Mistplay: North American players behaviour in Mobile Games in 2023

What genres have the most loyal audience; how North American players behave in mobile titles in terms of payments & engagement, and more.

The Mistplay Loyalty Index is based on several monetization indicators (the share of paying users in 30 days; average spending; average frequency of repeat purchases) and engagement (30-day retention; average number of sessions per user; average session duration).

The survey involved more than 3,000 mobile gamers aged 18 and older from the USA and Canada. The survey was conducted among Mistplay users in the third quarter of 2023.

Genre Overview

RPG, strategy, and simulation games have the most loyal audience. RPG games lead in average spending and average session duration.

Lifestyle projects have the highest number of paying users in 30 days. Strategies have the highest repeat purchase rate among all genres. RPGs, as mentioned earlier, lead in average spending.

Puzzle games are the strongest genre in D30 retention; RPGs lead in the average number of sessions per user; Lifestyle projects lead in average session duration.

User Interaction with Advertising and Game Installation

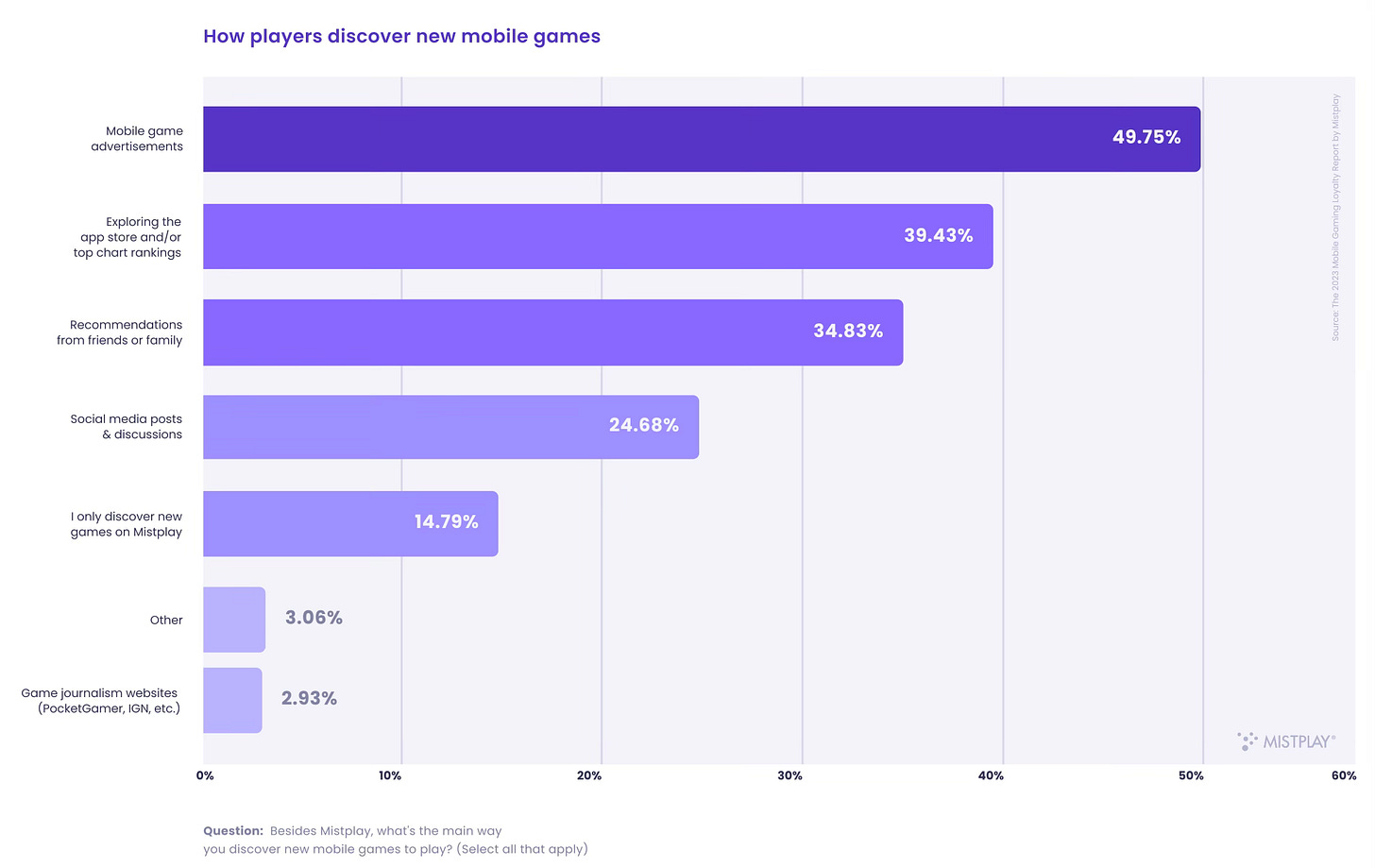

49.75% of users discover new games through advertising; 39.43% find them through app stores and top charts; 34.83% rely on recommendations from friends.

