InvestGame: Gaming Investment Market in Q4'24 and 2024

The gaming market is searching for opportunities to grow. The early stages are challenging, but overall, the market signals some positivity.

You can download the full InvestGame report here. The team is doing a fantastic job, and I highly recommend subscribing to their newsletter.

2024 results

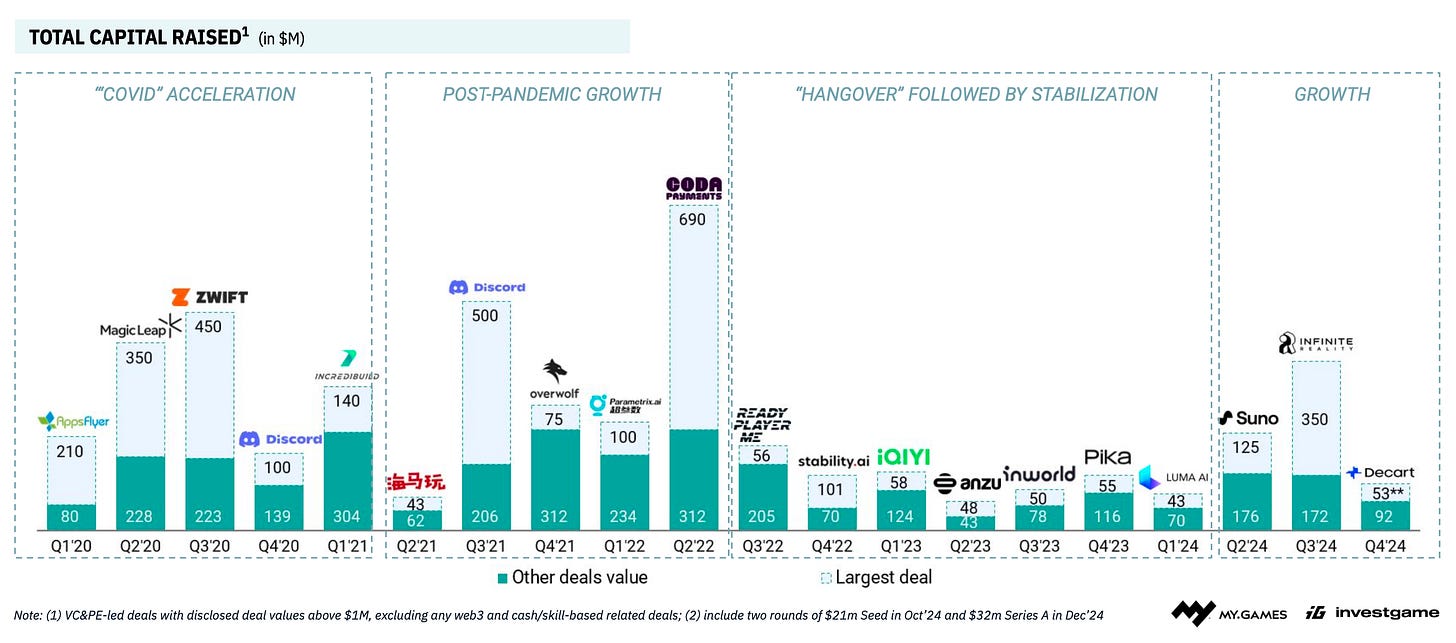

The volume of private investments in 2024 increased compared to 2023. The total deal value was $5 billion across 466 deals.

