Newzoo: The Gaming Industry in 2023

The main annual market numbers are here.

The user research is based on a survey of more than 74,000 people from 36 countries around the world aged 10 to 65. Revenue data does not include taxes, advertising, and "hardware" sales.

Revenue

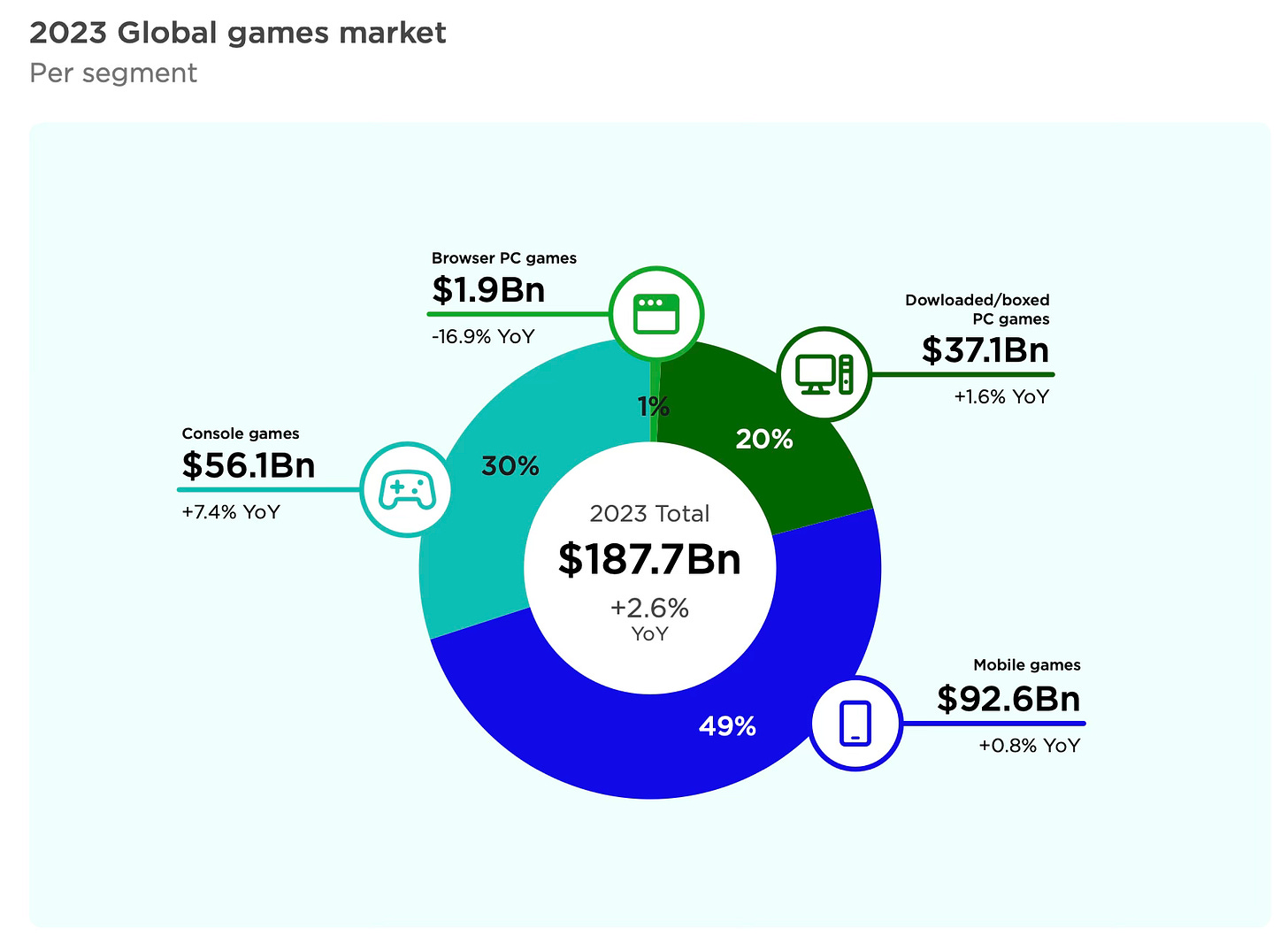

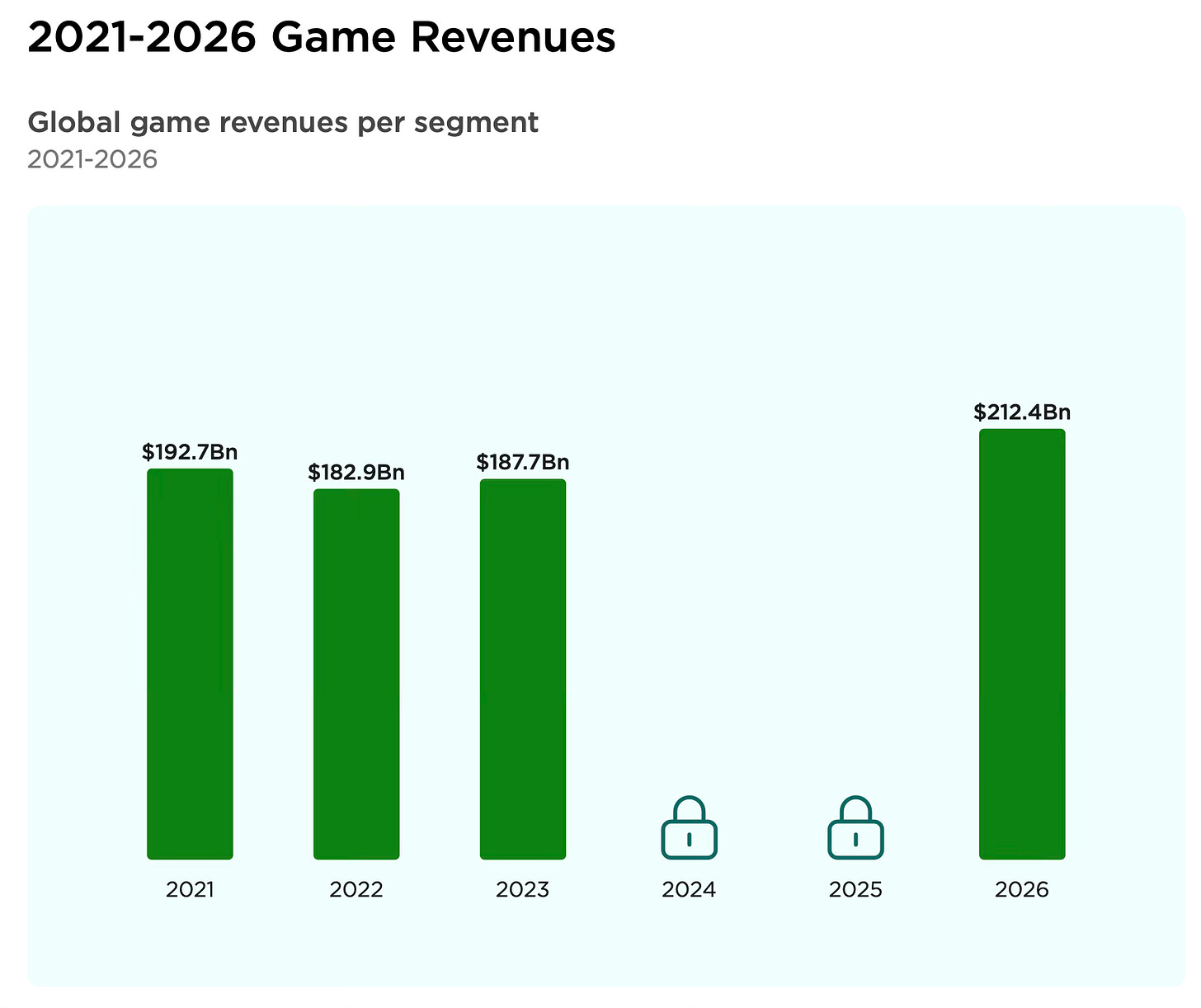

By the end of 2023, the gaming market will grow by 2.6% and reach $187.7 billion.

$92.6 billion (49%) - revenue of the mobile market. Newzoo believes that the growth of this segment will be limited due to platform policies regarding user data. By the end of 2023, it will grow by 0.8%.

The console market grew the most, by 7.4%, reaching $56.1 billion. Newzoo analysts note that this segment in 2022 underperformed in revenue due to delays in major releases and a shortage of consoles.

PC segment revenue by the end of 2023 will reach $37.1 billion. This is 1.6% more than the previous year. Browser PC games continue to decline rapidly, by 16.9% per year. The volume of this segment in 2023 will be $1.9 billion.

46% of gaming revenue ($85.5 billion) is concentrated in the Asia-Pacific region. 27% ($51.6 billion) in North America. 18% ($34.4 billion) in Europe. 5% ($8.8 billion) in Latin America. 4% ($7.2 billion) in the Middle East and Africa. This region is growing the fastest - by 6.9% per year.

