Game7 Research & Naavik: Web3 Games in 2024

The market has been declining since 2021, but stabilization is on the horizon.

The companies studied over 2,500 games; 1,500 rounds and more than 100 blockchain ecosystems; using closed and open sources. Data was collected from September 30, 2023, to September 30, 2024.

Web3 Gaming Ecosystem

The number of announced games in 2024 decreased by 36%. At the same time, the number of closed projects also reduced - by 84% at once.

The report authors note the growing popularity of the Play-to-Airdrop (P2A) model, where players must participate in playtests or reach leaderboards to receive rewards.

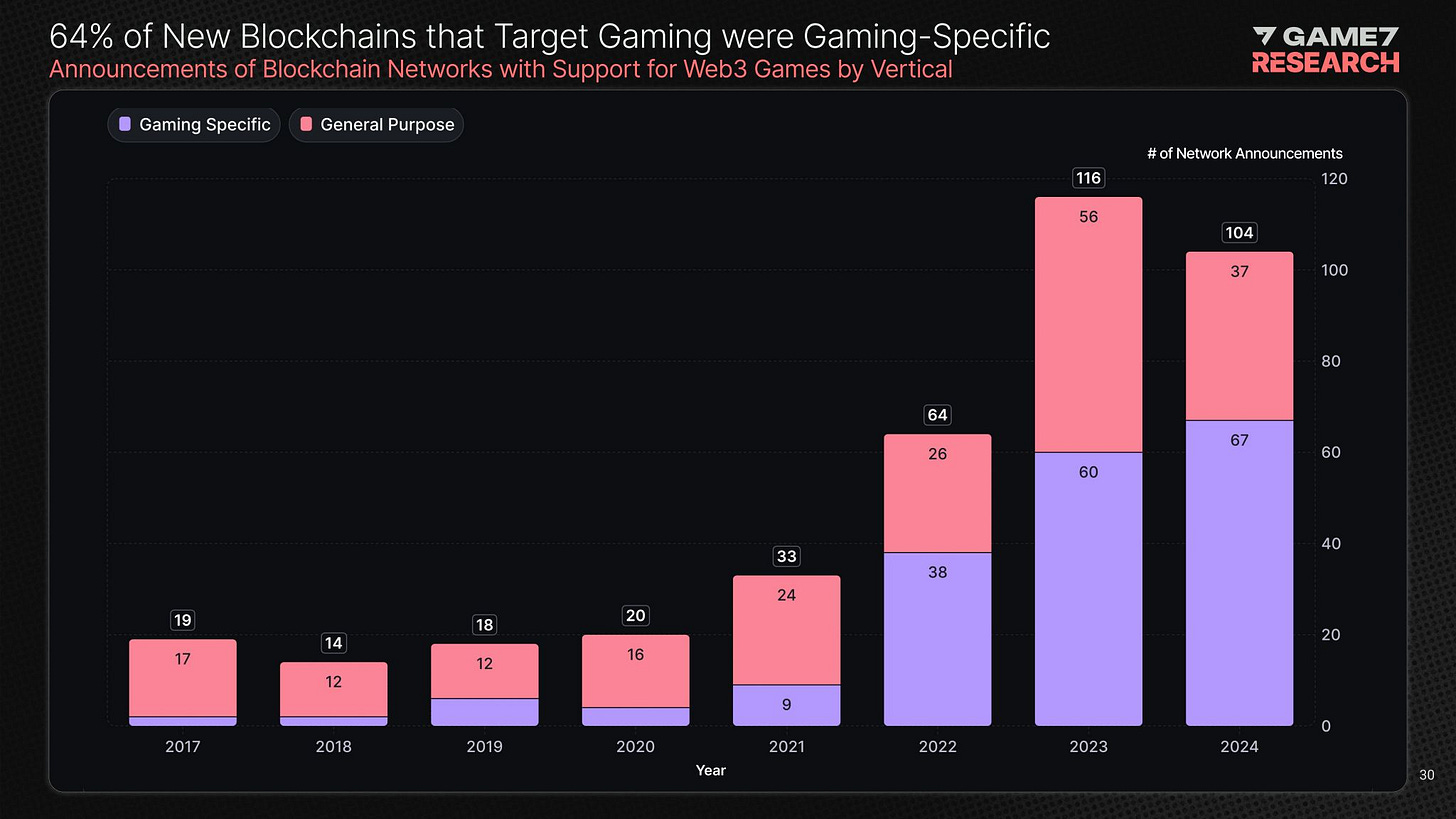

Market players continue to be more interested in launching their networks than launching their games, based on the dynamics. This is likely related to the desire to control and scale business. And, of course, with the possibility of earnings.

