[Editorial] Mobile Gaming Market in 2023 - not as bad as you want it to be

An overview of what was happening with the mobile gaming market in 2023 - with some numbers you haven't seen elsewhere & my thoughts.

In 2023, we heard a lot about the gaming industry experiencing a crisis. In particular, many people talk about there being fewer new games, and those that do come out earn less. It became interesting to verify this with numbers to have a slightly more objective view of the situation.

Downloads

The number of new projects in the top 1000 by downloads has remained roughly consistent since 2021. However, the number of new games by downloads falls short in the years 2021-2023 compared to the figures for 2019 and 2020.

The number of new projects in the top 100 by downloads has indeed decreased over the years. In 2023, there are three times fewer projects in the top 100 compared to 2020 and 2019. It's harder for new games to break into the top ranks.

The number of new projects in the top 10 by downloads has remained relatively unchanged since 2020. Becoming a global hit is very challenging - only three projects in four years can boast such an achievement.

Here are the new entries in the top 100 by downloads for the year 2023:

5th position (151.7 million downloads) - Block Blast! - a block puzzle game, a variation on the theme of Tetris. Hungry Studio developers have never released a game as popular as this before.

14th position (107.5 million downloads) - Monopoly GO! - a game that needs little introduction, a modern interpretation of the classic board game by Hasbro. Scopely, the developer has several world-class hits under its belt.

26th position (90.1 million downloads) - Attack Hole - an arcade game where you control a black hole and consume objects. Developed by Black Hole Games and published by Homa, a global leader in publishing hyper-casual and hybrid-casual games.

39th position (76.5 million downloads) - Burger Please! - a tycoon game about managing a burger restaurant. Released by Supercent, a successful hyper/hybrid-casual publisher.

45th position (72.3 million downloads) - Avatar World: City Life - a children's life simulation game developed by Israeli company Pazu Games, specializing in such games.

50th position (70.1 million downloads) - Real Car Driving: Race City 3D - an open-world racing game with various gameplay modes. Developed by Botanica Global, which has a dozen similar genre games under its belt.

74th position (57.9 million downloads) - Ramp Car Games: GT Car Stunts - a casual racing game about tracks with obstacles. Developed by Fun Drive Games, with 13 other racing genre games.

81st position (54 million downloads) - Build A Queen - a viral runner game by Supersonic Studios.

84th position (52 million downloads) - Snake Run Race・3D Running Game - another runner game, this time about a snake. Developed by Freeplay, a popular developer and publisher of hyper/hybrid-casual projects.

92nd position (49.4 million downloads) - Slow Mo Run - an arcade game where you overcome various obstacles by controlling a character's body parts. Developed by Supersonic.

100th position (47.5 million downloads) - Vehicle Masters - an arcade driving simulator. Developed by SayGames, another popular hyper/hybrid-casual publisher.

A few conclusions:

In 2023, only Hungry Studio, a relatively unknown developer, managed to enter the top 100 with a new game. All other projects were from market leaders.

Racing games and runners gather a large amount of viral traffic. In 2023, people were still interested in games in these genres. However, the value of this traffic is questionable - for example, Real Car Driving: Race City 3D received 35% of downloads from India and 8% from Brazil.

Hyper/hybrid-casual projects continue to dominate the top 100 by downloads.

Revenue

Disclaimer:

Only calendar years are taken into account. For this reason, for example, in 2020, Genshin Impact did not make it into the top 10 by revenue. The game was released on September 28 and simply did not have enough time to earn sufficient money.

Only sales in Google Play and the App Store are considered. Sales in 3rd-party stores in China are not taken into account, nor are payments outside of platforms (top-ups on websites).

For games available only in China, information is only provided for iOS.

Some projects in the top 100 were released at the end of December 2022. I included them in 2023.