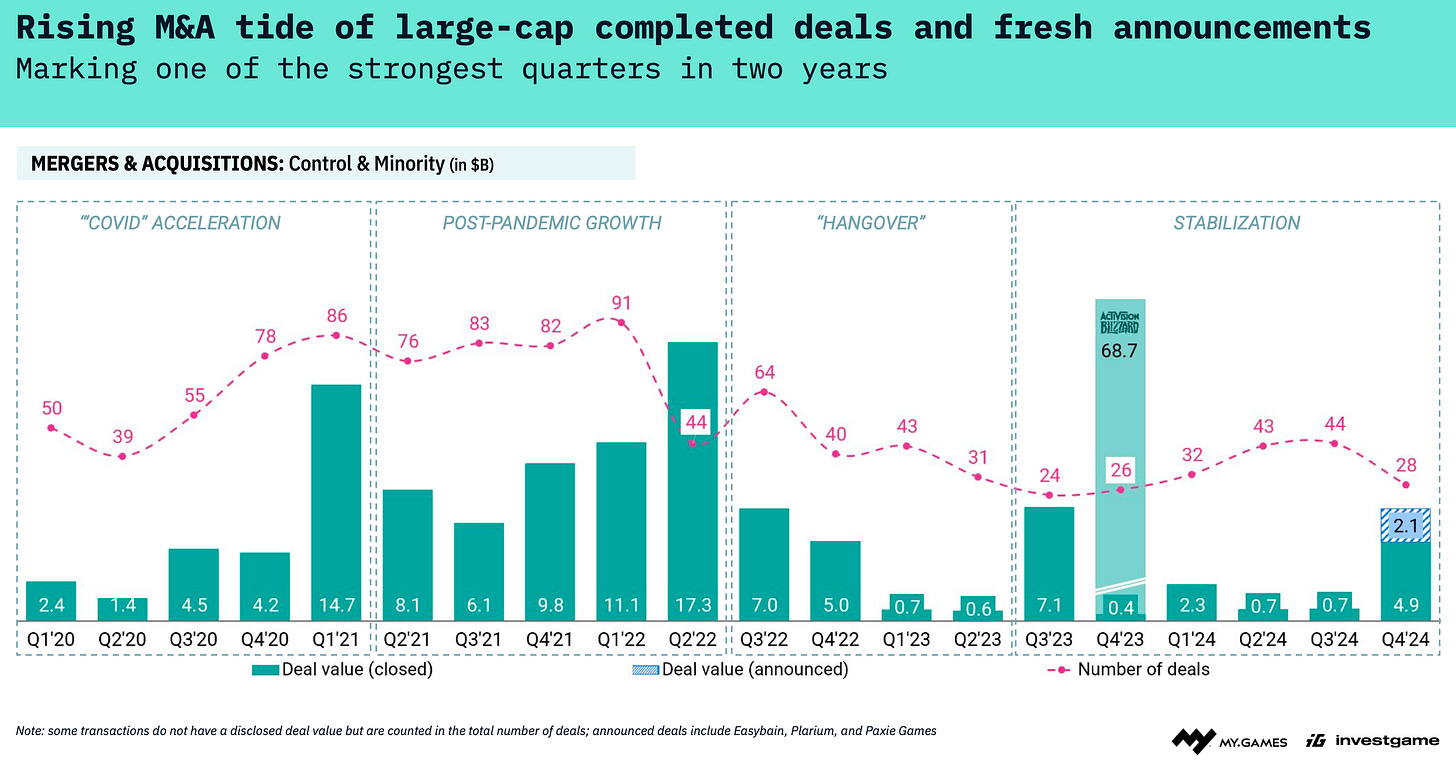

The number of M&A deals in 2024 increased (147 deals versus 124 in 2023). However, the transaction volume slightly decreased to $8.6 billion. If we consider the closed Activision Blizzard and Microsoft deal, the volume dropped significantly.

❗️InvestGame only accounts for closed deals, including earn-outs. Therefore, some announced but not yet closed deals (Easybrain, Plarium, Paxie Games) are not included.