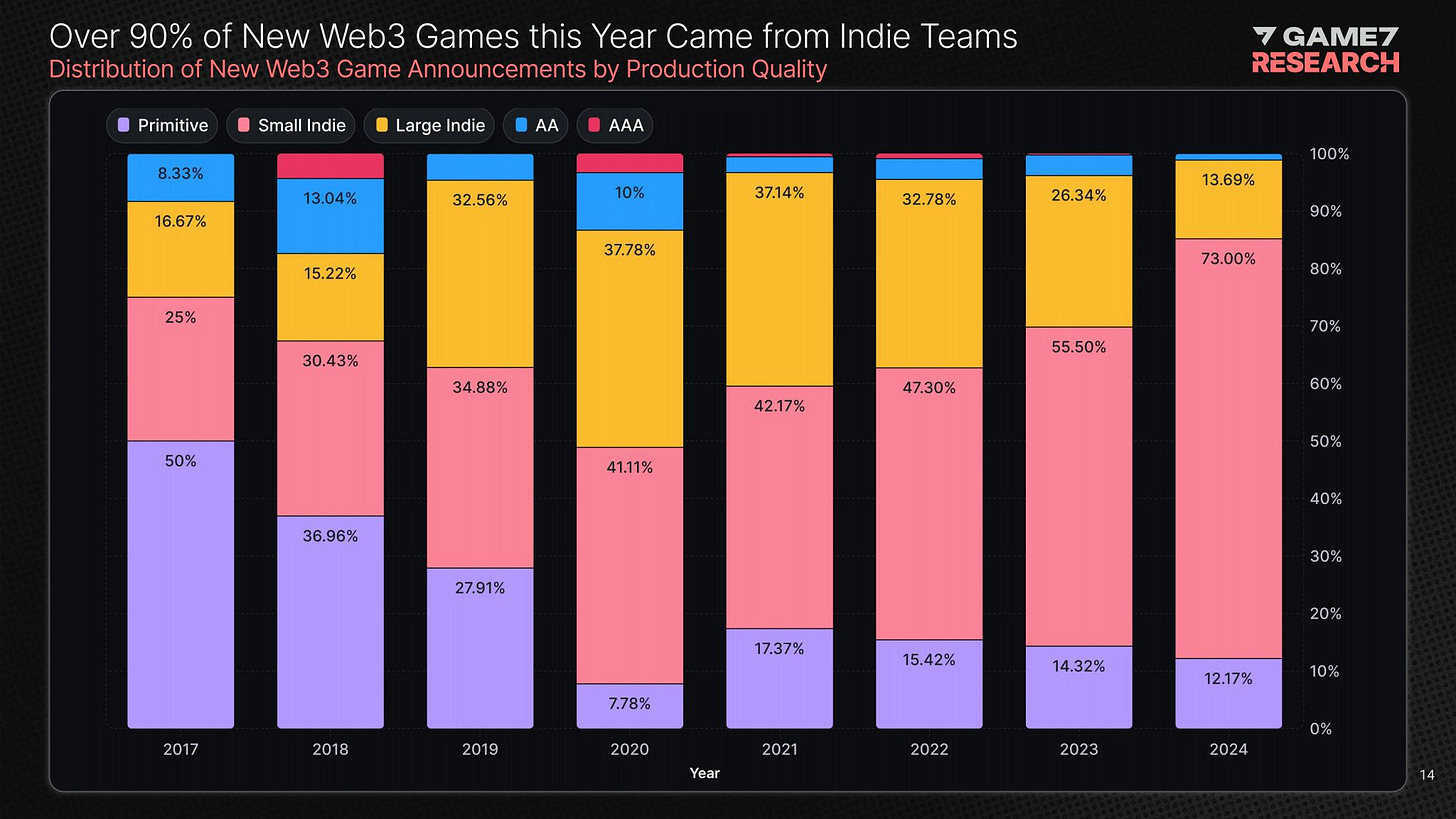

98.86% of all Web3 games are indie, according to Game7 Research classification. Primitive - projects at the "concept verification" stage. Small indie - games made by small teams without external funding. Large indie - games that received up to $10M in funding. AA - games with budgets from $10 to $25M. AAA - games with budgets from $25M.

