InvestGame: Gaming Investment Market in Q3'24

It seems that the investment market found a new baseline from which it will grow, and there is an increasing interest in gaming technology startups.

InvestGame is the only source in the industry covering all investments happening in gaming. And they never fail. Subscribe!

❗️Smart people told me, that “Minority M&A” is when you’re buying the major enough stake to dictate strategic decisions, yet you don’t have the majority part of the company. It’s something new to me.

Private Investment

In the third quarter of 2024, there were 119 deals (compared to 88 in Q3 2023) totaling $1 billion (compared to $0.8 billion in Q3 2023). Investment activity is approaching the levels of the peak year of 2021, but the deal sizes are significantly lower.

Overall, after a decline from the peak levels of 2022, the market has stabilized. However, the volume and number of deals in 2024 are generally higher than those in 2023.

Investments in Content Companies

Focusing on early-stage deals with content companies, the number of rounds and investment volumes are decreasing in 2024. Most deals are still in seed and pre-seed rounds, although Series A deals had a significant share in Q3 2024.

There are major issues with late-stage funding for gaming companies. In Q3 2024, the total volume of such investments amounted to $151 million, spread across five deals.

The most active early-stage investors include a16z Games, BITKRAFT, SISU Game Ventures, TIRTA, GEM Capital, and vgames. For Series B and later stages, the leaders are Lightspeed Ventures and Makers Fund.

Since the beginning of 2020, corporate VC funds have played a significant role in deals. In some quarters, they accounted for the majority of transactions.

The main regions for venture investments in Q3 2024 were North America (13 early-stage deals, 3 late-stage deals) and Europe (10 early-stage deals, 1 late-stage deal, 3 deals involving corporate VC funds).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

