Newzoo x Tebex: Player payment behaviour in the West in 2025

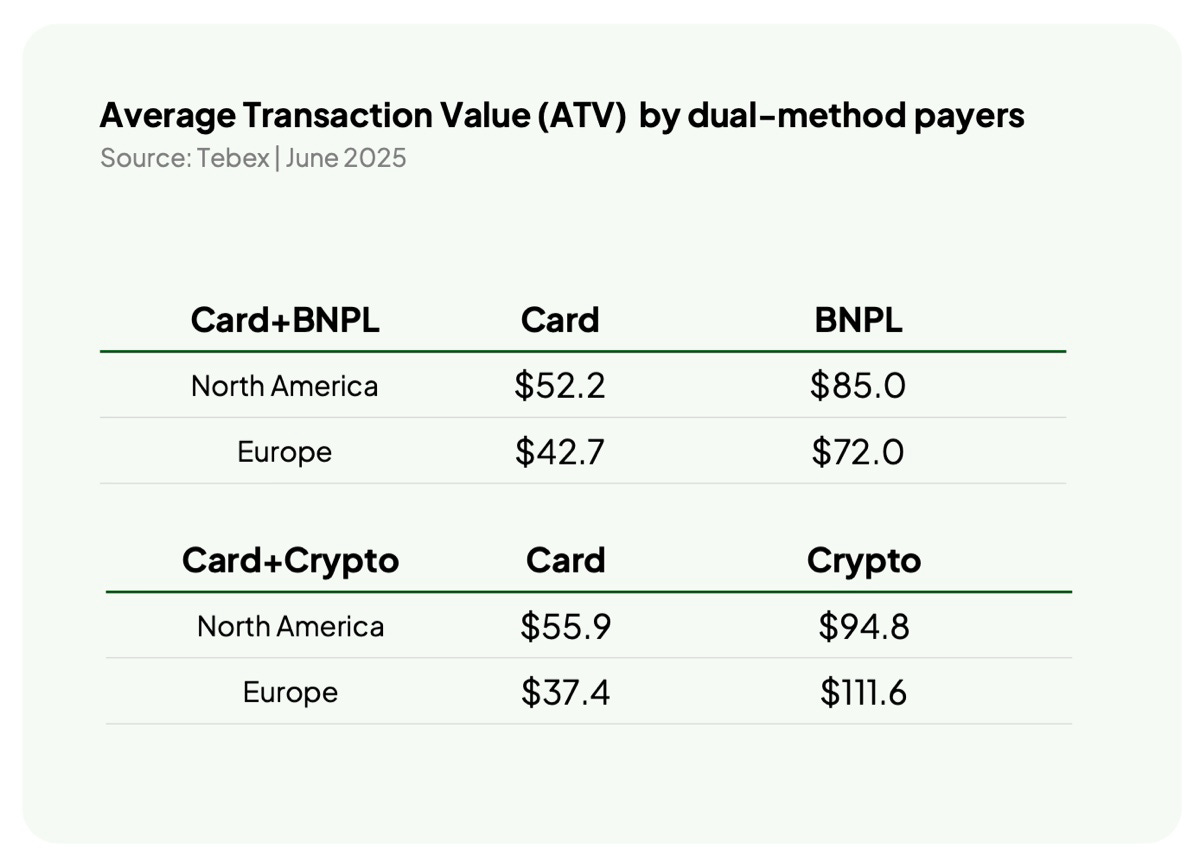

BNPL services and Crypto payments have a high median cheque, yet volume is unclear.

Tebex is a D2C payment system from Overwolf. Companies break down payments into different types, which are shown in the image.

