Liftoff & Singular: Casual Games in 2025

Marketing benchmarks, monetization & live-ops trends are in the material.

Companies collected marketing data from February 2024 to February 2025. The research is based on 2.4 billion installs and $11.9 billion in marketing budgets. Ad campaigns from the sample projects were viewed 1.1 trillion times and received 36 billion clicks.

Marketing benchmarks

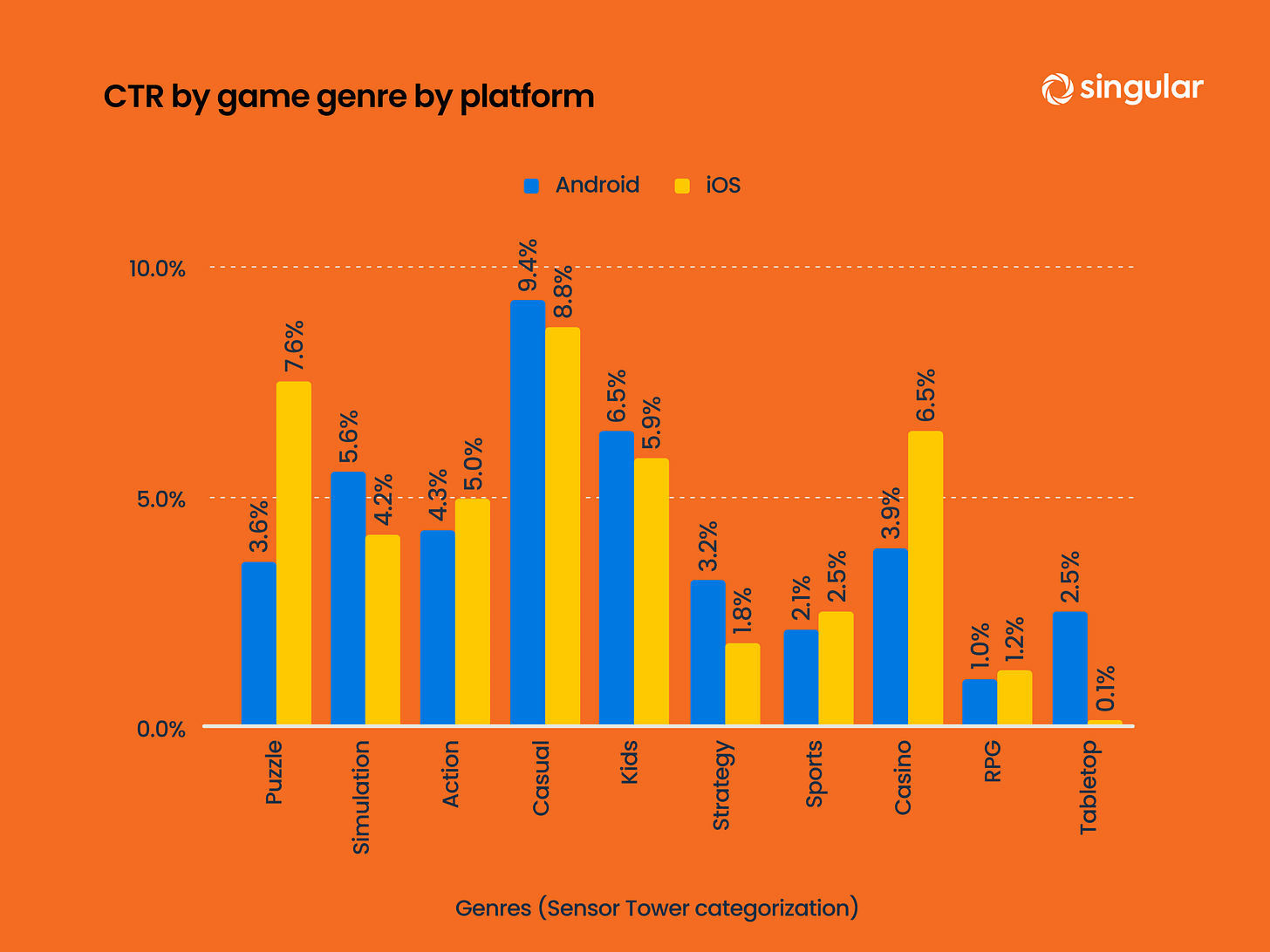

Casual games have the highest CTR among mobile projects (9.4% on Android; 8.8% on iOS). It’s important to note that this includes hyper-casual projects.