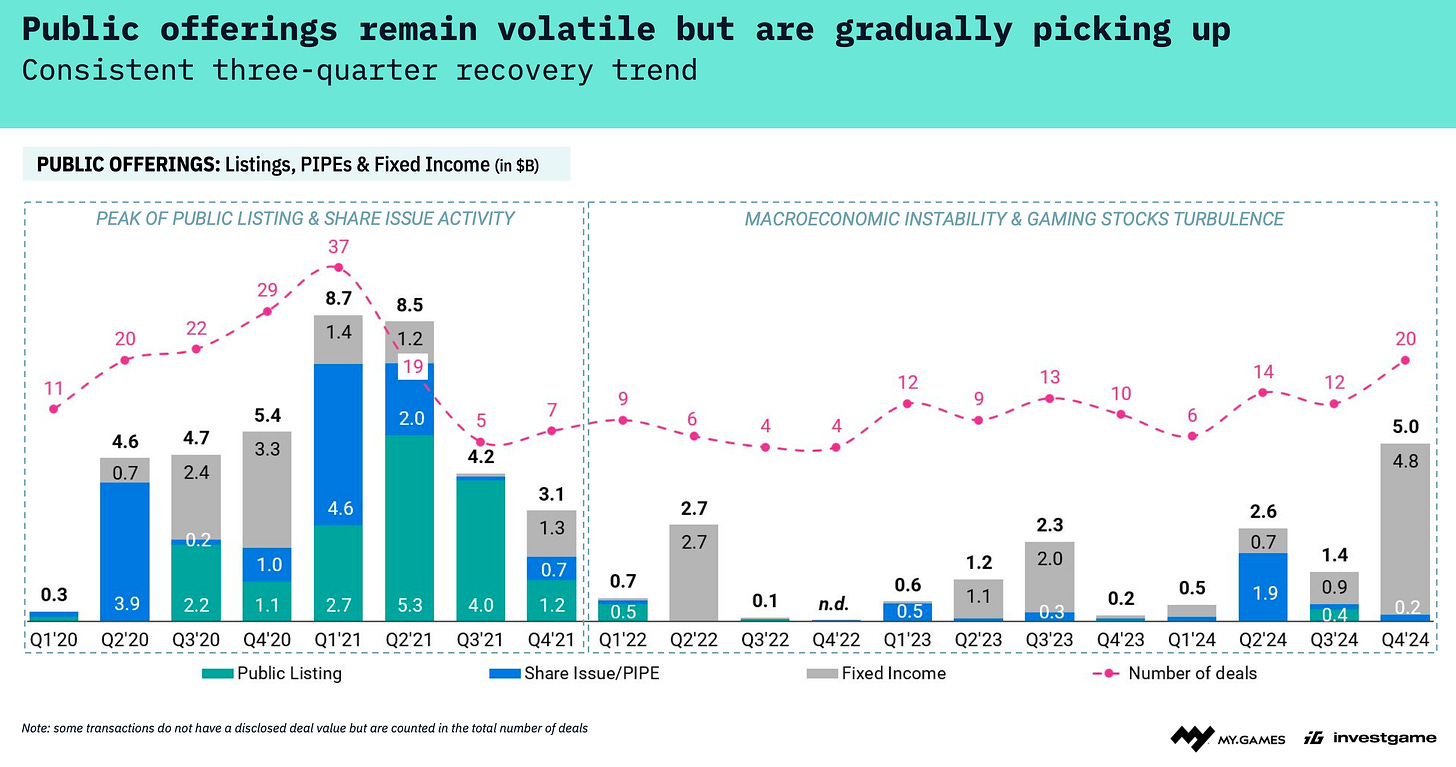

In 2024, 52 public companies made transactions (or went public). The total volume of these deals amounted to $9.6 billion. Growth in both quantity and money has continued since 2022.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

In 2024, investor interest in platforms and technical solutions nearly doubled compared to the previous year.

The total volume of investments in technological solutions in 2024 surpassed investments in content itself, although the total number of deals with such companies is smaller.

Private Investments in details

This section includes investments from VC funds, corporate investment funds, and PE funds.

In Q4’24, the number and volume of private deals were below the year’s average. However, growth compared to last year was 22% in deal volume and 12% in the number of rounds.

Epic Games ($1.5 billion), Aonic ($157 million), and Build a Rocket Boy ($110 million) were the most notable deals of 2024 when it comes to game studios (Epic Games is included here as most of its revenue is generated by games).

Infinite Reality ($350 million), Zentry ($140 million), and Suno ($125 million) were the leaders in 2024 in the platforms and game technologies sector. 9 out of 10 largest deals in the list are AI or Web3 companies.

Deals with game studios

It’s becoming more difficult for game studios to raise money in initial rounds (up to Series A). The number of deals decreased throughout 2024, while their volume plateaued.

The US (47 deals - $244 million) and Europe (44 deals - $200 million) are world leaders in financing startups at early stages among game studios.

There’s cautious optimism regarding the later stages. Compared to 2023, 30% more deals were closed, and the volume of these transactions increased by 43%. Nevertheless, InvestGame analysts note that the market remains volatile.

Corporate VC funds have a stable interest in deals. In Q3 and Q4, the number of joint deals with traditional VC funds and deals that corporate VC funds made alone increased.