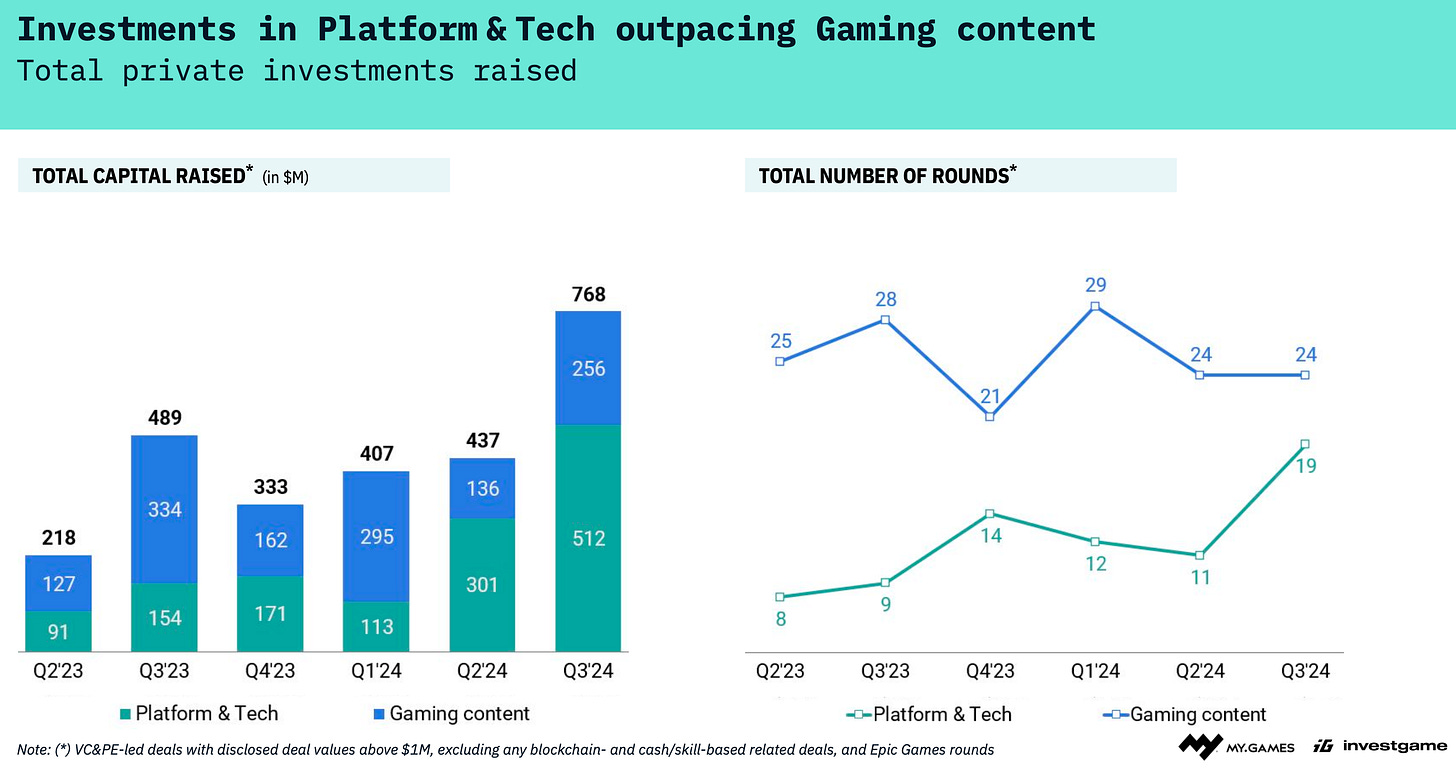

Investments in Gaming Platforms and Technology

Investor interest in technology startups has increased in Q2 and Q3 2024.

❗️InvestGame doesn’t include blockchain or skill/cash-games startups.

The deal volume was $301 million in Q2 2024 (11 transactions) and $512 million in Q3 2024 (19 transactions), which is 2.5-3 times higher than investments in content.

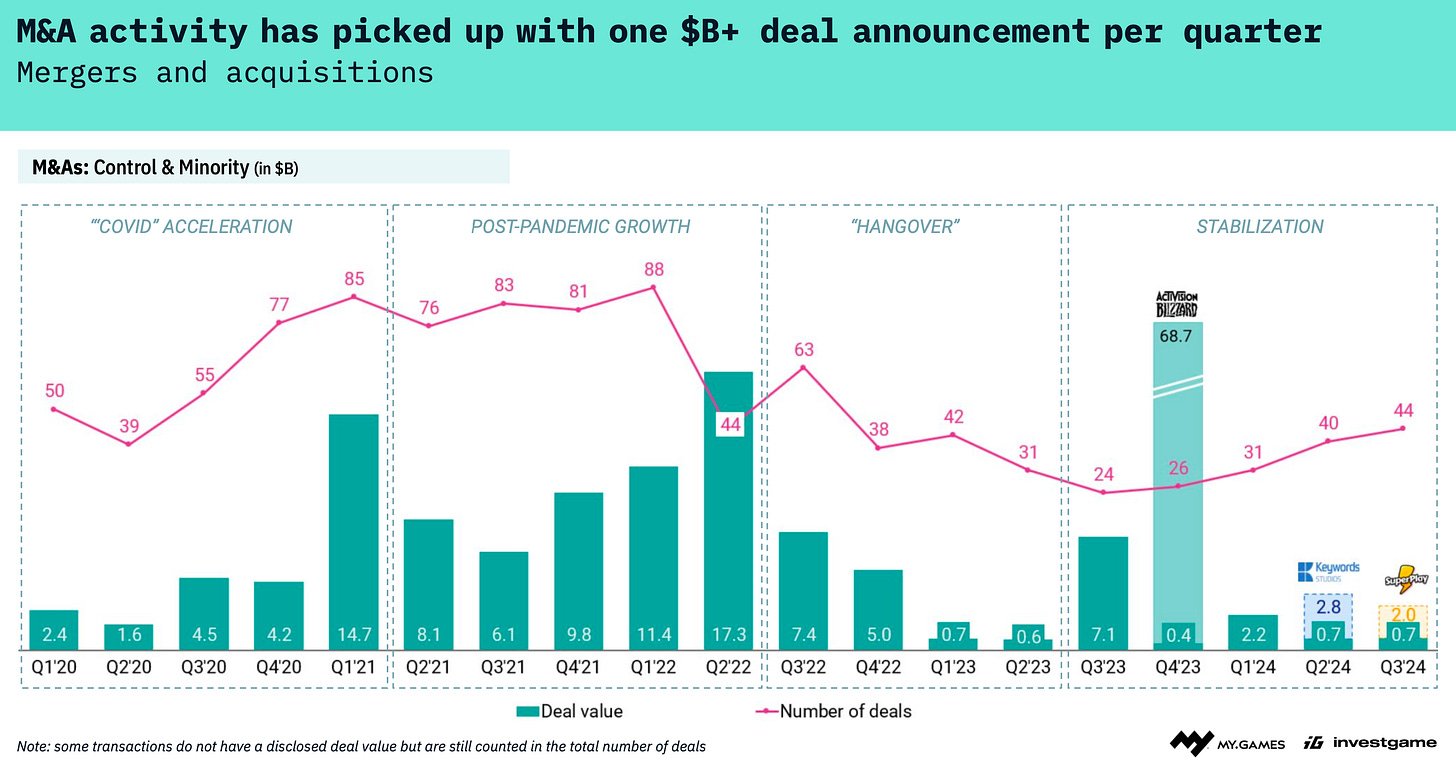

Mergers and Acquisitions

There were 44 M&A deals in Q3 2024 (compared to 24 in Q3 2023), but their total volume—$0.7 billion—is significantly lower than in previous years.

