InvestGame: Investment activity in Turkiye in the last 5 years

The country that brings hope to the VCs.

The InvestGame team studied the state of one of the most active countries for game investments in the world - Turkiye. Data is collected from 2020 until now.

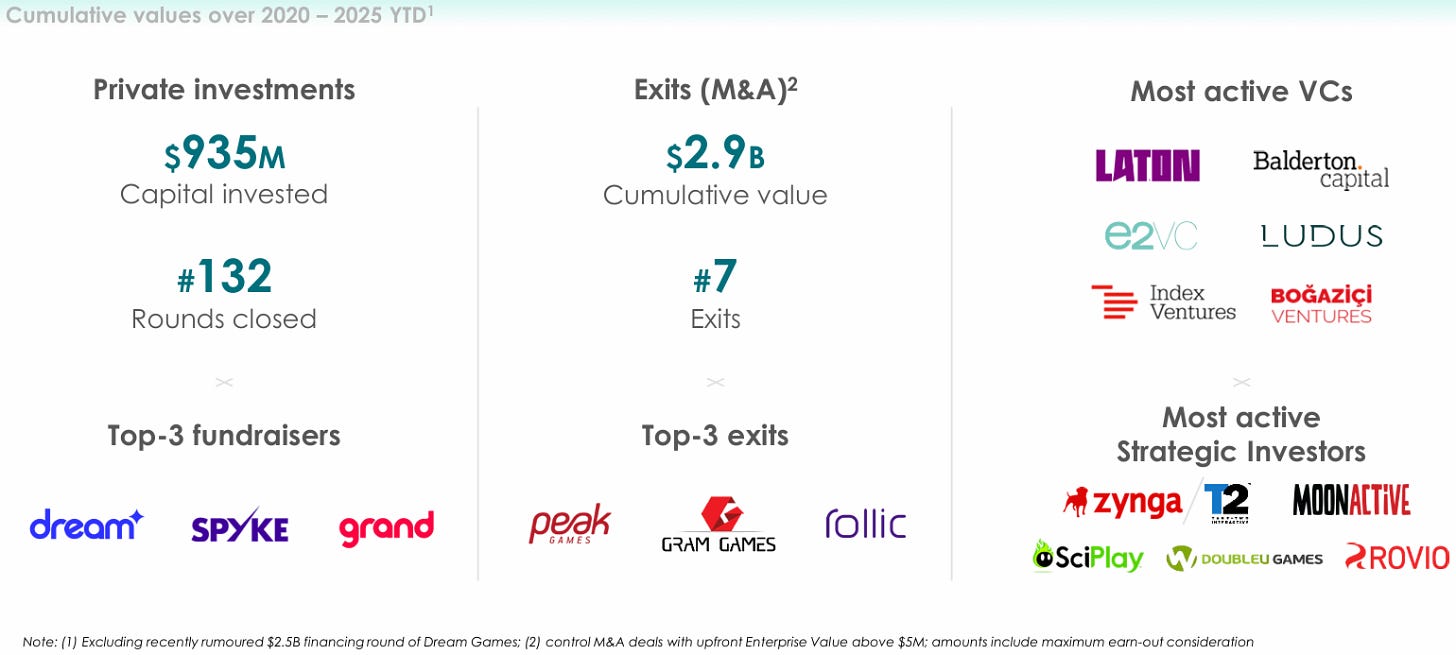

Since 2020, Turkish companies have raised $935 million through 132 rounds. The leaders in funds raised are Dream Games, Spyke Games, and Grand Games.

