Konvoy VC: Gaming Investments in Q1’25

The investment market is slowly recovering, but far from its highest numbers.

Konvoy VC’s report includes deals with both gaming technology companies and content producers. The list of deals also features companies that many wouldn’t consider strictly gaming (for example, Underdog Fantasy Sports—a fantasy sports platform).

Correction: In a previous publication, I mentioned that GameDiscoverCo is not tracking PlayStation/Xbox physical sales. It is. The only blind spot is Nintendo Switch physical sales. Thanks to Simon’s hawk eye, now it is fixed!

General industry overview

In 2025, the gaming market is expected to reach $186.1 billion. Market growth is slowing down.

The number of gamers worldwide reached 3.422 billion in 2024. The majority (53%) are in the Asia-Pacific region.

The US and China account for 27% of the global gaming base but generate 52% of all industry revenue in 2024.

Investment Climate

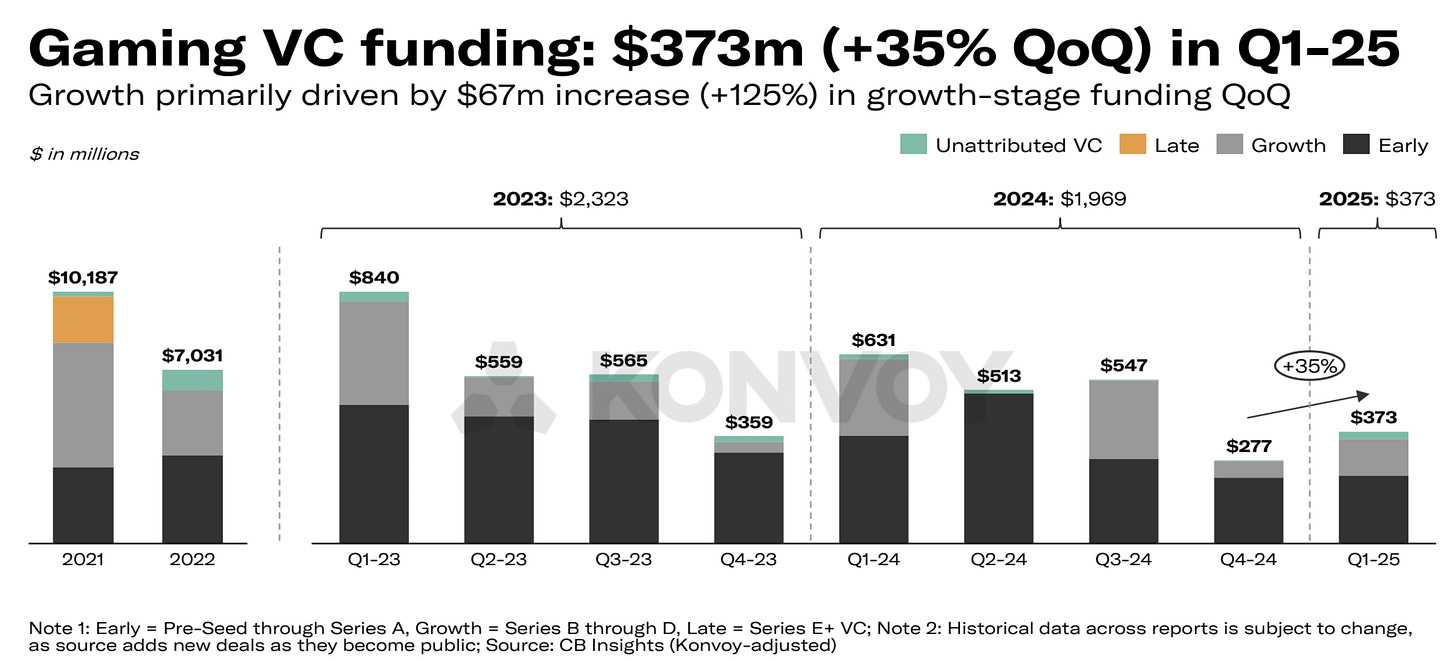

Private investments in Q1’25 totaled $700 million, a 23% increase compared to the previous quarter.

In Q1’25, there were 77 venture deals totaling $373 million. This is a 35% increase in deal value but a 6% drop in deal count compared to the previous quarter.

Growth-stage investments (Series B–D) increased by 125%. However, most investment activity still happens on early stages.

The number of deals has been declining since Q1’24. The Q1’25 figure is the lowest since early 2021.

Gaming ETFs for public companies grew by 4.8% (ESPO) and 6.2% (HERO) in Q1’25. The S&P 500 fell by 5.4% during the same period.

Public gaming companies hold $36 billion in cash or equivalents. Including tech companies interested in games, this figure is much higher.

Asian firms are the leaders in cash reserves among gaming companies.

There were 43 public company-related transactions in Q1’25—a record since 2022. Most deal values were undisclosed.

The largest Q1’25 gaming tech/platform deals: Underdog ($70M—Series C), Halliday ($20M—Series A), and SlingShot DAO ($16M—Series A).

❗️Underdog is a fantasy sports platform. Halliday is a blockchain platform for app development. SlingShot DAO is an AI launcher for Roblox with Web3 integration. Whether these count as gaming companies is debatable.

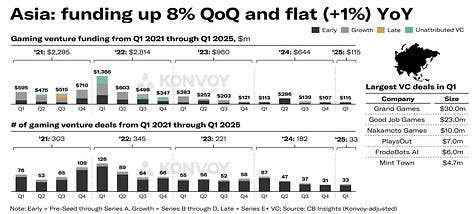

Top content company deals: Grand Games ($30M—Series A), Good Job Games ($23M), Pixion Games ($12.4M—Series A).

Regional Investment Breakdown

North America ($198 million) continues to lead in venture investment volume in Q1’25.

Asia leads in deal count (33 deals).

From 2021 to Q1’25, the US outpaced China in gaming venture investment volume by 7.6x. The deal count difference is similar.

❗️Konvoy VC only tracks publicly announced deals. In China, public deal announcements may be less frequent or stay within the local market.

Business activity has slowed significantly in all regions. In recent quarters, there have been no deals in Africa, Australia, or South America.

Awesome post