InvestGame: Gaming Investment Market in Q2'24

The normalization of the market continues, yet the business activity is far from previous heights.

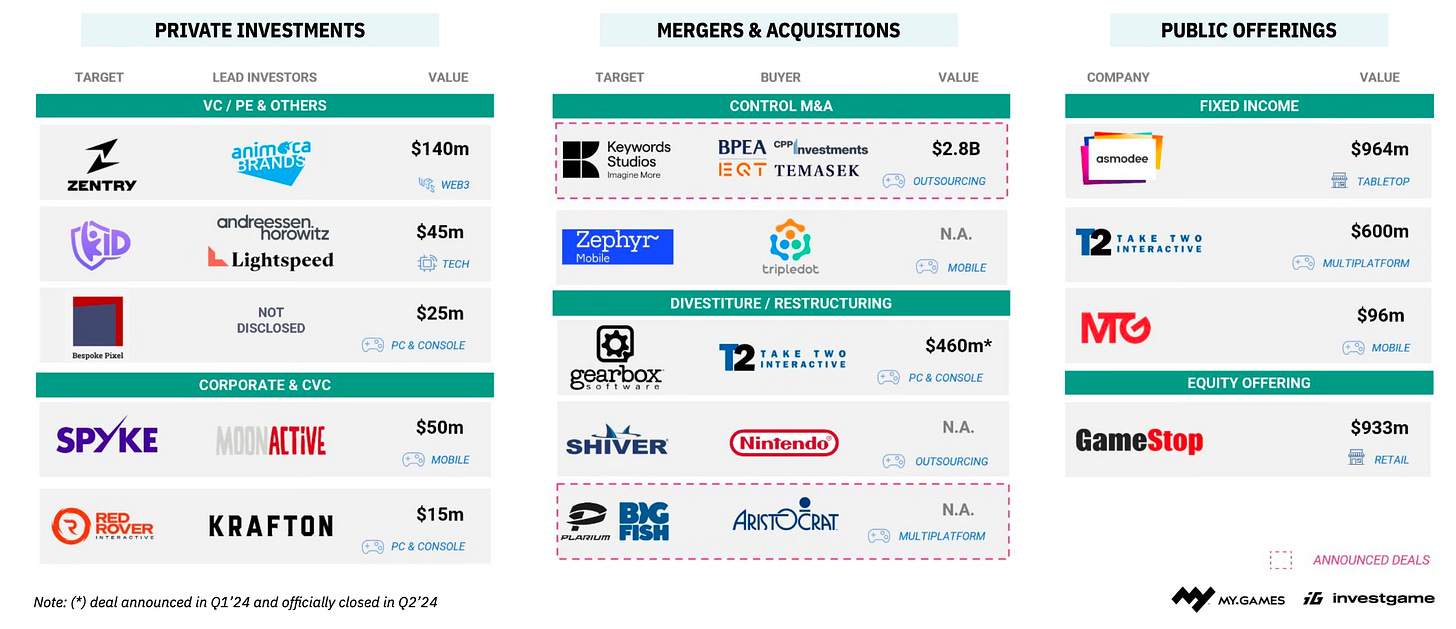

Investment activity is growing compared to the second quarter of the previous year. In the case of private investments and public offerings, both the number and volume of deals have increased. Number of M&A deals have also increased, although their volume has slightly decreased (InvestGame notes that the $2.8 billion purchase of Keywords Studios is not included).