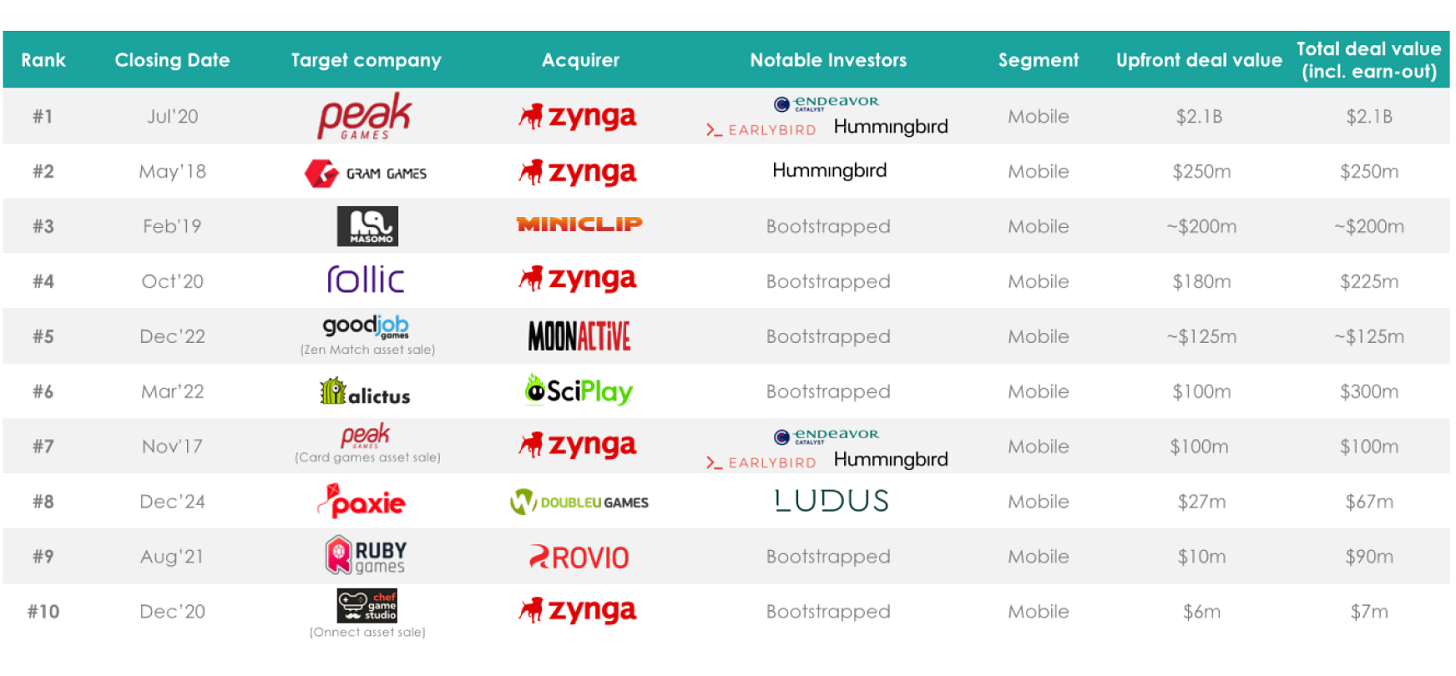

Since 2020, Turkish companies have made 7 exits totaling $2.9 billion (this figure includes earn-outs). The leaders are Peak Games, Gram Games, and Rollic.

Laton Ventures, Balderton Capital, e2VC, Ludus Ventures, Index Ventures, and Bogazici Ventures are the most active VC funds in the country. Among strategic investors, the greatest interest in the market is shown by Zynga (Take-Two Interactive), Moon Active, SciPlay, DoubleU Games, and Rovio.

