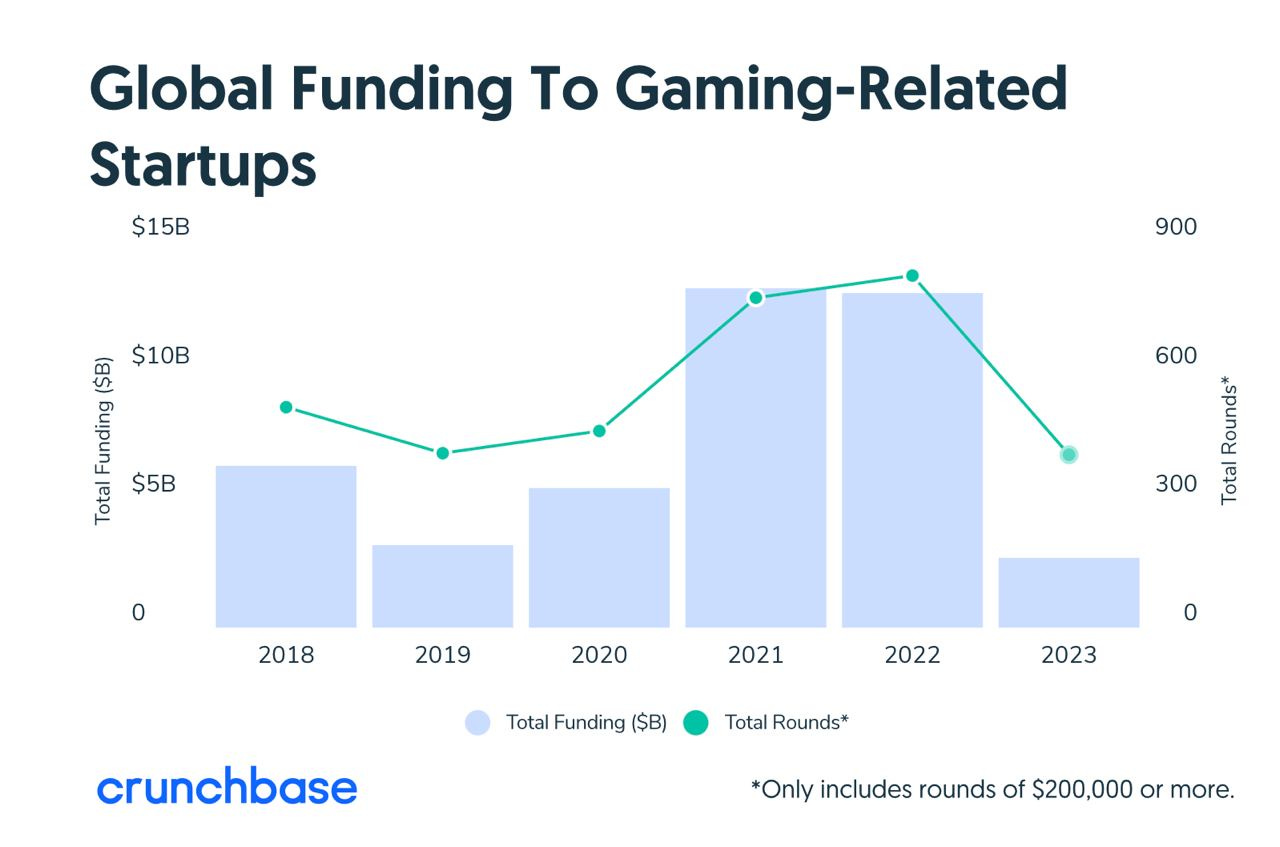

Crunchbase: Investments in gaming startups at venture stages in 2023 reached a minimum since 2018

After the COVID rally, investors learned that the gaming industry doesn't print money. Ouch.

Crunchbase considered all stages in the statistics until the company went public or was acquired by a strategic investor.

The total funding volume in 2023 at the early stages amounted to $2.71 billion, compared to $13.03 billion in 2022. This is a 79% decrease.

The number of deals decreased by half, from 824 in 2022 to 403 in 2023. Rounds larger than $200 thousand were taken into account.

In 2023, there were no deals with venture investors exceeding $100 million. In 2022, for example, there was a $2 billion round from Epic Games. Additionally, thatgamecompany raised $160 million in a Series D round.

