InvestGame & GDEV: The History of Web3 Gaming Investments

The rise & fall is there; what about the future?

InvestGame only considers private investments; public offerings and token sales are not included.

Market Overview

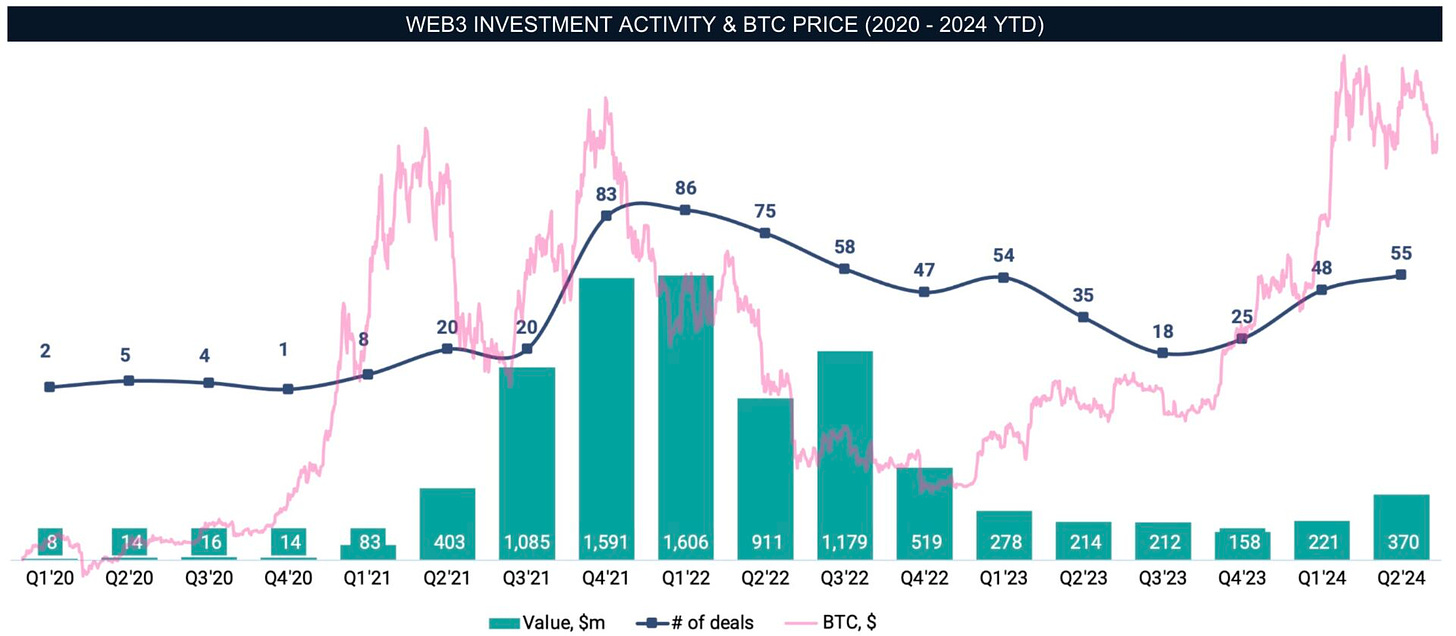

A surge in investment activity began in late 2020 and early 2021, coinciding with the rapid rise in Bitcoin's value.

The peak of investment activity occurred in Q1 2022, with 85 publicly announced deals totaling $1.6 billion.

After that, the market declined, accompanied by significant events: in March 2022, the Ronin network from the creators of Axie Infinity was hacked; LUNA crashed in May 2022; and the crypto exchange FTX shut down at the end of the year. Business activity reached its lowest point in Q3 2023, with 18 deals worth $212 million. The lowest point regarding money invested was in Q4 2023, at $158 million.

There is no direct correlation between Bitcoin's value and business activity in the market. Since late 2023, Bitcoin's value has steadily increased, but the Web3 investment market hasn't followed suit, indicating deeper fundamental issues.