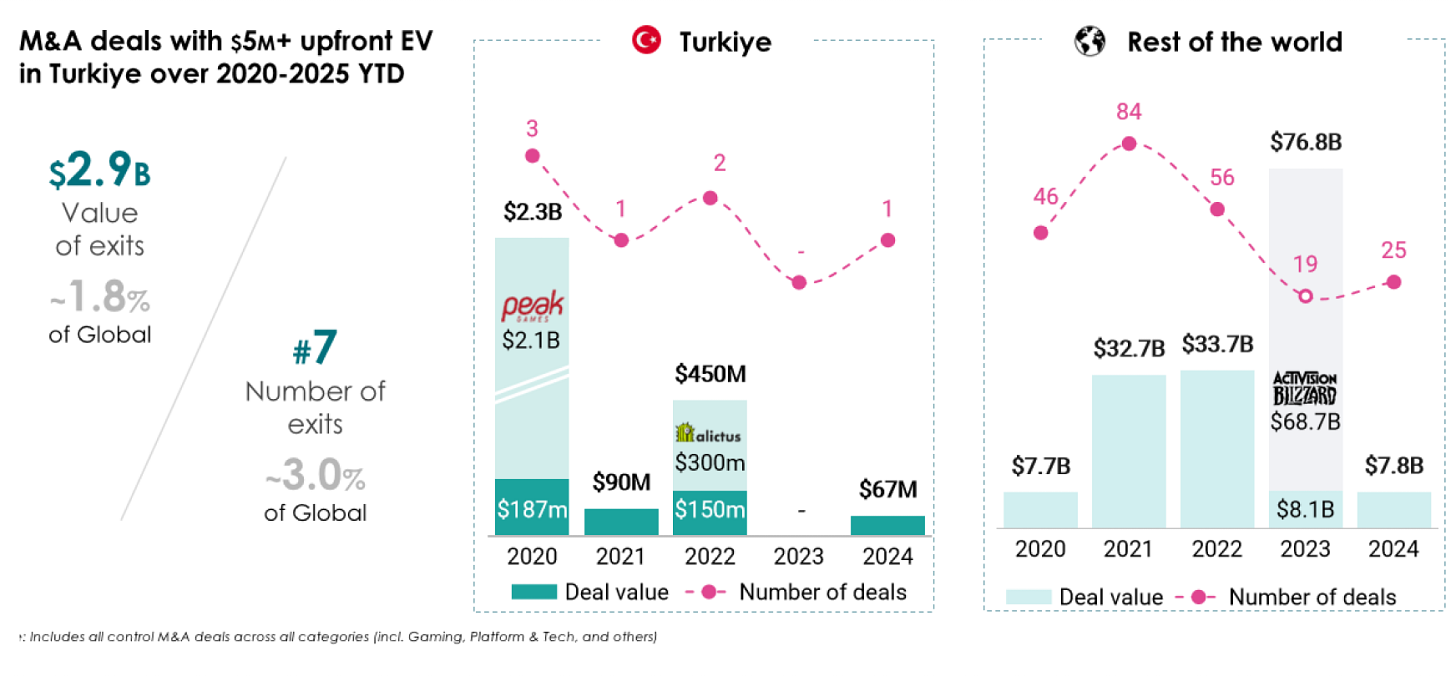

Since the beginning of 2020, Turkiye has accounted for 1.8% of the total volume of M&A transactions and 3% of all exits.

If you’re in mobile marketing or working with creatives, here’s something worth checking out — a tool built for all marketing operations. It predicts campaign performance (on iOS too), provides full metrics transparency (more than 200 of them), allows you to operate creatives easily, and has many other cool features. Details are available on the website.

All MY.GAMES’ marketing teams have been using it internally for years and are happy with how it simplifies the entire marketing cycle. If you’re interested in making your UA journey easier and more efficient, you can book a demo to see. For a better price, refer to my name!

VC activity in Turkiye is noteworthy. The country has a developed investment infrastructure that allows attracting both small rounds (up to $1M) with the help of specialized investors, accelerators, and business angels and large rounds (more than $1M) with the participation of a large number of VC funds.

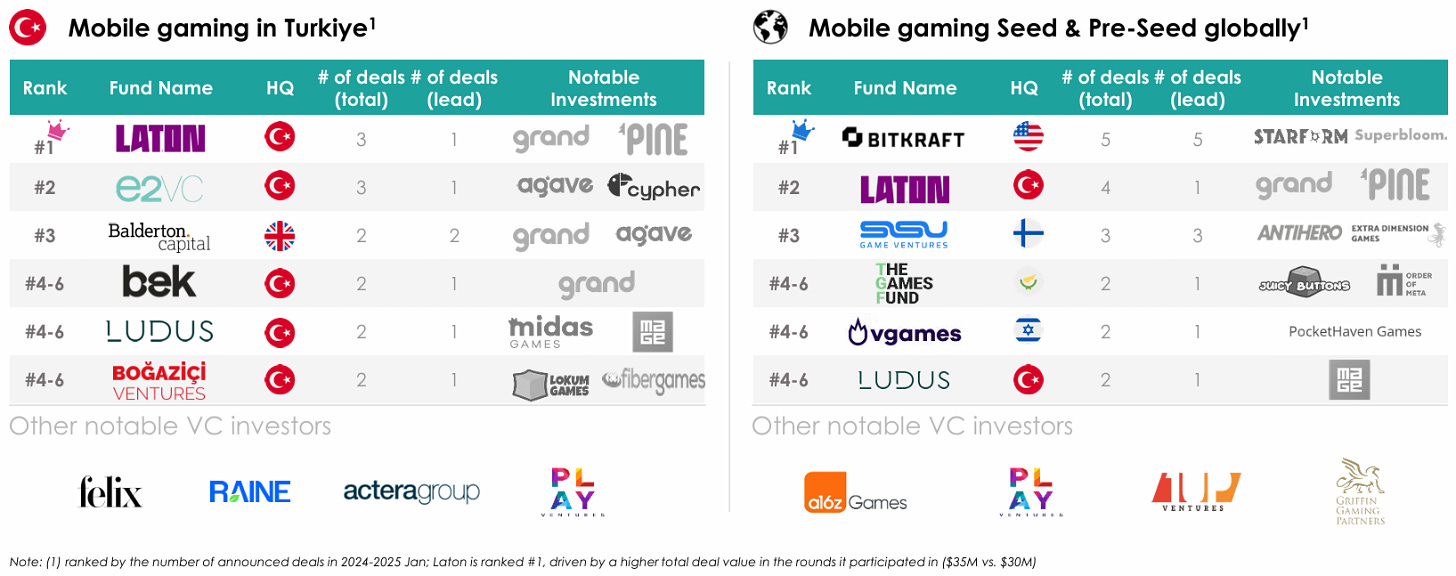

New players are also appearing on the market; for example, Laton Ventures began operations in Turkiye in 2024 and immediately became the leader in the number of deals in which it acted as the lead investor.