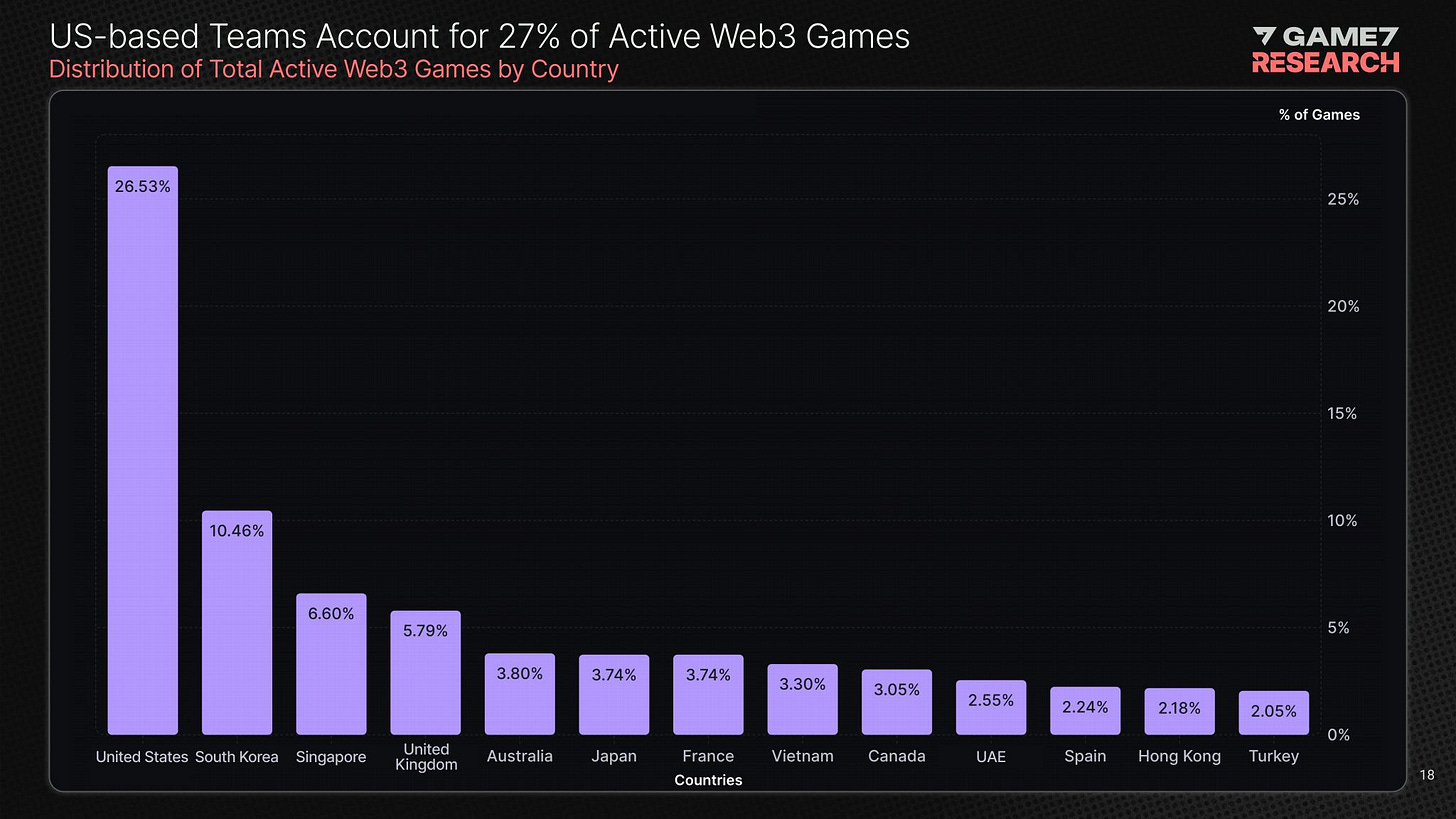

In 2024, there were more developers from North America; the number of Web3 project creators from Latin America increased. At the same time, the share of APAC developers decreased significantly.

However, if we consider all active Web3 studios, most of them are located in the APAC region (38.8% of all developers). North America is in second place (35.6%).

If we look at active games, most of their developers (26.53%) are based in the USA. The country leads by a large margin.

