InvestGame: The gaming investment market in H1 2023

Declines in private investments, M&A, and IPOs Mark First Half of 2023.

Key Figures

The volume of private investments decreased by 81% compared to the previous year, from $7.6 billion to $1.5 billion. The number of deals decreased from 316 in the first half of 2022 to 239.

M&A deals dropped by 97%, from $28.7 billion to $0.9 billion. It's worth noting that neither the deal with Scopely, nor the deal with Rovio, nor the deal with Activision Blizzard (if it ever closes) are included in the first half of this year.

The size of IPO deals decreased by 49%, from $3.4 billion in the first half of 2022 to $1.7 billion.

Private Investments

In the first half of 2023, 90 deals were made with gaming companies or publishers totaling $300 million. This is 90% less than the previous year.

The volume of early-stage deals (pre-seed or seed) decreased threefold compared to the first half of 2022 (from $2.7 billion to $904 million). The number of these deals also decreased by 22%.

Investors are increasingly preferring to support additional rounds for their existing portfolio companies rather than investing in new ventures.

The situation with deals at later stages is even more challenging. In the first half of 2023, 12 deals were closed, totaling $500 million. In a similar period in 2022, there were 27 deals totaling $2.6 billion.

Despite venture funds having capital, obtaining investments has become more difficult. Experienced managers have better chances.

a16z, games, BITKRAFT Ventures, Makers Fund, and Gem Capital are the leaders in the number of deals in the first half of 2023.

a16z, BITKRAFT Ventures, Makers Fund, Lightspeed Ventures, and Griffin Gaming Partners lead in deal volume for the first half of 2023.

