Liftoff: Mobile App marketers survey - 2024 results & 2025 forecast

Mobile marketing professionals shared their thoughts on the current state of the market.

The Liftoff report uses figures provided by AppsFlyer and Sensor Tower.

Over 700 marketers from different regions participated in the Liftoff survey.

48% of respondents are from the gaming industry, and 52% are from non-gaming segments.

Liftoff surveyed companies of different sizes - 24% of respondents operate marketing budgets of more than $1 million monthly. 63% have a budget less than this amount.

Overall market conditions

According to AppsFlyer, app downloads increased by 7% in 2024. Non-gaming app downloads grew by 12%. Time spent by users in apps either increased or remained unchanged.

According to Sensor Tower, people spent 4.2 trillion hours in apps in 2024. Most of the growth comes from non-gaming apps.

The increase in time spent by users in apps leads to an increase in spending on them. Again, this mainly applies to non-gaming apps.

The USA, China, Germany, and the UK are the main beneficiaries of the growth in user spending on non-gaming apps.

The situation in the gaming market is not as rosy. After explosive growth in 2020-2021, downloads declined in 2024.

IAP revenue in games decreased by 1% in the gaming market. Casino games showed growth, while casual and midcore projects were in the negative zone.

Survey results - Industry in 2024 vs 2023

About 80% of respondents believe that the state of the mobile market is either at the same level or better than in 2023.

Respondents from North and Latin America are the most optimistic. Representatives of the EMEA region are less optimistic. Those who started spending more in 2024 are more optimistic about market prospects.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Gaming market representatives are the most pessimistic. 30% believe the market condition has worsened - compared to 14% in the non-gaming segment.

