data.ai: Mobile Gaming Market in 2023 (State of Mobile 2024)

Everything you need to know about the mobile gaming market last year.

Overall Mobile Market state

In 2023, users spent $171 billion on mobile applications, which is 3% more than the previous year.

Apps were downloaded 257 billion times, a 1% increase compared to 2022.

Spending on mobile advertising reached $362 billion, an 8% increase from the previous year.

Users spent 5.1 trillion hours in mobile apps on Android alone, marking a 6% increase from the previous year.

State of the Mobile Gaming market

Revenue from mobile games in 2023 decreased by 2% to $107.3 billion.

The overall decline is strongly tied to a decrease in the Chinese market by $4.62 billion. Revenue in the U.S. remained stable, with a slight decrease in Japan. There was growth in the South Korean markets, Latin American markets, and several Western European countries (United Kingdom, France, Germany).

While it is common to talk about a crisis in the mobile market, it's important to consider a few things. Firstly, part of the revenue has shifted from mobile stores to alternative payment methods. Secondly, an increasing number of games are being released on the web and PC. Thirdly, the decline reported by data.ai is primarily due to the Chinese market, represented only by iOS within the scope of the data.ai research. This does not mean there are no challenges, but examples from miHoYo, Scopely, Century Games show that great results can be achieved.

Gaming Mobile Market - Downloads

Hyper-casual projects lead in downloads, accounting for 28% of the total volume. In 2023, 16.4 billion hyper-casual projects were downloaded, which is 7.5% less than the previous year. However, the genre saw a 52.9% growth in In-App Purchase (IAP) revenue (now contributing 0.5% of the total IAP market).

Simulators rank second with 10.5 billion downloads (18% of the total - a 0.7% increase from 2022). This category includes games like Roblox and My Talking Tom. Simulators account for 9.5% of the total IAP payments, a decrease of 5.3% from 2022.

Action games are in third place with 5.5 billion downloads (9% of the total - a 12.1% decrease from 2022). In terms of IAP payments, the genre declined by 10.3% in 2023, now representing 5.8% of the total IAP market with games like Subway Surfers.

Thief Puzzle, Attack Hole, and My Perfect Hotel were leaders in 2023 in their subgenres.

data.ai notes that in 2023, the number of new projects in the top 1000 by downloads was the lowest since 2019.

However, until 2020, the average download volume of new games exceeded that of existing projects. In 2021-2022, the situation changed, with older projects generating more downloads on average. But in 2023, the situation has reversed again, and new games are attracting installations.

While a more detailed view is necessary, the fact that new games, on average, are getting more downloads than old ones is a positive sign, indicating people are willing to try new products.

Party games (23.3% of top 3 downloads), shooters (15.8% of top 3 downloads), and sports games (15.8% of top 3 downloads) are the most challenging genres in terms of competition, if we consider only downloads. Interestingly, in all three genres, 65%+ of downloads are from users who installed games 2 or more years ago.

