Neogames: Finnish Game Industry in 2025

Turnover is down; Finnish gaming companies are receiving less investments.

71 game studios took part in the survey and report preparation (26% of the total number in the country), employing 3,160 people (86% of the total workforce in Finland). The report uses complete or partial factual data from 141 Finnish game companies.

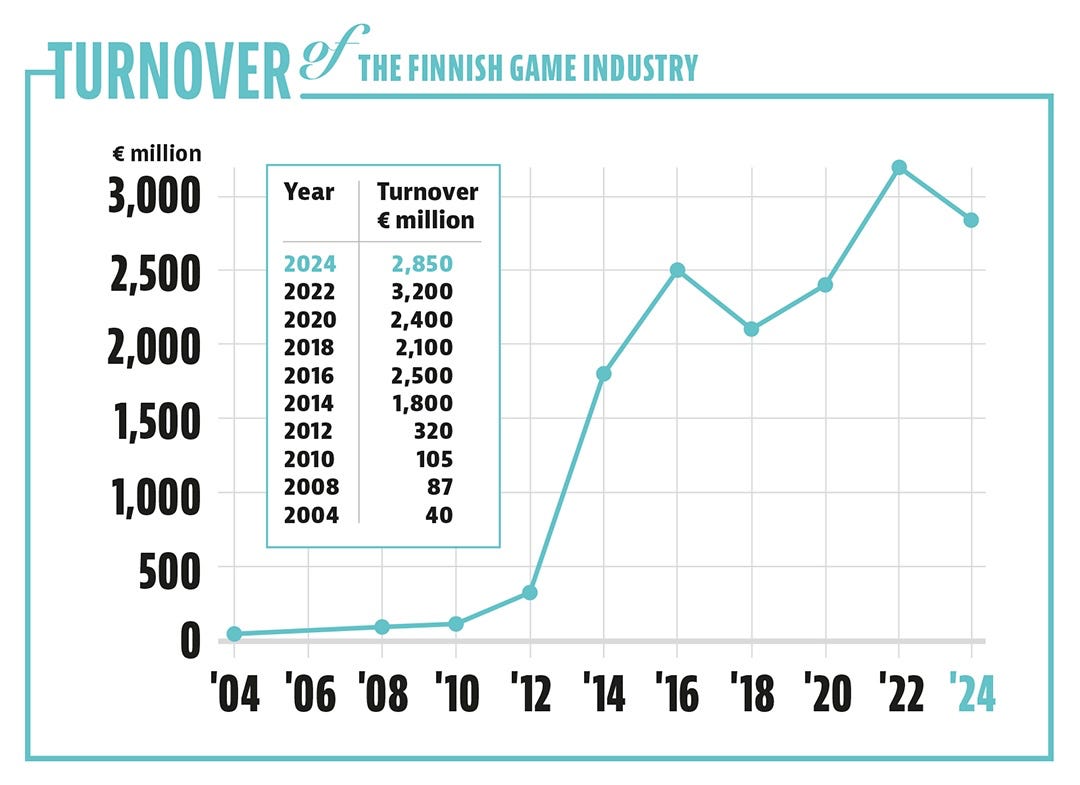

Financial Performance

In 2024, the turnover of the Finnish game industry amounted to €2.85 billion. This is a decrease compared to 2022, when turnover exceeded €3 billion.

❗️The report notes that calculating calendar year results has become more complicated, since many companies now use a fiscal year from April to March.

In 2023, Finnish companies earned €800 million in net profit. In 2024, that number dropped to €400 million.

Over the last 12 years, Finnish game companies have paid €3.5 billion in taxes. During this period, their total turnover exceeded €28 billion.

Investment in Finnish game companies has decreased. In 2023–2024, they received €128 million in funding, compared to €300 million in 2021–2022 (including Supercell’s €150 million credit line for Metacore).

The number of companies with annual turnover above €100 million has remained the same. However, in the last 2 years, the number of companies with turnover above €1 million fell from 45 to 37.