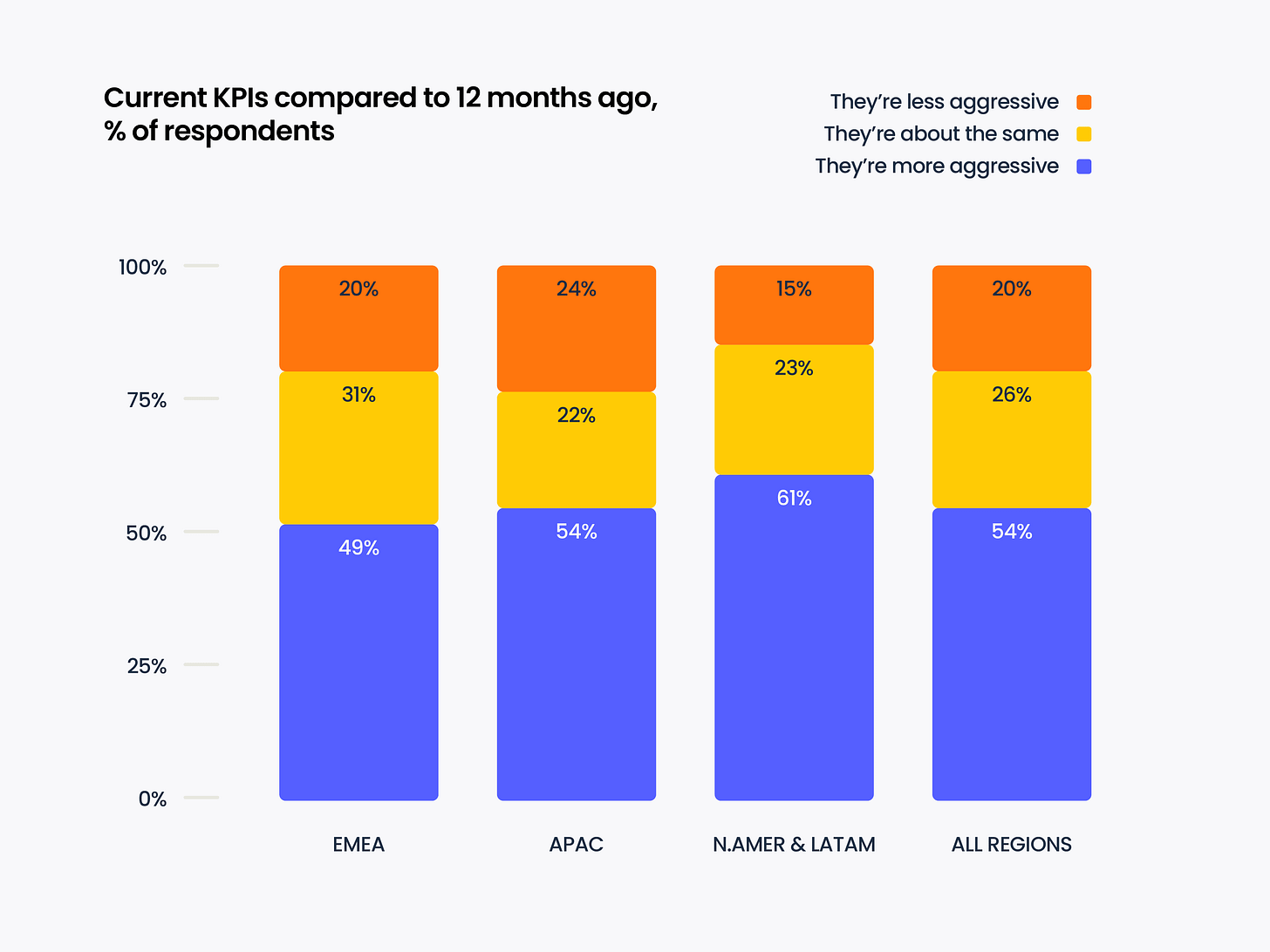

However, more than half of the market signals that KPIs have become more aggressive.

Interestingly, despite the growth of the non-gaming segment, its representatives more often report stricter KPIs.

Despite ambitious goals, non-gaming companies either hit their targets or are close to them. The percentage of those who miss is the same across segments.

About half of the respondents noted growing budgets. Those operating budgets of more than $1 million per month more often report growth, which indicates ongoing market consolidation.