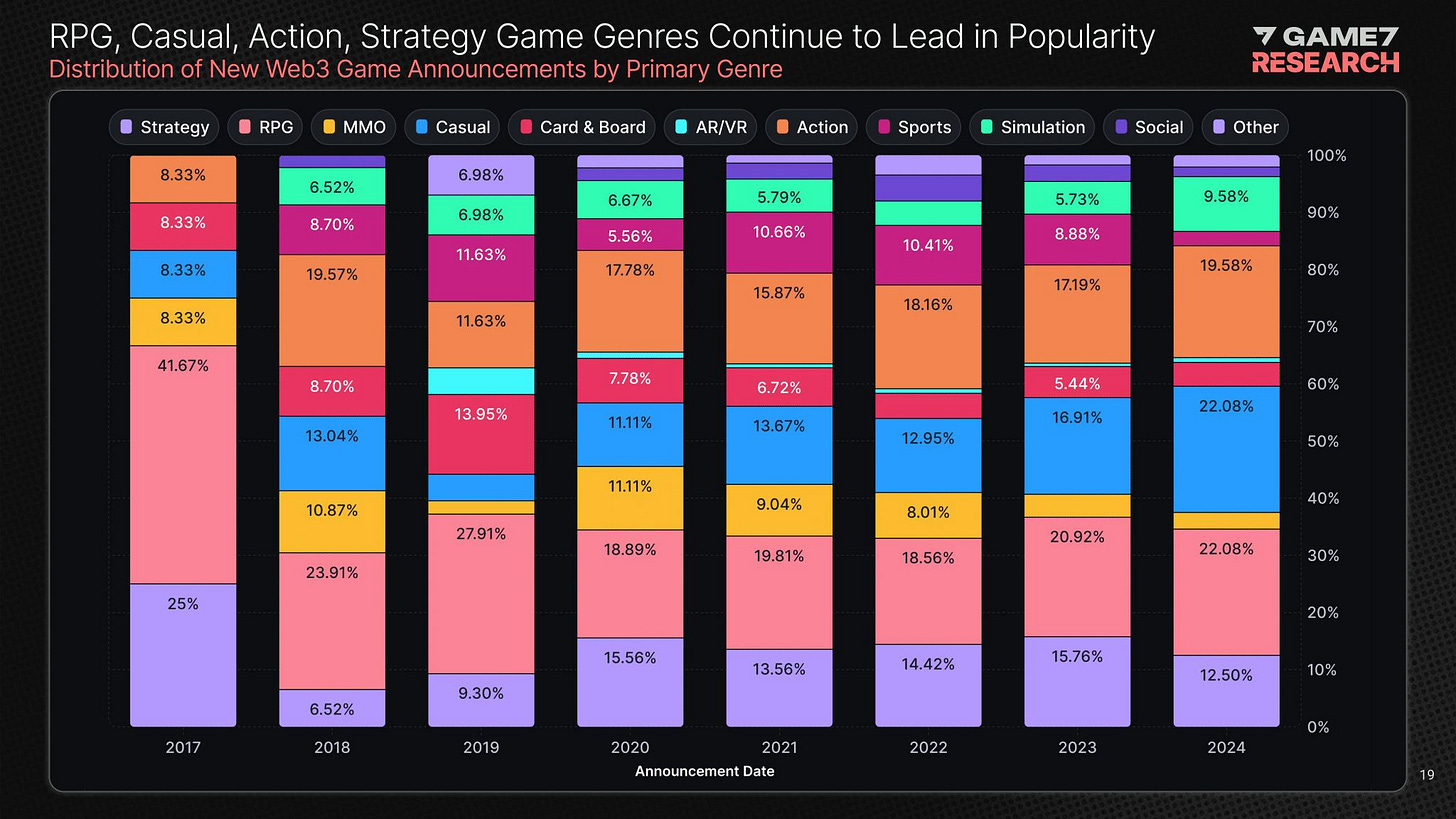

Regarding genres, there's a noticeable increase in interest in casual games (the share of announced projects has doubled over 4 years). The number of Simulation games has increased.

❗️I've heard the opinion that the Web3 market is now returning to simpler games to reach as wide an audience as possible.

Only 45.3% of announced Web3 games are currently playable. 65.7% of all announced projects still don't have Web3 integration.

Platforms and Distribution

Telegram is the breakthrough of 2024 in terms of platforms. In 2024, it took a 20.86% share. Many developers are using Telegram to bypass platform restrictions.

