Newzoo: PC and Console market in 2025 | Sponsored by Neon

One of the most important reports of the year is live. Check the numbers!

Market overview

Newzoo predicts that the console segment will be the primary growth driver for the market by 2027. Between 2021 and 2024, the PC market grew by 1.2%, while the console market increased by 2.1%. From 2024 to 2027, the company expects PC growth to reach 2.6% and console growth to hit 7%, with the market projected to grow to $92.7 billion.

In 2024, premium game sales on PC dropped by 2.6% year-over-year, while microtransactions grew slightly (+1.4% YoY) alongside DLC sales (+0.8% YoY). The PC segment was valued at $37.3 billion by the end of 2024.

The rising popularity of premium monetization models does not lead to overall PC market growth, as established free-to-play (F2P) projects generate most of the revenue. Additionally, the number of PC players is not increasing, making monetizing the existing audience a major challenge. There is hope for increased spending among Gen Z and Alpha users, but they currently spend less compared to how much they play.

A word from the newsletter sponsor

Neon is more than just another DTC provider for games. Our webshop, checkout, and merchant-of-record solutions are designed to attract players, increase conversions, and build long-term loyalty. The result is higher revenue and better profit margins. That’s why top studios like Metacore, PerBlue, and Space Ape choose Neon. If your direct-to-consumer strategy hasn’t come together or isn’t delivering the results you need, we can help. Visit Neon to learn more.

