Newzoo: The Games Market in 2025

It's positive, and the prediction is that the market will grow!

Newzoo has released its key report covering the numbers, trends, and results of 2025. The report will be updated as new data arrives.

The report does not include the hardware sales.

Overall Market State – Revenue

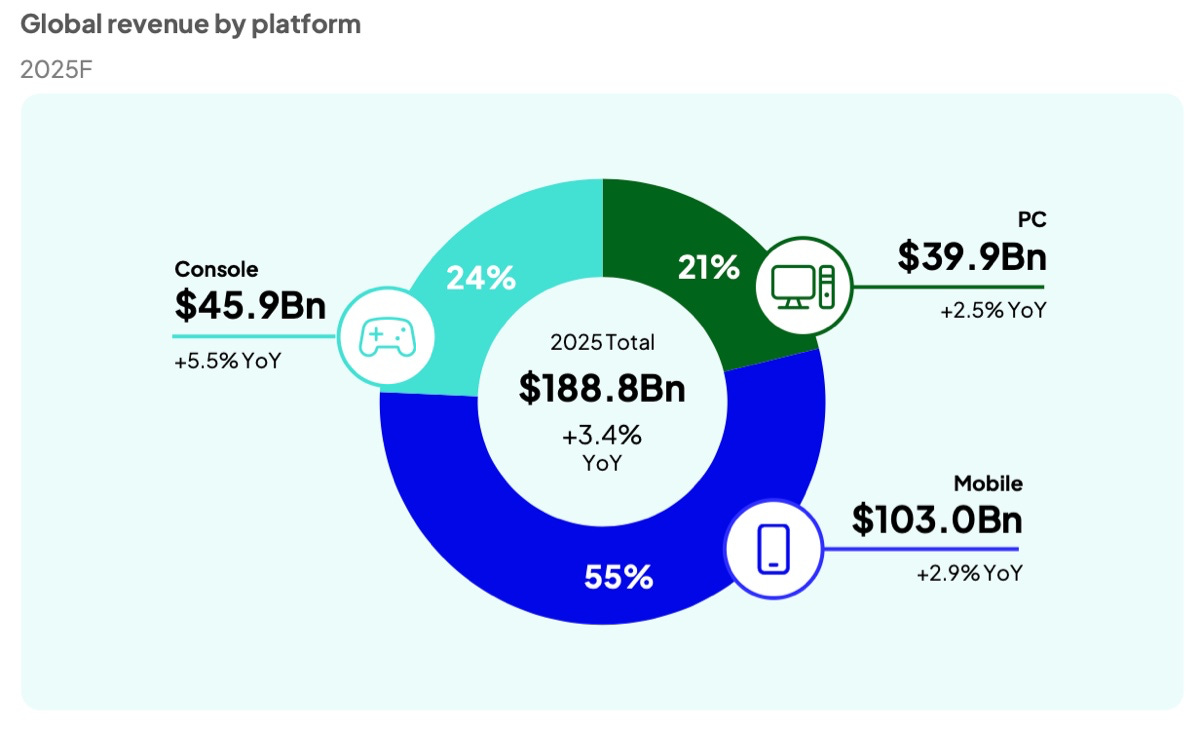

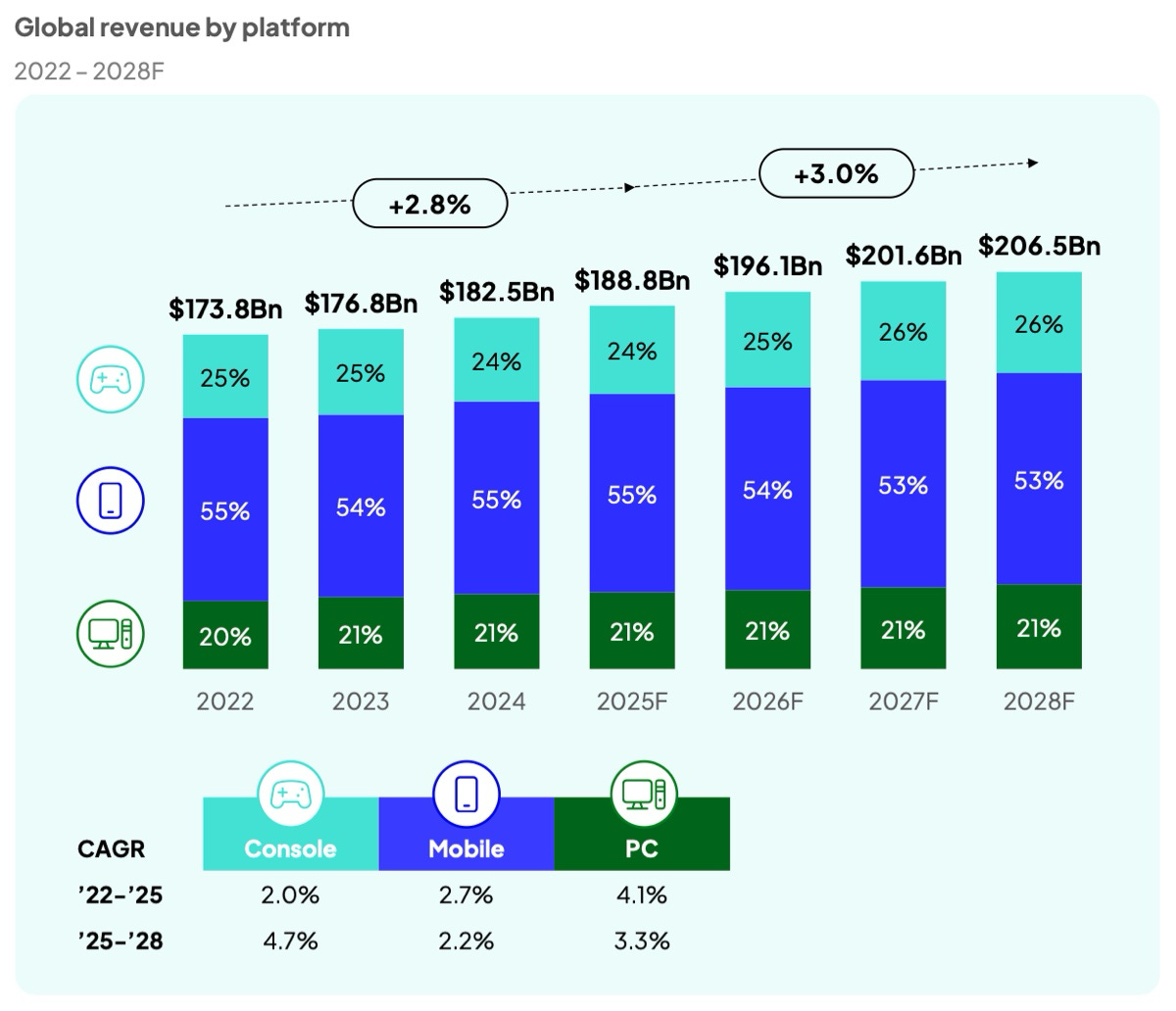

Total games market revenue in 2025 will reach $188.8 billion, which is +3.4% compared to 2024.

The console segment is projected to grow the fastest, with +5.5% YoY to $45.9 billion. Newzoo attributes the growth to the launch of Nintendo Switch 2 and a general rise in prices.

Sports games continue to grow and make strong revenue on consoles. By the end of 2025, Newzoo forecasts $10.6 billion in revenue (console-only) with YoY growth of +3.5%.

The mobile market will increase by +2.9% and hit $103 billion.

Newzoo points out that the mobile market is undergoing structural changes. D2C payments are reshaping revenue composition for devs and publishers, but not driving overall segment growth.

Roblox continues strong growth on mobile.

RPGs, one of the largest mobile genres, are struggling. In 2025, the genre will generate $18.7 billion, down –14.7% YoY.

PC market revenue will reach $39.9 billion (+2.5% YoY). Growth is seen in both player numbers and revenue in China (+3.1% YoY) and Japan.

❗️Steam Deck and other handhelds are counted as part of the PC segment in Newzoo’s classification.

Part of PC market growth comes from stronger releases in H1’25 vs last year — Monster Hunter Wilds, Kingdom Come: Deliverance II, Assassin’s Creed Shadows. 2024 hits like Palworld and Helldivers 2 also add to the pool.

Newzoo notes that PC shooters will bring in $9 billion in 2025. That’s –5% YoY.