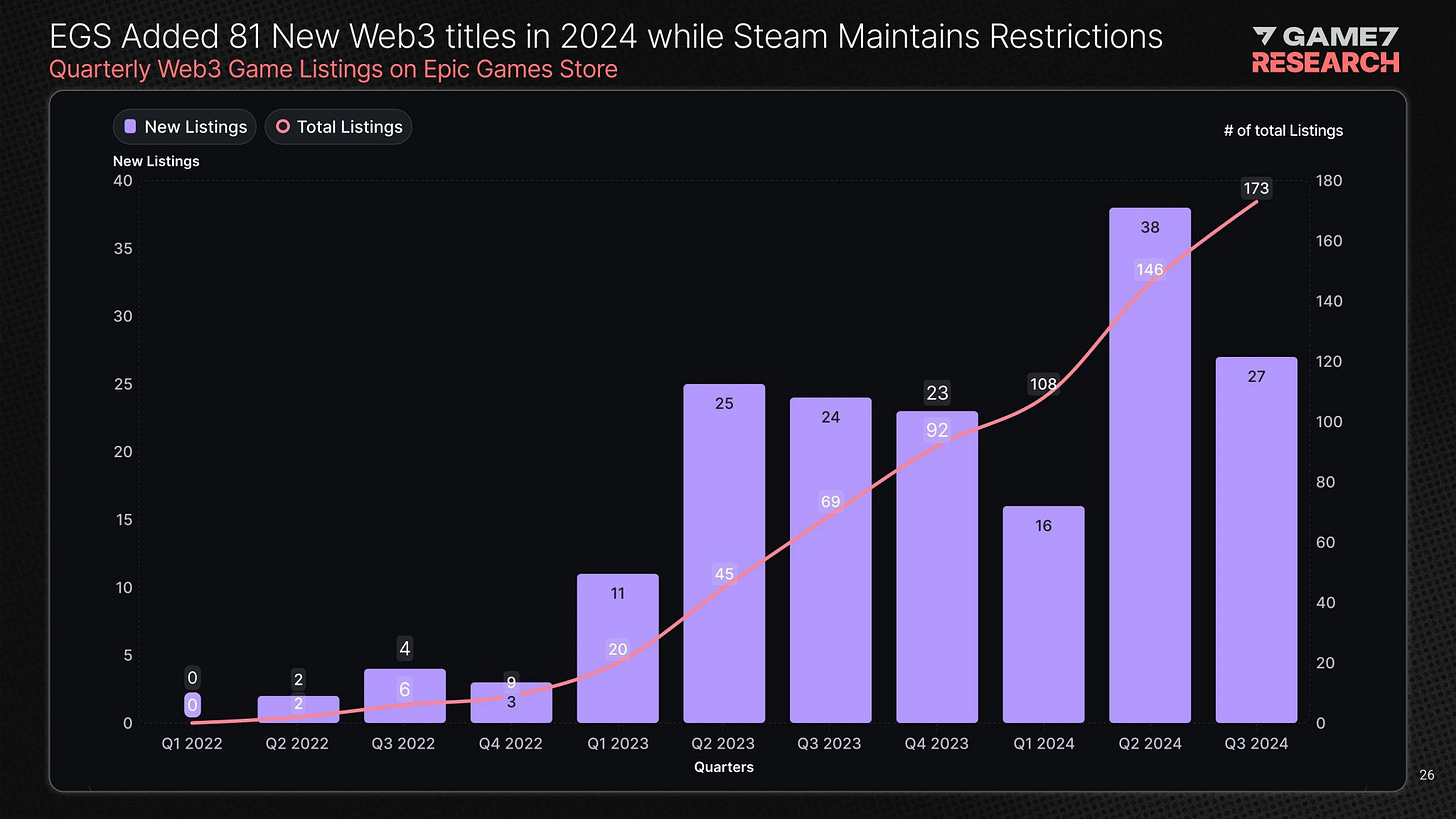

In the Epic Games Store, 81 new Web3 games were added in 2024. Industry representatives also have hopes for the launch of the mobile EGS.

The recent launch of Off the Grid demonstrated that Web3 projects can be launched on consoles, despite the non-native integration of Web3 elements.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Blockchain Technologies

In 2024, 104 new blockchain networks were launched. 67 of them are focused on games.

The majority of launched networks are Layer 2 (35%) and Layer 3 (41.67%).