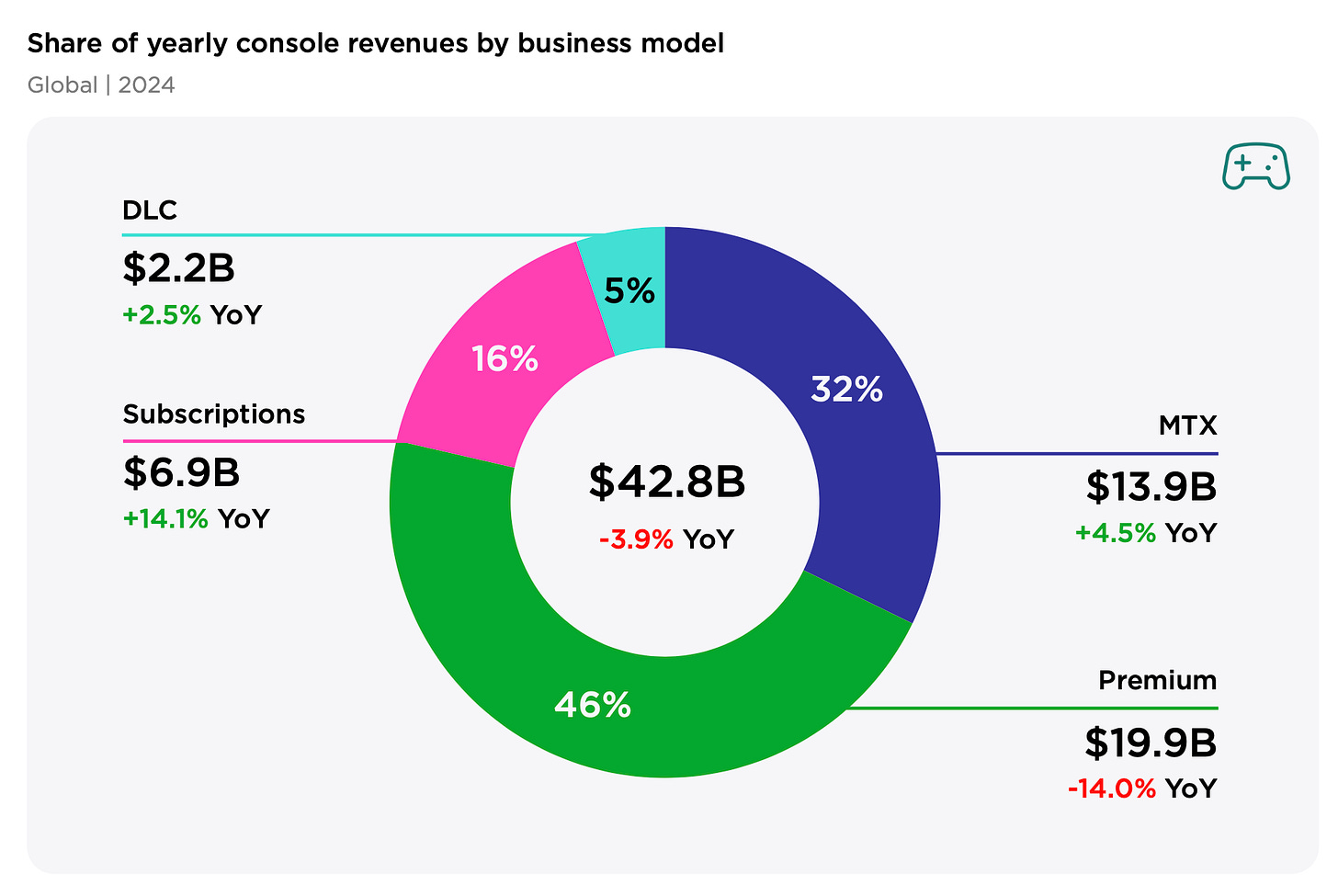

The console segment declined by 3.9% in 2024, reaching $42.8 billion. Game sales dropped by 14% (to $19.9 billion). However, subscriptions grew (+14.1%, reaching $6.9 billion), along with microtransactions (+4.5%, reaching $13.9 billion) and DLC sales (+2.5%, reaching $2.2 billion).

Newzoo attributes the drop in game sales to post-pandemic corrections and a strong lineup of releases in 2023. Growth is expected from this year onward, driven by factors such as the release of GTA VI, Nintendo Switch 2, and a new console cycle.

The player base for both PC and consoles has been growing at approximately the same rate since 2021.

Player Playtime Analysis

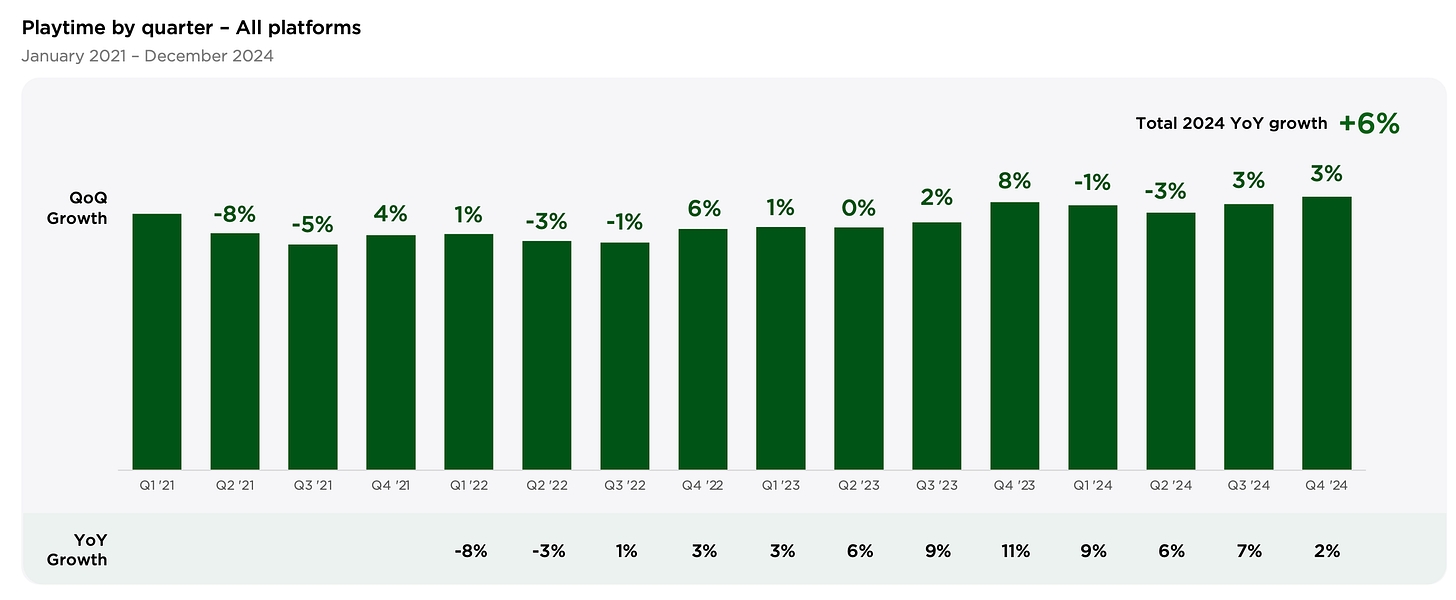

Q4'24 marked a record month for total player playtime since Q1'21.