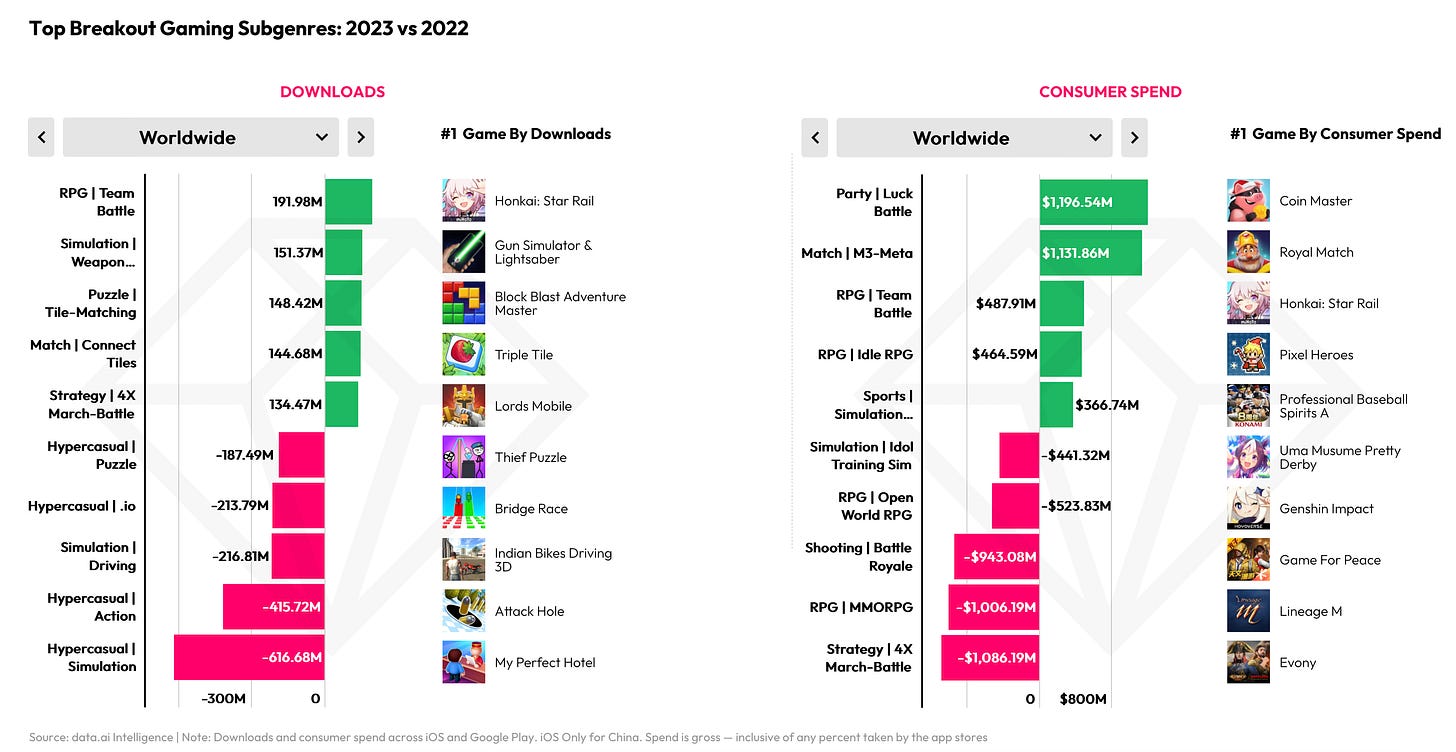

In 2023, RPGs (Team Battle) showed the strongest growth in downloads, thanks to Honkai: Star Rail (+191.98 million downloads).

Gaming Mobile Market - Revenue

RPG is the most profitable genre globally, bringing in $24.5 billion in 2023. It represents 30% of the entire IAP market, but it experienced a 3.8% decline from the previous year. However, in terms of downloads, the genre grew by 19.7%, accounting for 3% of the market share.

In 2023, strategies earned $10.7 billion, securing the second position. The genre accounts for 13% of the total IAP market, with a 11.7% decline in revenue in 2023. Nevertheless, in terms of downloads, the genre grew by 2.2%, holding a 2% market share.

Match projects secured the third position with $10.2 billion. The genre is growing in all aspects; IAP revenue increased by 16.3% (13% of the total volume), and downloads grew by 6.7% (5% of the total volume).

Evony, Lineage M, and Honkai: Star Rail were leaders in 2023 in their respective categories.

The number of new games entering the top 1000 by revenue in 2023 reached the minimum since 2019, with a slight decline compared to 2022 (and in some markets, no decline at all).

However, the average revenue of new projects compared to old ones shows growth in many markets - the U.S., Canada, the UK, South Korea. This indicates that new projects entering the top 1000 are approaching revenue figures of old projects with more content and active Live-ops.

In 2023, many high-earning projects were released, including Monopoly GO!, Whiteout Survival, Honkai: Star Rail, and more. Importantly, new games are managing to collect both audience and revenue. Comparing this with the download data provided by data.ai earlier, it can be concluded that users are ready for new projects.

The most challenging genres in terms of revenue competition are party-games (81% of revenue shared among the top 3), shooters (58.2% of money going to the top 3 products), and action games (53.1% for the top 3). In the latter two, more than 94% of users are "old" (installed games more than 2 years ago).

An interesting situation emerges. At the time of the release of Monopoly GO!, the party games genre was a "red ocean." Almost all revenue was accumulated by old projects. However, Scopely, through an excellent game, strong IP, and large budgets, entered a very competitive category and found success. The question is, in fact, complex. Many teams, when choosing a genre for a new project, are afraid to compete with "heavyweights" - and this risk is justified. But the graph above shows that in the mobile market, there are currently no genres without serious competition. Therefore, it is essential to pay attention to the expertise of the team and what they can, love, and want to do. I believe that quality products - in any niche - even the most crowded - have good chances.

The revenue growth leaders in 2023 were party-games (Luck Battle) with +$1.2 billion. Coin Master is the revenue leader in this segment, but the growth is attributed to Monopoly GO!. Match 3 also saw growth with +$1.1 billion (Royal Match being the largest game in the genre).