Circana: The US gaming market returned to growth in October 2024

CoD: Black Ops 6 started this year in October, so we can expect a decline next month (CoD: MW3 was released in November 2023).

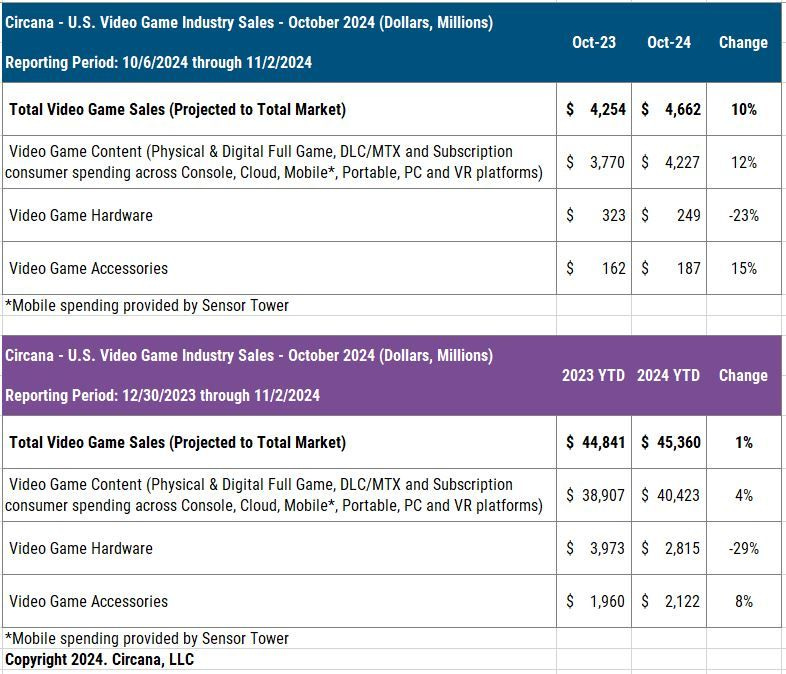

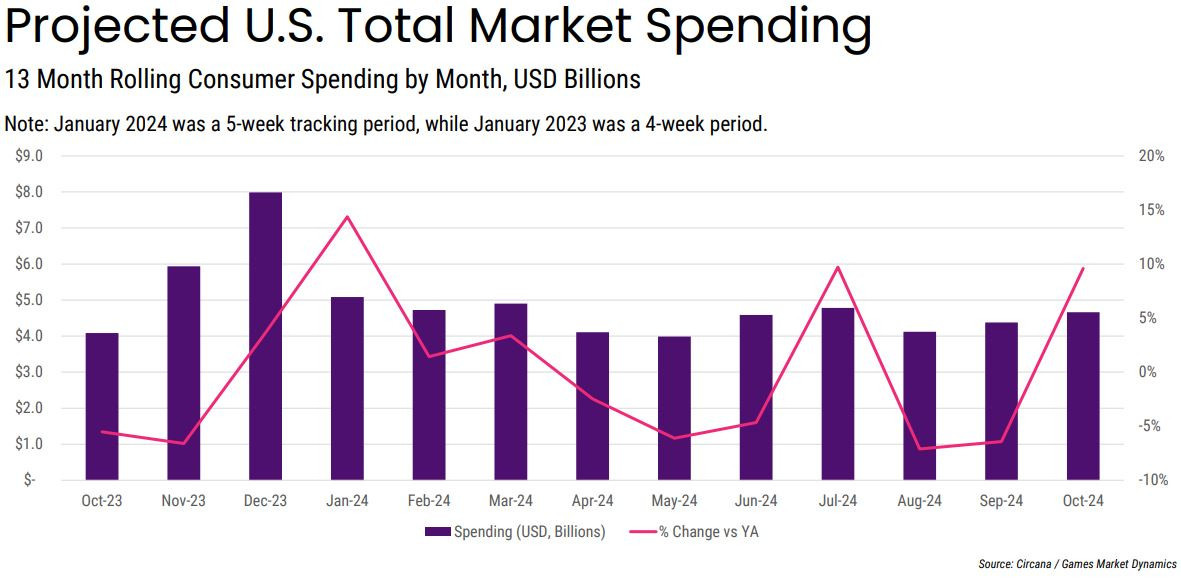

Market status

Overall market revenue increased by 10% compared to October 2023. Games and gaming content sales grew by 12%, and accessory sales increased by 15%. However, gaming hardware sales were 23% lower than last year's figures.

Considering the growth in gaming content sales, spending on console games saw the most significant increase, rising by 27% year-over-year (YoY).

In dollar terms, the best-selling accessory in October was the PlayStation Portal.

Sales of the Nintendo Switch fell by 38% compared to October last year; PS5 sales dropped by 20% YoY; and Xbox Series S|X lost 18%. Nevertheless, the PS5 remains the best-selling system both in terms of units and dollar value.

Spending on gaming subscriptions in the country rose by 16%, with most of the growth attributed to Game Pass subscriptions.

For the first ten months of 2024, the American market showed results of 1% better than the same period in 2023.