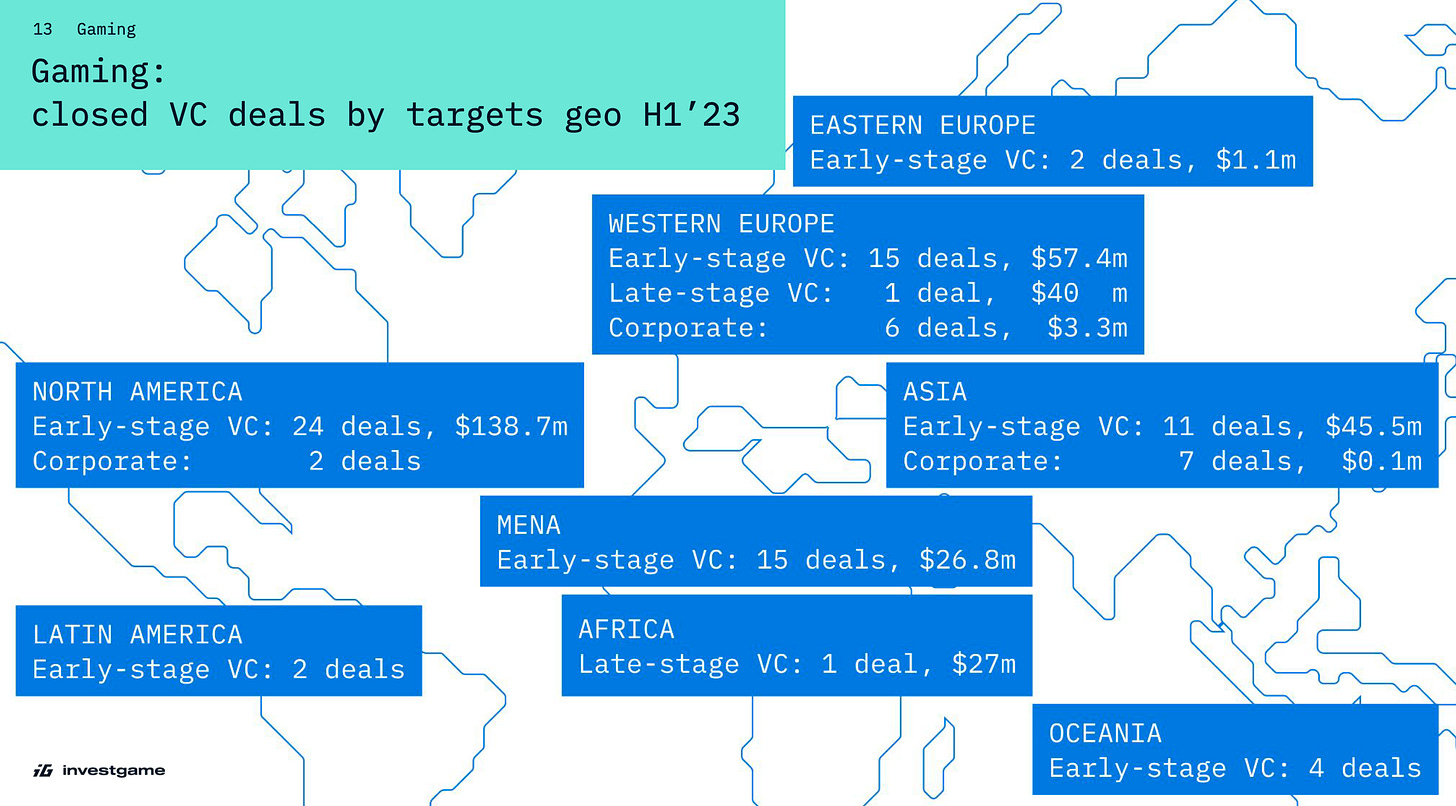

North America, Western Europe, Asia, and the Middle East are leaders in business investment activity in gaming.

M&A

The first half of 2023 resulted in $300 million and 46 deals when it comes to gaming companies and publishers. This represents a 99% decrease compared to the previous year.

InvestGame notes that in volatile economic conditions, strategic investors prefer internal investments over external ones.

Companies are also reevaluating their portfolios and optimizing their workforce (as seen with Embracer Group).

IPO

Gaming product companies accounted for 13 deals and $1.3 billion. This is 57% worse than the previous year.

Private companies are delaying listings due to the unfavorable market climate. Those already on the market are implementing stock buyback programs.

The American stock market shows early signs of recovery, but Europe is struggling.

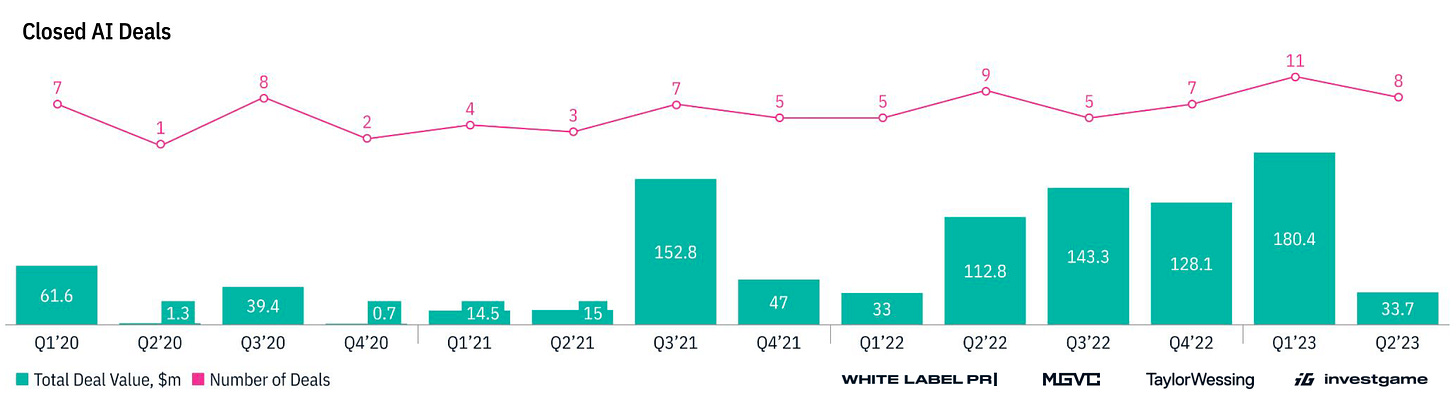

Investments in AI in Gaming

In the first half of 2023, 19 deals were made totaling $214.1 million.

The same demand that once existed for Web3 is not observed.