Survey results - Innovations and Changes

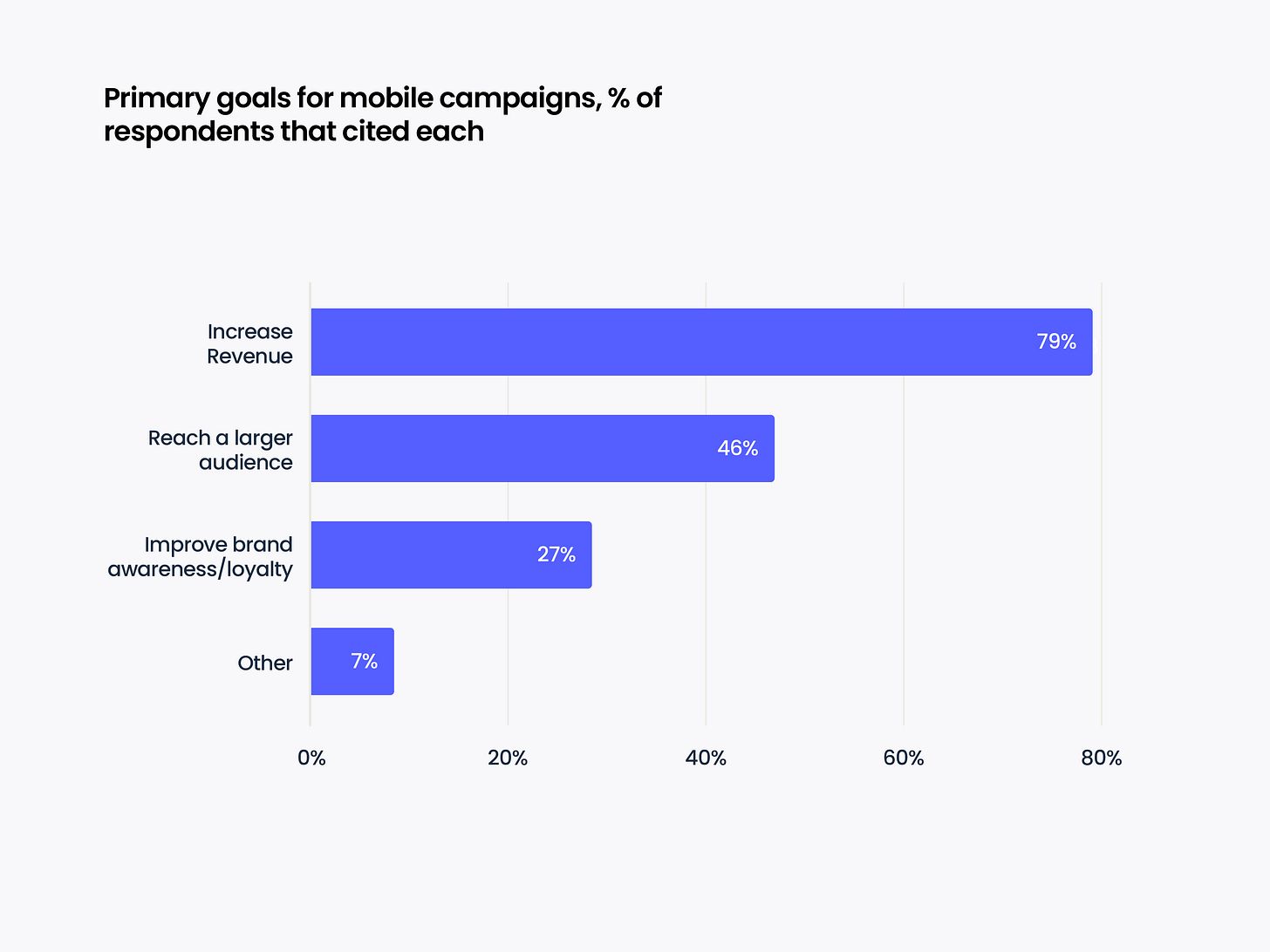

79% of respondents noted that growing company revenue is their main goal. 46% noted that they are working on increasing the audience of their projects. 27% are working on improving the brand and its positioning in the market - mainly representatives of the financial and educational segments.

When it comes to KPIs, most game developers (60%) focus on ROAS. They also set CPI (16%), LTV/ARPU (15%), CPA (6%), and CPC (2%) as KPIs. Among non-gaming marketers, CPA KPIs are set much more often (4 times more often).