57% of Web3 games announced this year chose to use Layer 2 (42.86%) or Layer 3 (14.29%) networks.

EthereumVM remains the foundation for smart contracts in the gaming environment - it's used by almost 70% of projects.

Blockchain Ecosystems

Over the past year, Immutable, Arbitrum, and Ronin have grown the most.

23 gaming blockchain networks of levels 2 or 3 were built on Arbitrum Orbit in 2024.

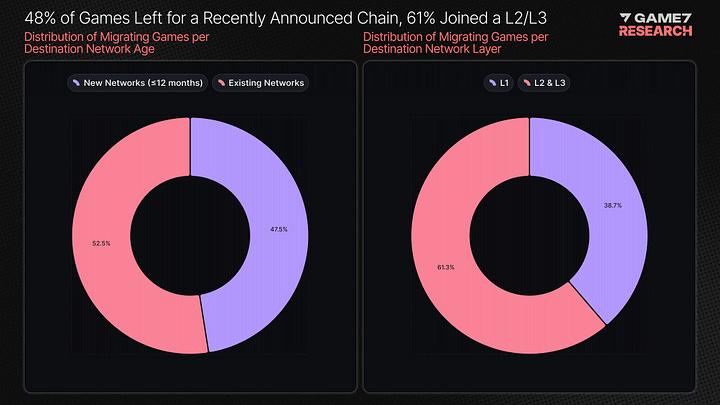

It's evident that in 2023 and 2024, developers began actively migrating to new blockchains. In 2024, there were 105 migrations, with Immutable, Arbitrum, Avalanche leading.