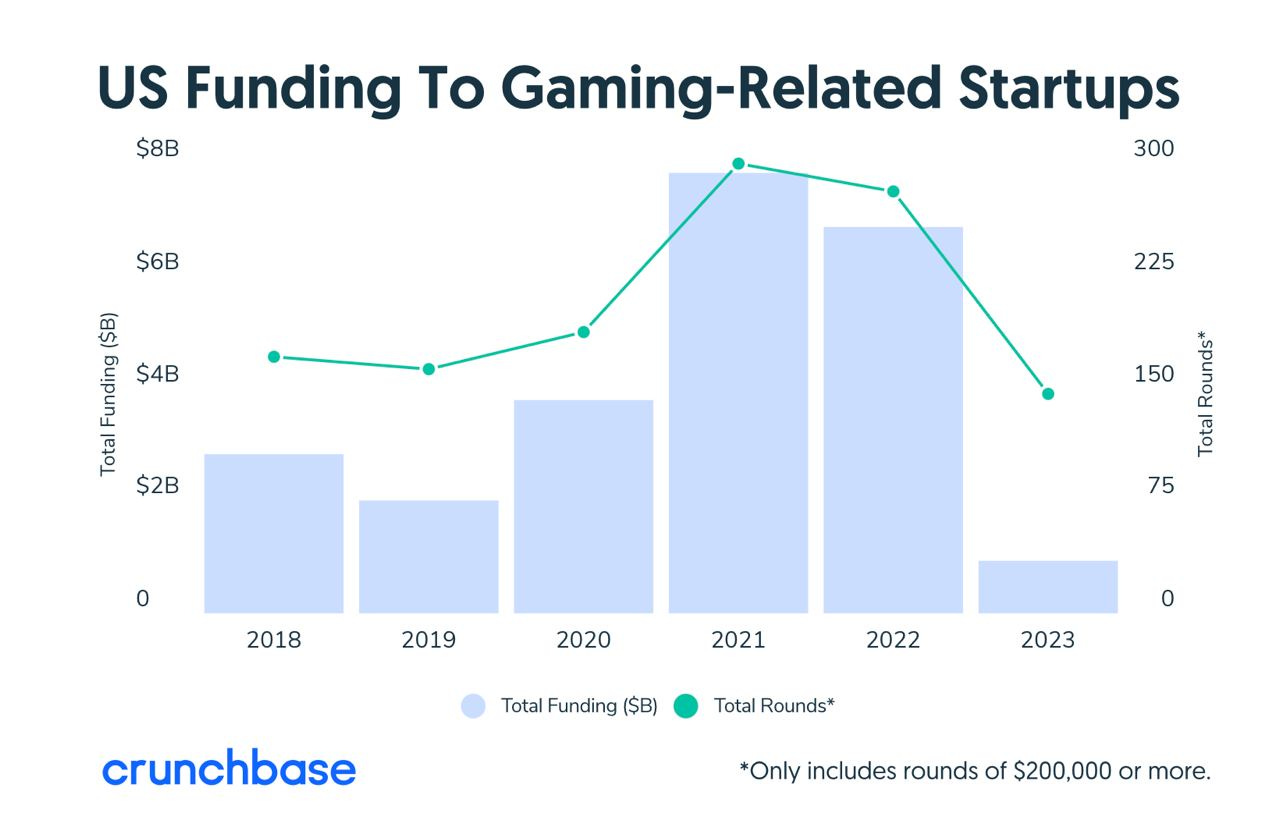

The situation in the US market

The investment volume decreased to $0.93 billion from $6.86 billion in 2022, an 86% drop.

The number of deals fell from 281 in 2022 to 146 in 2023.

Overall market situation

Crunchbase notes that the year was not bad for the entire industry. Take-Two Interactive Software, Electronic Arts, Nintendo, and Sony ended the year with stock values higher than at the beginning of the year. Microsoft completed a deal with Activision Blizzard. It is more accurate to describe the situation not as a market crisis but as a market entry crisis—it is challenging to compete with big players.

There is a slight consolation in all of this. According to Crunchbase, 2023 was so bad that it will not be difficult to surpass it in 2024.