InvestGame & GDEV: Investments in Mobile Game Companies since 2020

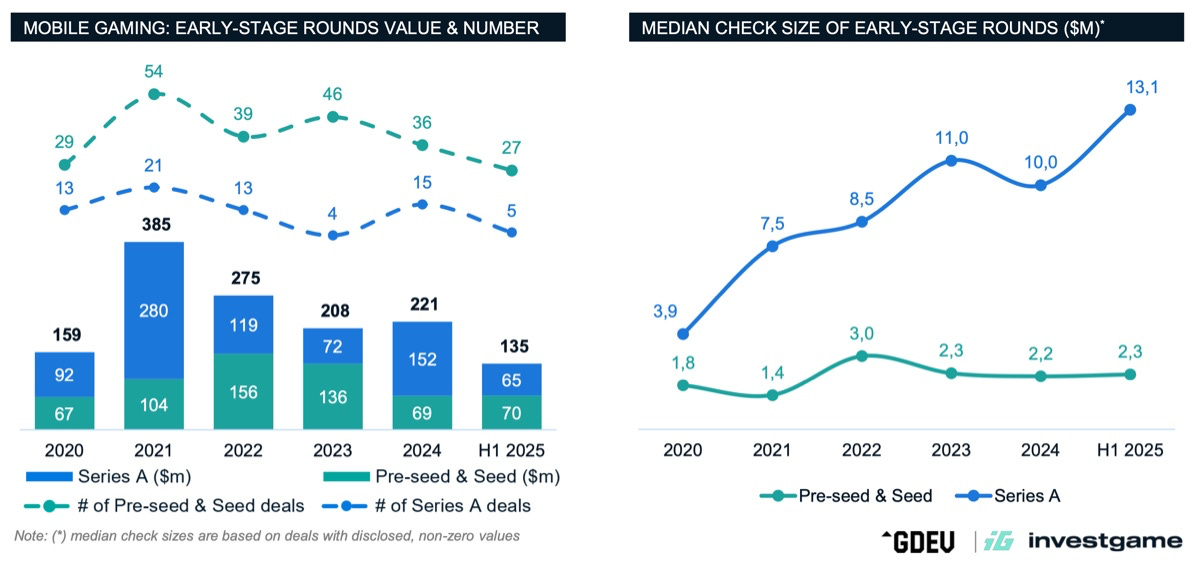

Series A rounds have struggled a lot recently due to structural market changes.

