GDC: The State of the Game Industry in 2025

People started to work more; many faced layoffs; the share of PC games in development is increasing.

Survey participants

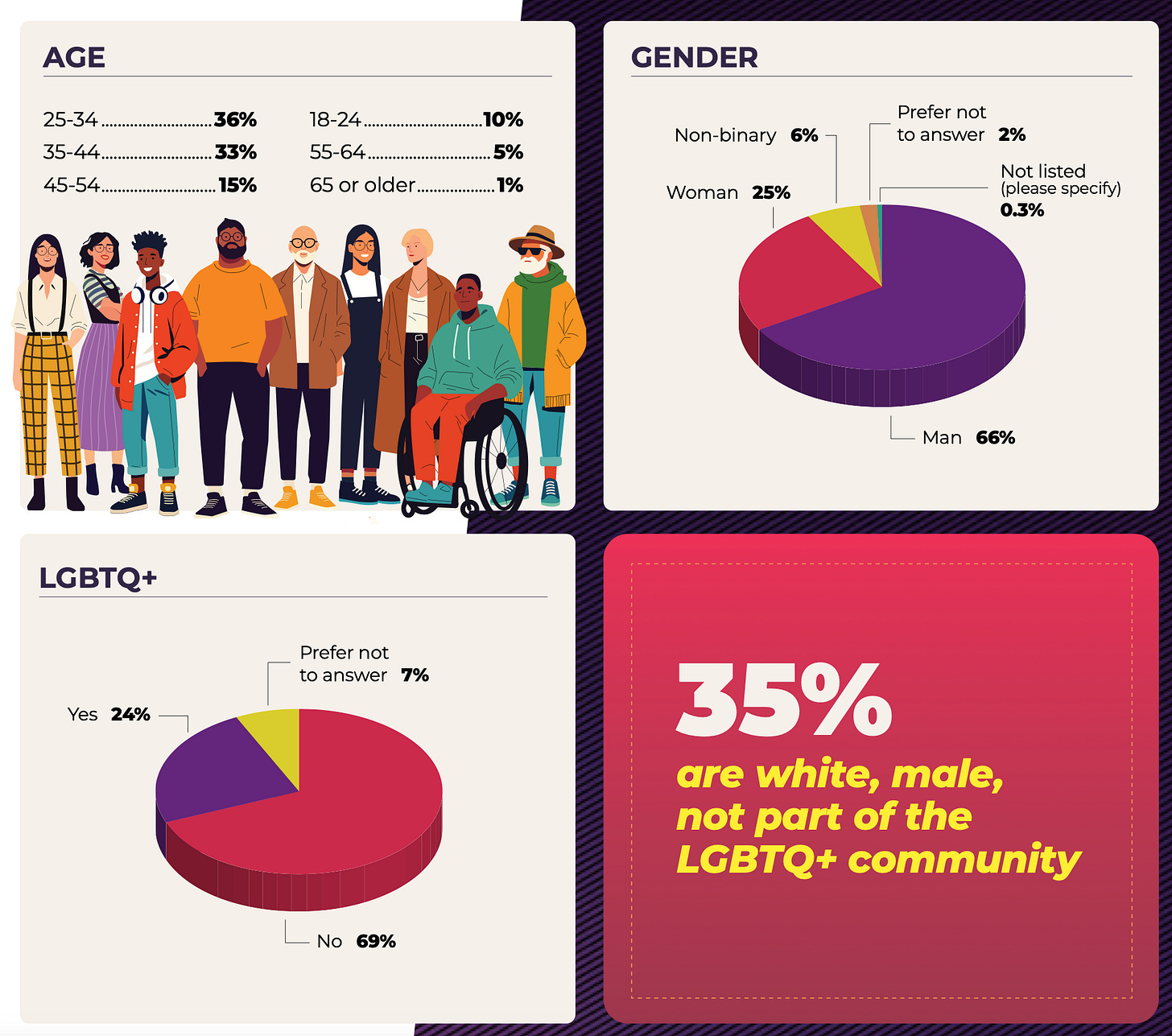

The majority of developers are between 25 and 34 years old (36%) and between 35 and 44 years old (33%).

69% do not identify as part of the LGBTQ+ community. 24% identify. 7% preferred not to answer the question.

66% are men, 25% are women, 6% are non-binary persons. The rest preferred not to answer.