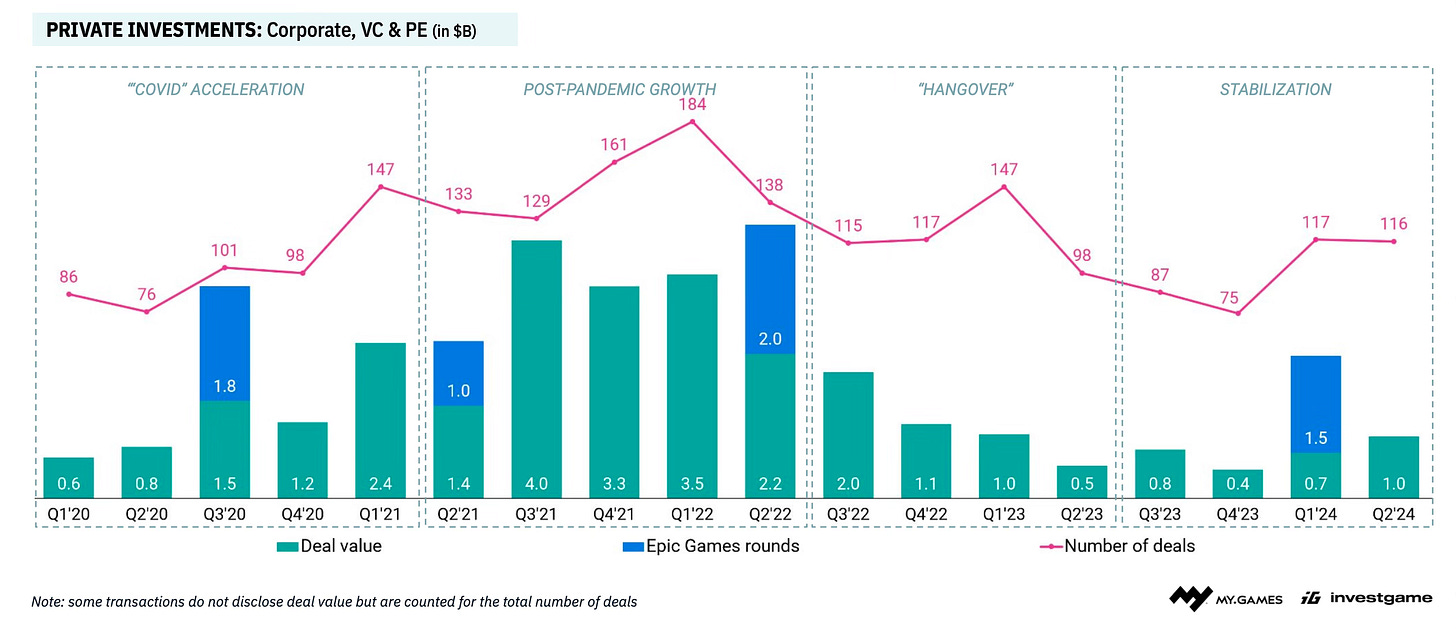

Private Investments

In Q2’24, 116 deals were made with a total volume of $1 billion. In terms of volume, this is (almost) the annual maximum, excluding Q1’24 quarter, which involved the Epic Games transaction. In terms of the number of deals, it's one less than in Q1'24 (which had a record number of deals for the year).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

There were 30 early-stage gaming deals in Q2'24, amounting to $125 million ($73 million for pre-seed; $52 million for Series A). It looks like the market is reaching a new plateau in terms of the volume and number of such deals.