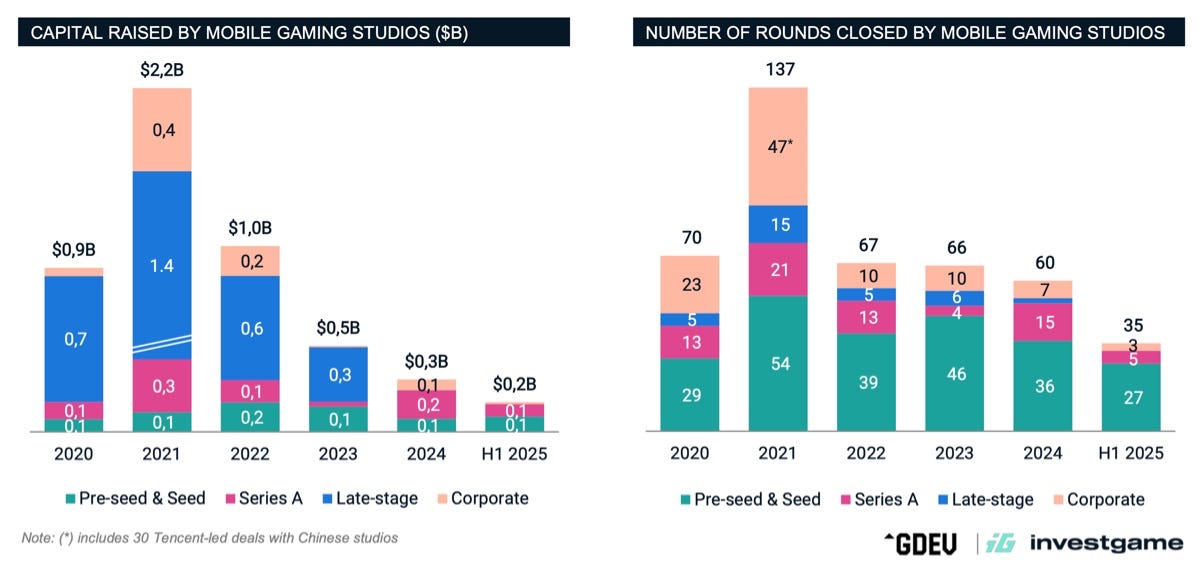

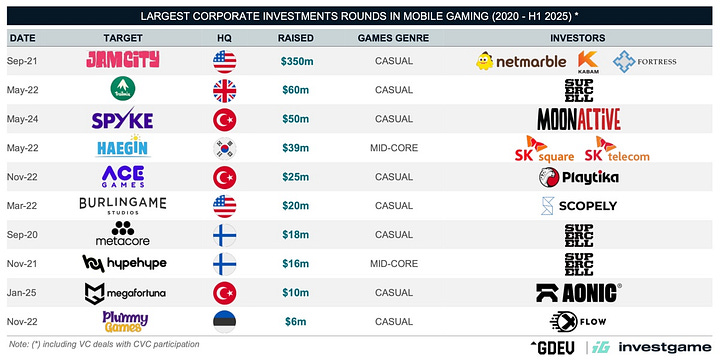

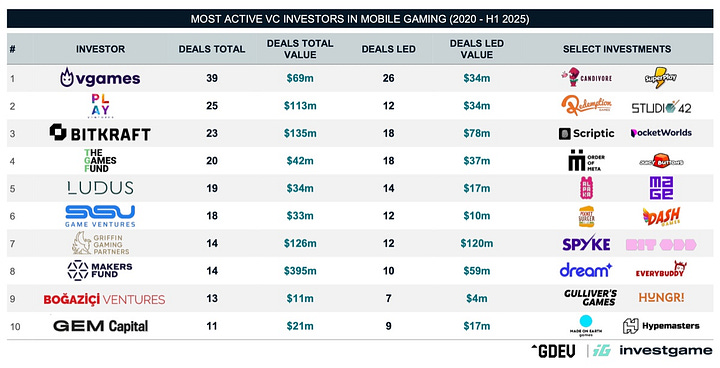

Since 2020, over $5 billion has been invested in mobile studios (435 recorded deals). The majority (302 transactions) were in the early stages, with $1.4 billion invested. 33 transactions totaling $2.9 billion were at late stages (from Series B+). Finally, since 2020, there have been 100 deals involving corporate venture funds or strategic investors, adding another $0.7 billion.

The chart shows that during the pandemic market boom, deals doubled, from 70 in 2020 to 137 in 2021. After that, there’s been a decline, which still hasn’t stopped.

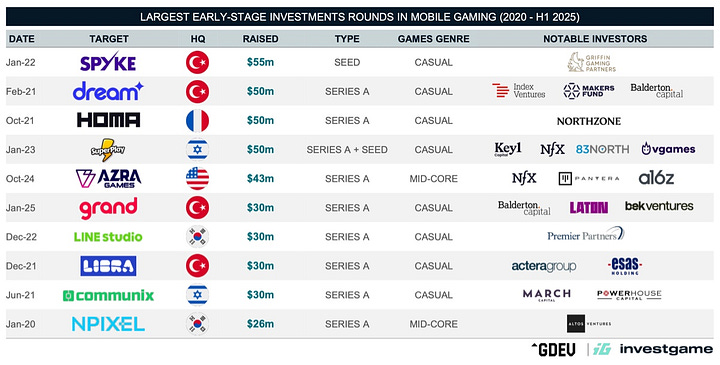

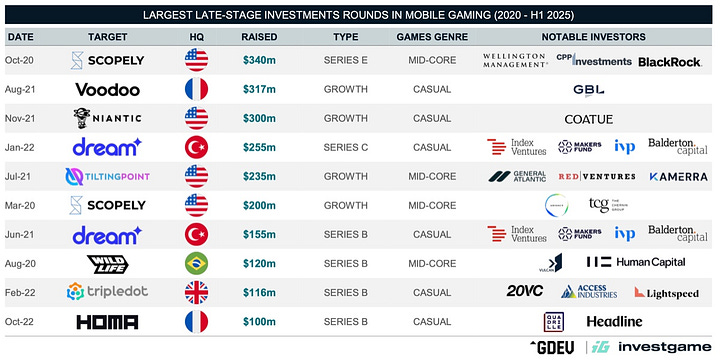

Casual studios are weathering the crisis better than midcore ones. There are more deals with these studios, and the total amount of those deals is also higher.

Turkish companies account for 27% of all VC capital invested in casual mobile studios since 2020. For midcore, however, Europe and Asia lead; 66% of all investments went to companies from those regions.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

At the same time, structural market changes have hit Series A deals the hardest. Median check has grown significantly, and the number of transactions has dropped sharply. Most likely, this is due to reduced risk appetite; companies at the Series A stage now need to show a proven, data-backed capacity for rapid growth.

It is also clear that the median check at pre-seed and Seed rounds has remained unchanged for the last few years. VC investors expect that the team and MVP can be built for $2.3M.

Against the backdrop of a more cautious approach from VC investors, the number of M&A deals in the mobile segment has grown over the past 12 months. There have been 5 deals totaling $7 billion—a record figure since 2022.

Since 2020, mobile studios have accounted for 61% of the total volume of M&A deals (excluding the Activision Blizzard deal). In H1’25, deals with mobile companies made up 98% of the total volume.