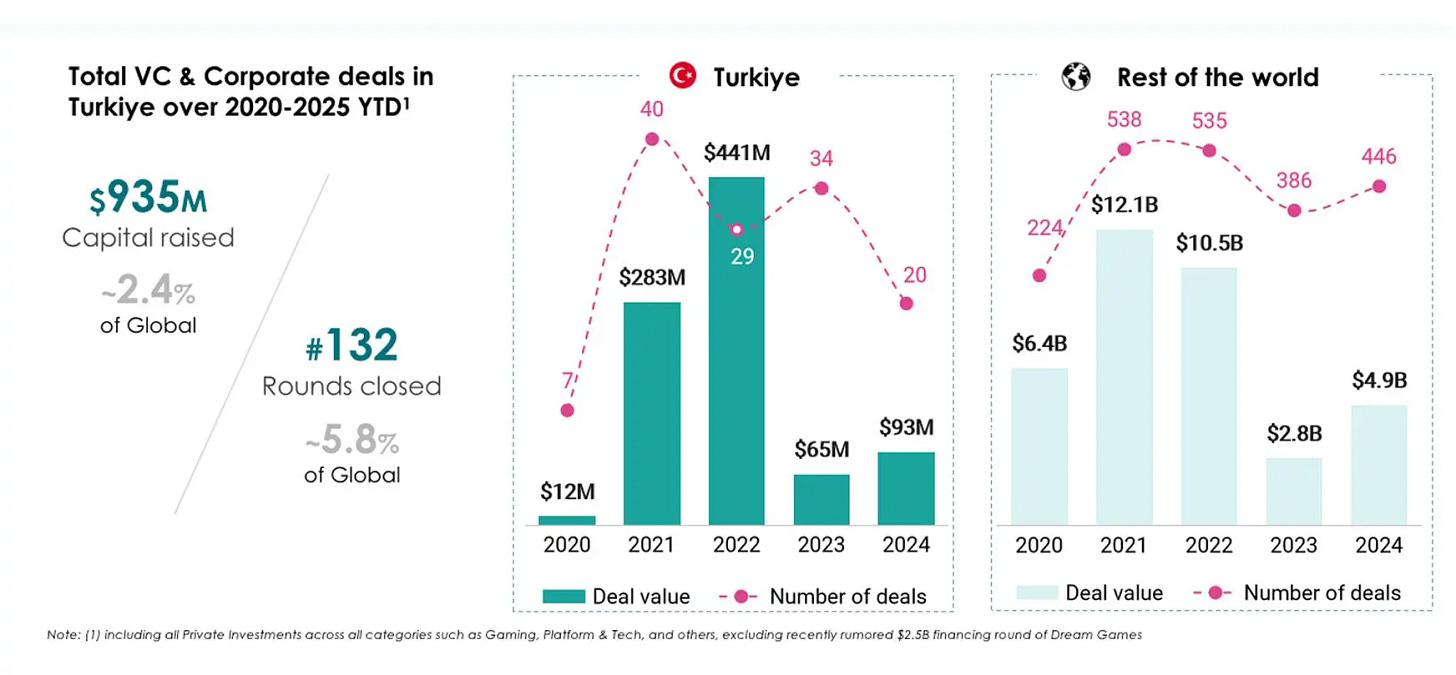

From the point of view of business activity, since 2020, Turkiye has accounted for 5.8% of all global deals in games and 2.4% of the total volume. It is noteworthy that even after the “big” years of 2021 and 2022, business activity in 2023 did not slow down - 33 early-stage deals were made. The average round size decreased (to $1.9 million per round).

In the list of the most notable Turkish startups, all are engaged in the development of casual projects. There is not a single midcore project in the top 10.

Turkiye is one of the leaders among the countries of Europe and the MENA region both in terms of the number of rounds and in terms of the volume of funds raised. Turkiye stands out from other countries in terms of investment activity at an early stage and occupies a leading position in terms of the number of M&A transactions.