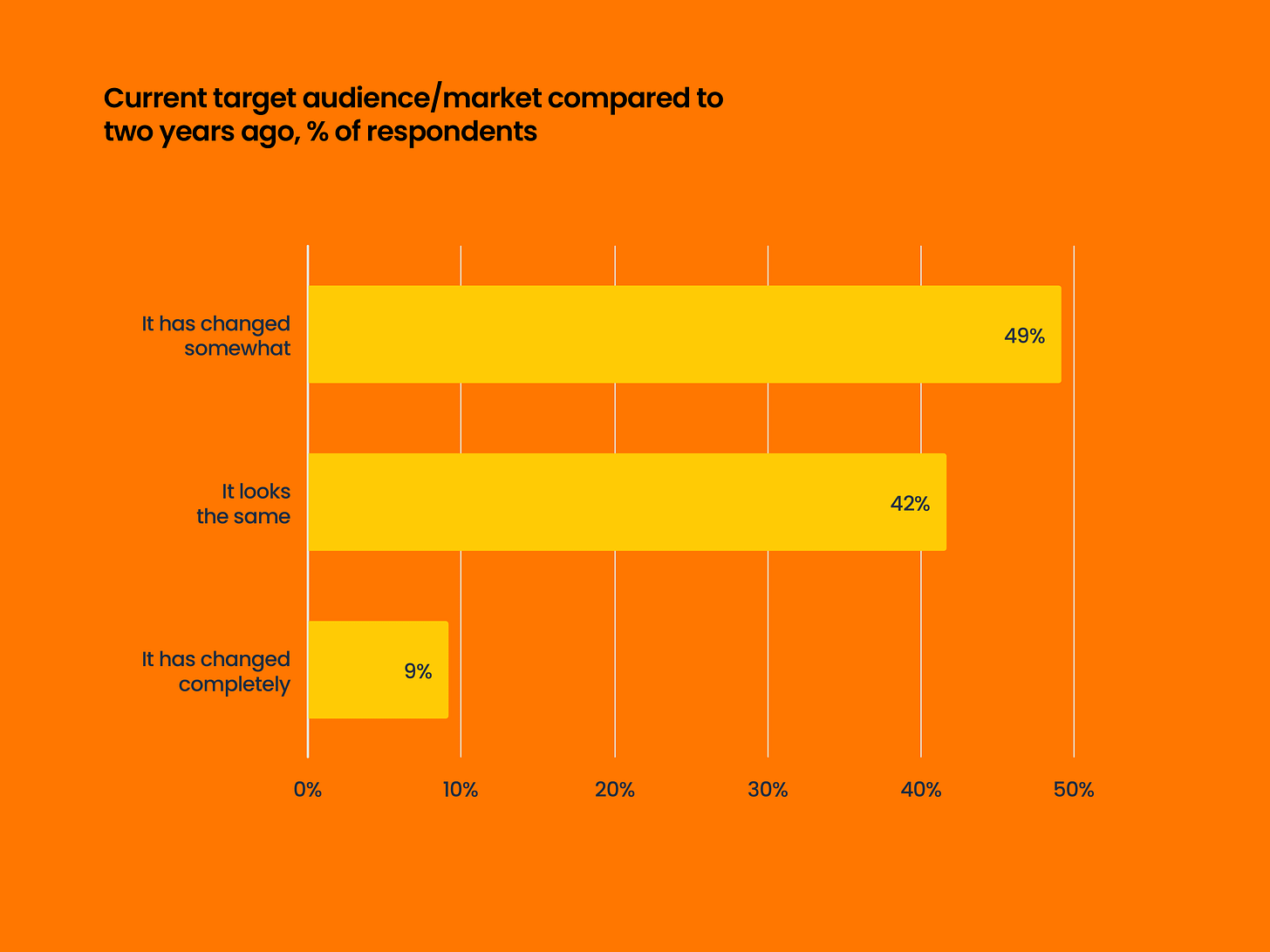

Most market representatives feel that the mobile app audience has changed. 58% of respondents reported this.