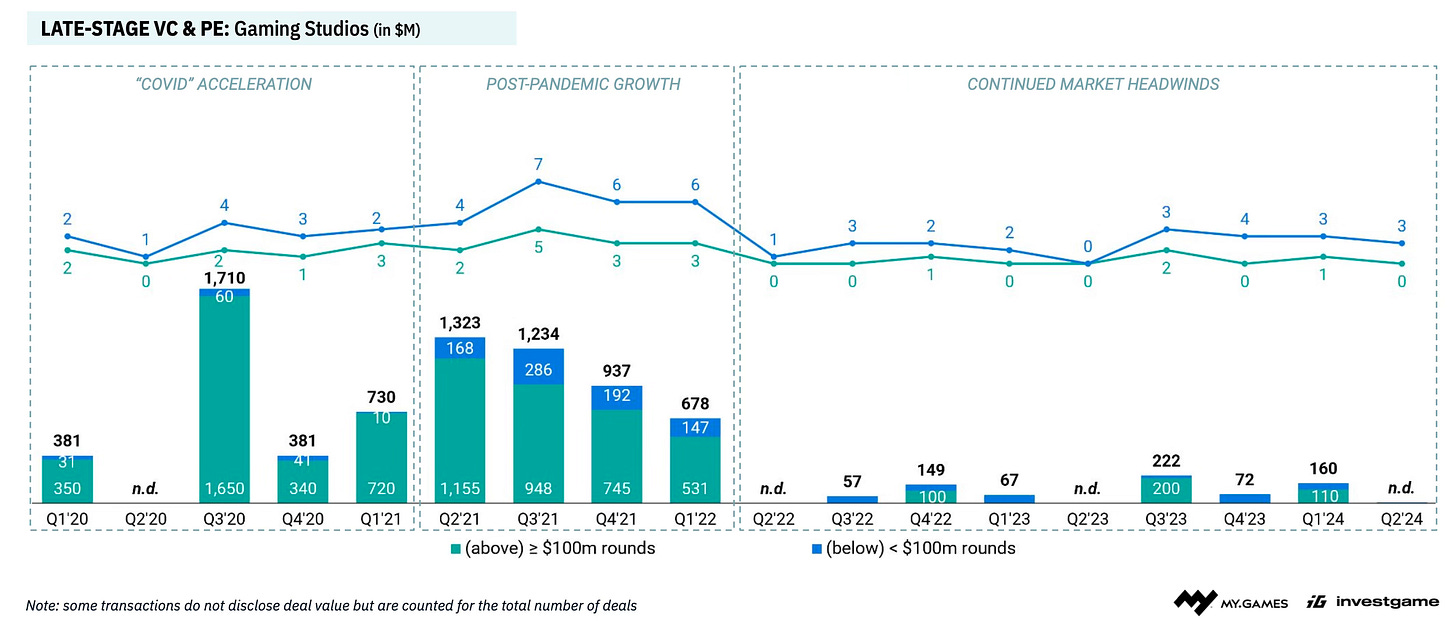

The number of late-stage investment deals is minimal - not a single one was publicly announced in Q2'24. However, InvestGame experts note 3 deals with a volume of less than $100 million.

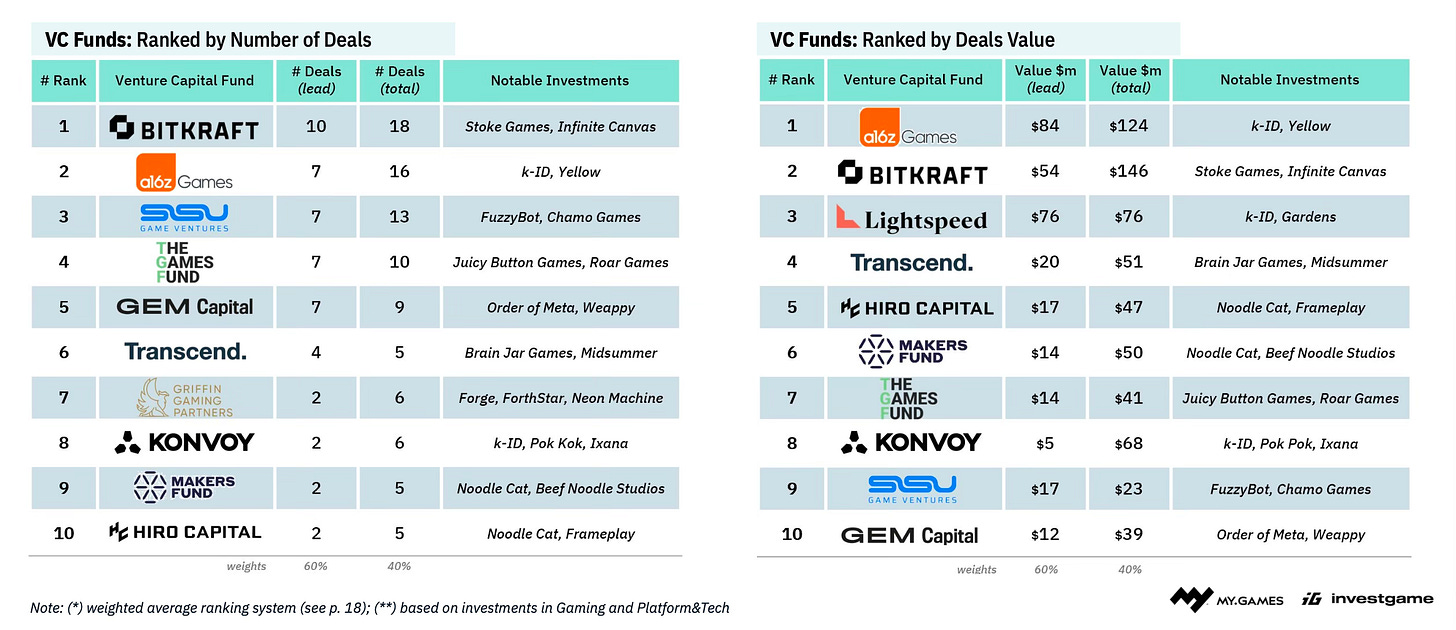

Bitkraft, A16Z Games, Lightspeed, Sisu Game Ventures, Transcend, The Games Fund, GEM Capital, and Hiro Capital are the most active VC funds both in terms of deal volume and quantity.

