GAME: German Games Industry in 2025

The industry declined a bit in 2024. The number of gaming companies in Germany shown the negative trend for the first time in 5 years.

Market Status

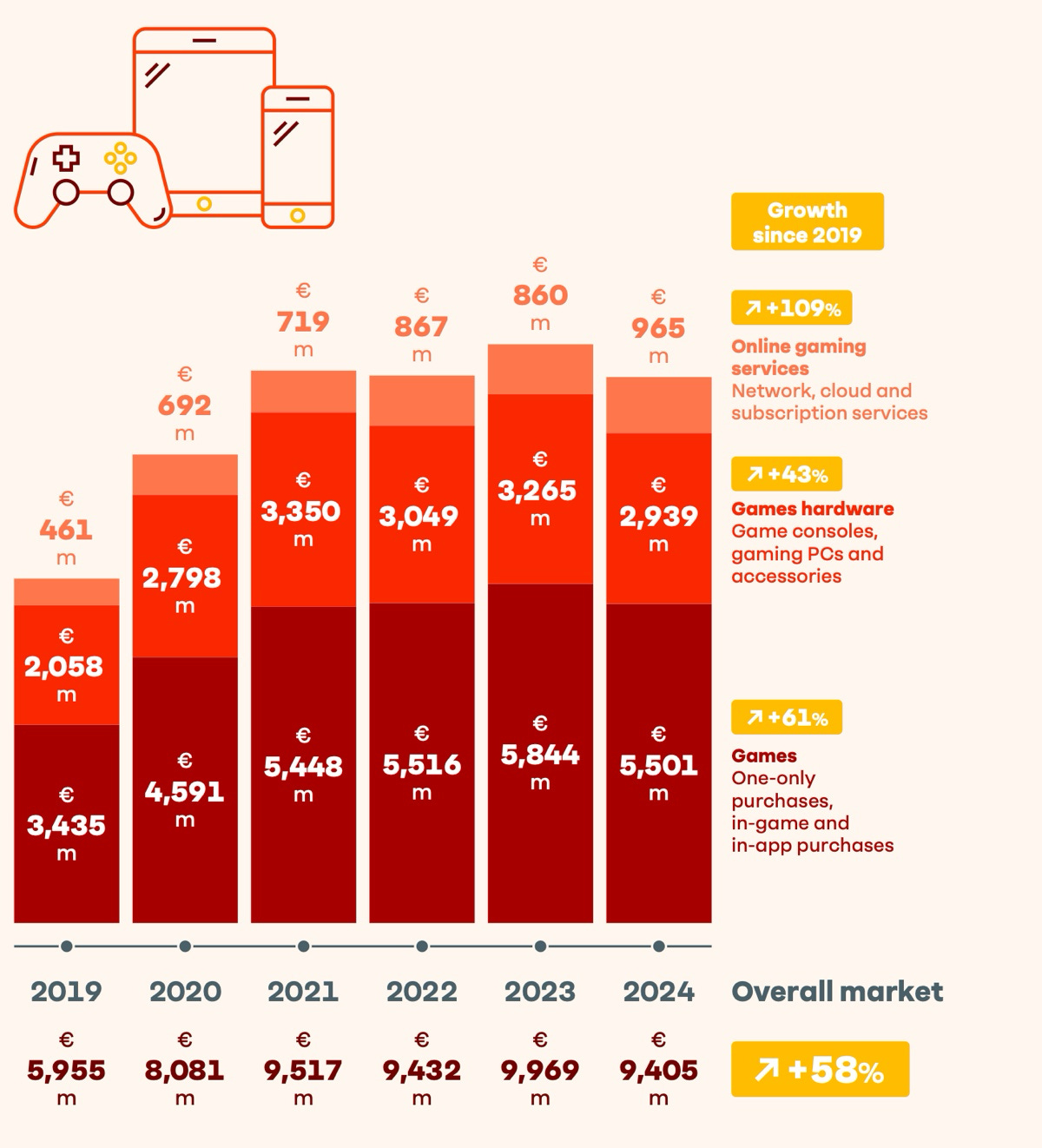

The German games industry generated €9.405 billion in 2024. That’s 6% less than in 2023 (€9.969 billion).

