InvestGame: Gaming Investment Market in Q1’24

The report shares the optimism. Are we really past the worst times?

Private Investments

Private investment volume in Q1’24 reached its peak since Q3’22 - $2.2 billion. However, it's important to note that $1.5 billion is attributed to the deal between Disney and Epic Games.

In the first quarter of 2024, 103 deals were made. This is fewer than in the first quarter of 2023 (147 deals) but more than in the past 3 quarters.

GameDev Reports Newsletter offers promotion opportunities to gaming companies. Reach out to learn more.

InvestGame vividly illustrates the market's development stages on a graph - showing how investment activity has changed at different stages.

The InvestGame team expresses cautious optimism about the market situation and notes the growth of pre-Seed and Seed deals. However, the market situation remains far from optimal.

Private Investments - Gaming Companies (Developers or Publishers)

If we consider only investments in gaming companies at stages prior to Series A, then in Q1’24, 28 deals were made totaling $115 million.

The situation with VC deals in later rounds is less positive. In Q1’24, 4 deals were closed totaling $160 million. Three of them were less than $100 million; one was larger.

Corporate investors in Q1’24 made 6 deals totaling $1.613 billion (including the Disney deal with Epic Games). The InvestGame team notes that corporate funds are increasingly behaving like VC funds, investing at early stages. Tencent, NetEase, Krafton, Kakao, Sony are particularly active (25 such deals since 2022).

Since 2019, over 45 funds have emerged in the market. Twice as many as in the previous 10 years. They have attracted over $15 billion but have only reinvested $7 billion so far. Despite the challenging market situation, 10 funds were announced in Q1’24. Over 80% of all funds focus on early-stage investments.

1Up Ventures; BITKRAFT Ventures; Transcend Fund; The Games Fund; Ludus Ventures - the most active players in Seed stages in Q1’24.

The primary markets for investments remain the USA and Western Europe.

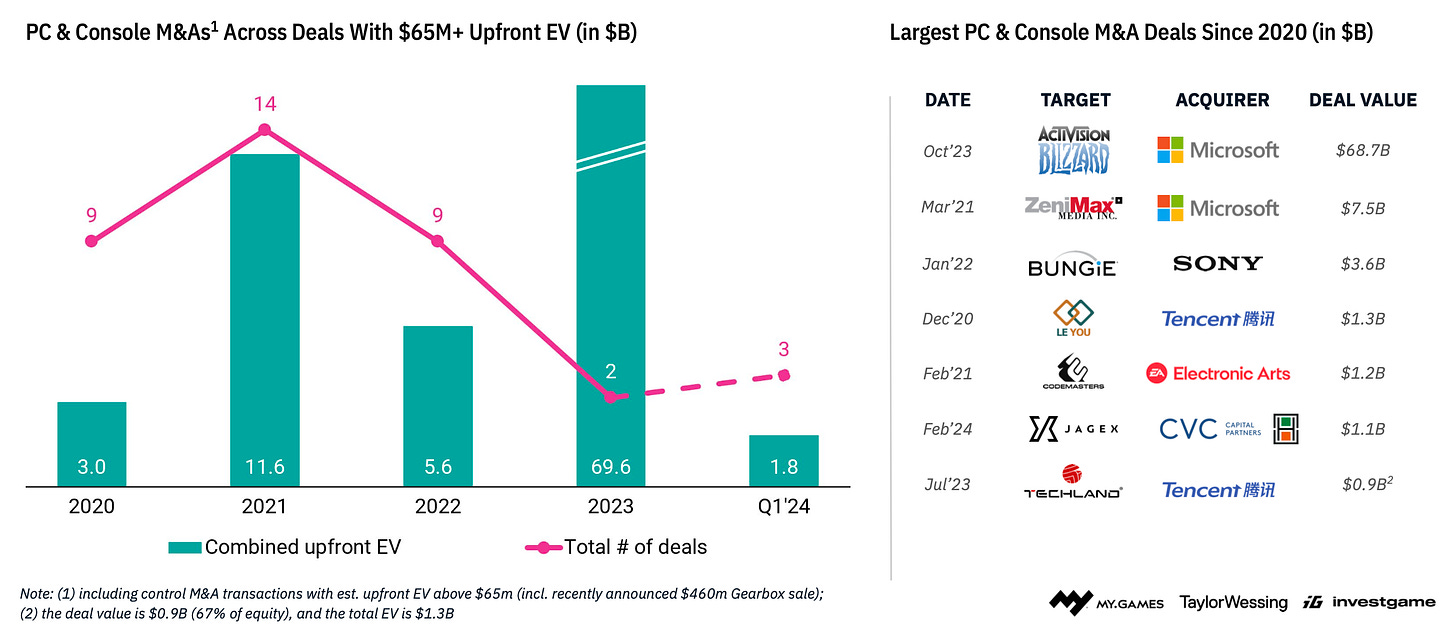

Private Investments - PC/Console Market

Since 2020, VC funds and PE firms have invested over $3.4 billion in PC/console companies. 50% of this amount was in Series B+ rounds. The majority of deals, both in terms of quantity and volume, occurred in 2021.