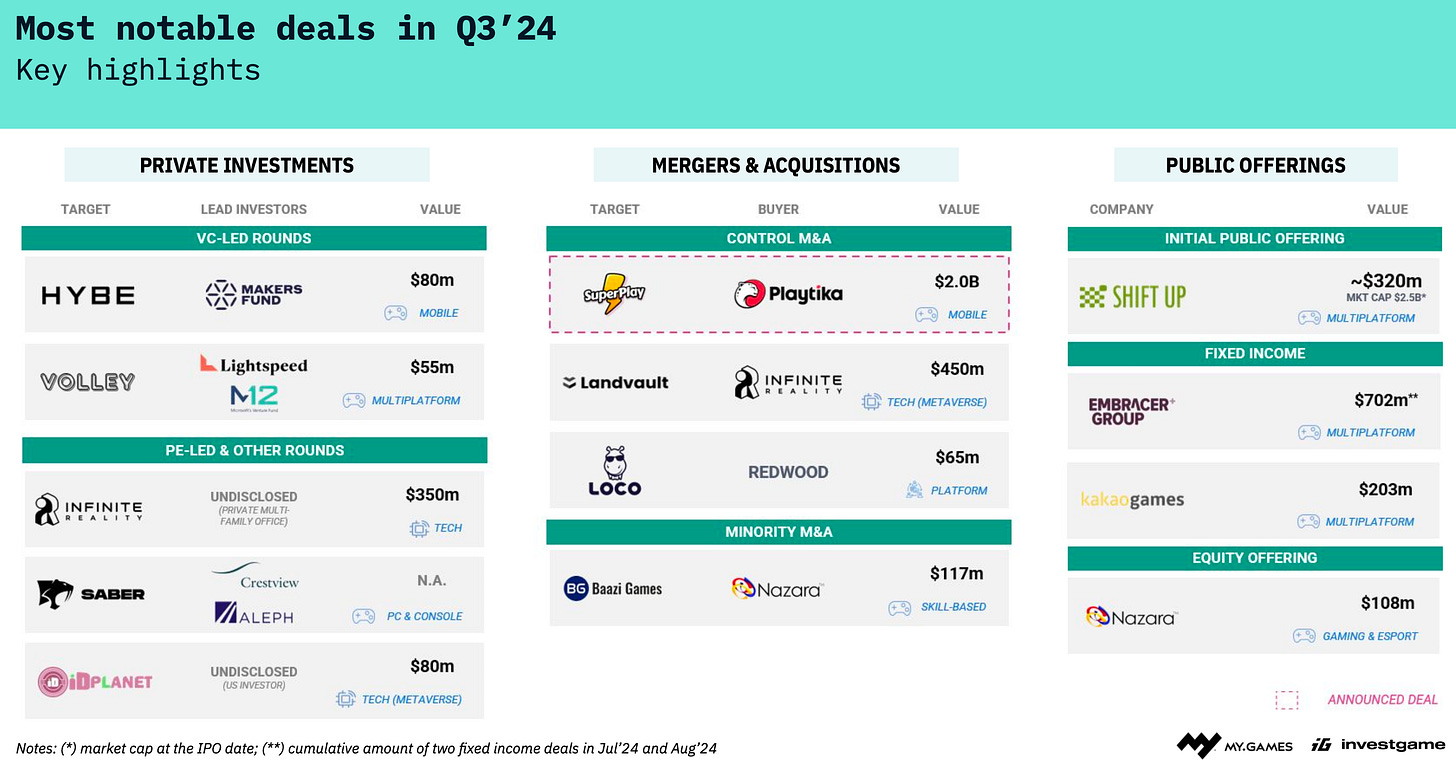

The number of M&A deals has been increasing in 2024, with at least one significant deal each quarter. In Q2 2024, it was Keywords; in Q3 2024, it was SuperPlay.

Public Offerings

In Q3 2024, 13 companies went public, with total IPO volume reaching $1.4 billion. This is more than in Q3 2022 but less than in Q3 2023.

The market for public offerings remains challenging. However, for the first time in two years, a gaming company, South Korea's ShiftUp, went public.