Game sales brought in €5.501 billion – 6% less than last year. Hardware sales dropped by 10% to €2.939 billion. Meanwhile, spending on cloud gaming and subscriptions grew by 12% to €965 million.

The market has grown by 58% since 2019, but it’s clear that revenues have stagnated since 2021. The biggest growth since 2019 has come from online services (+109%), game sales (+61%), and hardware sales (+43%).

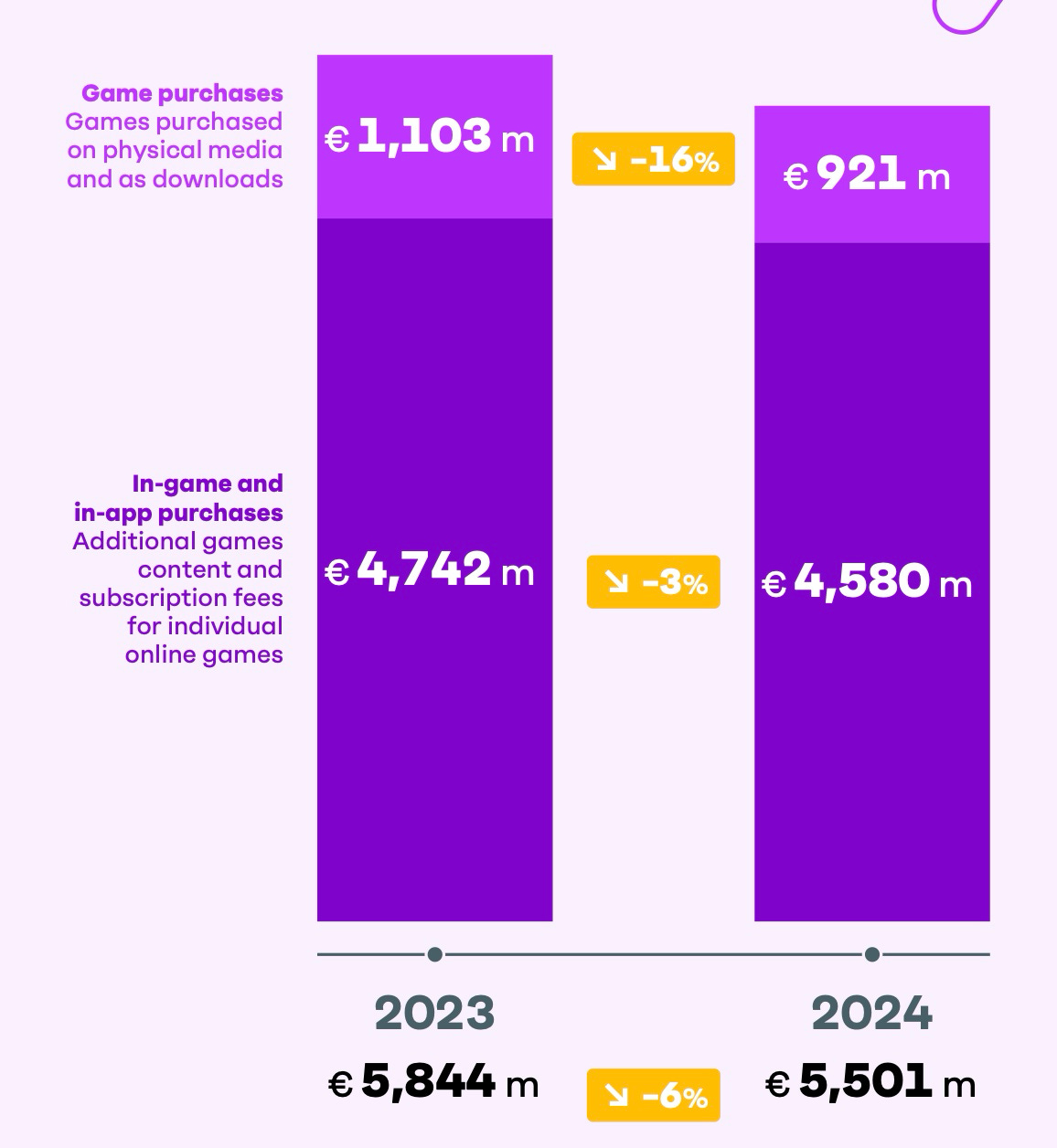

In 2024, microtransactions and DLC dropped by 3% compared to last year, reaching €4.58 billion. Meanwhile, sales of full-price titles (both physical and digital) fell by 16%, down to €921 million.