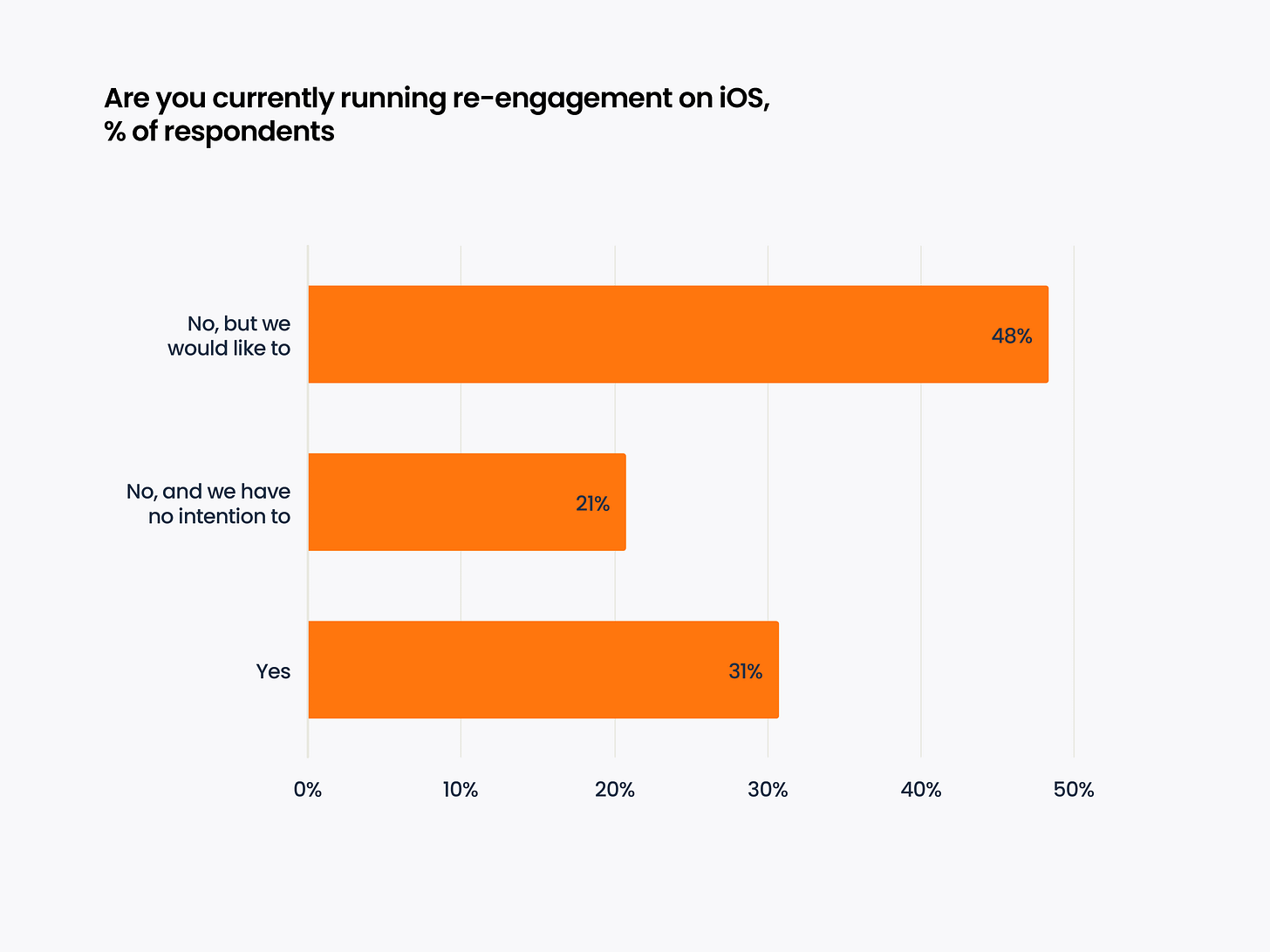

Only 31% of marketers use re-engagement campaigns on iOS. However, 48% would like to engage in them but for various reasons are not doing so yet.

Most respondents see the benefit of AI in creative production. 34% use AI for creative production, 20% use it for creative optimization. AI is less involved in code writing, operational work, and sales.

Survey results - SKAN & GAID

Only 67% of respondents are familiar with AAK (AdAttributionKit).

30% believe that the introduction of SKAN negatively affected their UA activity. 32% saw no changes. And 24% noted positive changes.

It cannot be said that the market is ready for GAID. Only 6% have prepared, and 32% of the market has done some preparatory work. The majority has not yet prepared for changes from Google. Among the respondents, companies with marketing budgets exceeding $1 million are more prepared for the changes.

Survey results - Expectations for 2025 and priorities

Overall, the situation in the mobile market is considered positive. But one-fifth believe that the situation will worsen in 2025.

In terms of plans, 88% of respondents want to spend either the same or more in 2025 than last year.

Most spending is planned in advertising networks (priority for 41% of respondents) and SAN (Self-Attributed Network - such as TikTok, Google Ads and others, priority for 36%).

However, compared to 2024, the popularity of advertising networks has increased, while all other advertising channels have slightly decreased.

Companies are also interested in investing in the development of organic/viral traffic (62%), influencer marketing (51%), and community building (29%).

Most respondents noted that in 2024, they started working with a larger number of partners. This is likely related to market difficulties and the desire to explore alternative opportunities.

Improving ROAS/ROI, access to new audiences and inventory, growth in new regions are the main factors when working with new partners.