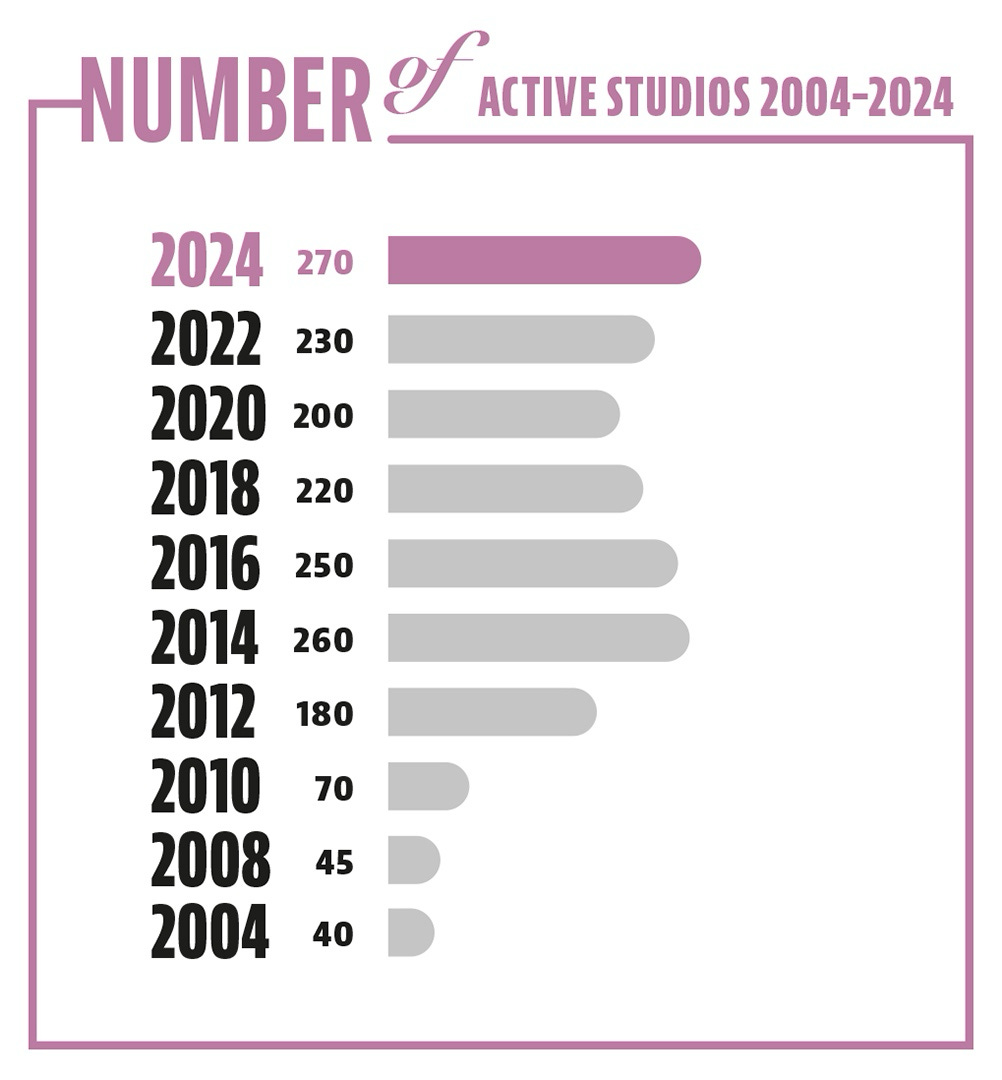

Finnish Studios

At the end of 2024, there were 270 active studios in Finland. At the end of 2022, there were 232. The number of companies grew despite the state of the industry and macroeconomic trends.

40 of them were founded in 2023–2024.

In 2004, Finland had only 40 game companies (already quite a lot for that time). 10 of them are still active.