Most survey participants are from the USA (58%), UK (7%), and Canada (6%). The report authors note that the survey may only representatively show what's happening in the Western game industry.

The largest ethnic groups are White / Caucasian (59%), Asian (16%), and Latino/Hispanic (10%).

Most respondents are game designers (35%), programmers (34%), and production or team managers (31%).

Most respondents have been in the industry for 3-5 years (24%), 6-10 years (22%), and over 15 years (22%). The study authors note that 60% of developers have been in the industry for less than 10 years - an increase compared to previous years.

Interestingly, the audience distribution by studio size shows that 21% of respondents work solo, while 18% work in studios with over 500 people. The number of people working in AAA companies has decreased.

Layoffs in the Industry

43% of respondents said there were no layoffs in their companies. In last year's survey, this figure was 53%.

4% said their company closed. 11% were laid off. 18% said layoffs occurred in other departments or teams of the company. And 29% noted that layoffs affected their direct colleagues.

Only 30% of respondents are not worried about layoffs. However, it's important to note that a large number of people chose to skip this question as they had already been affected by layoffs.

Narrative professions (19%), managerial positions (16%), and artists (16%) were most affected by cuts. Business and finance specialists were least affected.

Restructuring (22%), revenue decline (18%), and market changes (15%) are the main reasons given for employee layoffs. 19% of those who lost their jobs said they were not informed of the reasons for the decision.

Attitude towards generative AI

52% of respondents note that they use AI tools. 27% say they don't use them and don't plan to. Surprisingly, older employees use AI more often than their younger colleagues.

AI is most often used in business processes and finance (51%), team management (41%), and communications, marketing, and PR (39%).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

