InvestGame & GDEV: The History of Gaming IPOs

Mobile is on the rise; more companies prefer diversification; and Asia is the IPO powerhouse.

In this material, the InvestGame team examines how the landscape of gaming IPOs has changed, which gaming companies have benefited, and how companies from different segments have fared after going public.

A total of 87 companies were analyzed, each of which had a post-IPO valuation that exceeded $100 million at least once.

InvestGame is the leading source of the gaming industry investment news. Subscribe here.

History of Gaming IPOs

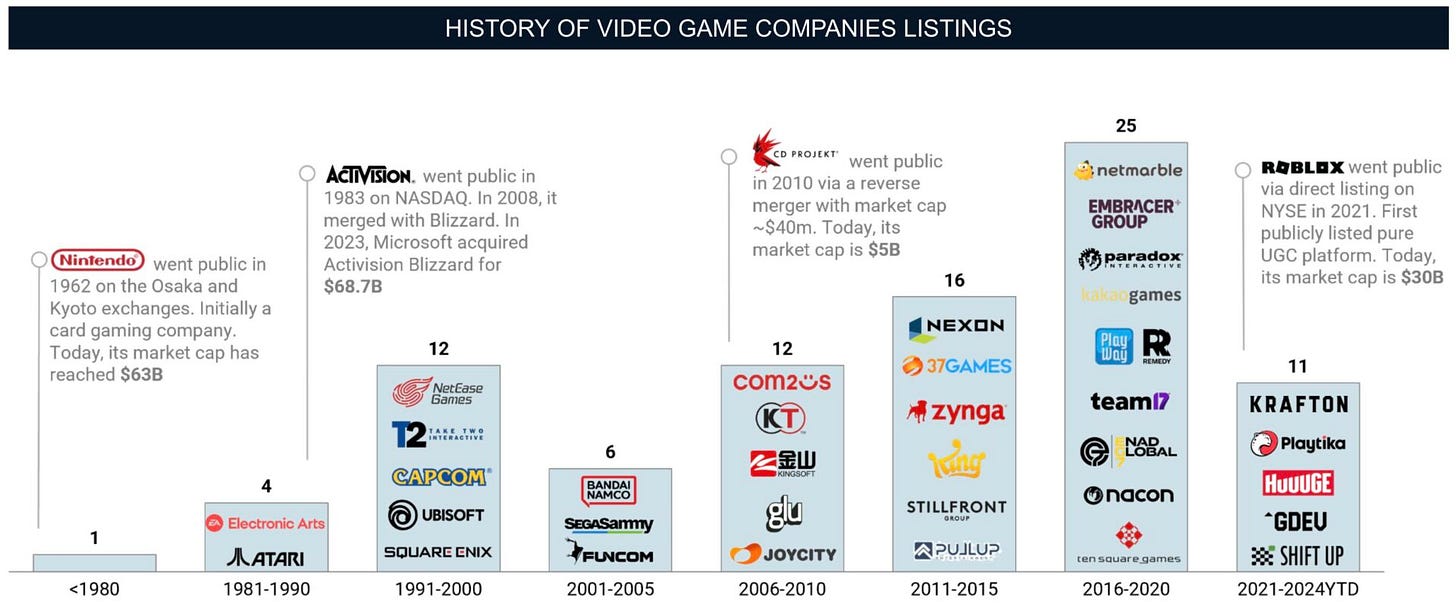

Before 2006, 23 gaming companies went public. Most of them were already in the gaming business, but the first—Nintendo—initially went public on local stock exchanges in Kyoto and Tokyo as a playing card manufacturer (hanafuda). The gaming division came later.

Between 2006 and 2010, 12 companies went public. From 2011 to 2015, another 16 companies did the same. IPOs reached their peak between 2016 and 2020, with 25 companies going public during that period.