Game Sales

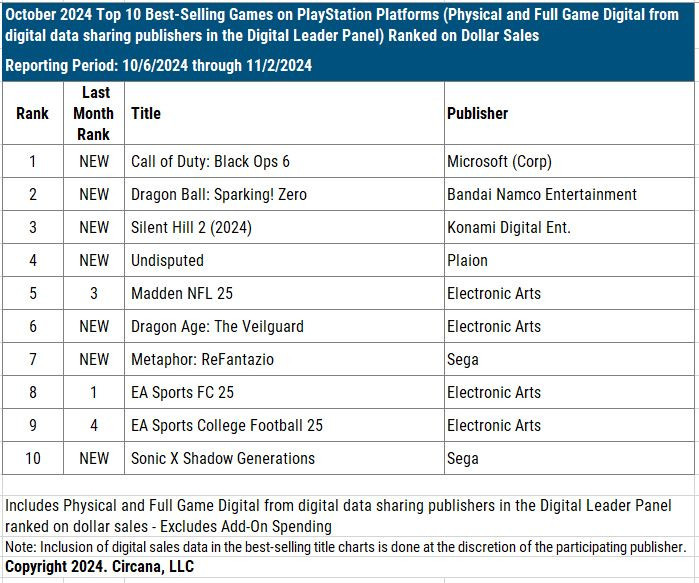

The growth in game sales is largely attributed to the launch of Call of Duty: Black Ops 6. Last year’s installment was released in November, so we can expect a decline next month. The game topped the October chart and immediately became the third best-selling game of the year. Sales of Call of Duty: Black Ops 6 in dollar terms for the first two weeks were 23% higher than last year’s Call of Duty: Modern Warfare III.

82% of all console sales for Call of Duty: Black Ops 6 were on PlayStation.

Dragon Ball: Sparking! Zero ranked second in October sales and fourth for sales in 2024. After a month of sales in the U.S., it is the best-selling Dragon Ball game in dollar terms on the market. Among all games released by Bandai Namco Entertainment, it trails only Elden Ring and Dark Souls III.

The remake of Silent Hill 2 placed third in October sales. It shows the second-best sales results in series history, behind only the original Silent Hill 2.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

MONOPOLY GO!, Royal Match, and Roblox remain leaders in the U.S. mobile market. However, revenue for MONOPOLY GO! in the U.S. fell by 20% in October, and results compared to May-June this year are 50% worse.

Platform Rankings

In October on PlayStation, there were seven new releases on the sales chart. Among those not named are Undisputed (4th place), Dragon Age: The Veilguard (6th place), Metaphor: ReFantazio (7th place), and Sonic X Shadow Generations (10th place).

In terms of Monthly Active Users (MAU) on PlayStation consoles, there were three notable changes: WWE 2K24 reached 4th place; Dragon Ball: Sparking! Zero appeared at 6th place; and the remake of Dead Space entered at 10th place.

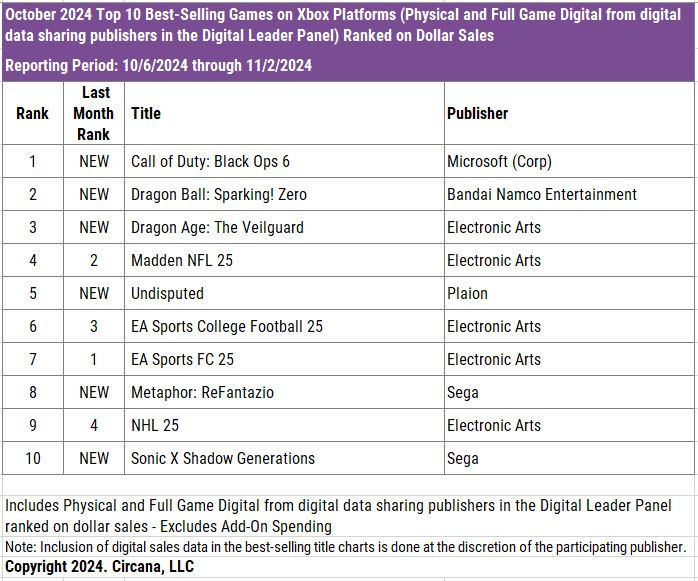

On Xbox Series S|X, a similar situation exists, except that there is no Silent Hill 2 on their chart, because there is an exclusivity deal with Sony.

The MAU ranking on Xbox saw little change from last month. Sifu reached 9th place due to its inclusion in a subscription service.

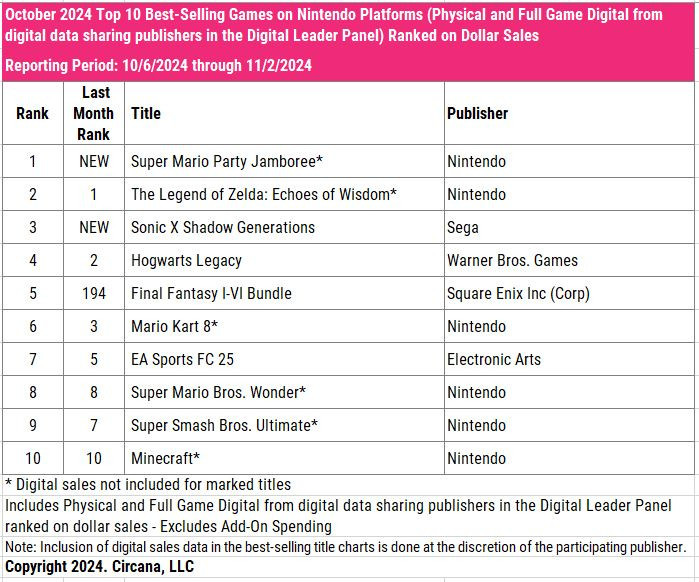

On Nintendo Switch, there are two new entries: Super Mario Party Jamboree and Sonic X Shadow Generations.

There are few changes in Steam's MAU ranking. The top spots are held by Counter-Strike 2, Deadlock, and Helldivers II. Throne and Liberty climbed to 4th place; TCG Card Shop Simulator reached 6th place.