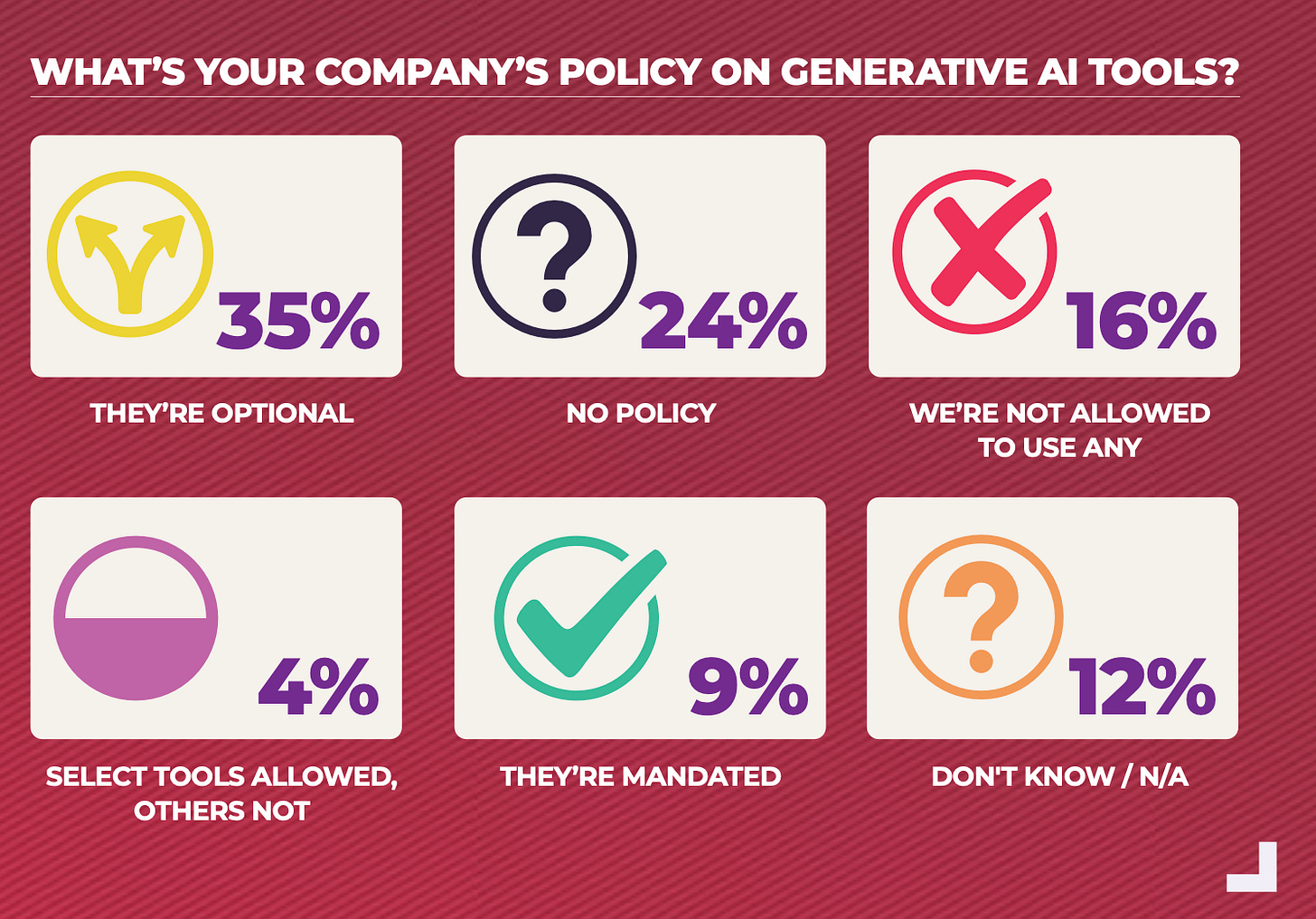

51% of companies in the market have some policy on working with AI. In AAA studios, this figure is 78%.

The number of employees who noted that they need to use AI for work has doubled over the past year. But it's still only 4%.

Opinion on generative AI has significantly worsened over the past year. 13% believe AI will bring positive changes (vs. 21% last year). 30% are confident that changes due to AI will be negative (vs. 18% last year).

❗️It seems to me that the negativity about AI is caused not so much by the technology itself, but by the time in which the technology appeared. People associate industry problems with AI, although there are many more reasons for layoffs.

Engines and Platforms

80% of developers make games for PC - the most popular platform recently. Last year, 66% of developers said they make games for PC. The popularity of UGC platforms remains low (only 3% work in this direction).

For the first time since 2020, the number of developers making games for mobile devices has increased. 28-29% of respondents work on games for iOS and Android (vs. 23% and 24% last year). Most of these developers are from Brazil, the Middle East, and Asia.

Web platform game development is a clear trend. 16% of developers are preparing their projects for the web (vs. 9% last year and 11% the year before). This is the highest value since 2015.

Meta Quest remains the main VR/AR device on the market, as well as the most interesting for developers.

Unity (32% of respondents) and Unreal Engine (32% of respondents) are the main engines in the industry. Another 13% work on their own proprietary engines. Interestingly, despite a lot of negativity associated with Unity Runtime Fee, it looks like developers haven't left the . The share of developers using the engine has hardly changed from last year.

Game Business

13% of respondents would like to make GAAS projects. Another 16% are already making them. But 42% don't want to get into this part of the business. Among AAA developers, the share of those working on service projects is higher - 33%.

62% believe that stable CCU is the main metric of a successful service game. 40% named DAU, 32% - the percentage of paying users.

13% of developers are already working on translating their IP into movies or series. 5% of respondents said they were approached with such an offer. Another 14% discussed this possibility internally. At the same time, a third of major AAA developers are working on transferring their IP to television format.

Publishing and Financing

Self-funding (56%), publisher funding or project financing (28%), grants and government support, venture investments, co-development (all at 15%) are the most popular financing formats among respondents. Interestingly, among AA developers, 40% are making projects with their own funds, while among AAA developers, only 29% do so.

In terms of subjective perception of success, venture investments received the most negative reaction as a financing method. 32% of respondents noted that their venture story didn't work out at all. Self-funding and co-development generate the most positive reactions.

Social Initiatives

Overall, the industry believes that they and their companies are succeeding in game accessibility, DEI initiatives, and sustainability.

16% of respondents noted that they faced natural disasters over the past year. This figure has seriously increased over the past couple of decades.