Average IPM (installs per mille) is significantly higher on Android than on iOS.

CPI is traditionally higher on iOS. In some genres, the difference is more than 4x. The highest CPI on iOS is in casino games - $21.03. On Android, RPGs lead with $4.29.

At the same time, average D30 ROAS figures are significantly higher on iOS.

❗️As always, a reminder: these are aggregated numbers across many projects. In my opinion, numbers more or less correlate with reality, but the Android benchmarks look low (if we’re talking about successful projects).

Where Casual Games attract their audience

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

In this section, Liftoff specialists examined ad campaigns that brought in 55 million installs. These ads were viewed 318 billion times and received 27 billion clicks.

The top-3 genres for attracting users to casual games: hyper-casual projects (29%), other casual games (21%), and board games (13%).

The situation is similar for puzzle games. 29% come from hyper-casual projects, 25% from other puzzles, and 15% from board games.

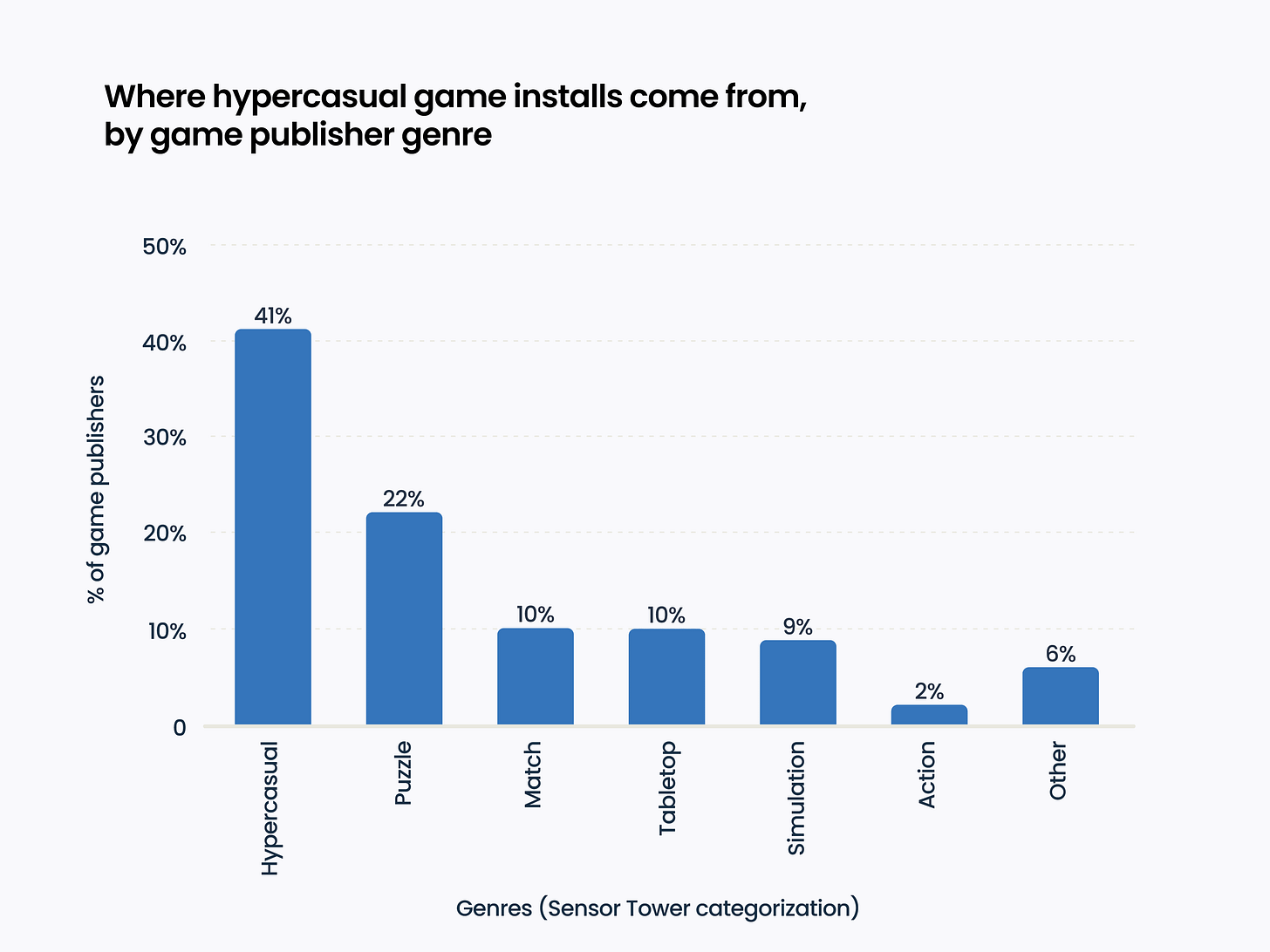

Main sources for hyper-casual projects: other hyper-casual games (41%) and puzzles (22%).

Finally, simulators get their audience from hyper-casual games (34%), other simulators (21%), and puzzles (17%).

❗️I remember when the hyper-casual market was just emerging, there were many theories that users from there would “grow up” and move on to more complex games. In part, you could say this prediction came true.

Liftoff specialists note that while attracting users from other games works, it’s not enough in today’s market. In the context of casual games, many developers place ads in non-gaming apps. Leading categories are utilities and productivity apps (28%) and other entertainment apps (25%).

Trends in Casual Games

Liftoff highlighted the top games on the US iOS market over the past year that consistently stayed in the top 200.

❗️Whether Capybara Go!, Archero 2, or Love and Deepspace can be classified as casual games is an open question.

