Newzoo: PC and Console Games in 2024

It shows that the PC/Console market is very saturated.

Market Overview

The PC and console market grew by 2.6% in 2023, reaching $93.5 billion.

The console market size reached $53.1 billion (+1.7% YoY). The PC market size grew to $40.4 billion (+3.9% YoY).

❗️Newzoo notes that the growth is quite moderate despite the large number of major releases in 2023. This is likely due to limited user time. Major buy-to-play releases diverted the audience and cannibalized GAAS projects.

Paid games accounted for 56% of revenue on PC and 57% of revenue on consoles in the US and UK markets. Microtransactions accounted for 30% (PC) and 33% (consoles); paid downloadable content accounted for 12% (PC) and 8% (consoles). The rest was attributed to subscriptions.

From 2015 to 2021, PC and console markets grew by 7.2% annually. In 2022-2023, the growth was negative, at -0.4% CAGR. However, Newzoo analysts are quite optimistic and expect the segment to grow by 2.7% annually until 2026, reaching $107.6 billion by the end of 2026.

Revenue growth is limited by the slowing growth of the audience base. On PC, the audience grew by 4% annually from 2018 to 2021, by 0.9% annually from 2021 to 2023, and is expected to grow by 1.6% from 2023 to 2026. On consoles, the audience grew by 8.9% annually from 2018 to 2021, by 3.8% from 2021 to 2023, and is expected to grow by 3% from 2023 to 2026.

Fortnite; Roblox; Minecraft; GTA V; the Call of Duty series are leaders on PC and consoles in terms of MAU (excluding Nintendo Switch). The most interesting thing here is something else. The average age of projects in the top 10 by MAU is 9.6 years on PC; 7.4 years on PlayStation; 7.2 years on Xbox; and 3.9 years on Nintendo Switch.

❗️This indicates that it is extremely difficult for new games to displace behemoths that have established themselves in the market. People still return to them.

Looking more closely at the top MAU rankings, there are ecosystems (Fortnite; Roblox); sandboxes (Minecraft; The Sims; GTA V); competitive multiplayer games (League of Legends; Counter-Strike; Valorant); annual major franchises (FIFA, Call of Duty); AAA projects (Starfield); and Nintendo exclusives are included.

Despite their age, both Roblox and Fortnite are growing in terms of MAU. Roblox is expanding to new platforms (the release on PlayStation in October 2023 led to a +54% MAU increase); Fortnite is releasing new modes and gaming experiences (the releases of Fortnite OG; LEGO Fortnite, etc., led to a 60% MAU increase in November 2023 and a 16% increase in December 2023).