Since 2021, companies' interest in IPOs has declined, with only 11 companies going public. Only one of these—Shift Up (July 2024)—happened after 2022. Market corrections, rising interest rates, and weak multipliers have all affected business owners' interest in going public.

Public Offerings by Region

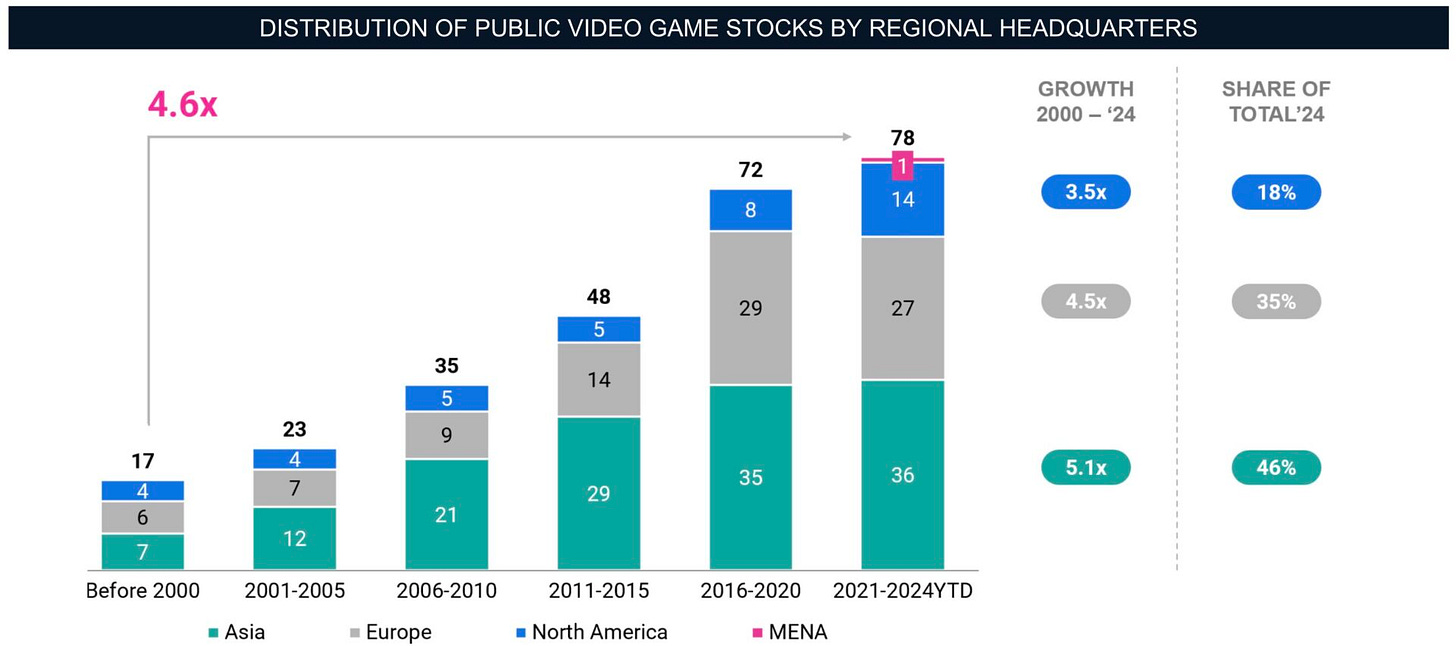

Asia is the leader in public offerings. As of 2024, 46% of all public companies are from Asia. Another 35% are from Europe, 18% from the U.S., and 1% from the MENA region (Playtika).

In Asia, the number of public companies has grown by 5.1 times over the past 24 years. In Europe, it has grown by 4.5 times, and in the U.S., by 3.5 times.

Platform Distribution

PC/console companies dominated IPOs until 2000. Currently, 46% of all public companies specialize in this segment. The number of companies has increased by 2.8 times since 2000.