Liftoff identifies the key trend in 2024 casual projects: combining midcore mechanics with hybrid core gameplay. For example, Love and Deepspace blends a classic interactive story with RPG elements; Capybara GO! from Habby combines roguelite, idle RPG, and casual casino mechanics.

Events in Top Casual Projects

Live-ops is everything. Liftoff provides a map of various live-ops activities in casual games.

GameRefinery (a Liftoff company) notes the growing popularity of collaboration events. The first was spotted in Monopoly GO!, then the idea was repeated in Royal Match, Truck Star, and other projects.

“Umbrella events” are also trending; those are events where the user participates in several small, parallel events. These have appeared in Royal Match, Match Factory, Gossip Harbor, Coin Master, and Dice Dreams.

Mini-games are trending as well. Over the past 12 months, GameRefinery has seen more casual projects adding new gameplay. Many companies adapt their UA for these events to attract new audiences.

GameRefinery also recommends looking at win-streak systems. Implementations can vary from “social win-streaks,” where users progress together, to more classic versions where a reward is given for a chain of wins.

Monetization innovations in Casual Games

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Liftoff notes that audio ads are appearing more in games. A good example is Pocket Land.

More projects are offering ad removal for both hard and soft currencies. Implementation varies: from temporary removal (24–48 hours) to permanent removal for a one-time payment.

Customizable IAP bundles are gaining popularity, where the user can choose the contents of the purchase.

Bundles where users are offered to choose one of multiple bundle options also gained significant popularity in 2024. In Grand Solitaire Harvest, there was an interesting variation of such a bundle - before the final of the Super Bowl, the company presented an offer to “vote” for the team they thought would win. Additional rewards were given to those who picked the winning team.