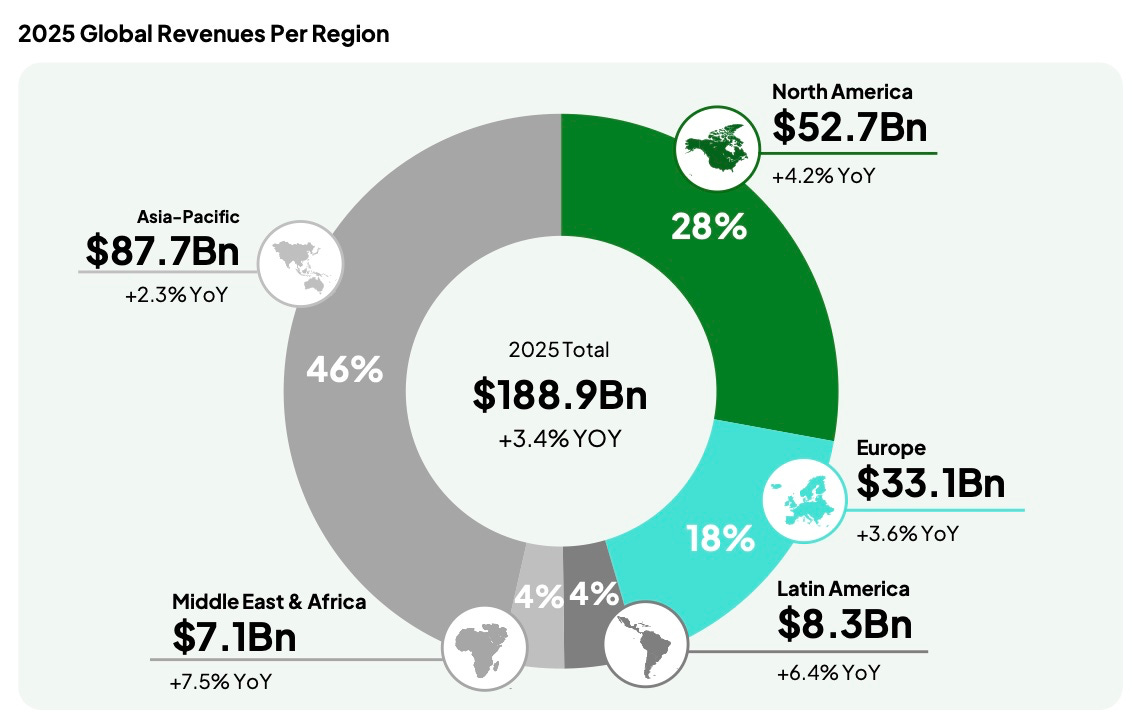

$188.9B is the size of the gaming market in 2025. North America and Europe account for 46% of all spending.

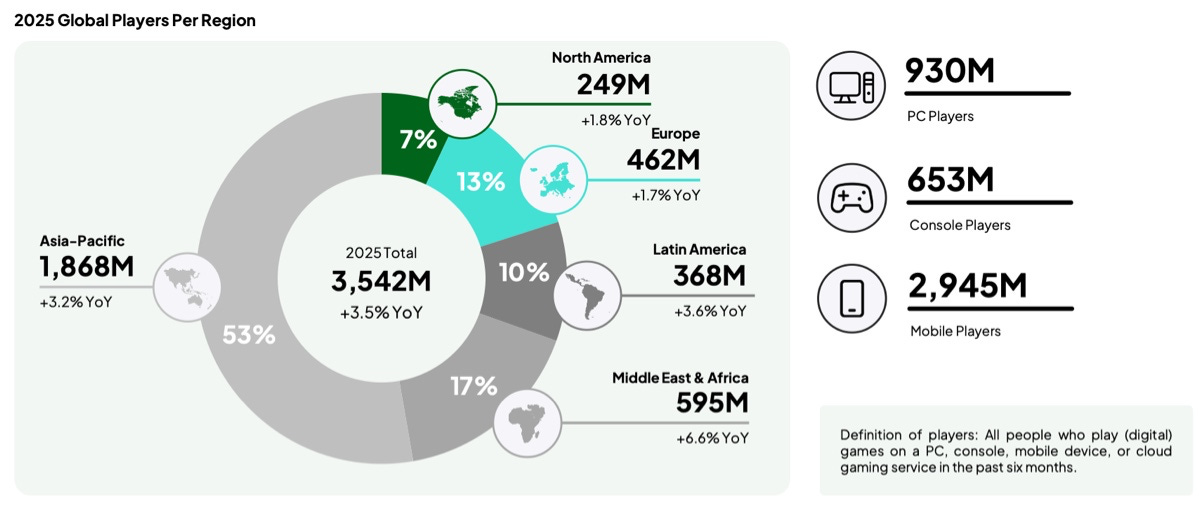

Despite taking a major share of revenue, North America and Europe make up only 20% of all players globally.