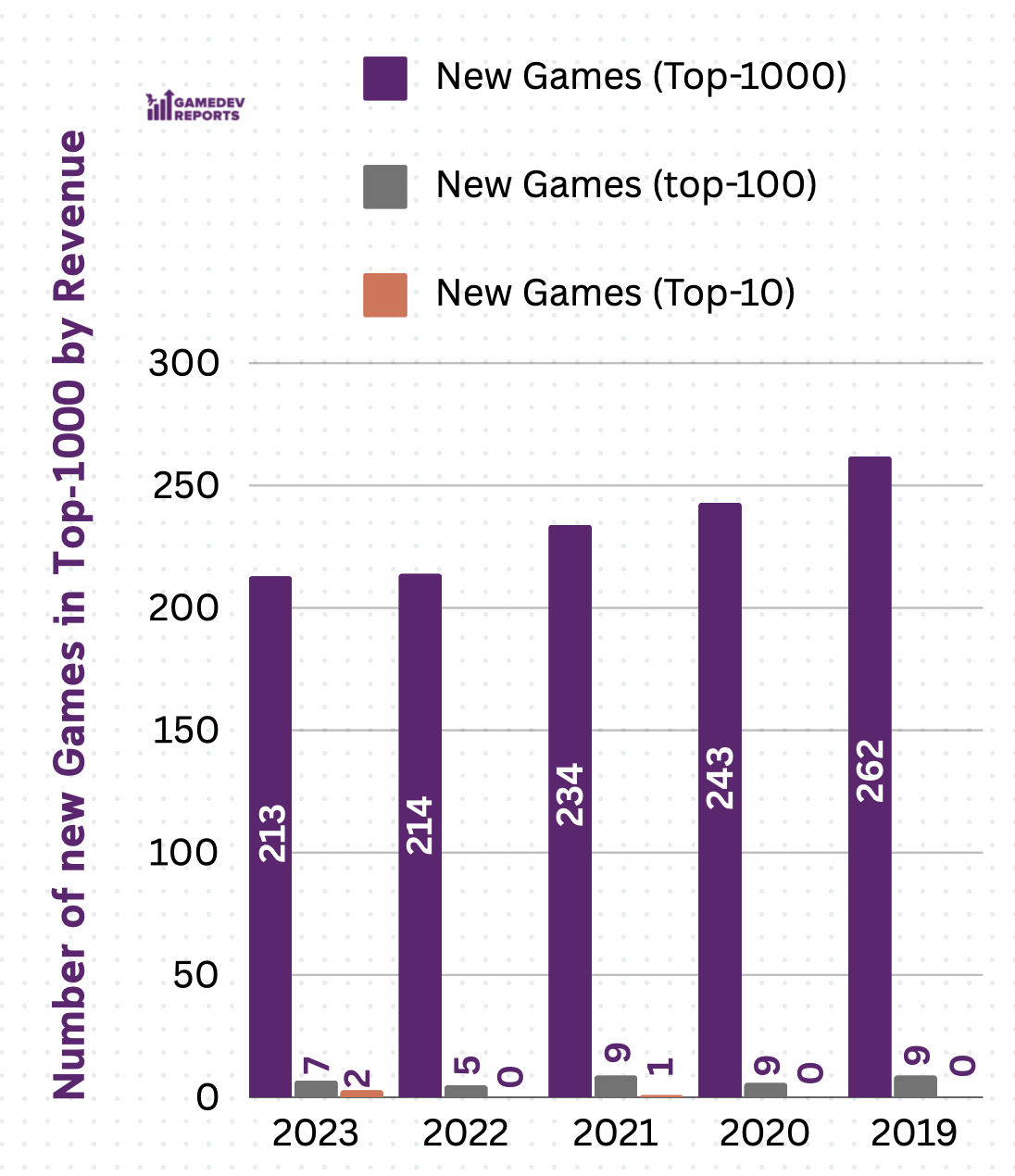

The number of new projects by revenue in the top 1000 has been slowly declining since 2019, indicating increasing competition.

However, in 2023, there were 7 projects released that made it into the top 100 by revenue. An interesting point here is that 4 projects from the list in 2023 were not available outside of Asia.

Surprisingly, 2023 was a breakthrough year for the mobile industry in terms of global hits. Two projects made it into the top 10 - Monopoly GO! and Honkai: Star Rail. This hadn't happened in 5 years.

According to AppMagic data, the top 1000 games in the mobile market earned $47.6 billion in 2023. Have a look into how the absolute market volume has changed (from 2021 - based on the top 1000 highest-earning projects - it is decreasing), as well as how the revenue distribution has changed in different segments.

Here are the newcomers of 2023 in the top 100 by revenue:

8th position ($659 million) - Honkai: Star Rail - a new RPG (jRPG?) from miHoYo, which applies the well-known gacha formula to a new core gameplay. All of this with stunning production quality.

9th position ($645 million) - Monopoly GO! - the game launched slightly later than Honkai: Star Rail, so it didn't manage to surpass it in revenue. Officially, Scopely announced that the game broke $1 billion in revenue (please note the disclaimer).

18th position ($358.2 million) - Justice Online (逆水寒) - an MMORPG from NetEase, currently only available in China. One of the project's features is the use of AI - it is used to simulate live players and dialogues with NPCs.

34th position ($260.1 million) - Whiteout Survival - a 4X strategy game from Century Games, launched in combination with Frozen City. One of the most interesting cases in the market recently, where one company releases two products in the same setting with the same assets but in different genres - and for different audiences - with a gap of a couple of months.

67th position ($148.9 million) - Changa Fantasy (长安幻想-送周年宠) - another MMORPG only for the Chinese market, based on the manga series of the same name.