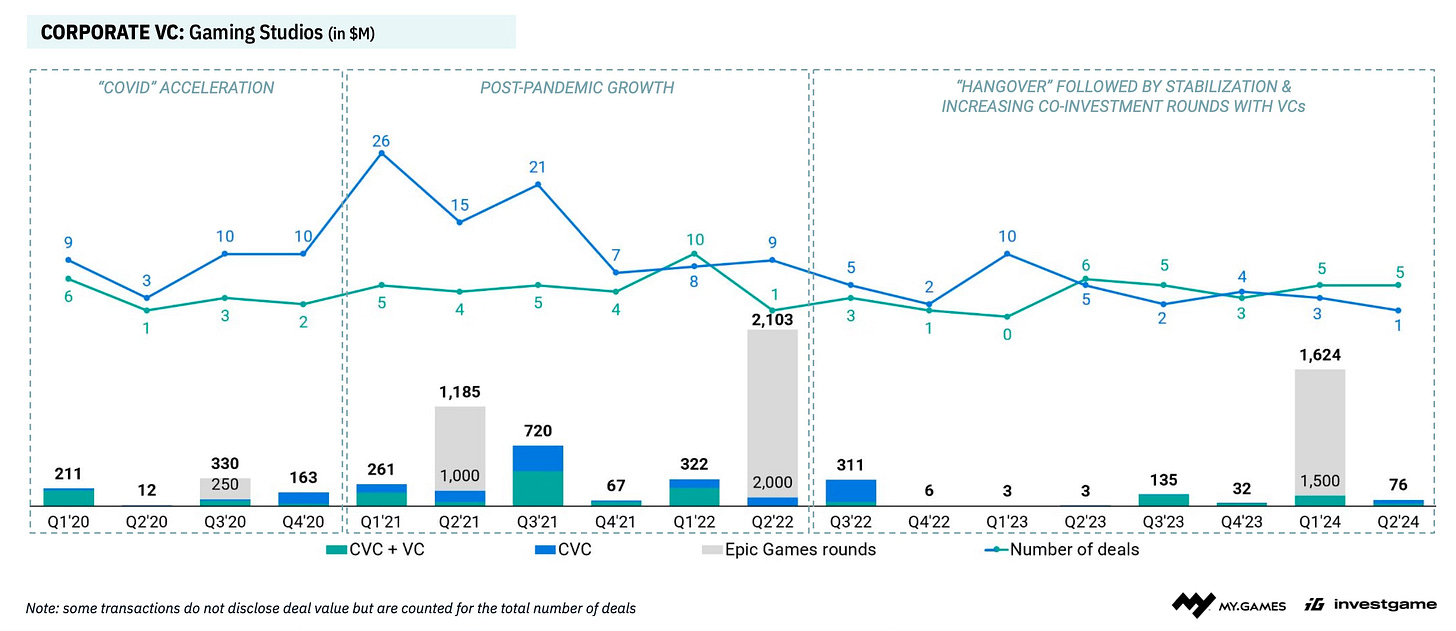

The activity of corporate VC funds remains low. In Q2'24, $76 million was spent. There were several joint deals with traditional VC funds, which can be explained by the desire to reduce risks in the deal.

The number of early-stage VC deals in the US, Europe, and Asia is almost equal.