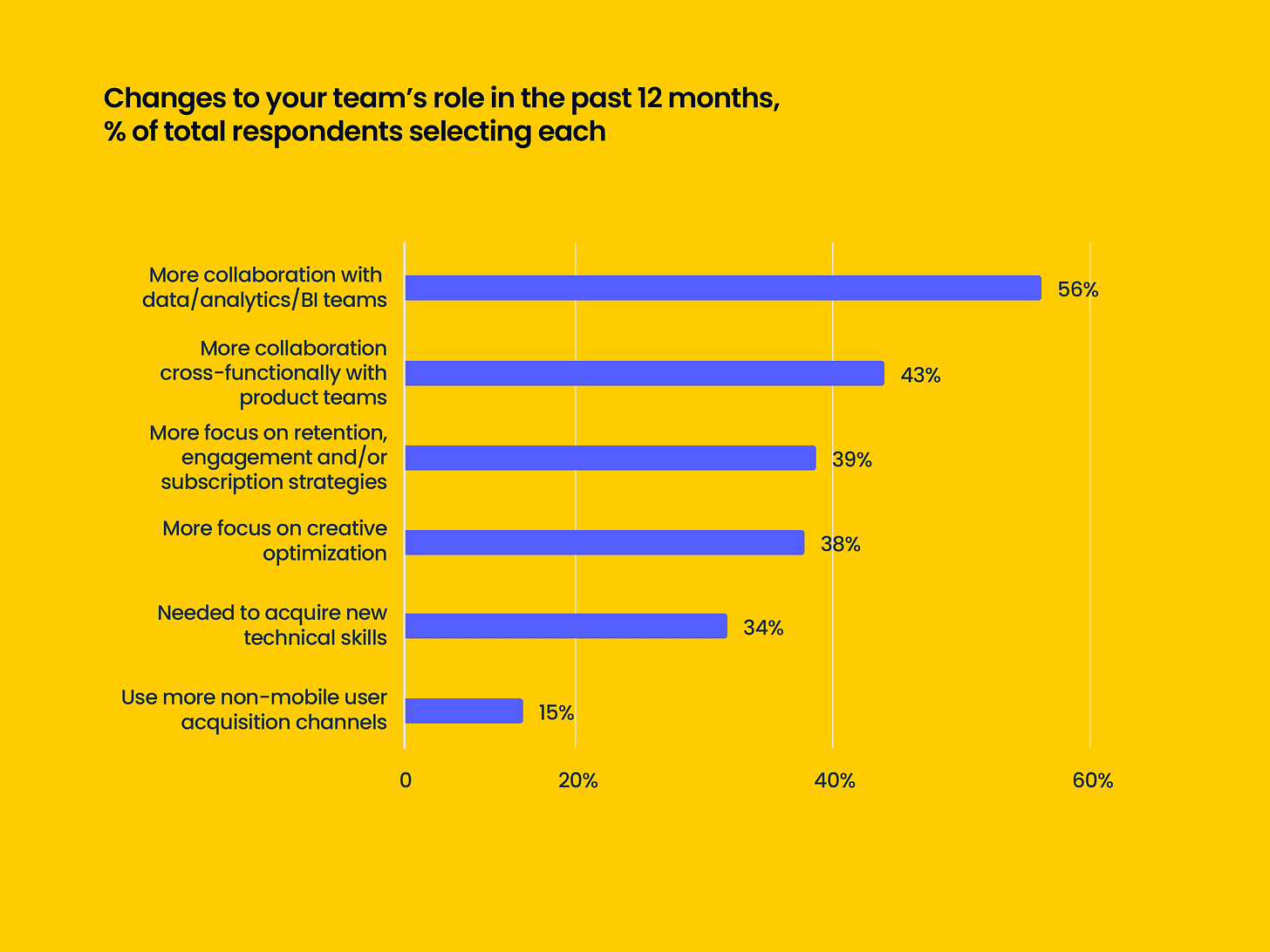

Survey results show that over the past year, marketers have started working more often with analytics teams and product teams. They have become more focused on metrics and creative optimizations.