How people play on PC and Consoles

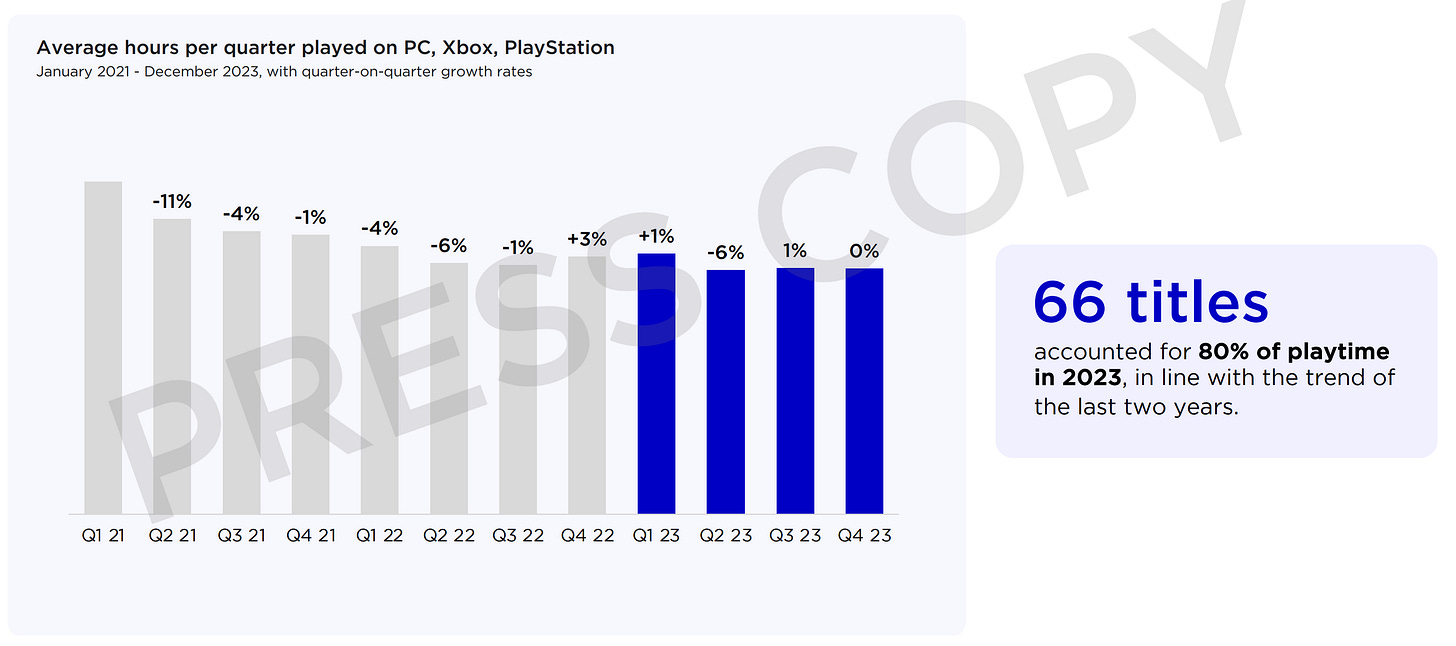

Since 2021, people have been playing less on PC and consoles. The total amount of time spent on games in Q4 2023 was 26% less than in Q1 2021.

❗️Newzoo compares the figures with the peak of pandemic lockdowns. For clarity, it is better to compare with Q4 2019 figures.

66 games on PC and consoles account for 80% of all gaming time.

In 2023, games older than 5 years accounted for 61% of all gaming time on PC and consoles. Another 16% of gaming time was spent on games aged 3 to 5 years. The situation was better in 2022 and 2021.

However, in 2023, relatively new games (less than 3 years old) were able to increase their share to 23% of gaming time. This is the best result in the last 3 years.

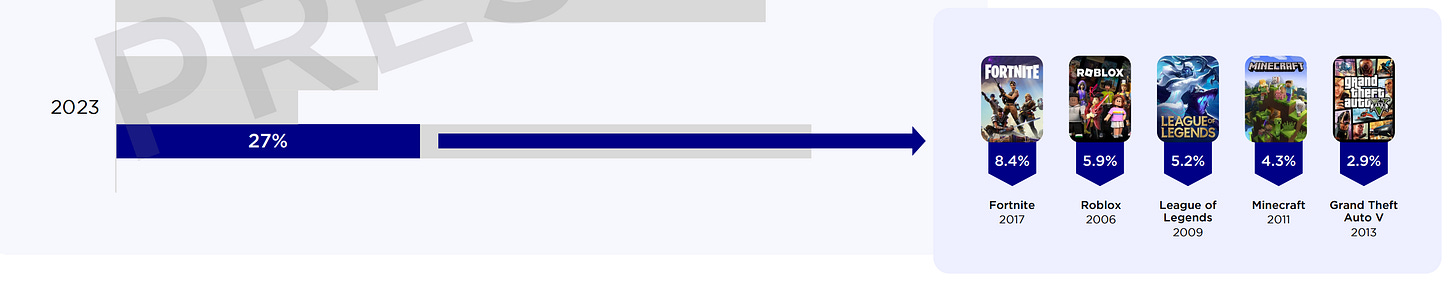

In 2023, Fortnite (released in 2017); Roblox (2006); League of Legends (2009); Minecraft (2011); and GTA V (2013) accounted for 27% of all gaming time for users.

❗️With a high degree of probability, these users are unlikely to go anywhere - they have been living in these games for years. This should be remembered when modelling business strategies.

Of the 23% of all gaming time spent on new games in 2023, 60% came from annual franchises - Call of Duty; EA Sports FC; NBA 2K; Madden NFL; MLB: The Show. Thus, in reality, new projects only accounted for 8% of audience time.

3.5% of players' time from these 8% was spent on Diablo IV; Hogwarts Legacy; Baldur’s Gate III; Elden Ring; and Starfield. Only one of these games is GAAS.

If we consider new games (released in 2022 and earlier, and accounting for 23% of gaming time in 2023) that users spent time on in 2023, the situation is as follows - 90% of the time was spent on 48 projects. The remaining 10% was spent on more than 1400 projects.

73% of the time was spent on GAAS Pay-to-play projects (including Call of Duty, with a total of 25 such projects); 16% was spent on Premium projects (20 games); 10% - on 1400 other games; 1% - on free GAAS games (3 projects).

90% of revenue from new projects (released in 2022 and earlier) came from 43 projects. 59% came from paid GAAS projects (almost 80% of this came from annual franchises); 32% - from new paid games.

All genres, except third-person shooters (+27% YoY) and Action-RPGs (+5% YoY), lost gaming time in 2023.

Market Situation

The number of publishers in the market has been declining since 2021. In 2023, there were constantly 23 publishers in the market (+5 that appeared in ratings), which accounted for over 80% of MAU on PC and consoles.

Overall, the number of games played by users has not changed since 2021. Only the time they spend on games has decreased.

80% of the top 50 games by MAU in 2023 have franchises; the brightest representatives without franchises are The Finals, BattleBit Remastered, Ready or Not, Starfield, and Party Animals. In the top 250 games, 54% has a franchise.