The largest number of migrations came from Polygon (more than a third of the total).

48% of games switched to a new blockchain. 61% joined L2, L3 blockchains.

Funding and Tokens

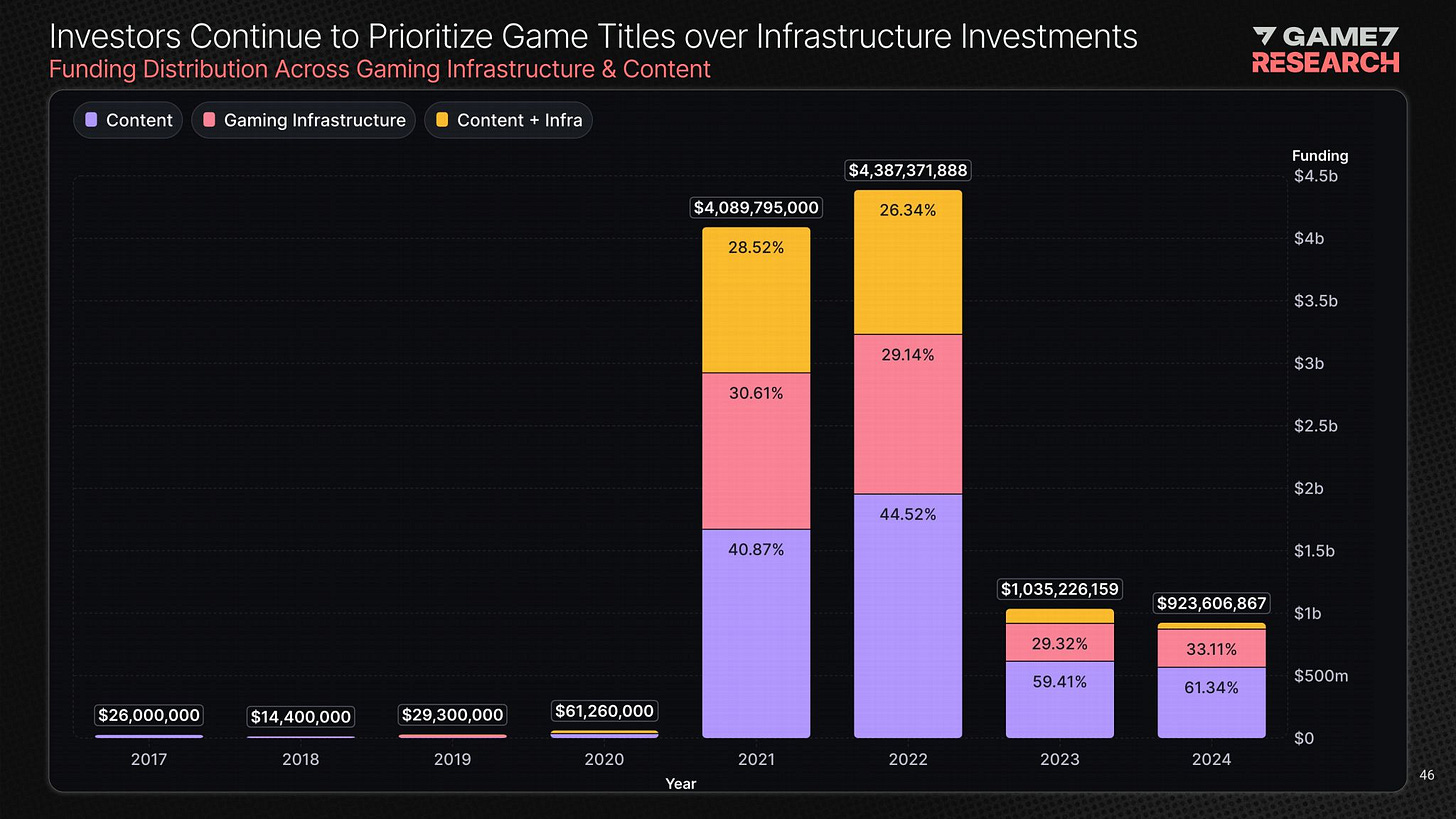

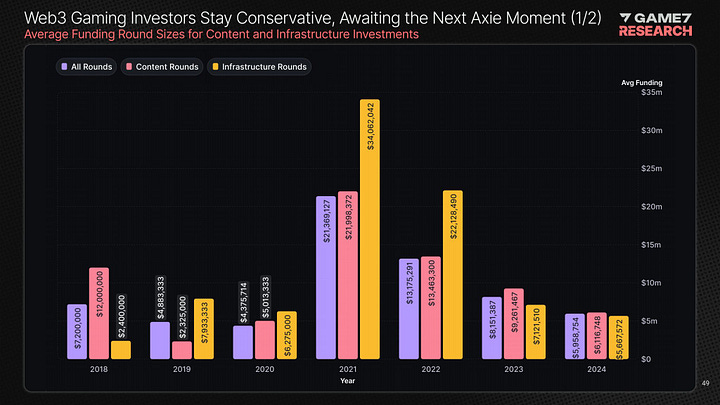

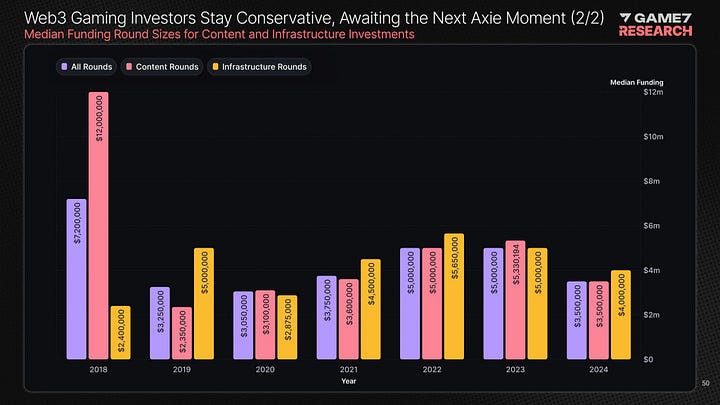

Funding for Web3 gaming projects decreased significantly compared to 2021 and 2022. The number of deals in 2024 increased, but their volume decreased.

Investors still prefer to invest in games - they account for 61.34% of all funds. 33.11% is spent on infrastructure.