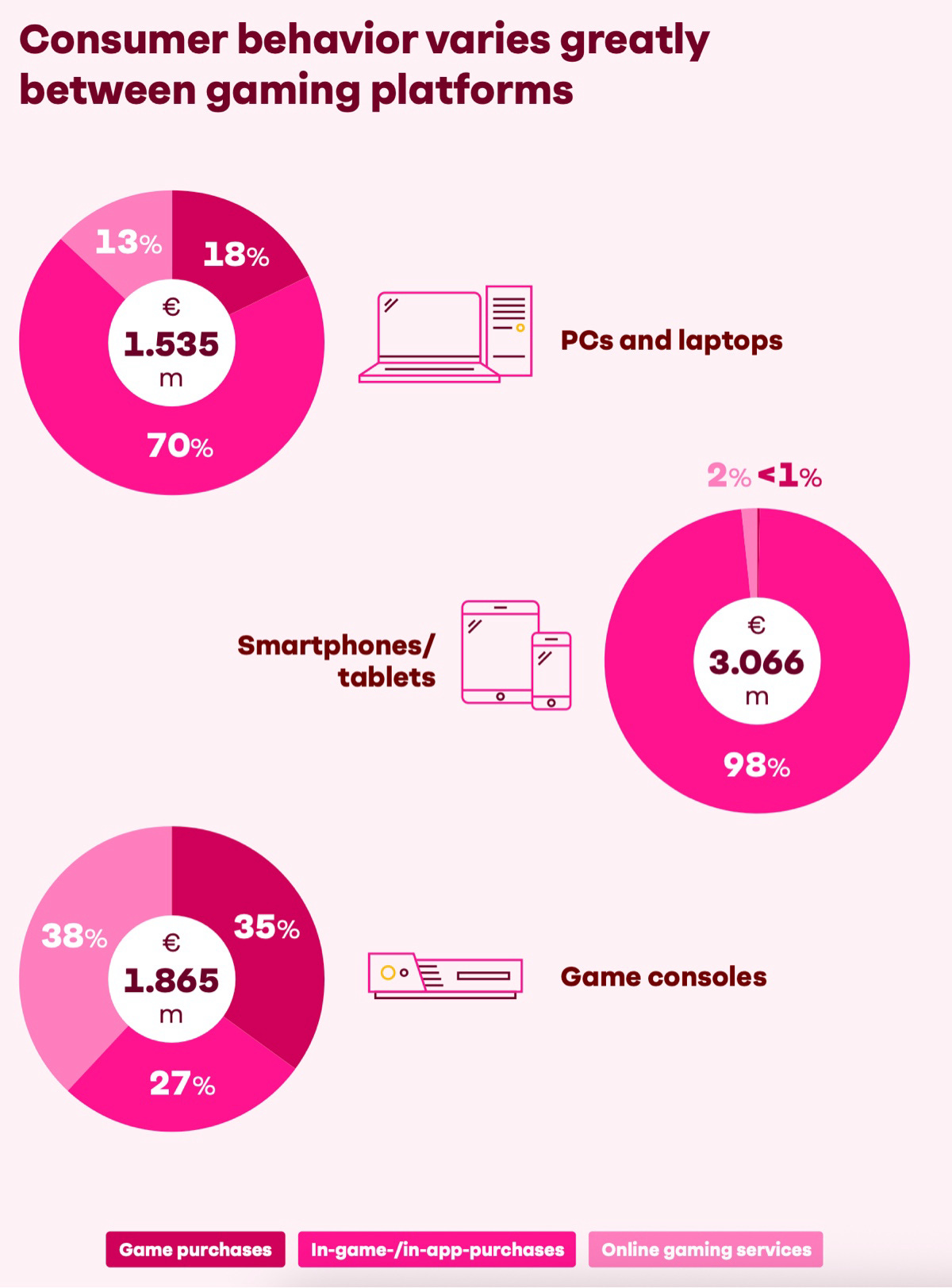

On PC, microtransactions make up 70% of all revenue. Full-price title purchases account for 18%, and online services for 13%. That’s 101% – rounding magic.