95th position ($102.8 million) - Night Crows (나이트 크로우) - an MMORPG released only in the South Korean market. The game will be launched on the Western market in early 2024, with an unusual feature - integration with Web3.

100th position ($96.5 million) - Crystal of Atlan (晶核) - the third MMORPG in the list for the Chinese market. The game closely resembles Genshin Impact in appearance and is currently undergoing closed beta testing for Western markets.

Based on the dynamics of new products appearing in the top 100, it's evident that 2023 wasn't as bad as initially perceived. However, it would be appropriate to conduct a retrospective comparison, which I'll leave for future issues.

Out of the top 100 by revenue in 2023, 23 projects were earned exclusively in Asia. These projects are either from China (like Justice Online), Japan (Monster Strike), or South Korea (Night Crows).

This graph shows the revenue share of projects from different years. The share of older projects is very large. Projects released since 2020 represent only 29.9% of the market. However, it is noticeable that the share of projects released in 2023 is the highest in the past couple of years. This is attributed to the breakthroughs of Honkai: Star Rail and Monopoly GO!.

Not long ago, Michail Katkoff from Deconstructor of Fun released an essay on the future of the mobile gaming industry. I recommend reading this article, and I also want to publish a graph from data.ai on the number of new mobile games released and the total number of mobile games on iOS.

It's an interesting situation. If we compare the numbers of new games in the top 1000 with the total number of releases, it turns out that in 2023, the Success Rate of mobile games was higher than, for example, in 2022. However, there might be a calculation issue as I accounted for games on Google Play and iOS, while data.ai provides only figures for iOS.

In 2023, projects for Asian markets account for 25.1% of the revenue in the top 100 - $6.87 billion. Many of them, probably, will never reach international markets and will only cater to local audiences. However, out of the 7 top projects released in 2023, 4 launched exclusively in Asia. Some of them, as mentioned earlier, will soon enter international markets. We'll be waiting for their results.

Separately, I was interested in examining how much games based on intellectual property (IP) earn. I wanted to note projects based on non-gaming IP (movies, anime, manga), as well as all of them combined.

There's a subjective feeling that the number of new projects based on intellectual property (IP) in the mobile market is increasing. The trend of major PC/console IPs coming to mobile devices is particularly noticeable. Just in 2024, a mobile game based on Devil May Cry has already been released; several projects from Ubisoft are expected to be released soon; the EA Sports FC franchise is expanding with a new project; Warframe is coming to mobile devices; and Bethesda is preparing The Elder Scrolls: Castles. Just recently, Age of Empires was announced for mobile devices.

Utilizing popular IPs allows developers to reduce traffic costs, attract organic audiences, and engage existing fan bases. In conditions of limited user tracking possibilities, I believe that there will be more and more IP-based projects in the gaming mobile market over time.

Overall, the mobile gaming market has become more competitive. Releasing a popular new game is becoming increasingly difficult. There's a trend of decreasing new games by downloads (perhaps fewer hyper-casual games?), and it's noticeable that the share of new projects in the overall revenue composition isn't that significant.