Increased user engagement primarily came from buy-to-play (B2P) monetization projects and Call of Duty. This game is so influential that it can single-handedly impact trends.

Playtime for F2P projects also increased significantly, with Roblox growing by +21%, Fortnite by +8%, and Marvel Rivals capturing audience share from Overwatch 2.

While playtime on PC and Xbox remained stable, PlayStation saw a significant increase (+21%) in 2024. After a +12% growth in playtime in 2023, the PC segment stabilized.

On PlayStation, Call of Duty accounted for 16% of total playtime; Fortnite for 15%; and Roblox for 3%.

New releases accounted for only 12% of total playtime in 2024—a modest improvement compared to previous years since 2021—but older projects (over six years old) dominated with 57% of total playtime.

When we’re speaking of new projects, annual franchises like Call of Duty and EA Sports FC are included. And they take a lion's share of the playtime.

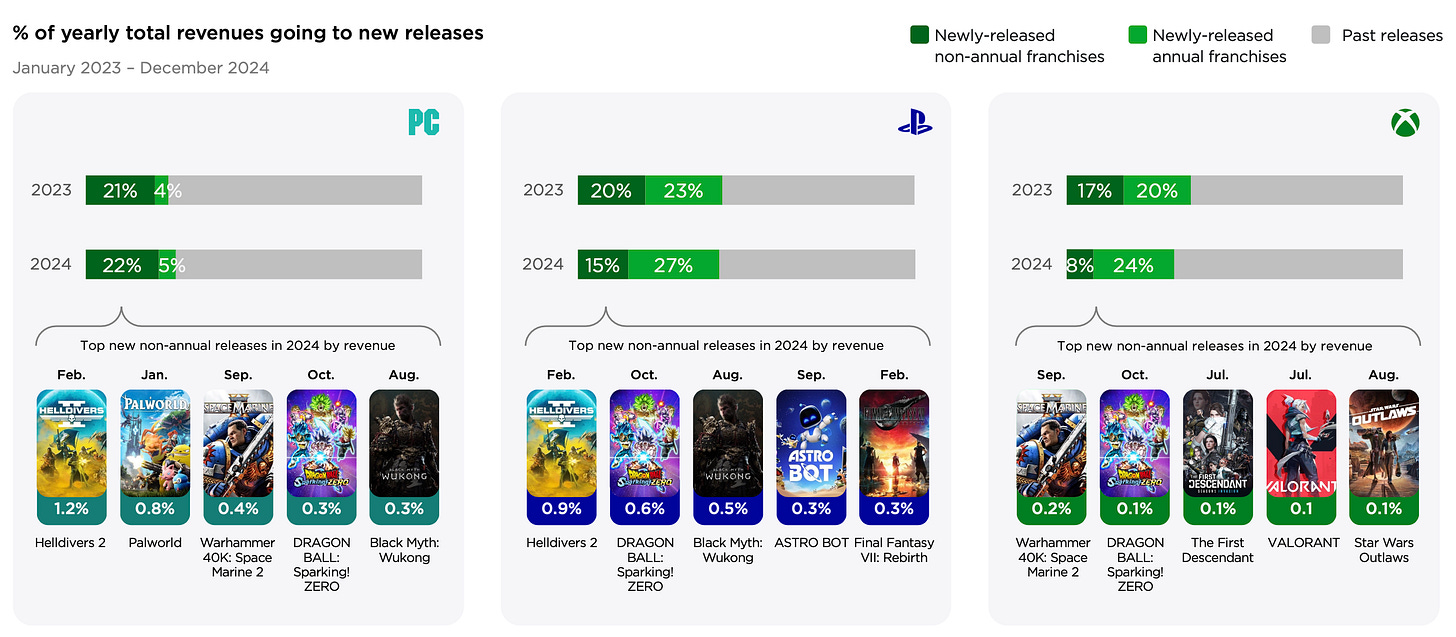

On consoles, new games accounted for a higher share of total playtime (15%) compared to PC (8%). However, non-annual release projects perform better on PC than consoles (7% vs. 6% on PlayStation and 5% on Xbox).

On PC the situation is better for projects that are not part of annual releases (such as Call of Duty, EA Sports FC, Madden NFL, and others). These new games perform better on PC, accounting for 7% of total playtime compared to 6% on PlayStation and 5% on Xbox.