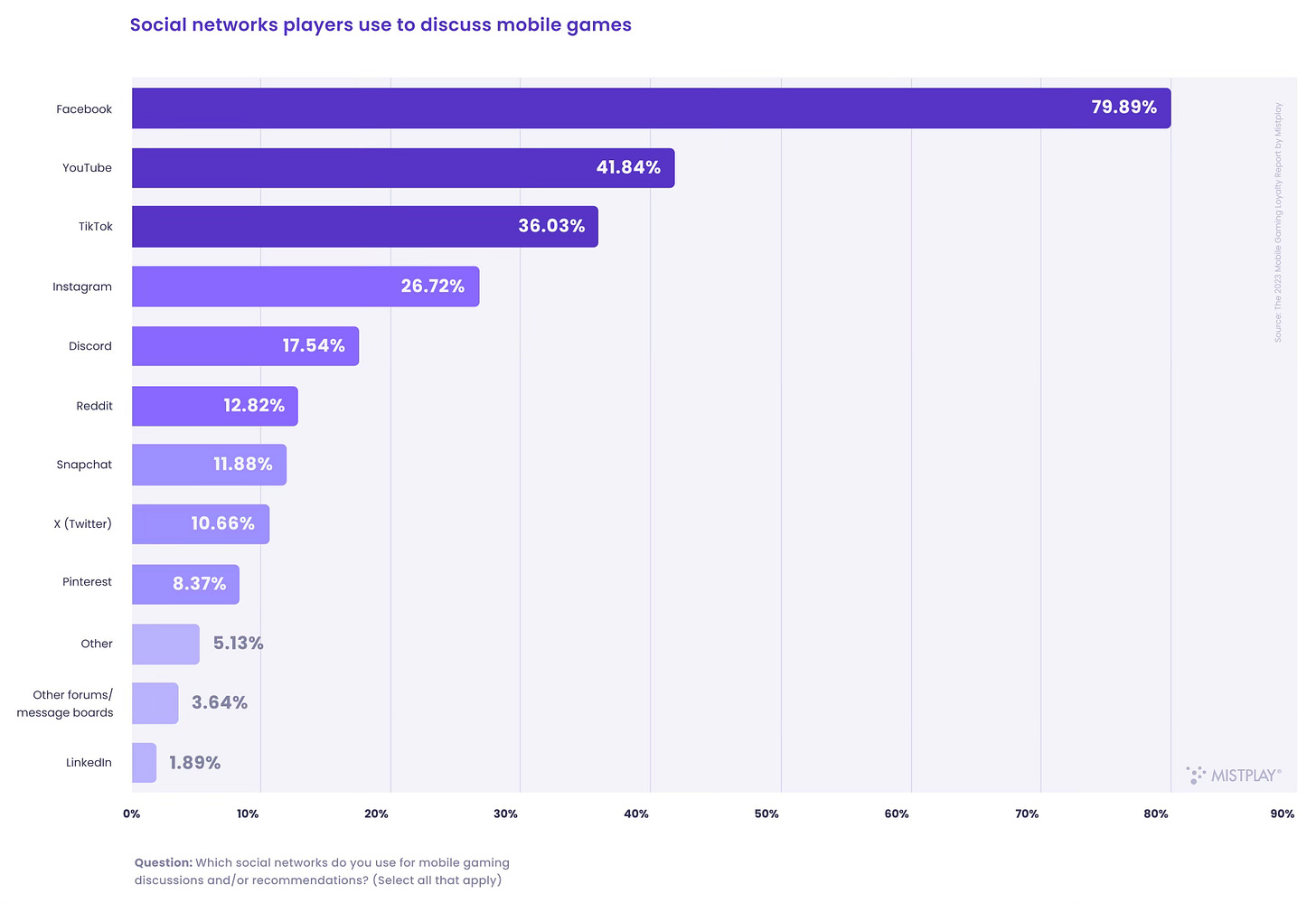

Facebook (79.89%), YouTube (41.84%), TikTok (36.03%) are the main platforms where players discuss mobile games.

36.7% of players do not interact with advertising at all, preferring to ignore it or hide it.

68.3% of users are willing to install a new game after seeing an ad within the first few weeks. 21.7% fundamentally do not install games they see in ads.

