Newzoo: Chinese Gaming Market Regulations in 2022

Everything you wanted to know about the Chinese market status in 2022 is inside.

Child protection

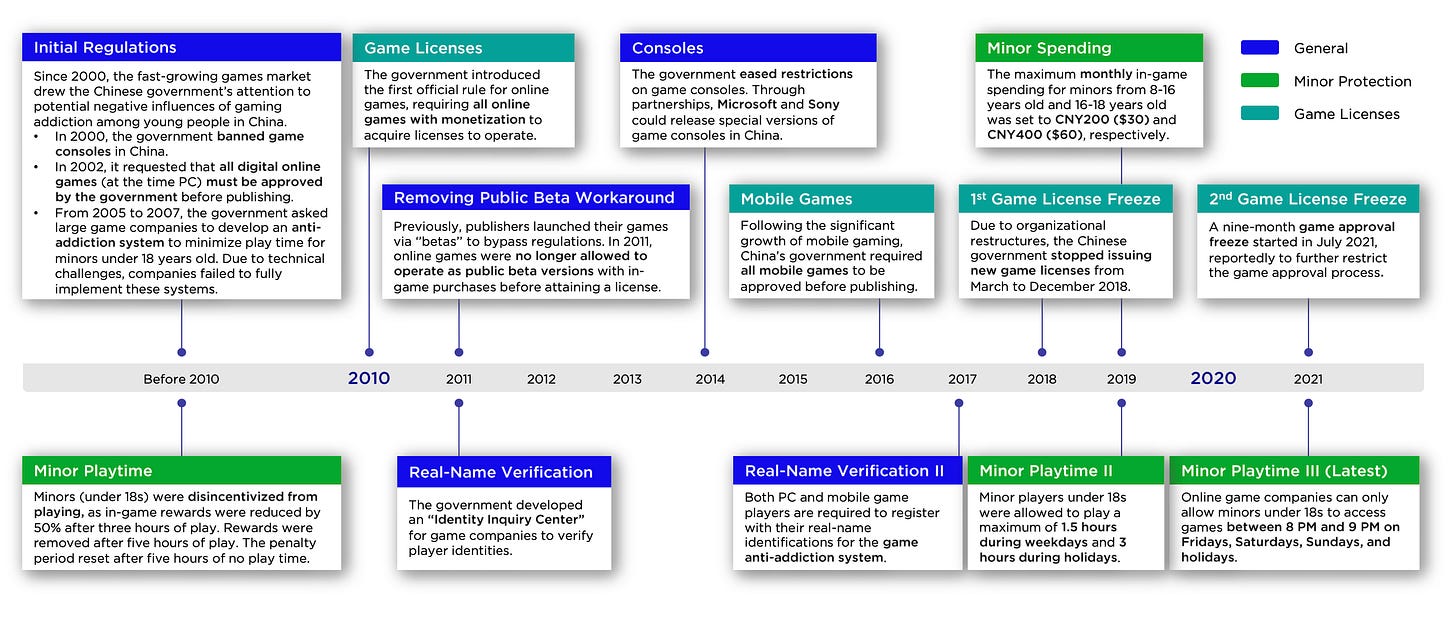

China's regulation allows children and teenagers under 18 years to play only from 8 to 9 PM on Fridays, weekends, and holidays.

Children aged 8 to 16 years have a monthly game payment limit of $30. Teenagers from 16 to 18 years can spend twice as more - $60.

Gaming companies are obliged to identify the person under 18 years. ID is required to play the game.

Users under 18 years can’t spend their money on streaming platforms. Teenagers from 16 years old can stream but only under an adult person's control.

People under 18 years old can’t participate in any E-Sports events. They also can’t buy/rent gaming accounts.

Newzoo suggests that these regulations will negatively impact the Chinese gaming market in the long run. Chinese children won’t have a habit of playing games. However, in reality, a big chunk of those regulations is possible to pass with a help of adults.