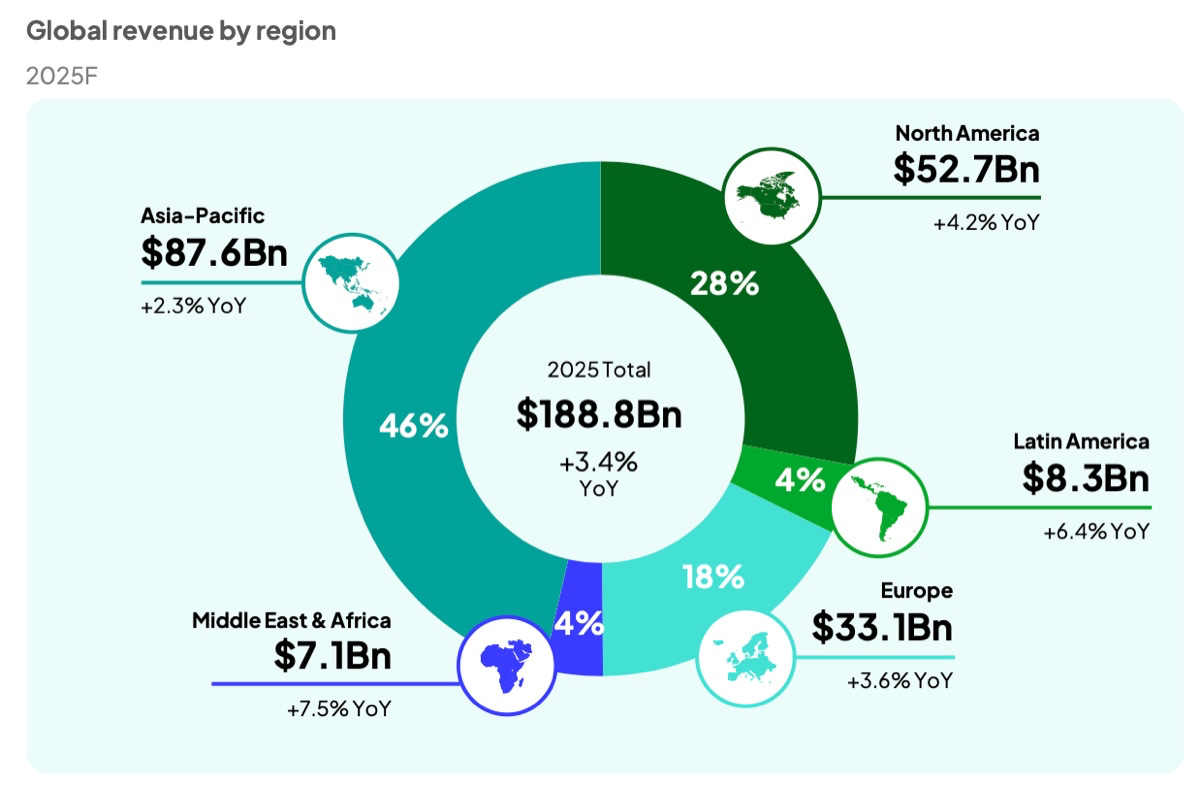

46% of global revenue comes from the Asia-Pacific region ($87.6 billion). But the fastest growing region is MENA, expected to hit $7.1 billion in 2025 with YoY growth of +7.5%.