Revenue-wise, the PC remains the best platform for new games, while annual franchises sell better on PlayStation and Xbox due to sports game releases for which many people are buying hardware.

12 games on PC, 9 games on PlayStation, and 11 games on Xbox account for 50% of total playtime.

On PlayStation, the number of B2P projects contributing to 50% of playtime is increasing.

When considering 90% of total playtime, the number of games included in this selection on consoles is growing, giving more projects a chance. However, on PC, the number of B2P projects within the 90% playtime category is decreasing.

Shooter games and RPGs are growing in audience engagement, while Battle Royale has been declining in audience share since 2021.

In 2024, sports games, shooters, and Battle Royale were the most popular genres on consoles. On PC, shooters led by a significant margin.

How many games do people play?

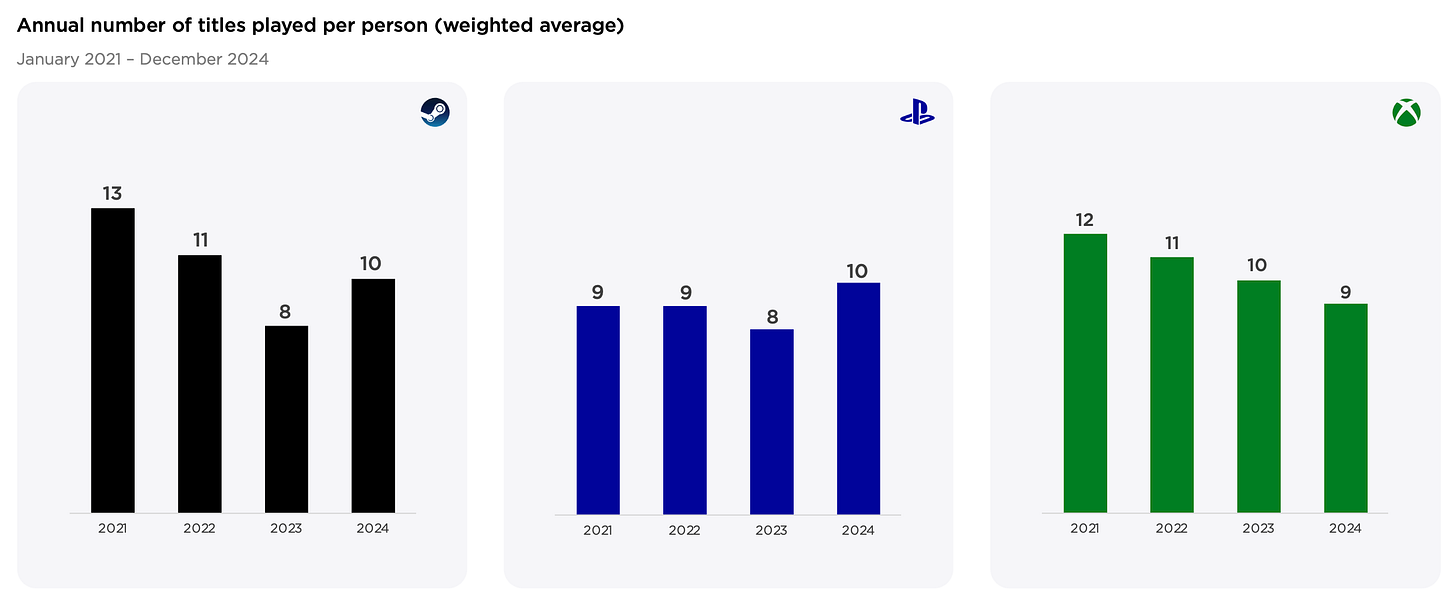

Newzoo analyzed over one million users; games were counted if players spent more than two hours in them and if total player numbers exceeded ten.

Over time, people tend to play fewer games on average. However, there was growth in Steam and PlayStation engagement in 2024, while Xbox saw declines.

User attention continues to focus on a small number of products; between 31-34% of players engage with only one to three games annually across platforms.

On each platform, over 95% of users play titles within the top 50.

PlayStation is the only platform where the number of games that people play has grown since 2021.

On consoles, the share of newer games (less than two years old) has been declining since 2021; Steam saw growth in this area during 2024 due to indie and AA projects.

When looking at the bigger picture, people on consoles tend to play free-to-play and AAA projects more often, while indie and AA projects are more likely to appear in the top rankings on Steam.