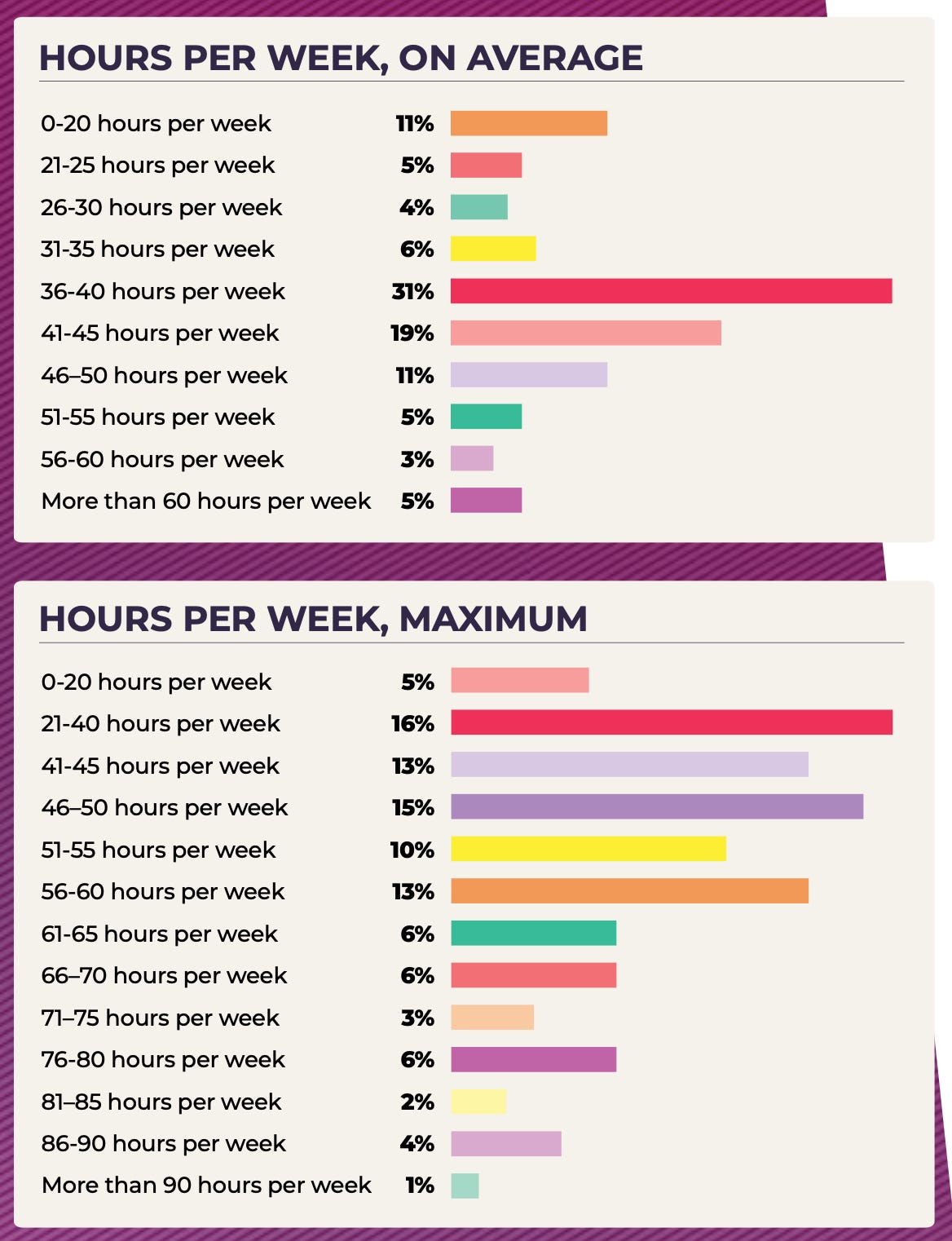

Game developers have started working more for the first time since 2019. The share of those who work 40 hours or less per week decreased from 64% last year to 57% this year. There are more of those who work more than 51 hours per week (the share increased from 8% to 13%).

People have different motivations for overtime. 67% do it on their own initiative (there may be a whole complex of factors why this happens). 23% don't consider it overtime. 14% fear consequences (probably layoffs). 12% noted that management pressures them.

Overall, the industry expresses support for the emergence of unions. Representatives of narrative professions and QA specialists vote the most for them. These are professions that are often at risk. Among young people, there are more who want to have a union.

Jesus Christ, why is the first statistic describing the industries identification of LGBQT? Does that really have any true important in the video game industry or am I missing something? And we wonder why the industry is struggling- it's because of agendas being pushed like this that has nothing to do with the state of the games industry. Keep the politics and propaganda out, do better!