The most significant growth has been in the mobile segment. The number of public companies has grown by 9.3 times since 2000, and now 47% of all public gaming companies specialize in mobile games.

Historically, diversified companies make up 6%. However, more companies are now trying to expand to new platforms. From 2021 to 2024, 46% of all public companies were diversified.

Gaming Market Capitalization

The capitalization of the gaming market gradually grew until 2007, reaching $145 billion. After the 2007 global financial crisis, it dropped to $75 billion but recovered to $122 billion by 2014.

The most significant growth occurred between 2014 and 2020, when gaming market capitalization skyrocketed to $535 billion, driven by favorable financial conditions and a record number of IPOs.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The consequences are well known. By 2024, the gaming market's capitalization has dropped to $353 billion, which is 30% lower than the peak years prior.

It's important to note that Asian companies contribute the most to gaming market capitalization—about 70% of the total.

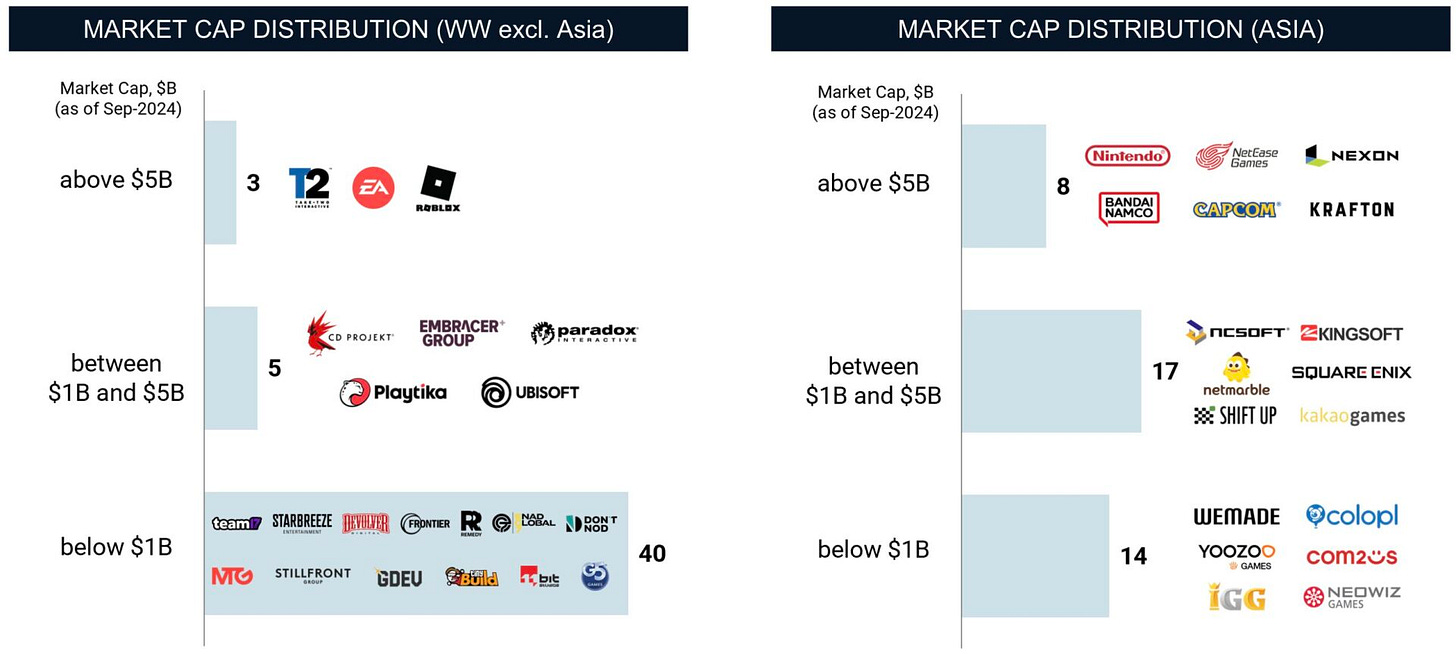

As of 2024, there are 13 companies with a capitalization of over $5 billion—8 of them are in Asia. There are 22 companies with a capitalization of over $1 billion but less than $5 billion—17 of them are in Asia. Among companies with a capitalization of less than $1 billion (those included in InvestGame's analysis), there are 54, and only 14 of them are in Asia.