Overall Market State - Players

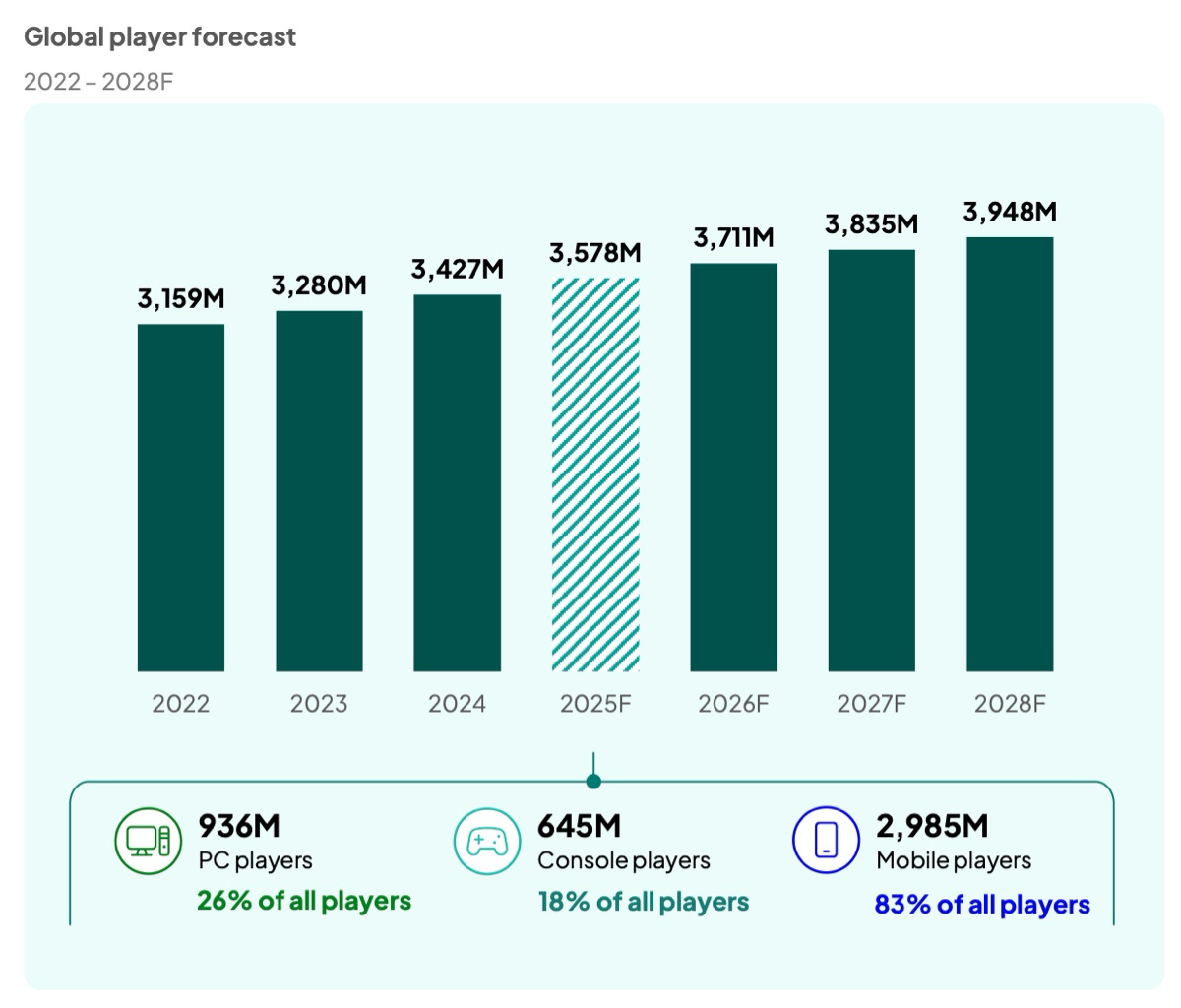

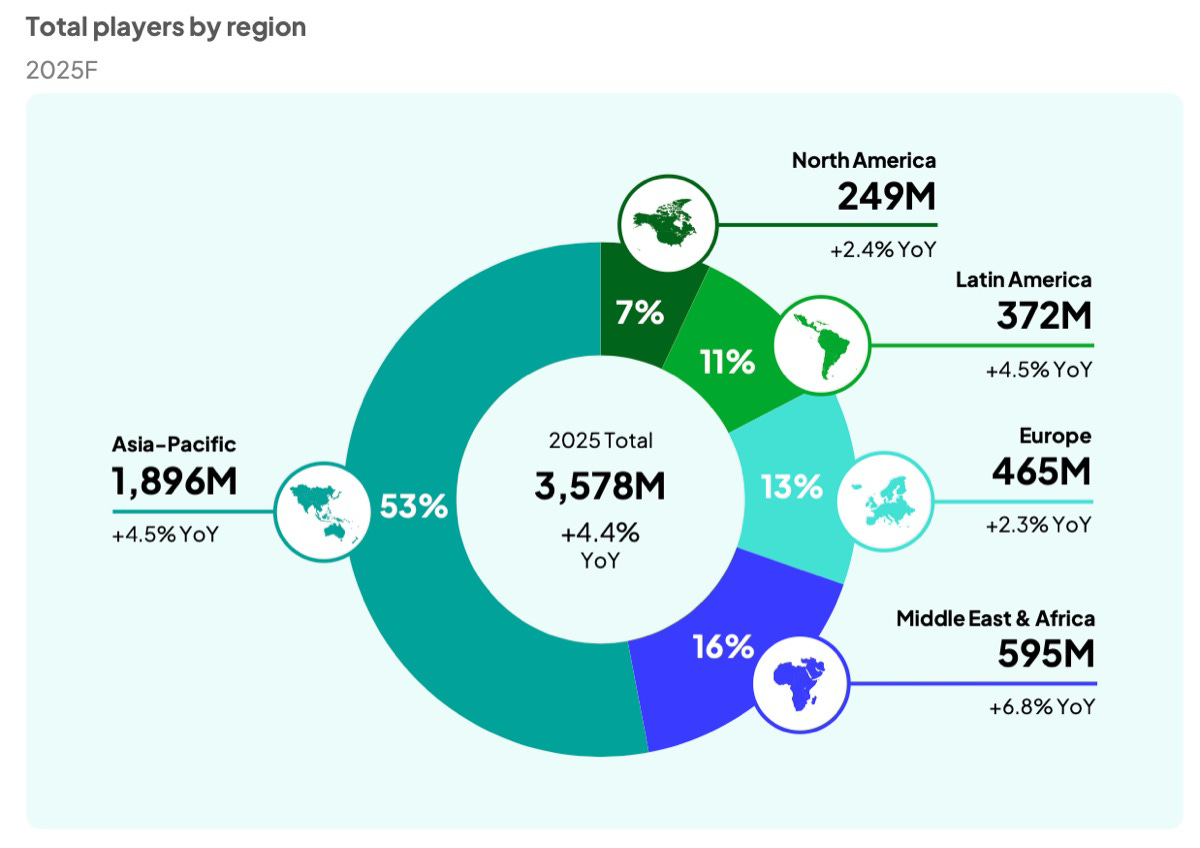

Global players in 2025 will reach 3.578 billion (+4.4% YoY), or 61.5% of the world’s population. By 2028, Newzoo expects this number to approach 4 billion.

The number of Mobile players is expected to reach 2,985 billion (+4.5% YoY); PC players: 936 million (+3.1% YoY); Console players: 645 million (+2.5% YoY).

Mobile player numbers are rising in Canada, much of Europe, and Oceania. Newzoo points to two interconnected trends: first, iOS is losing share in both emerging and developed markets (including the US); second, Chinese smartphone makers (Xiaomi, Realme) are rapidly expanding across Europe, MENA, and Southeast Asia.

53% of all players are in Asia-Pacific. Fastest growth comes from MENA (+6.8% YoY). Latin America’s growth is mainly driven by mobile and PC.

Gen Alpha players (born after 2010) are becoming a larger share, especially on PC.

Steam continues to grow faster than the overall PC player base.

1.6 billion people (+4.9% YoY) spent money in or on games in 2025. That’s 44% of all players.

The paying player base is growing faster than the overall player base. The average annual spend per payer is $119.7 across all games.