On smartphones and tablets, microtransactions make up 98% of total revenue; online services (cloud gaming, subscriptions) 2%, and full-price game purchases less than 1%.

On consoles, spending is the most balanced: 35% of all revenue comes from game sales, 38% from online services, and 27% from in-game purchases.

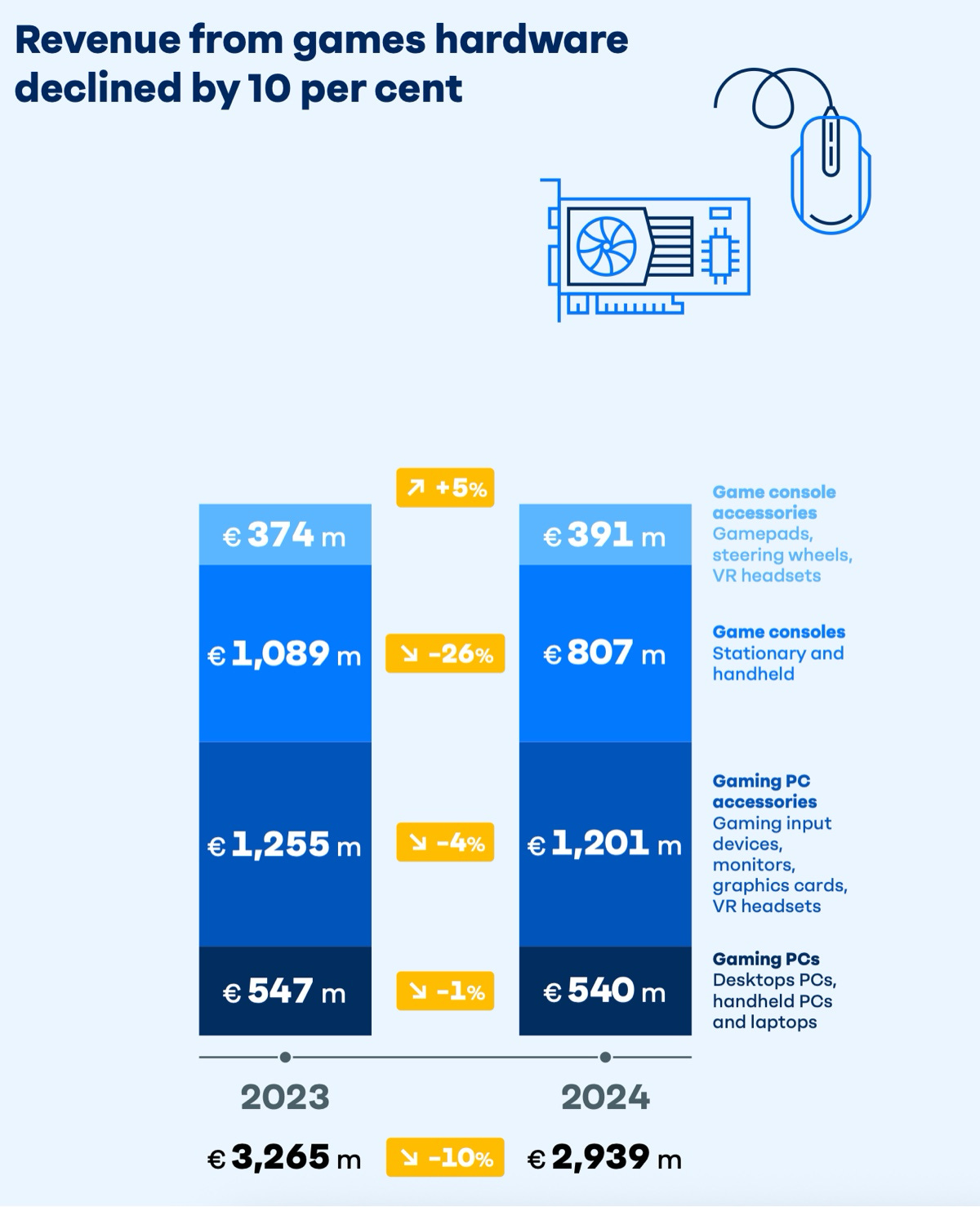

Gaming PC accessories are the largest segment of hardware sales in Germany. In 2024, they brought in €1.201 billion – 4% less than the previous year.

