InvestGame & GDEV: Major exits in the Gaming Industry over the last 10 years

42 gaming startup exits were reviewed.

The InvestGame team defines “major” exits as those valued at $500 million and above. Data from the past 10 years is considered. Only companies for which such a deal is the first are included (which is why Jagex or Activision Blizzard, for example, are not on the list).

Top 5 Largest M&As and Public Offerings

4 out of 5 largest M&A deals in the last 10 years involved mobile companies. Mojang Studios stands out, as at the time of the Microsoft deal, most of its revenue came from PC and consoles. Two companies (Mojang Studios and SpinX Games) were built without external investors.

The leaders in valuation at the time of public offering are companies working with the mobile market. All of them generated most of their revenue from mobile devices at the time of listing (including Krafton). It's also worth noting that VC funds financed all the companies on the list.

Deals timeline

2021 proved to be the most productive year in terms of large M&As and public offerings. There were 7 M&A deals totaling $9.5 billion and 7 public offerings with a total valuation of $90.7 billion at the time of listing.

The industry median is one M&A deal and one public offering larger than $500 million per year.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

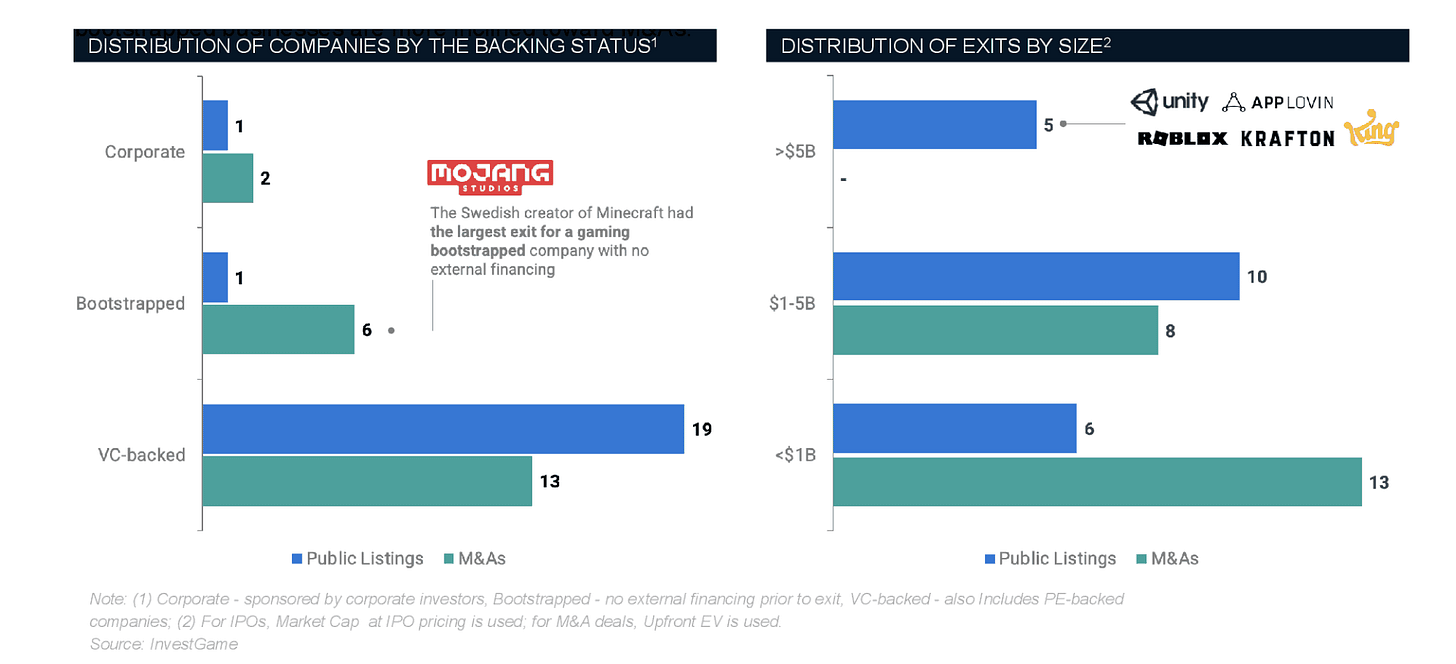

Deals by backing method

Companies with VC fund involvement account for 75% of all major deals (valued over $500 million). 60% of VC-funded companies went the public offering route.

Among companies founded with their own funds, only 1 out of 7 went public - GDEV. All the others were bought by larger players. Interestingly, out of 7 companies, 5 had a valuation exceeding $1 billion at the time of the deal.

When looking at companies financed by corporate funds, 3 companies made it into the sample. One was bought, and the other two went public.

❗️The goal of many corporate funds is to consolidate successful companies in their early stages. This might be why there aren't many of them on the list. The valuation simply doesn't have time to "grow".

Deal Sizes and Time to Completion

Only companies that went for an IPO have valuations above $5 billion. M&A deals dominate in the category of deals up to $1 billion.

Mobile gaming companies, on average, exit 40% faster compared to PC/console studios.

Statistically, companies that raised funds from corporations take the longest to exit (10 years). Companies with VC funding take 9.5 years. The fastest to reach the point of sale or public offering are companies without external financing - they take an average of 7 years.