Impact of Release Dates, Early Access, release tactics

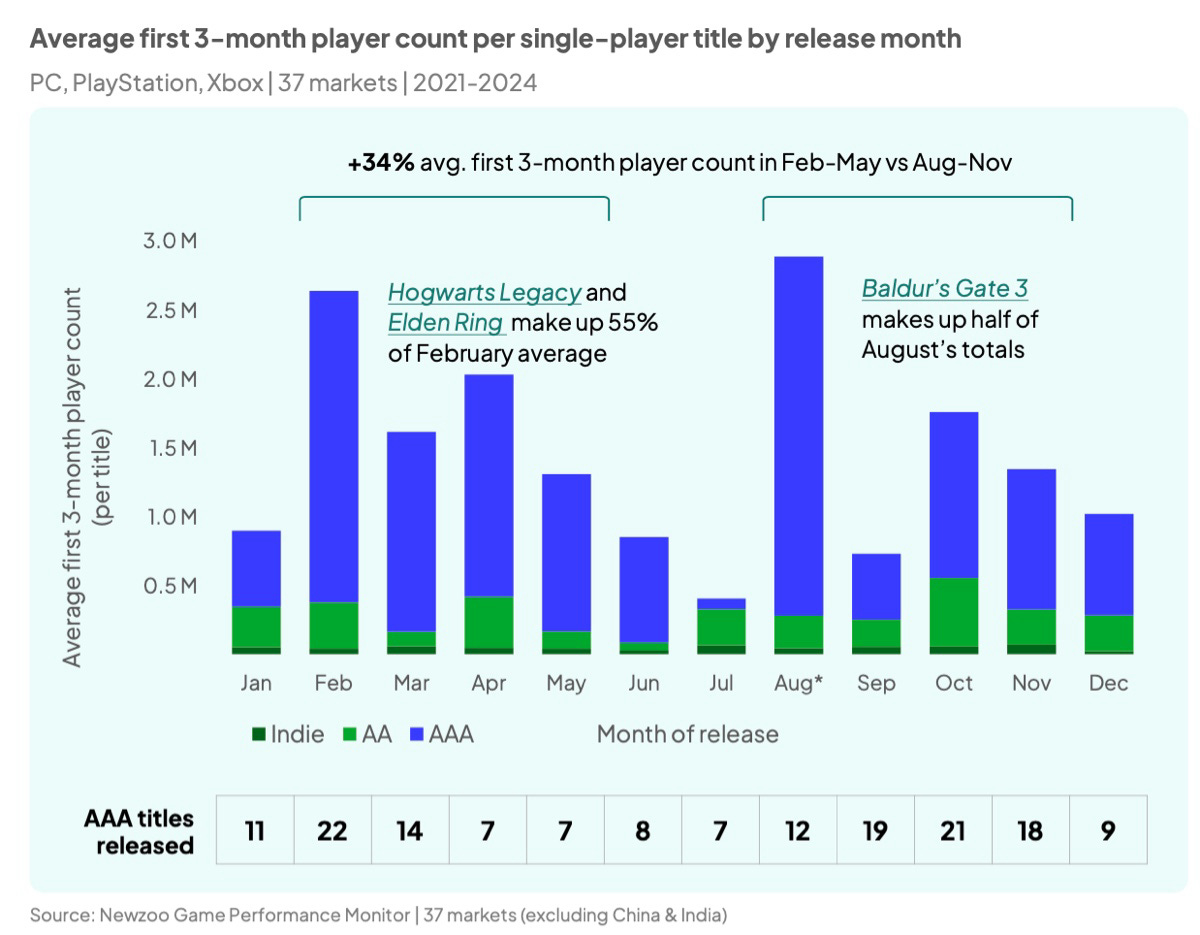

Newzoo analyzed single-player launches from Jan 2021 – Dec 2024. A launch counts as first release on any platform. Titles launched on Xbox Game Pass within 3 months of release were excluded. Pricing categories: indie ($30 or less), AA ($31–50), AAA ($51+).

Success was measured as the average number of players in the first 3 months post-launch.

Traditional AAA release windows are February–March and September–November, these months have the highest release density.

Interestingly, Feb–Mar releases averaged 34% more players than Aug–Nov ones.

Exceptions skew Baldur’s Gate 3 accounted for over half of the Aug AAA average. Without it, August drops to October’s level.

Similarly in February, Elden Ring and Hogwarts Legacy made up 55% of total engagement. Without them, February numbers fall in line with May.

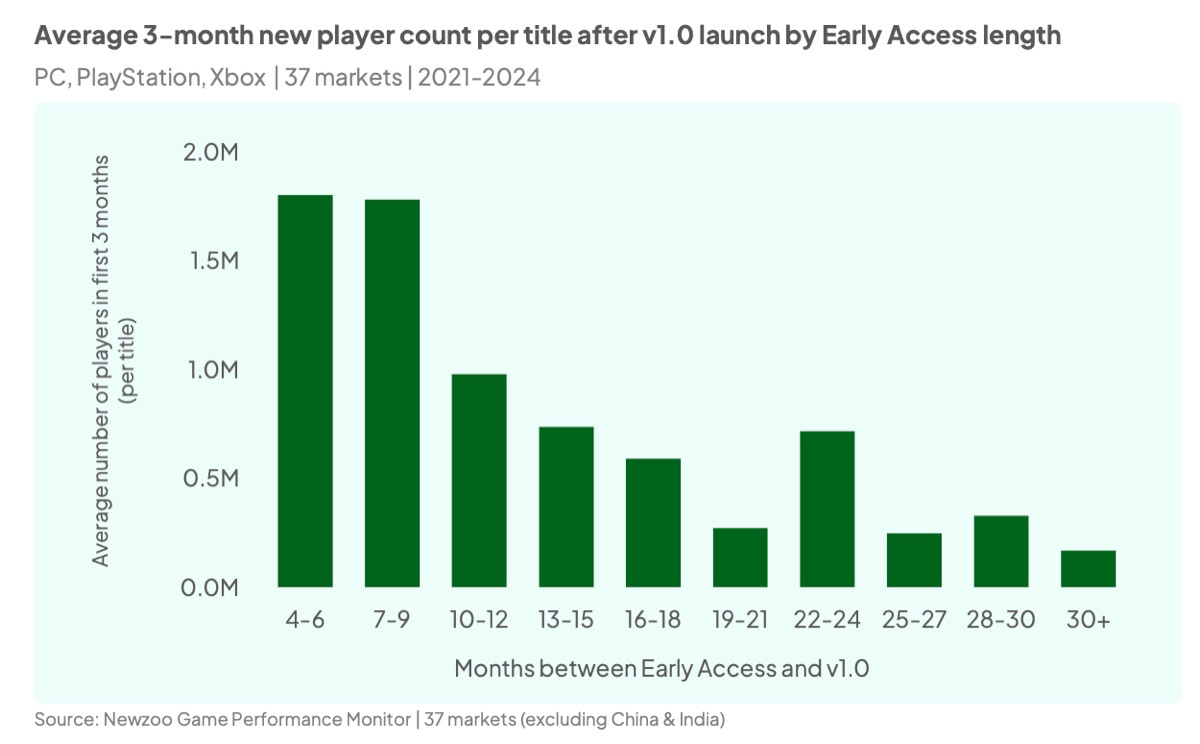

Early Access in Steam works best if limited to about 6 months. Longer Early Access runs saw weaker 3-month post-launch player counts, likely because the audience had already played enough.