Age of Public Companies and Time to IPO

Most public gaming companies today are over 20 years old. Many well-known companies, such as Nintendo, Activision Blizzard, and Electronic Arts, are over 40. On average, Asian public companies are 28 years old, and Western ones are 23 years old.

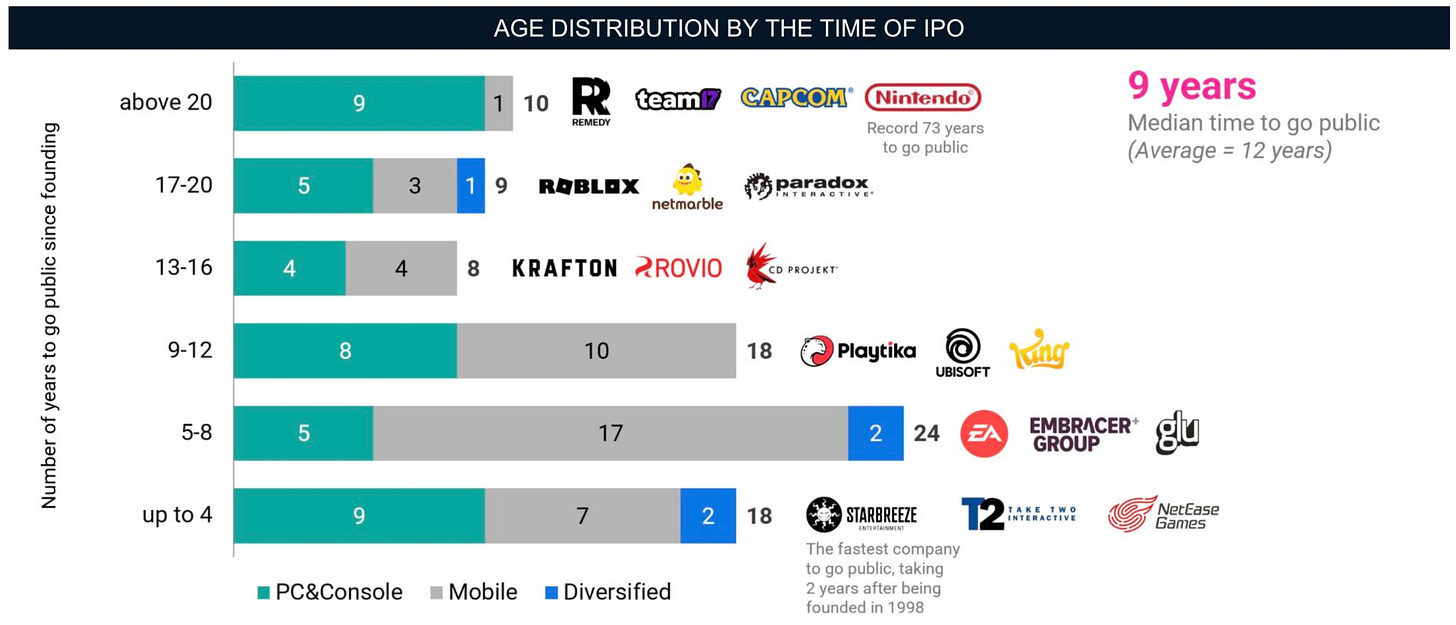

The median time for a gaming company to go public is 9 years (with an average of 12 years) after their founding.

Between 5 and 12 years after being founded, 48% of companies from the analyzed sample went public.