Second place goes to console sales: €807 million in 2024 – a drop of 26%. Third: gaming PCs at €540 million (-1% YoY). Fourth place – but the only growing segment (+5% YoY) – is console accessories, worth €391 million.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The share of digital game purchases rose sharply in Germany in 2024, reaching 68%. On PC, 99% of games are purchased digitally, while on consoles, players still prefer physical editions (44% of purchases are digital).

Younger players tend to prefer digital purchases, while older players stick to physical ones.

37.5 million Germans play games. The average age of a German gamer is 39.5. 79% of all players in the country are over 18.

48% of German gamers are female.

The number of players over 60 grew to 7.7 million in 2024.

Smartphones (22.9 million players) and consoles (20.5 million) are the most popular platforms in the country. Interestingly, the console audience grew significantly in 2024, and since 2019 has increased by 29%.

PC gamers in Germany decreased in 2024 (from 13.5 million to 13.1 million). The platform has been losing audience in the country since 2019.

Tablet players in Germany number 10.3 million. This audience has stayed stable for the past 6 years.

Most Popular Games

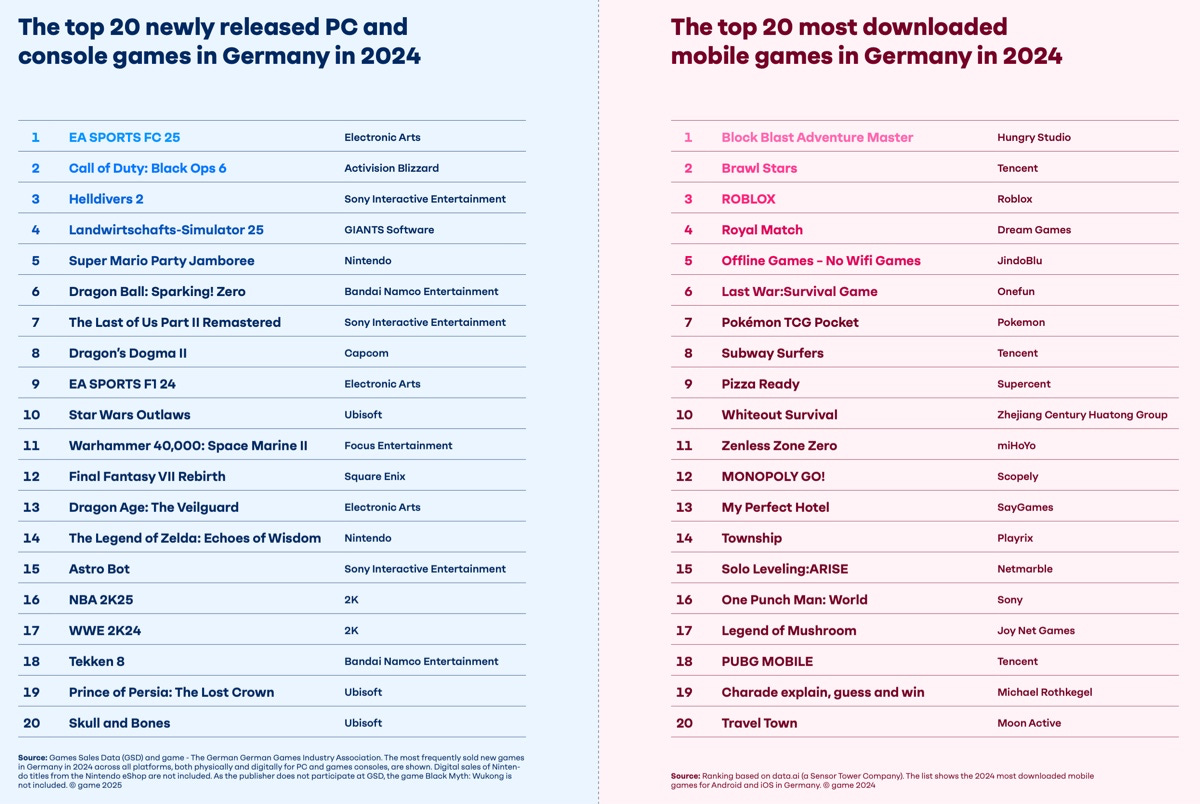

EA Sports FC 25, Call of Duty: Black Ops 6, and Helldivers 2 were the top sellers among new PC/console games in Germany in 2024.