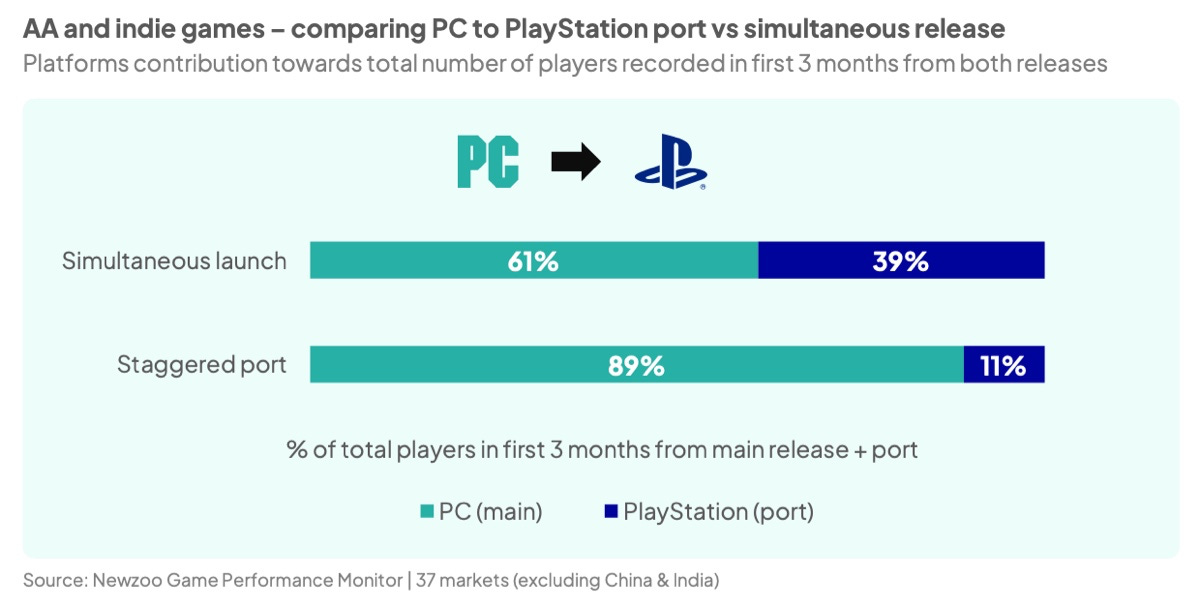

Newzoo compared simultaneous multi-platform launches with staggered ones (indie & AA in this case).

When launched simultaneously, PC made up 61% of the audience in the first 3 months. If console releases were delayed, PC’s share jumped to 89%. Console players generally show less interest in late-arriving projects.

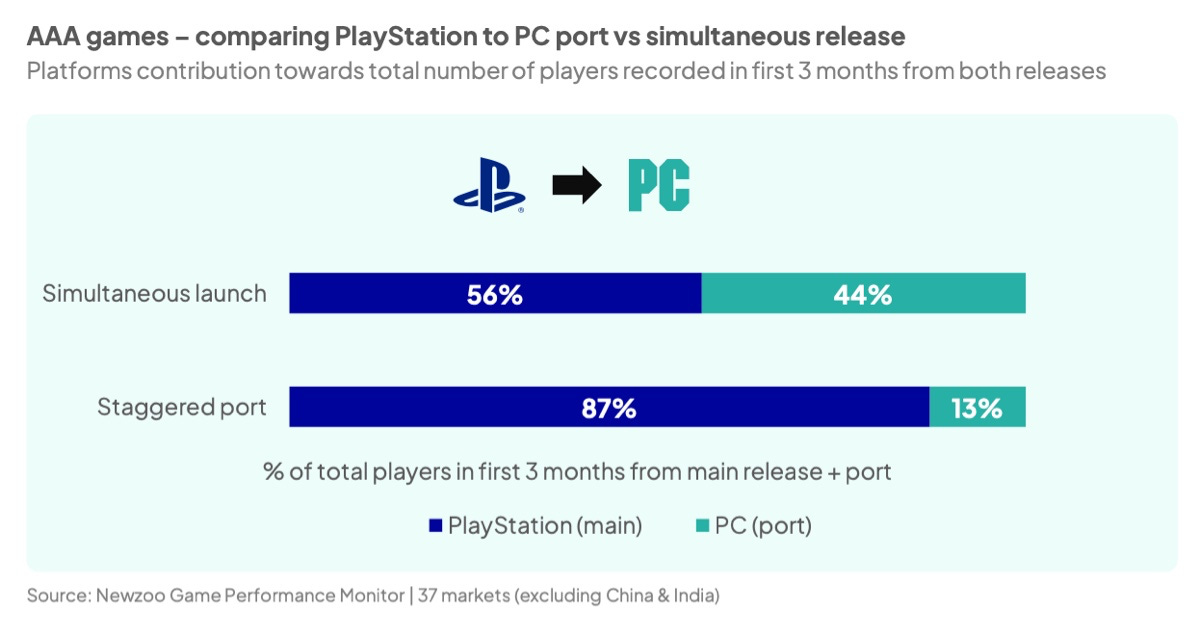

The reverse also applies: for PS games ported to PC. If simultaneous, 56% of the audience is on PlayStation. If PC is delayed, 87% of the audience stays on consoles. This covers AAA games (as they’re typically moving from PlayStation to PC).