Newzoo believes that the gaming market has stabilized after the pandemic growth and subsequent correction. By the end of 2026, the market volume will reach $212.4 billion.

Users

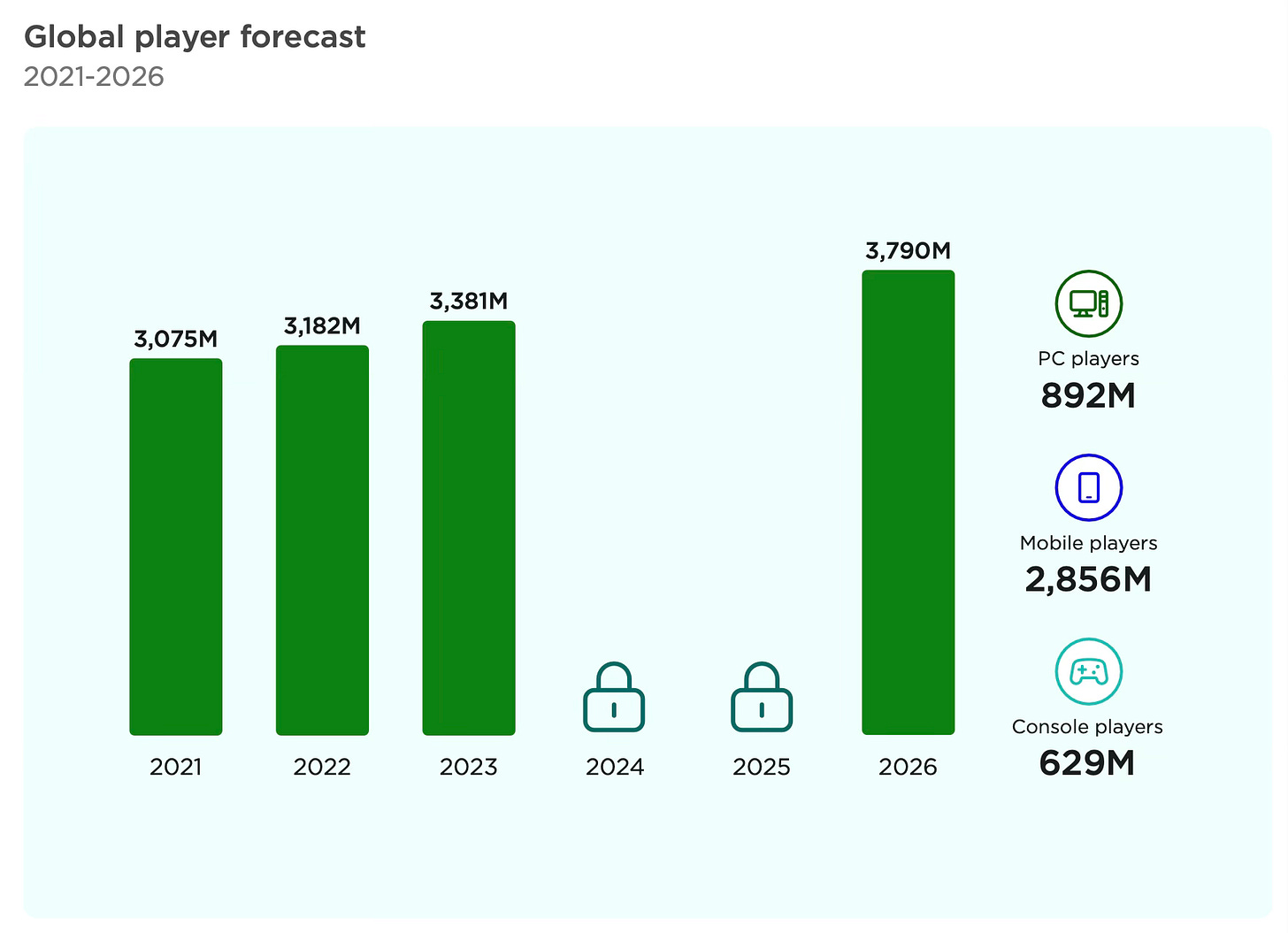

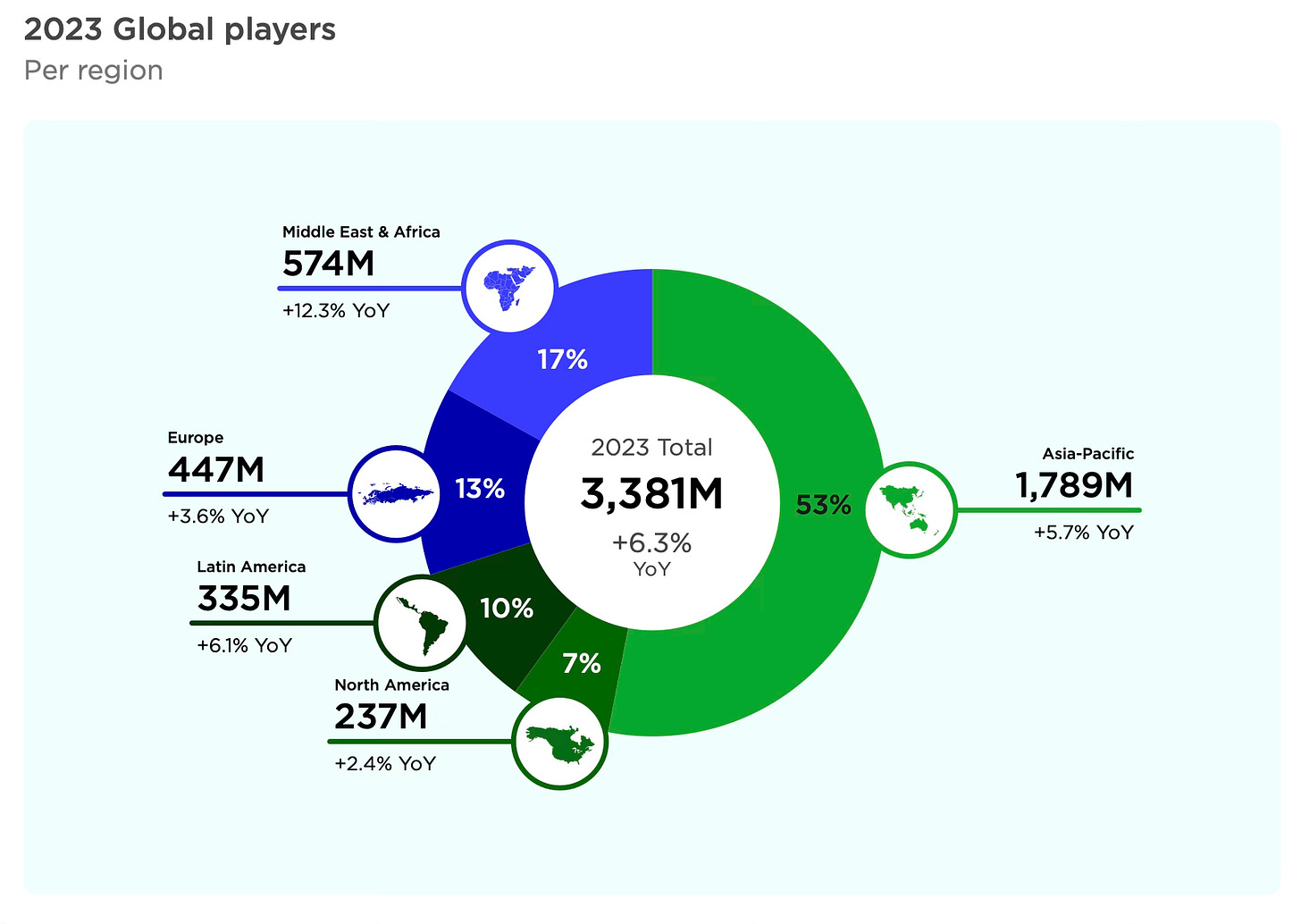

The number of gamers worldwide will reach 3.38 billion. This is 6.3% more than the previous year.

2.856 billion gamers play on mobile devices; 892 million on PC; 629 million on consoles.

53% of the entire gaming audience is concentrated in the Asia-Pacific region. 17% in the Middle East and Africa (also the fastest-growing region in terms of users - +12.3% per year). 13% in Europe; 10% in Latin America; 7% in North America.

The number of paying gamers by the end of 2023 will grow by 7.3% to 1.47 billion. The average annual growth rate from 2021 to 2026 is expected to be 4.7%, and by the end of 2026, there will be 1.66 billion paying gamers.