44.6% of the audience is satisfied with a 3-star app rating. 29.95% do not install apps with a rating below 4 stars; 6.36% only want to see a 5-star rating.

User Motivation

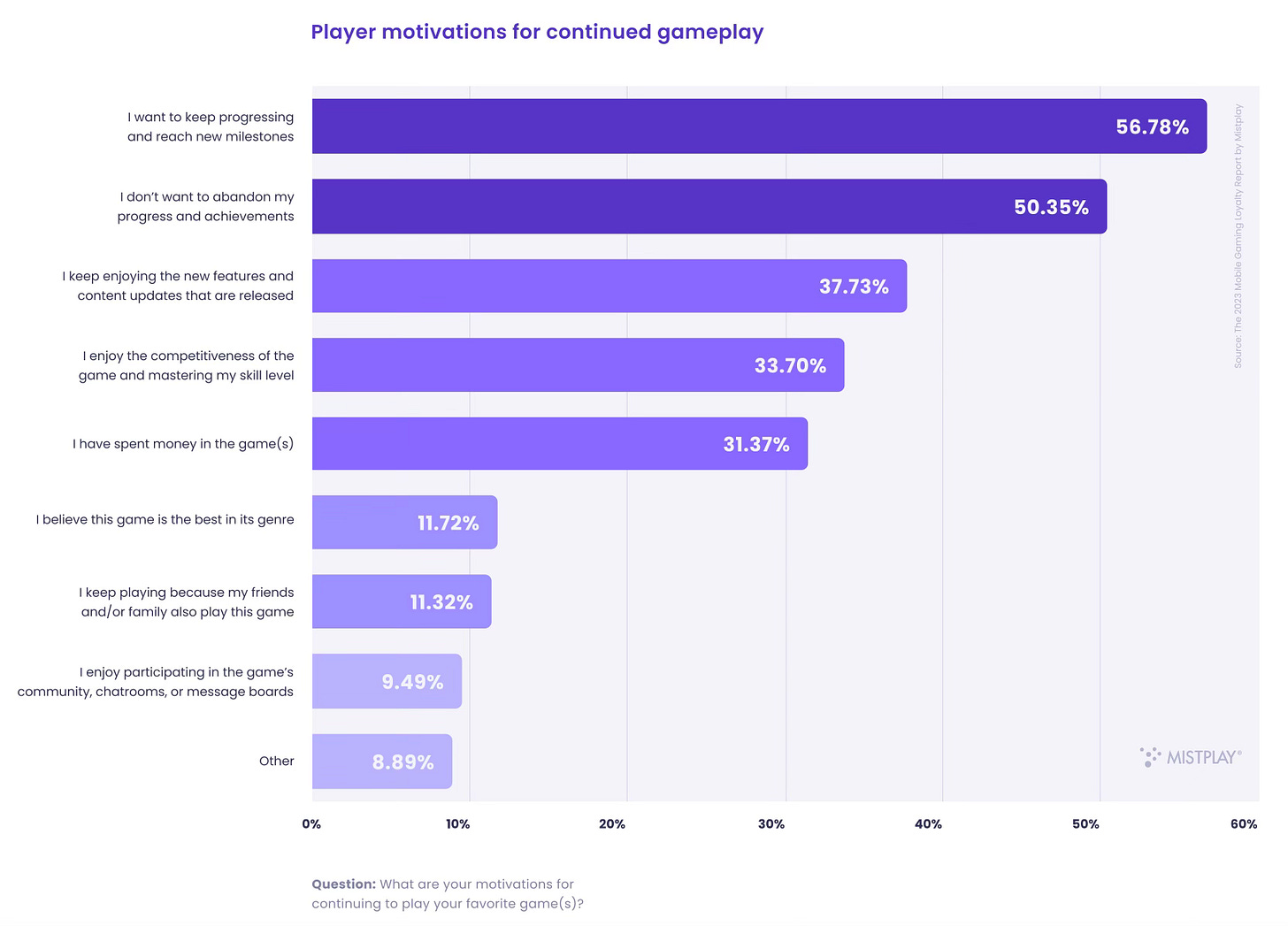

56.78% of players continue playing for progress and achieving new results; 50.35% do not want to lose their accumulated progress and achievements; 37.73% like new updates and content.

On the other hand, 59.75% of users stop playing because the game becomes "pay to win"; 55.18% quit due to bugs or errors; 54.55% do not feel a sense of progress.

25.64% of people will not leave the game if there is a bad update, knowing that the issue will be fixed. On the contrary, 4.7% will stop playing immediately. The majority, around 70%, is willing to give the game from 1-3 days to 2 months to fix issues.