❗️Newzoo covers only PC and PlayStation cases, since most Xbox releases launch on PC day-one, leaving too small a sample.

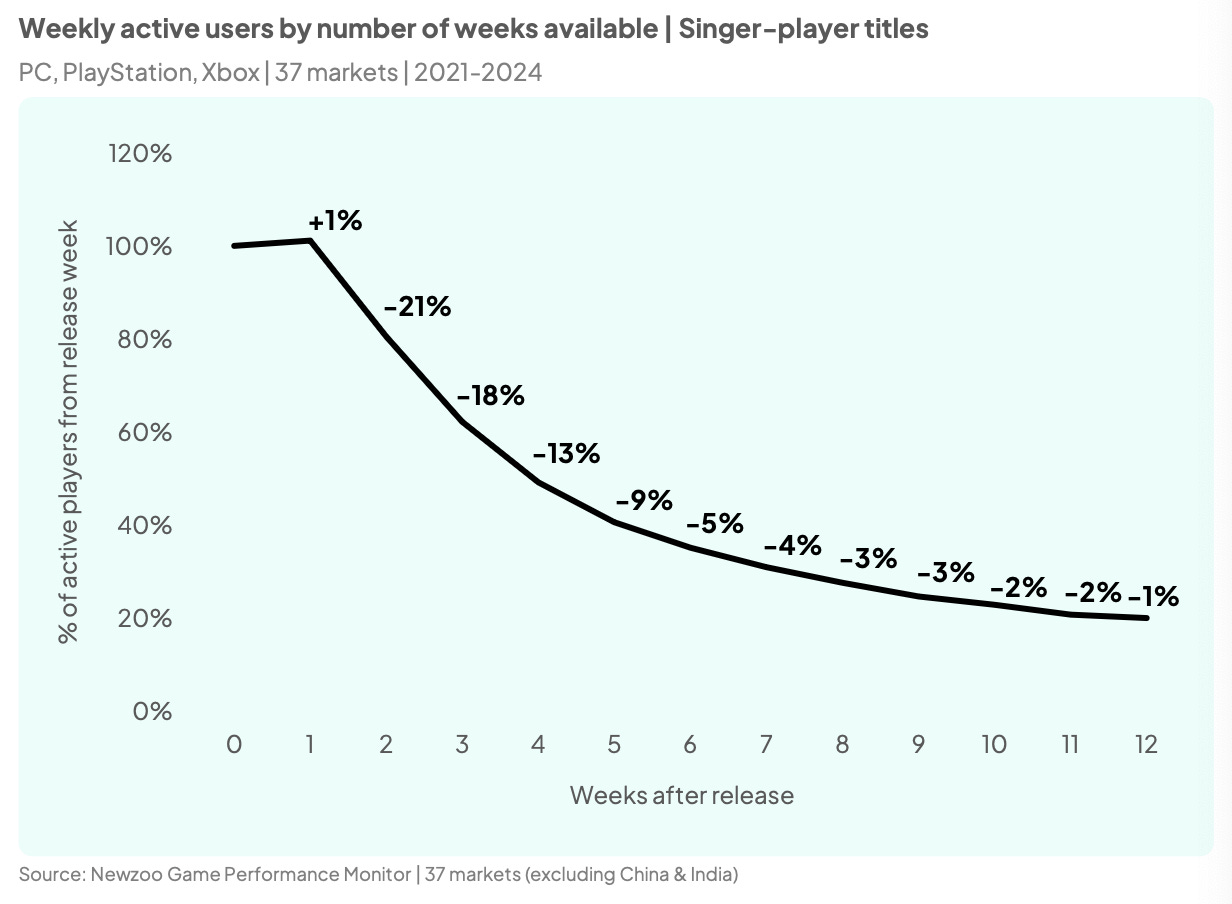

Player interest in new single-player games typically lasts 1–2 weeks. After that, engagement drops sharply (around –60% by week 5). Post week 12, retention declines at –1% per week. Metrics are based on % of active launch-week audience remaining.