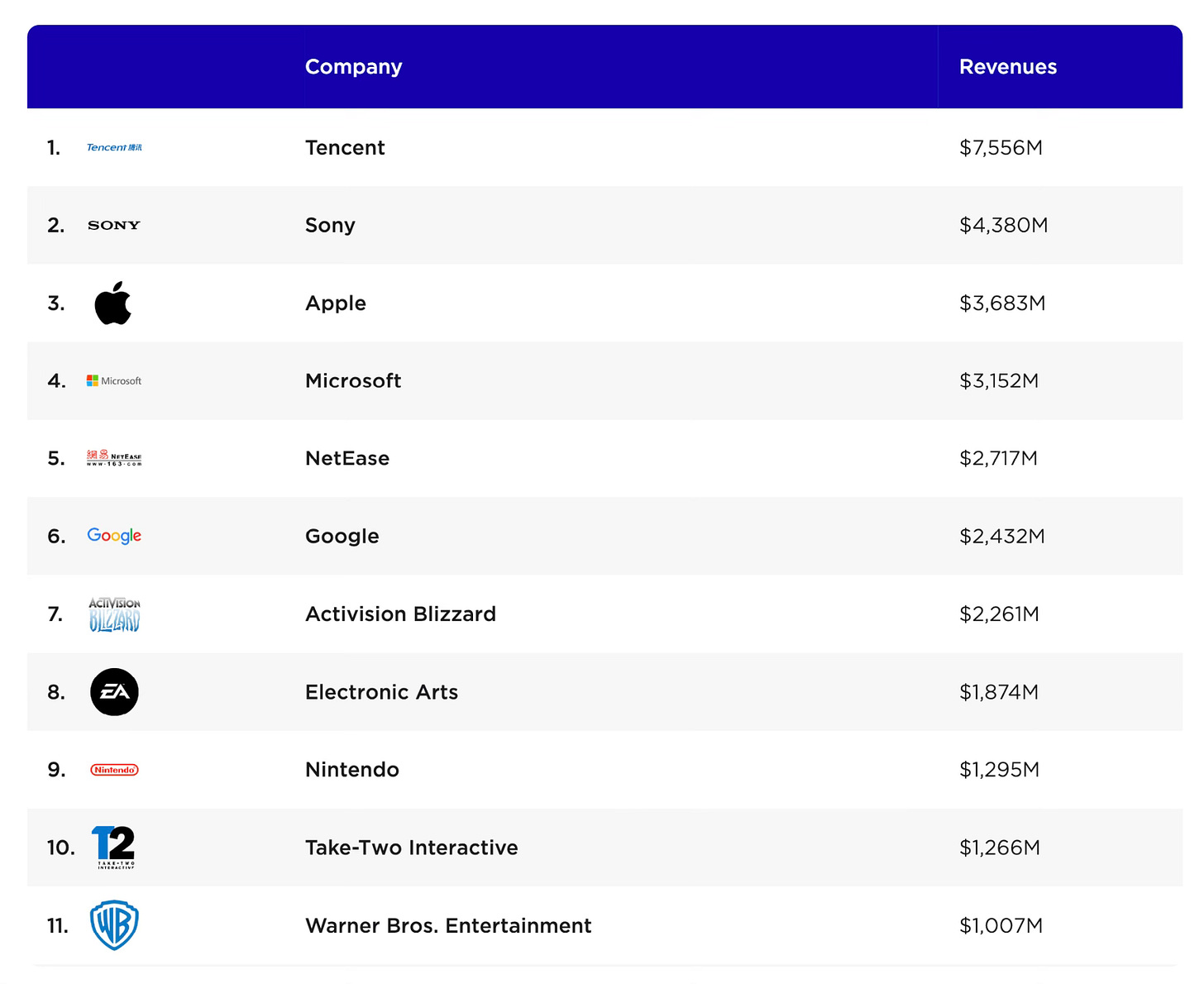

Companies

Tencent - the largest public company by gaming revenue. In 2023, it will earn $7.556 billion.

The combined revenue of Microsoft and Activision Blizzard will be $5.413 billion. This makes Microsoft the second company in the world by gaming revenue. Sony will have $4.38 billion in 2023.

Cloud Gaming

In 2023, the number of paying users will be around 43.1 million. By 2025, this number is expected to almost double - to 80.4 million.

Trends

The boom in live-service games continues. But it's very difficult for new players to get started.

AI is changing approaches to development in the gaming industry.

Complementary gaming devices are becoming increasingly popular. Newzoo includes Steam Deck and Nintendo Switch in this category.

Mobile game studios continue to adapt to changing platform regulations.

User-generated content (UGC), the creative economy, and opinion leaders become a crucial part of the success of games and studios.

Apple enters VR; Meta still believes in the direction. There is growth.

Development of the gaming market in Saudi Arabia (thanks to Savvy Games Group). Strengthening positions of developers from China and Japan.