Users who play a larger number of projects tend to prefer the B2P monetization model. This can be easily explained by the fact that F2P games often require significant time investments.

Interestingly, PvE games are more popular on Steam than on consoles. Moreover, the more games a user plays, the higher the likelihood that they engage with PvE games.

Regarding genres, Steam has seen an increase in RPG popularity since 2021. On consoles, however, Battle Royale is declining in popularity, while adventure games, RPGs, shooters, and sports titles are gaining traction.

A word from the newsletter sponsor

Neon is more than just another DTC provider for games. Our webshop, checkout, and merchant-of-record solutions are designed to attract players, increase conversions, and build long-term loyalty. The result is higher revenue and better profit margins. That’s why top studios like Metacore, PerBlue, and Space Ape choose Neon. If your direct-to-consumer strategy hasn’t come together or isn’t delivering the results you need, we can help. Visit Neon to learn more.

Additionally, the more projects a player engages with in a year, the less they tend to play shooters and Battle Royale games.

Steam Visibility

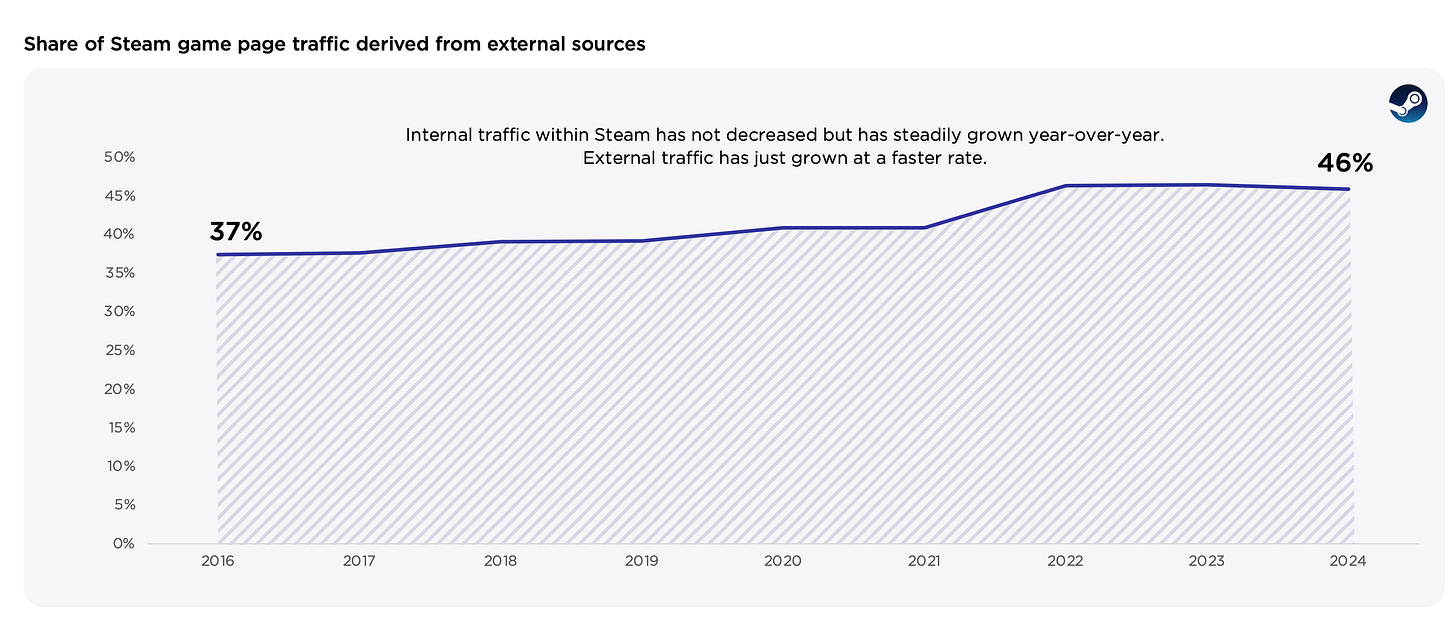

External traffic share in Steam grew from 37% in 2016 to 46% in 2024.

Popular projects rely less on external traffic as platform algorithms likely favor them.

Individual Steam promotions (e.g., Weekend Deals) became four times less effective since 2019; viewership increases dropped from a multiplier of x38 to x7.4 as of late 2024 figures.

Launch discounts reportedly boost game views up to 38x.

❗️I don’t understand what is used for benchmarking here.