The publisher's name is important to players. On a scale from 1 to 5, only 6.39% of players chose a rating of 1 or 2, which means that survey participants are unlikely to try games from the same publisher.

Player Purchasing Preferences

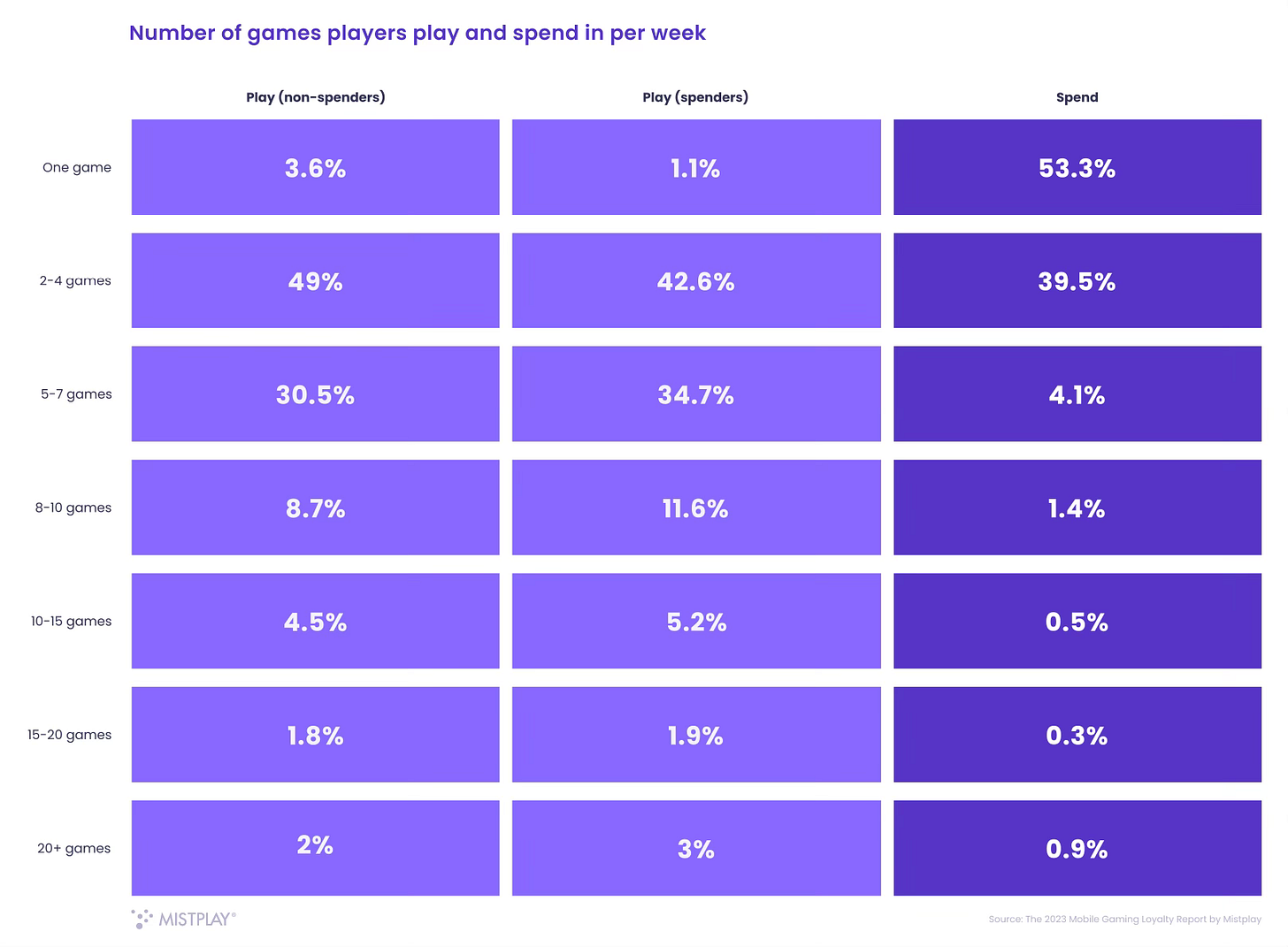

92.8% of the paying audience simultaneously makes purchases in 1-4 projects. 53% spend on only one game per week.

61.96% of users spend money to achieve new progress; 30.71% for rare or unique content; and 29.27% to play without ads.

59.55% of players prefer bundles with a larger number of items; 45.95% prefer one-time profitable offers; 28.64% want to buy in-game currency to spend as they see fit.