Licenses

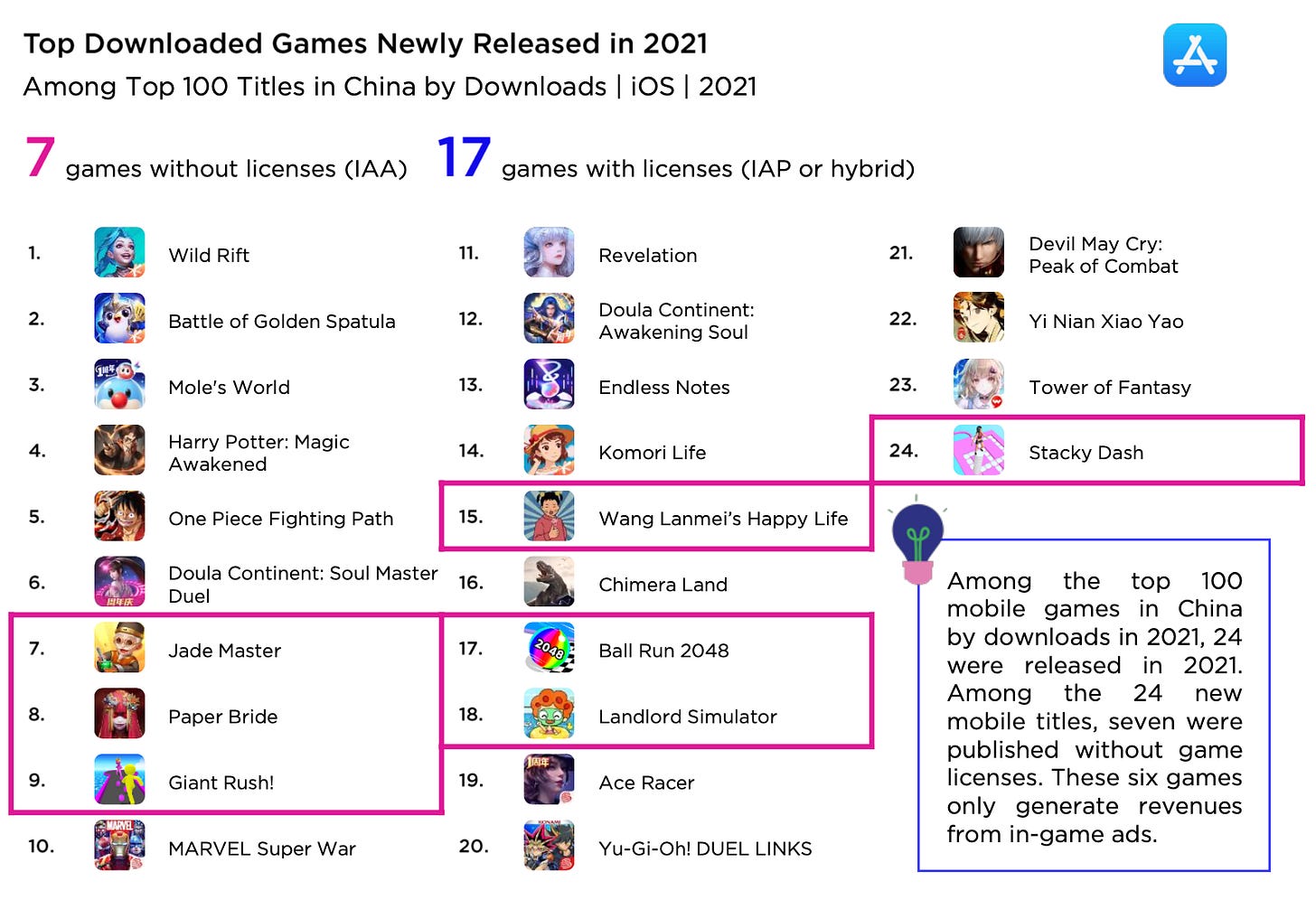

All games with a feature of receiving money (Premium or IAP) are required to have a license to be published in China.

The Chinese government issued 9,177 licenses in 2017 for Chinese developers, and 456 licenses for foreign developers. In 2022 (valid for October 2022) the Chinese government provided only 314 licenses - all of them for local companies.

Grey zone

Steam is still available in China. There are rumors around for the last couple of years that it will be blocked, but it’s still alive. Now gamers are using Game Accelerator and VPN services to get access to it.

VR and Cloud Gaming platforms are not currently regulated by the government.

Mobile games with only ad monetization are not required to get a license. But in June 2022 three games with such monetization were fined by the Chinese government. It took their revenue and banned them from App Store.

There is a huge grey console market in China. People are buying consoles from Japan & Hong Kong to play games that didn’t get a license to launch on the local market.

What Chinese companies are doing.

Big Chinese companies are working on self-regulation. Tencent, NetEase, and 37 Interactive have a technology of identification by the face. Tencent also registered a patent that helps to verify users by their location.

Chinese companies that want to launch in the local market, are focused in general on big F2P titles, which are launching on several platforms. Only one license is required for a multi-platform release.

Chinese companies started to focus on overseas markets. Their revenue outside of China increased from $9.6B in 2018 to $18B in 2021.

Chinese companies are actively investing in foreign companies. Ubisoft, From Software, 1C Entertainment, and Quantic Dream - all of them have Chinese participation.

What developers should do?

Releasing a game in the Chinese market with a Premium/IAP game is a hard job. Even with a partner.

Even if you were extremely lucky and got the license, you need to compete with other projects. For this, you’ll need a world-known IP, that matches the Chinese audience's interests. 7 out of 10 foreign games in Chinese top charts were based on big IPs.

One of the few remaining relatively easy ways to enter the Chinese market now is to launch the game on Steam. But there is always a risk that the platform will be closed.