The number and volume of Seed rounds for PC/console developers have remained almost unchanged over the years, while Series A+ rounds have decreased both in volume and quantity.

Meanwhile, there have been 37 deals totaling $91 billion for PC/console developers since 2020.

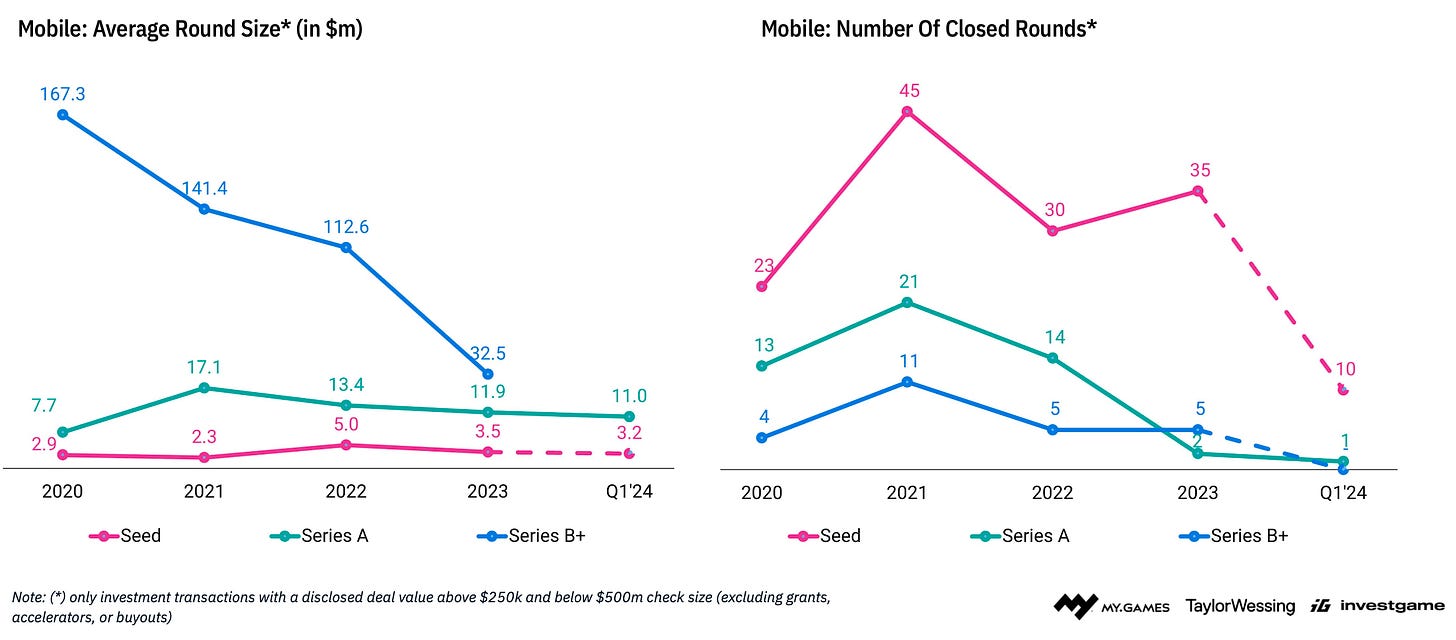

Private Investments - Mobile Market

The number of M&A deals with mobile developers has been decreasing since 2021 in terms of both volume and quantity of deals.

The popularity of mobile studios among VC and PE investors is also declining. In 2023, such studios attracted $0.3 billion in 42 deals.

The decline is most noticeable in later stages. The number and volume of Seed rounds are more stable.

M&A

In Q1’24, 23 M&A deals totaling $2.2 billion were completed.

The most notable deal of the quarter was the acquisition of Jagex for $1.1 billion.

IPO

The situation with going public remains complex. High interest rates and poor performance of companies already on the market are putting pressure.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The largest upcoming IPO might be Shift Up. It is reported that they have already applied to the Korea Stock Exchange with a valuation of $2 billion.

Many public gaming companies are currently trading at a discount, so they are conducting buyback campaigns.