M&A

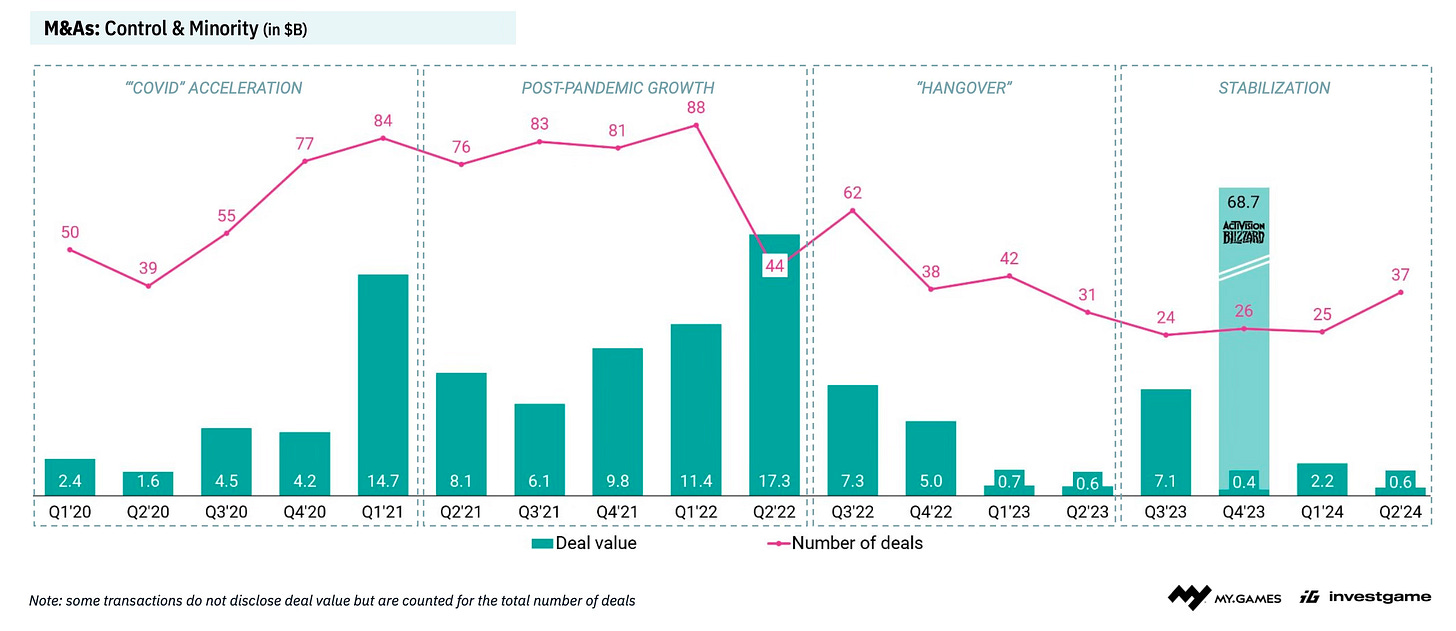

The number of deals in Q2'24 increased to 37 - the maximum since Q1'23.

However, the volume of deals is one of the lowest since Q1'20 and matches the result of Q2'23. The only lower volume was in Q4'23, excluding the closed Microsoft and Activision Blizzard deals.

Public Offerings

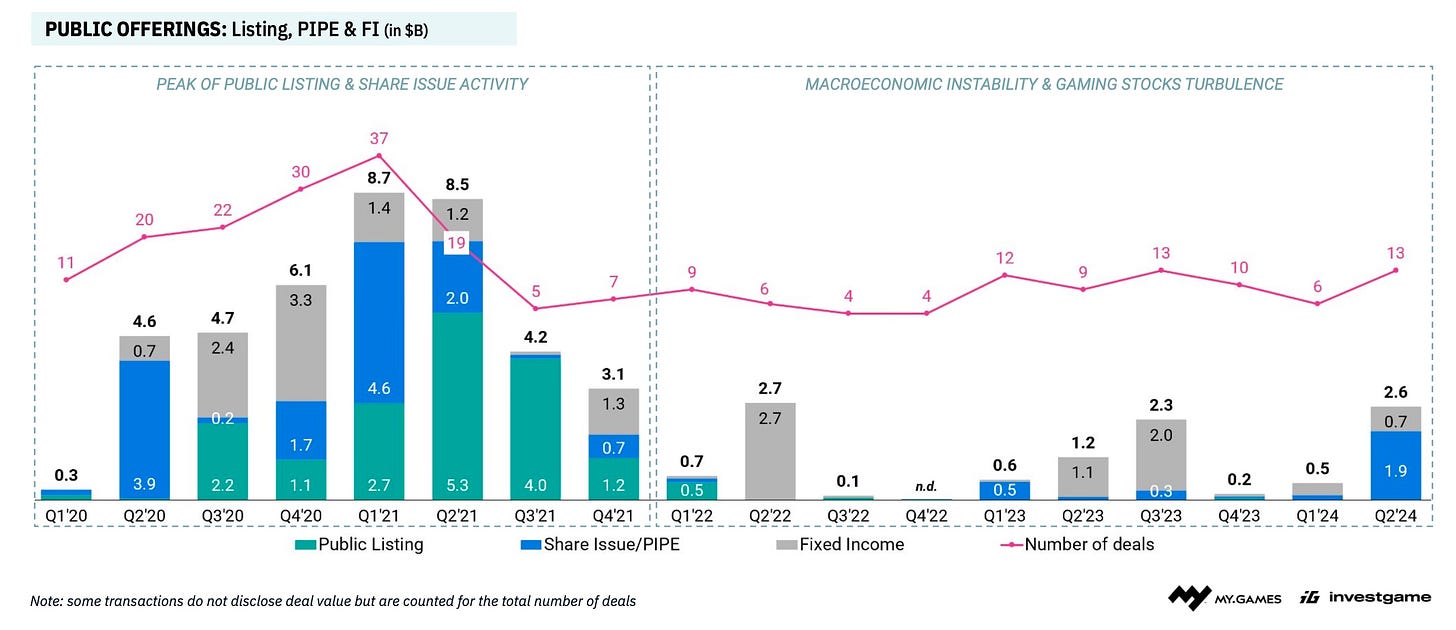

In Q2'24, the number of transactions with public companies increased, but as noted by InvestGame, this growth is not due to public offerings. Most of the transactions are related to investments through additional share issuance and raising funds using fixed-income instruments (bonds, preferred shares, etc.).