Web3 Market Investment Structure

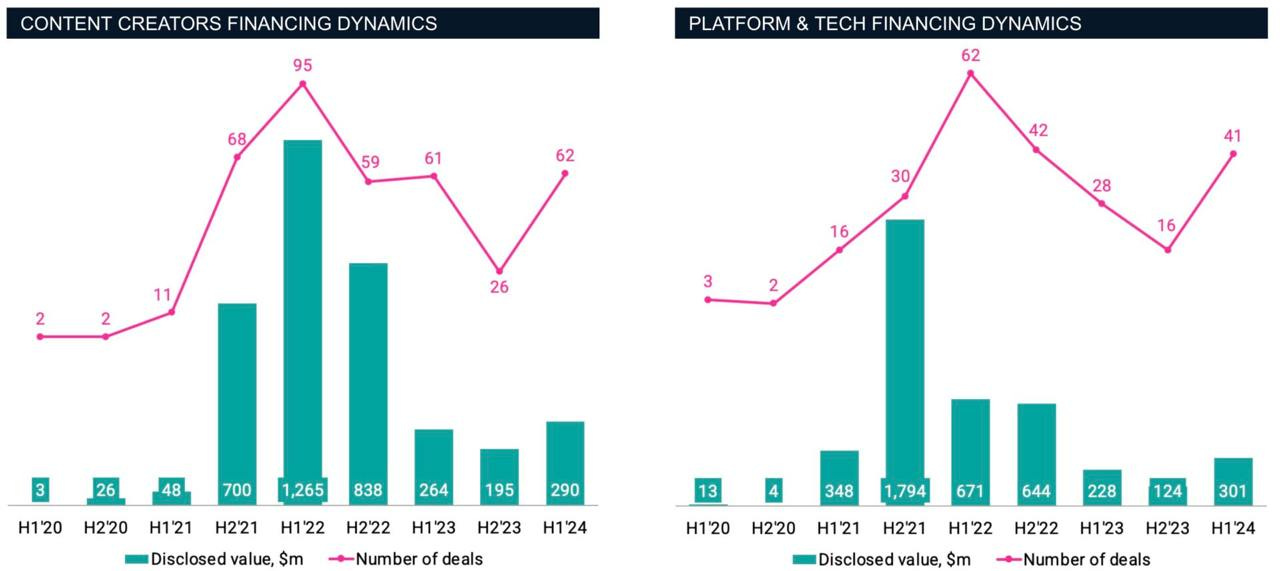

Crypto gaming startups can be divided into two categories: content (games) and platform/tech developers.

In 2020, there were 9 public deals (4 content-focused, 5 platform-focused) totaling $46 million.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

In 2021, the number of publicly announced deals increased to 125 (79 content-focused, 46 platform and technology-focused), with a total deal value of $2.9 billion.

The peak of Web3 startup deals occurred in 2022, with 258 deals (154 content-focused, 104 platform-focused) totaling $3.418 billion.