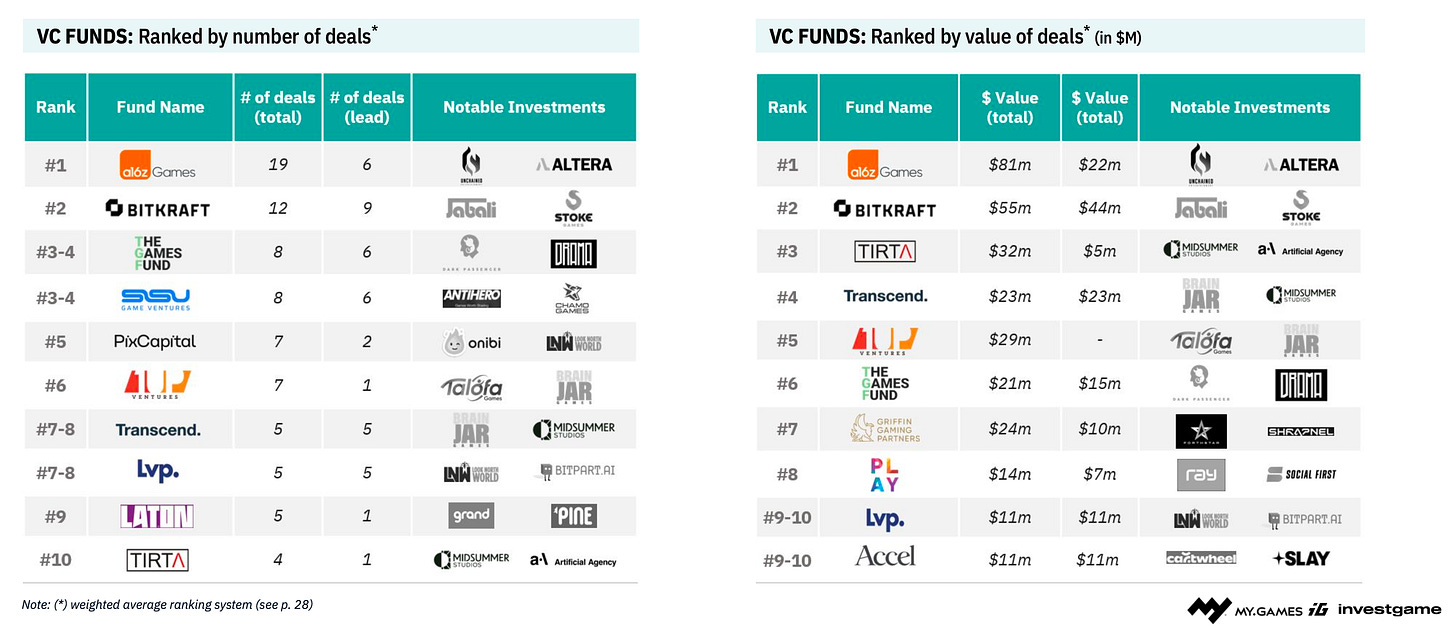

a16z Games, Bitkraft, and The Games Fund were the most active VC funds in 2024 by the number of early-stage deals. a16z Games, Bitkraft, and Tirta Ventures are leaders in investment dollar value.

GEM Capital, Bitkraft, a16zGames, vGames were the most active VC funds in Series A by the number of deals. In terms of deal sizes, Bitkraft, a16z Games, and Lightspeed are in the lead.

Regarding later stages, Lightspeed, Makers Fund, Bitkraft, and Galaxy are leaders both in the number of deals and investment volume.

M&A in details

Q4’24 became one of the most successful quarters in the last two years. There were 28 deals of $4.9 billion in total size. Deals worth $2.1 billion were also announced, which should close in 2025.

The most notable deals of 2024 were the acquisition of Keywords Studios by a consortium of investors ($2.8 billion), the purchase of Jagex ($1.1 billion), and the acquisition of SuperPlay ($700 million). Large deals for Easybrain ($1.2 billion) and Plarium ($620 million) were also announced, but they will be closed in 2025.

Looking at the last decade, 2024 ranks 6th in deal volume and 6-7th in the number of deals.

Aream is the leader by a large margin among investment banks in the number of deals completed in 2024. The company has 5 deals with a total volume of $3.3 billion.

Public offerings in details

In Q4’24, there were 20 deals related to public companies, with a total volume of $5 billion. Most of these deals ($4.8 billion) were the issuance of fixed-income debt instruments.