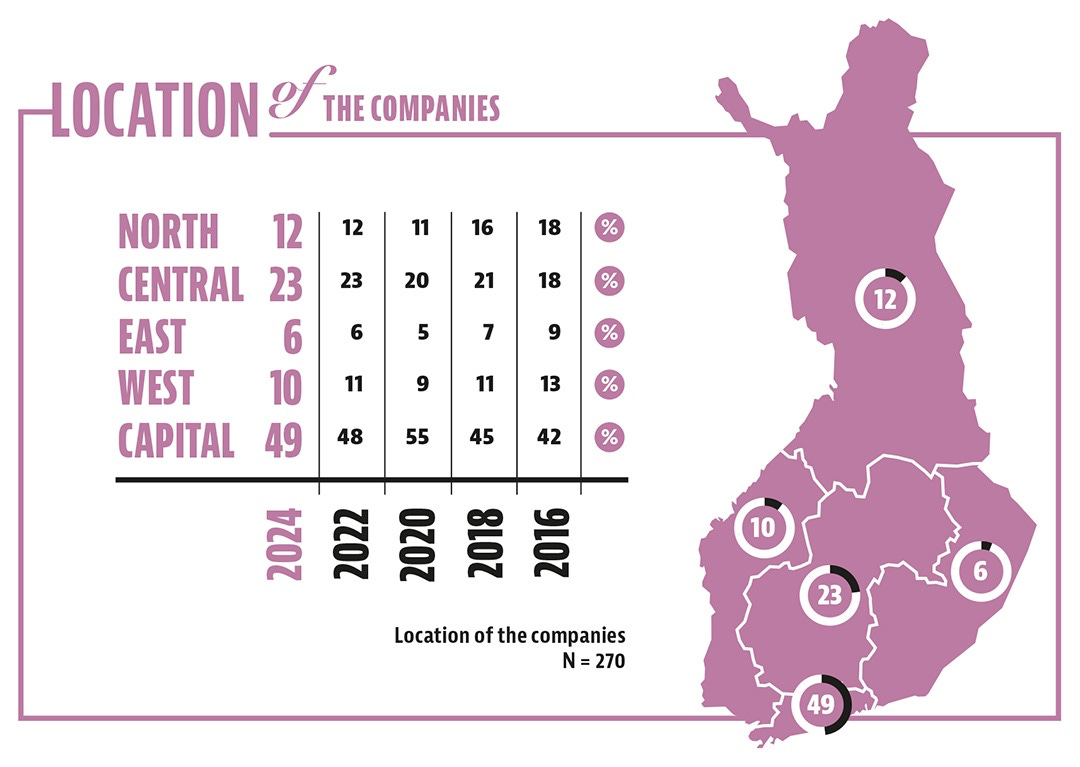

Nearly half of all Finnish studios are concentrated in the capital region, which also accounts for 97% of industry turnover.

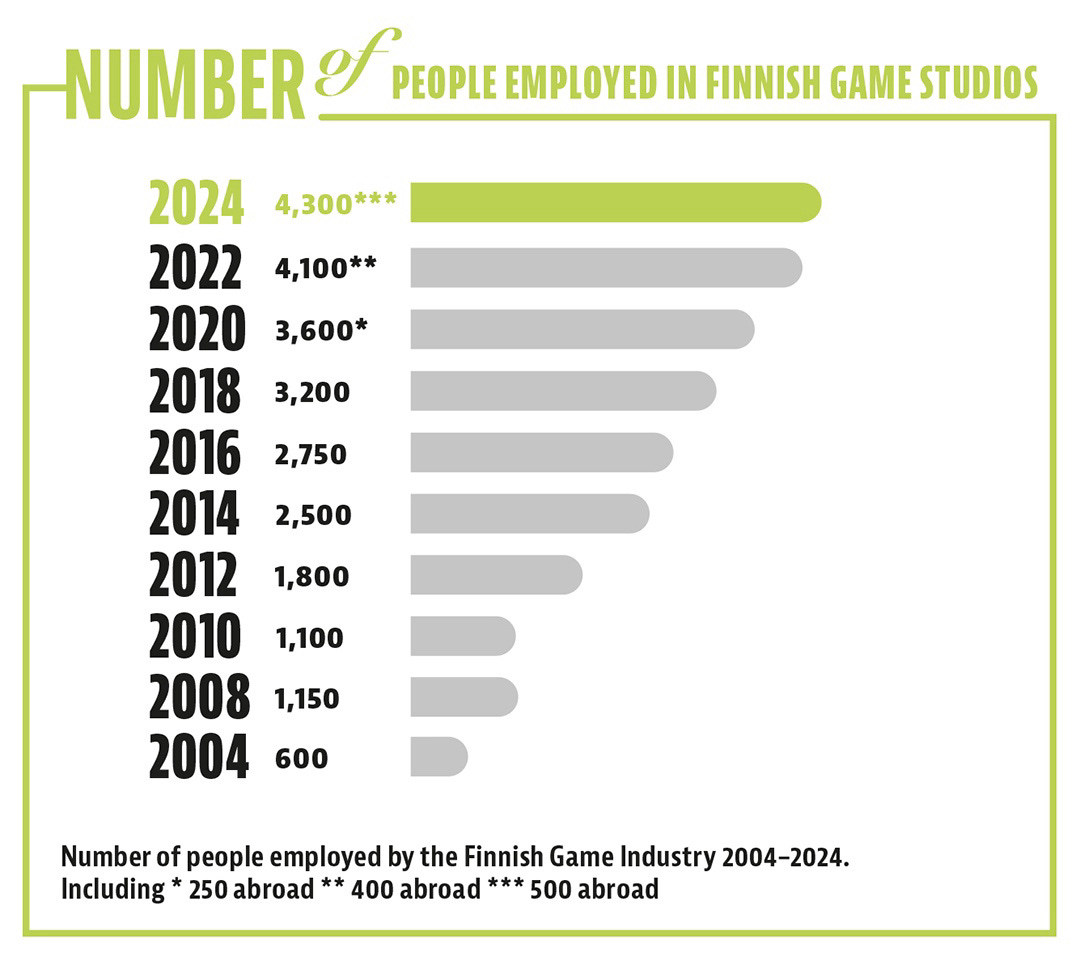

Game Industry Workforce

At the end of 2024, 4,300 people were employed in the Finnish game industry.

