lowest figure since March 2019.

PlayStation 5 sales fell 26% YoY. Despite this, PS5 leads both in revenue and units sold. Xbox Series S|X is second (revenue down 9% YoY). Nintendo Switch saw a 37% drop compared to last year.

Digital-only Xbox Series versions account for 75% of all sales, and half of PlayStation 5 sales.

Accessory sales fell 11% YoY, down to $238 million. The steepest drop was in gaming headsets (down 19% YoY).

DualSense continues to be the most popular accessory.

Game sales in March 2025 fell 4%, to $4.164 billion. The only content categories that grew were subscription services (+11% YoY) and digital B2P project sales on consoles (+12% YoY). Mobile games declined 6% compared to March last year.

For the first three months, the 2025 gaming market is 9% behind the first three months of 2024.

Game sales

Assassin's Creed: Shadows, MLB: The Show 25, and Monster Hunter: Wilds topped the March sales ranking.

In total, 7 new projects made the U.S. top 20 in March. In addition to AC: Shadows and MLB: The Show 25, WWE 2K25 (4th), Split Fiction (5th), Bleach: Rebirth of Souls (9th), Xenoblade Chronicles X (17th), and Suikoden I & II HD Remaster: Gate Rune & Dunan Unification Wars (18th) also had strong debuts.

The ranking of best-selling projects for the first three months of 2025 was updated. Monster Hunter: Wilds remains first, Assassin's Creed: Shadows moved up to second, and Kingdom Come: Deliverance II is third. Three more new releases in the chart: MLB: The Show 25 (4th), WWE 2K25 (6th), Split Fiction (10th).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Assassin's Creed: Shadows had the third-best launch month in series history in U.S., behind only Assassin's Creed III and Assassin's Creed: Valhalla.

MLB: The Show 25 started 23% better in revenue than the previous entry.

MONOPOLY GO!, Royal Match, and Candy Crush Saga led March mobile revenue. Despite the overall decline, leaders performed well: Pokemon GO revenue grew 42%, Candy Crush Saga grew 12%. Last War: Survival grew 1.6%, which wasn’t enough for a top-3 spot.

Platform rankings

On PlayStation, 5 new projects made the top 10 in sales, with MLB: The Show 25, AC: Shadows, and WWE 2K25 leading.

Dragon Age: The Veilguard entered the PlayStation top 10 MAU charts after joining PS Plus in March.

Xbox showed a similar picture to PlayStation. Avowed performed well in MAU charts, staying in the top 10.

March was an active month for Nintendo. The top 10 in sales included 3 new releases: Xenoblade Chronicles X, Hello Kitty Island Adventure, and Suikoden I & II HD Remaster: Gate Rune & Dunan Unification Wars.

Steam’s situation was notably different from other platforms. R.E.P.O. took first place in MAU, Schedule I was sixth, and FragPunk and GTA V: Enhanced held the eighth and ninth spots. Marvel Rivals showed strong numbers, and there was notable user interest in Helldivers II and Balatro.