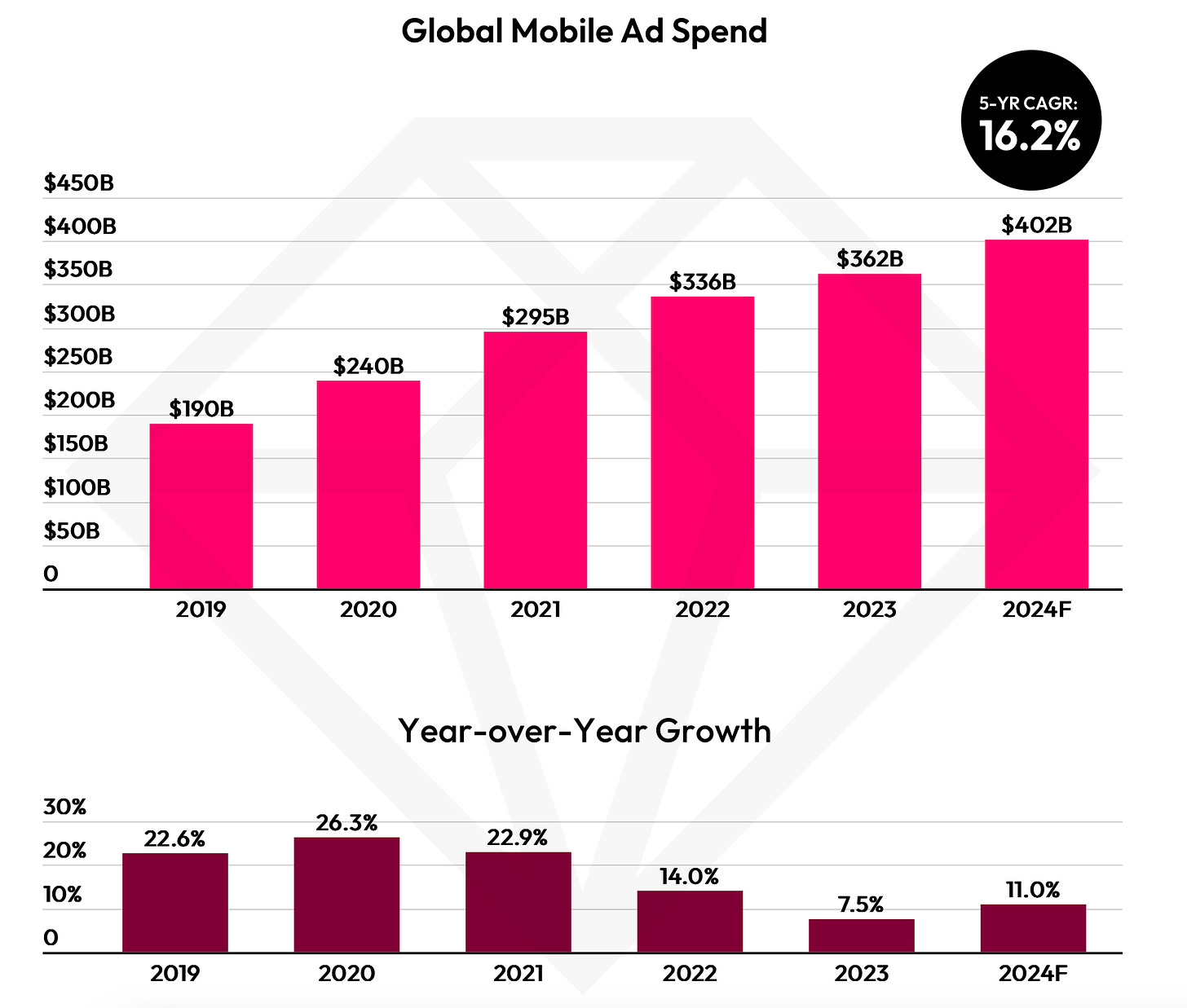

It would also be fair to note that analytical platforms only allow us to see the revenue part of the equation. It's important to consider that in the post-IDFA era, the problem has become acquiring the right users, and user acquisition itself has become more expensive, which has overall reduced marketing effectiveness. This has impacted profitability. Many companies expanded their teams during market growth, which also led to increased expenses. Furthermore, heightened product quality requirements necessitate more resources for development.

However, speaking about the market as a whole, I disagree that 2023 was the worst year for the mobile market in a long time. Rather, in 2023, many postponed risks materialized. Market correction continued; companies that raised funds in 2020-2021 ran out of money; studios began adjusting their P&L and removing unprofitable divisions; the global recession has compelled users to pay more attention to even cheaper forms of entertainment (videos and short videos).

In terms of volume, the mobile market in 2023 exceeded the figures of 2019. Additionally, we don't consider advertising revenue, and the recent report from data.ai indicates another increase in mobile ad spending. Companies will pay more attention to optimization and smart planning. Both AI and painful experiences from the previous (and current, for that matter) year should help with this. All of this should lead to a healthier overall situation.

There's still a huge problem with launching new projects in the mobile market. Organic reach is almost dead, and mobile platforms are not in a hurry to address the situation. This leads to the situation where it's practically impossible for small developers without big budgets to launch any successful product on mobile devices. The level of hits in 2023 makes one ponder the requirements for successful projects. It seems that marketing departments of large companies have to adapt and learn (or return to?) classical marketing - using not only Performance tools but also less predictable channels.

Creating successful mobile games has always been challenging, and the situation has somewhat worsened recently. However, - and examples prove it - new major projects are being released, finding their audience, and earning their millions. This means that anything is possible.

In short, the main conclusions are:

In 2023, entering the market without an expensive and high-quality product is challenging. All new projects on the list are the result of many years of work by large and already successful teams. However, the situation hasn't changed much over the past few years. Therefore, saying that "it was better before" would be unfair.

In 2024, Asian hits from 2023 will enter the Western market. It will be interesting to see how they perform.

The majority of new games on the revenue list are in the RPG genre. However, the high monetization potential is offset by the high cost of development and increasing competition. It's possible to spend a lot of money and "miss the audience."

Games based on IP licenses and collaborations are something to learn from. This is one way to solve user acquisition problems.

The market crisis everyone talks about is largely the result of the overheated market during the coronavirus pandemic. 2023 turned out to be heterogeneous - there was both a general decline in new revenue-generating projects in the top 1000 and the emergence of global hits in the highest quantity in the last 5 years.

Brilliant analysis. I follow many Substack newsletters on topics like this, yours is one of the very best.