Of these, 3,800 work in Finland and 500 in international branches of Finnish studios.

24% of the workforce are women.

The average team size in a Finnish game company at the end of 2024 was 20, compared to 23 in 2022.

35–37% of employees by end of 2024 were expats.

Actual workforce growth was slower than the optimistic forecasts of the previous report. Over the next 2 years, Finland is expected to see between 450 and 1,000 new industry jobs.

24% of employees primarily worked remotely by the end of 2024, compared to 35% in 2022.

Released Games

Finnish game companies launched 120 new titles in 2023–2024. Only 10 were released on mobile.

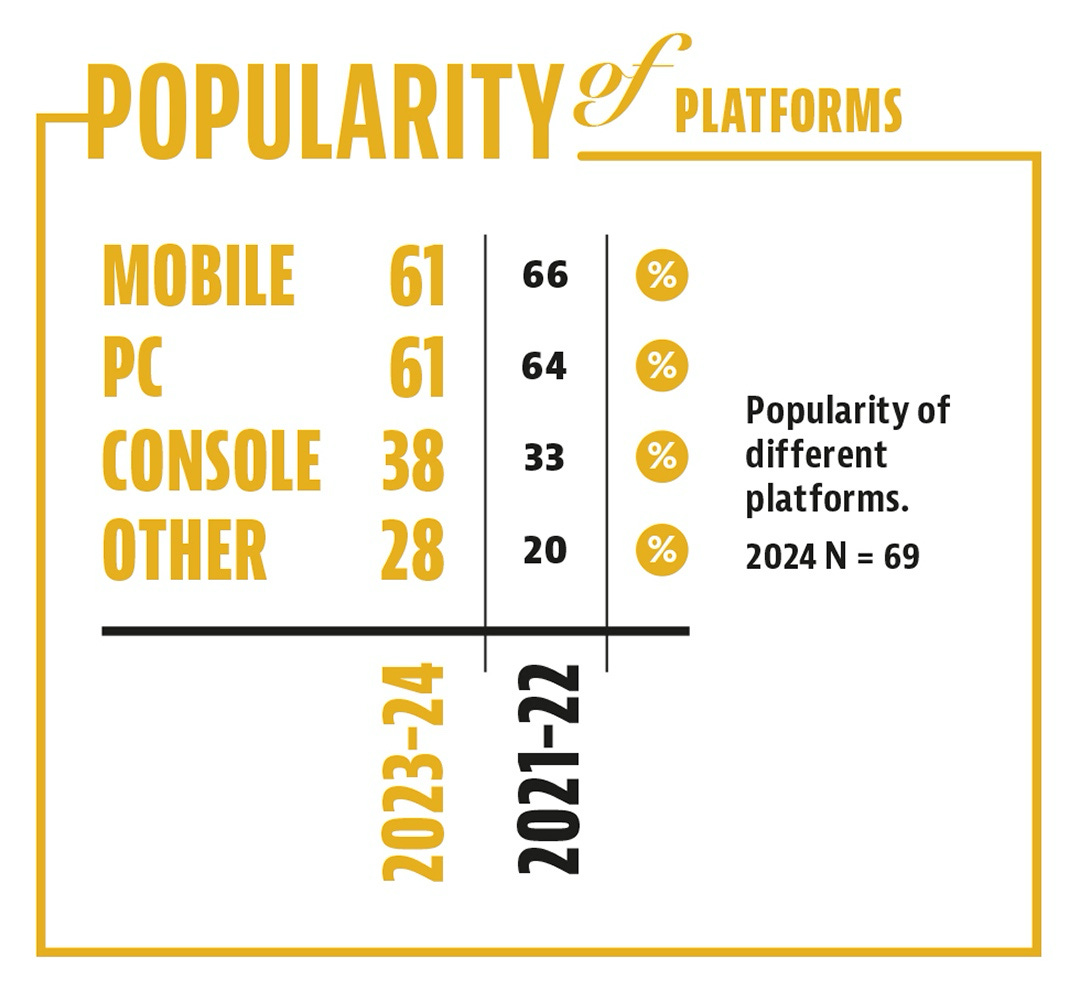

Mobile remains the main revenue platform for Finnish studios, but its dominance is decreasing. Interest in consoles and alternative platforms is growing.

58% of surveyed studios are developing projects for at least two platforms; 23% are targeting three or more platforms. Only 20% are making a mobile-exclusive title.

Web games are gaining popularity. 14% of studios plan browser support, double the share from 2021–2022.

The most notable games from Finnish studios in 2023–2024 include Alan Wake II (Remedy), Squad Busters (Supercell), Cities Skylines II (Colossal Order), and Pax Dei (Mainframe Industries).