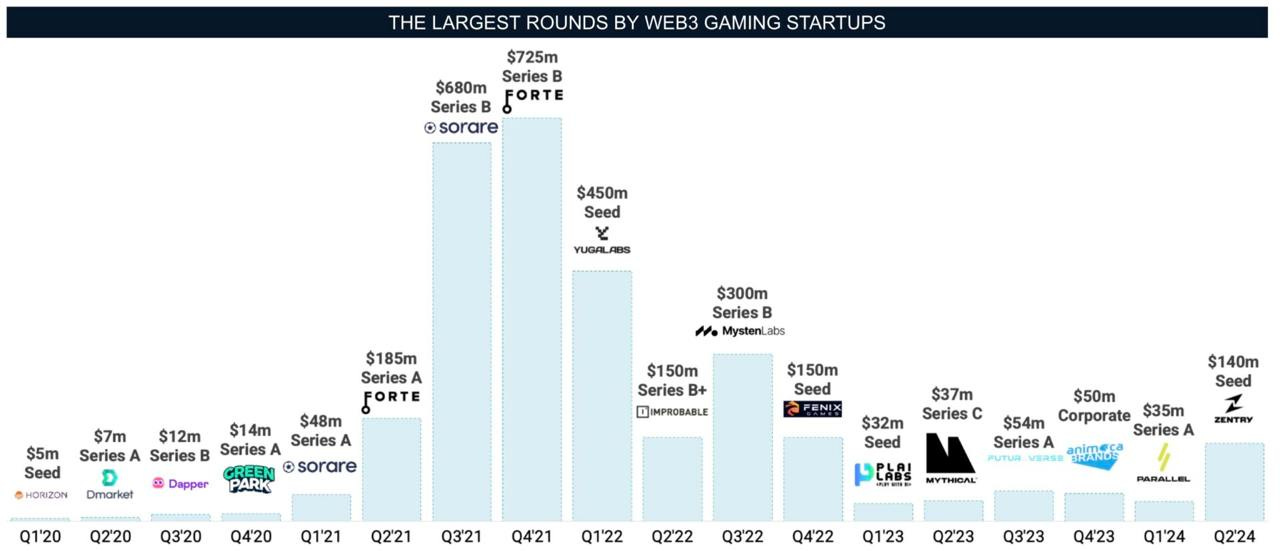

The most notable VC deals during the market's peak were Forte, Sorare, Yugulabs, and Mystery Labs, which attracted nearly $2.4 billion, accounting for 30% of all investments in crypto gaming startups from 2020 to 2024.

Most Active Investors

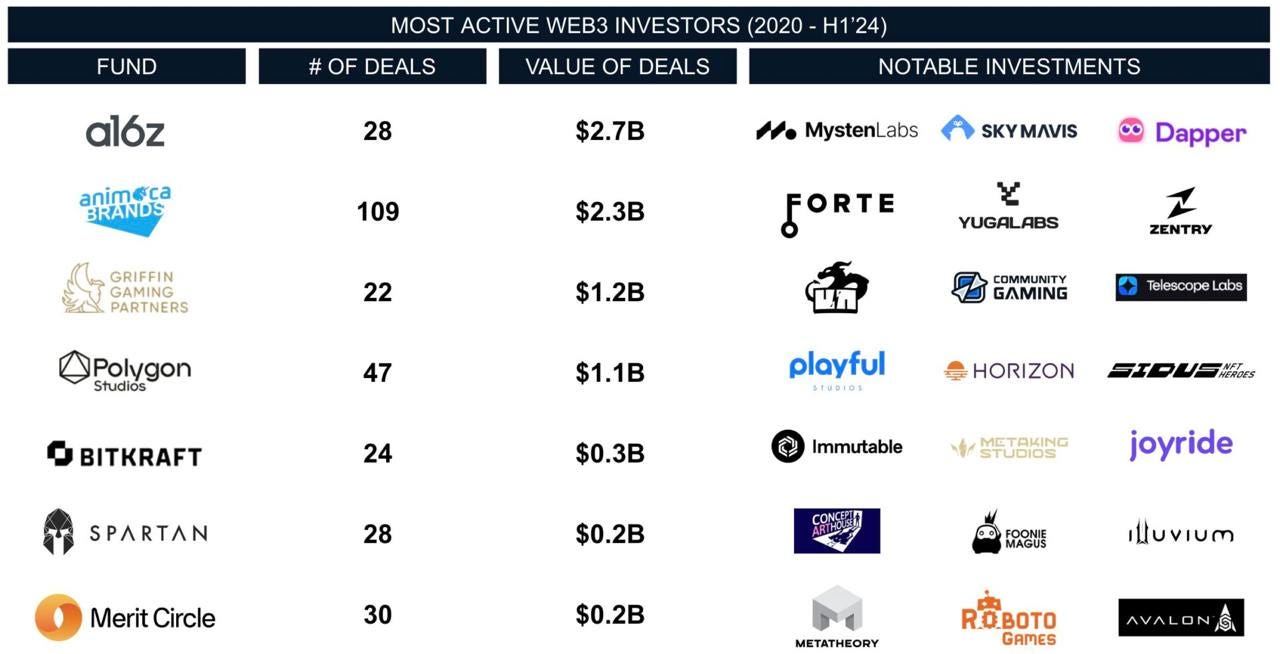

Animoca Brands is the most active crypto investor in terms of the number of investments (109 disclosed deals), with a total investment of $2.3 billion.

However, Andreessen Horowitz (a16z) holds the record in terms of deal value, with 28 deals totaling $2.7 billion.

Other notable investors in the market include Griffin Gaming Partners (22 deals worth $1.2 billion) and Polygon (47 deals worth $1.1 billion).

Exits

Many crypto companies have attracted venture investor interest, but there have been relatively few M&A deals due to the industry's early stage and the need to deliver on promises.

The largest deal was the acquisition of SundayToz by Wemade for $115 million.

Animoca Brands has conducted at least 6 M&A deals, but their values remain undisclosed.

Between 2020 and 2024, InvestGame tracked a total of 33 M&A deals worth $146 million.