Over the past 12 months, the most funds were invested in action games (31.04%), RPGs (15.23%), and casual games (13.84%). The graph shows a noticeable increase in the popularity of action games and casual projects.

When considering investments in ecosystem products, investors are most interested in gaming blockchains (27.49%). As well as user engagement tools (17.58%).

Average and median round sizes continue to decline.

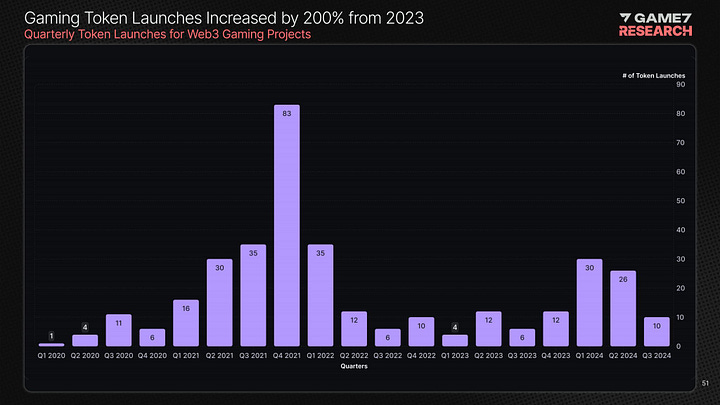

The number of tokens launched in the last 12 months increased by 200% compared to 2023. 74% of all launches occurred in Q3'24.