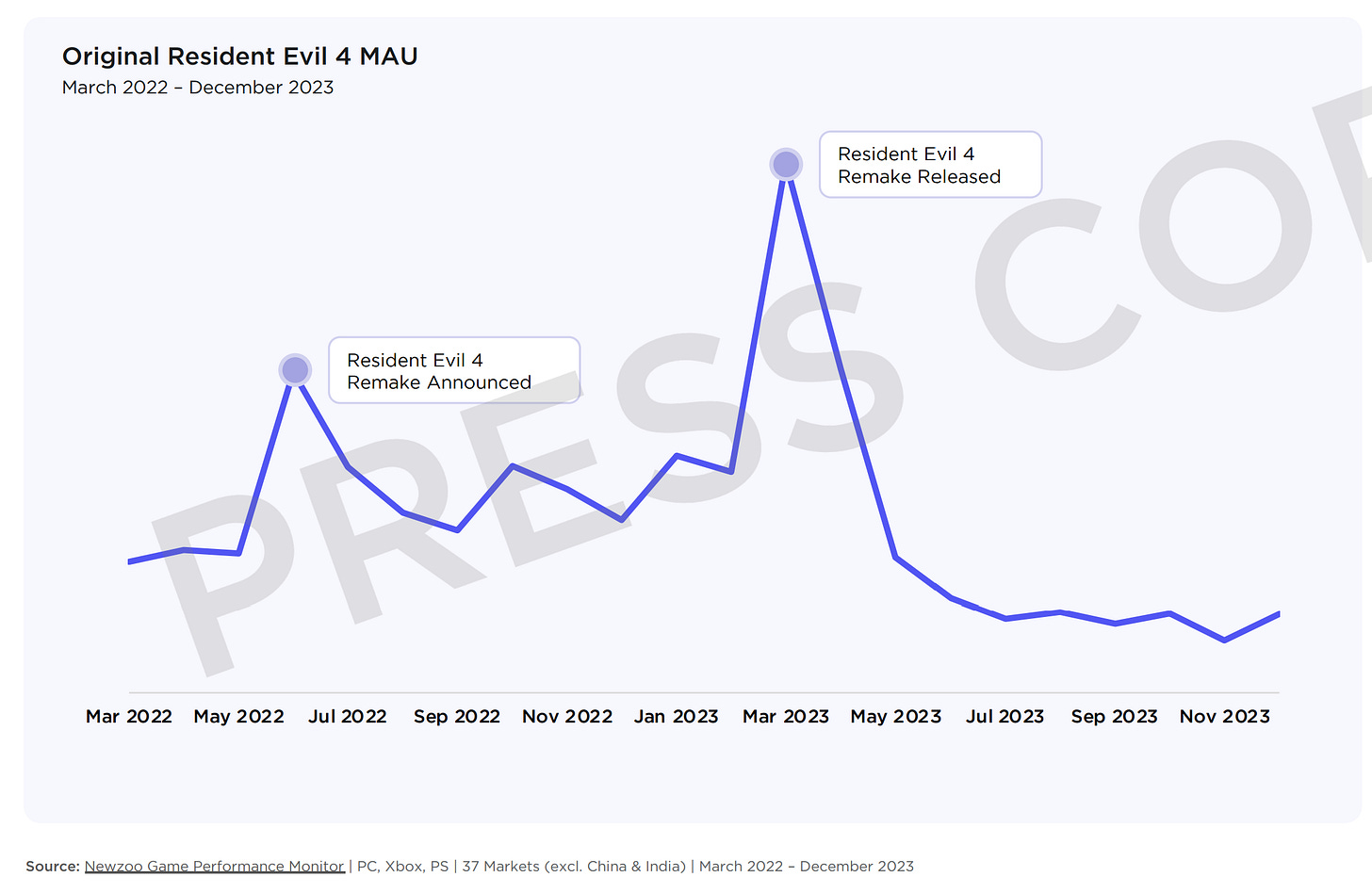

Newzoo notes the success of remasters and remakes. Square Enix sold over 7 million copies of Final Fantasy VII Remake; Capcom successfully released Resident Evil 4 Remake (over 6 million copies); Konami is preparing remakes of MGS 3 and Silent Hill 2.

Remakes have a positive impact on the performance of the original game. For example, MAU in Resident Evil 4 increased by 57% after the remake was announced. It grew even more significantly after the release.

❗️However, it is worth noting that after the release of the remake, MAU of the original game dropped below the values before the remake was announced.

Newzoo analyzed 35 transmedia launches and found a positive impact on games. On average, games see a 35% increase in MAU after releasing content related to the franchise (movies, series, etc.).

Launching on mobile devices helps franchises reach new audiences. For example, in Call of Duty Mobile, the percentage of female audience is higher than on PC and consoles. And EA Sports FC Mobile managed to capture a new audience in markets where PC and consoles are not as developed.

Potential Growth Factors

Newzoo analysts note that there is a large category of players transitioning from one multiplayer game to another. The study was conducted based on Palworld; projects with 150,000 or more total MAU were compared. More intersections were found in paying users with Enshrouded, The Remnant II, Party Animals, and The Finals.

The boundaries between PC, consoles, and mobile devices are blurring. 47% of the audience plays on two systems or more.

The growth rate of the PC audience in developing markets exceeds the growth rate of the console audience by 23 times. This is likely due to economic reasons.

Developing markets show more interest in cloud gaming than developed countries. There is interest in Latin America, India, Southeast Asia - markets typically considered mobile-centric.