Block Blast Adventure Master, Brawl Stars, and ROBLOX were the leaders in downloads.

The Games Industry in Germany

As of 2025, there are 910 game companies in Germany. 454 act only as publishers, 404 both develop and publish, and 52 only develop. The total number of game companies in the country has decreased for the first time since 2020.

The number of employees in game companies has also declined. In 2025, the German games industry employs 12,134 people – 2% fewer than last year.

Nintendo of Europe (935 employees), Ubisoft (660), and InnoGames (350) are the largest employers in Germany’s games industry.

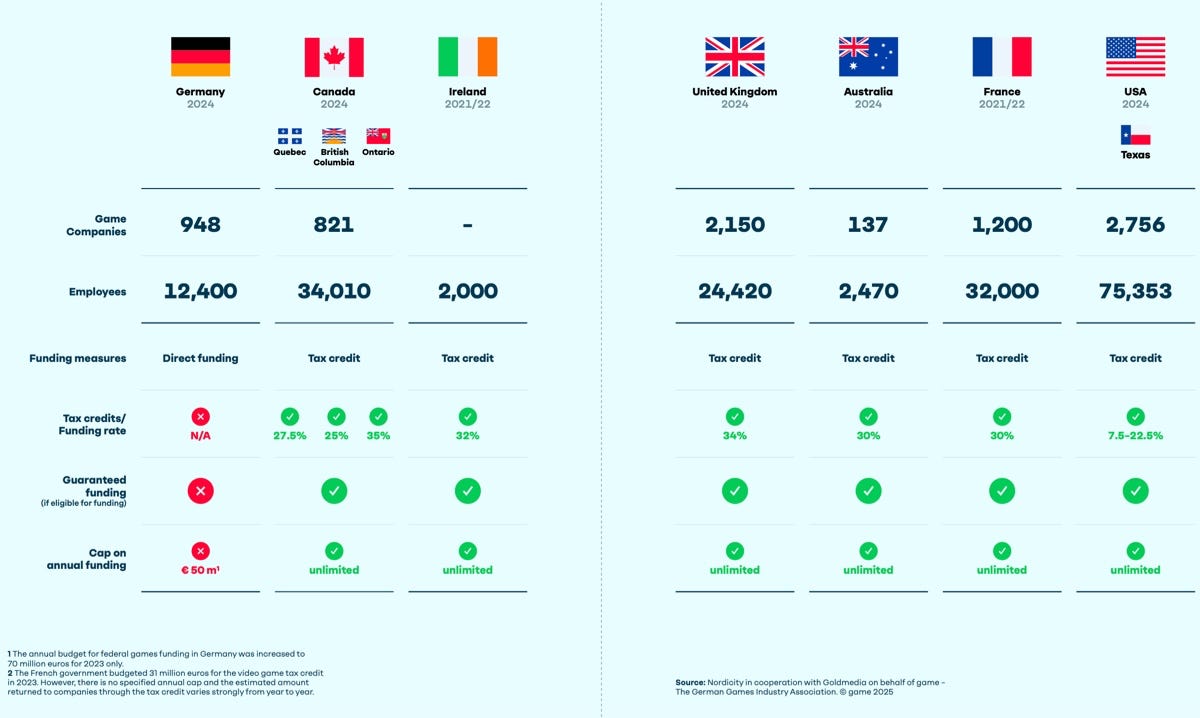

Report authors criticize the German government’s games support system, noting that other countries have much stronger frameworks.

This is confirmed by a survey of game companies: 87% stated that Germany performs poorly as a competitive location for game development.

The report also includes an interesting infographic on the development of the German games market since 1995.