Mistplay: Mobile Gaming Growth Report (2024)

How users discover games; react to ad creatives; spend their first days in the game and more.

Mistplay analyzed 3,000 users from Tier-1 Markets (US, Canada, United Kingdom) in Q2 2024 who used Mistplay. Paying users are defined as players who purchased within the last 30 days at the time of the survey.

Mistplay studies user behavior during the early days of their engagement with a game, specifically from discovery up to the 7th day.

How users discover games

The top source (67%) is in-game ads. Second (37%) is searching in app stores, and third (25%) is recommendations from friends.

The most popular alternative channels include social media ads (18.9%), Google Ads (18.4%), and offerwalls (16.1%).

The most popular social platforms where users discover games are Facebook/Instagram (64.8%), YouTube (41.2%), and TikTok (22.6%).

Ad Creatives

Users report encountering several issues with ads: they don’t like the ads (48.5%); there are too many ads (48.26%); ads are of poor quality (41.69%); and the games are not unique (36.39%). These are the most common problems.

The preferred ad formats are ones that showcase real gameplay (47.5%) and interactive ads (35.5%). Other types of ad creatives are less popular with audiences.

Brand collaborations appeal to only 1/5 of users. They are the least interesting to casual players but most appealing to fans of sports games.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

ASO Optimization

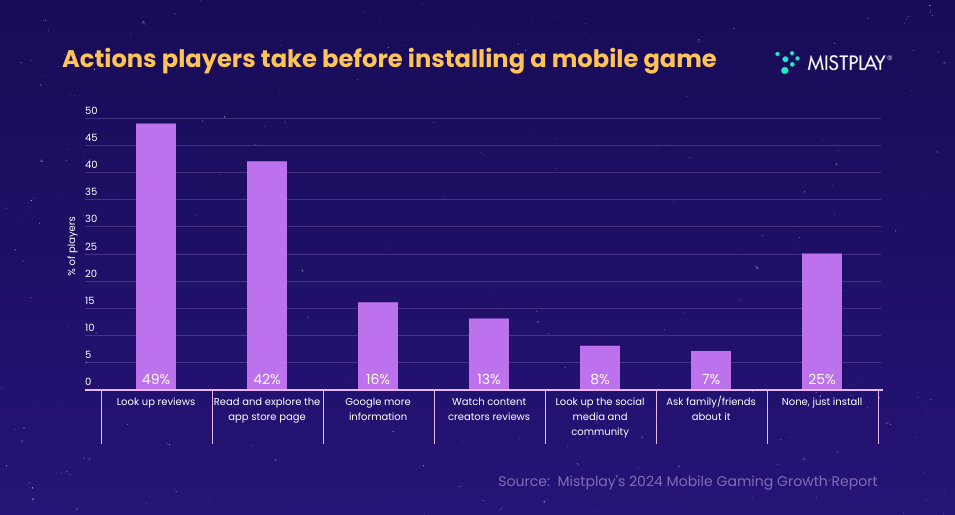

75% of users check the game’s page before installing it. 48.6% look at the ratings, and 42.4% read the description.

Around a quarter of users say that the developer’s brand and the game’s brand influence their decision to install the game.

Visuals and screenshots are the most important elements users consider. Following that (in descending order of importance) are the game description, title, rating, trailer, user reviews, price (if the app isn’t free), app size, number of downloads, chart position, and awards.

Player Behavior in the First Days of Gameplay

The main reasons players stay after their first session include enjoying the gameplay mechanics (69.2%), a strong sense of progression and rewards (67.1%), appealing visual style (45.2%), ads matching the gameplay (40.6%), and a well-balanced experience (39.8%).

The main reasons for leaving a game are pay-to-win mechanics (77.18%), too many ads (71.85%), and misleading ad creatives that don’t reflect real gameplay (66.17%).

The key mechanics for bringing back lapsed users are rewards or discounts for returning users (51.96%) and releasing new content (49.18%).

Alternative User Monetization Methods

17.19% of paying users have bought subscriptions in the last six months; 12.87% have purchased paid games; and 8.1% of users bought in-app purchases (IAP) via web shops. 3.37% bought merchandise, 2.08% supported developers through crowdfunding, and 1.68% purchased NFTs.

Most users (59.4%) are not interested in web shops. 14.3% have used them before.

42.2% of users have played games based on IP, and 53.5% of players made purchases in games because of brand collaborations.