Payment characteristics in global markets

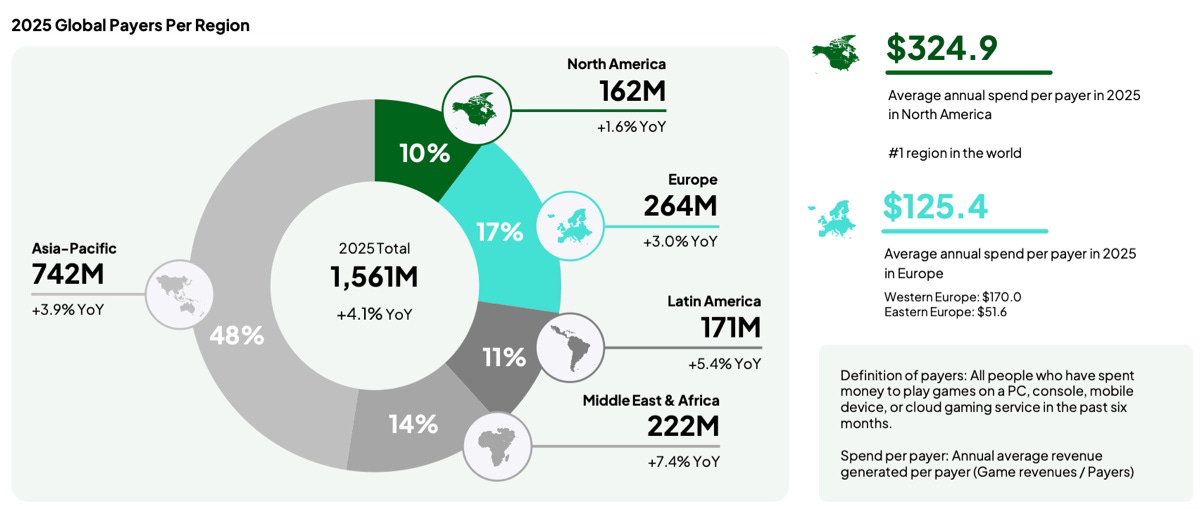

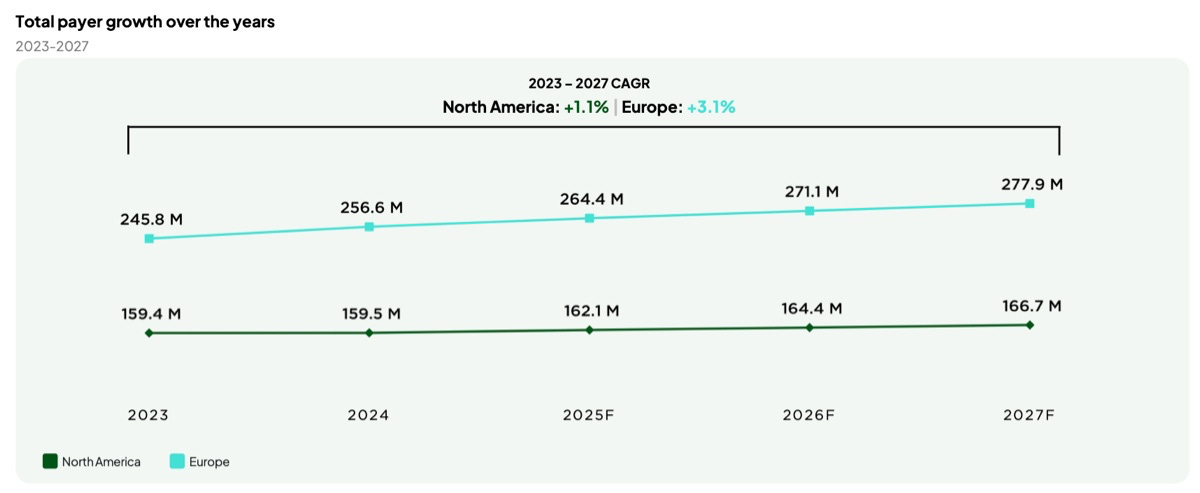

For the first time, Newzoo publishes statistics on the number of paying players by region. The Asia-Pacific region leads with 742M (+3.9% YoY); second is the Middle East & Africa (222M, +7.4% YoY); third is Europe (264M, +3% YoY); fourth, Latin America (171M, +5.4% YoY); last is North America (162M, +1.6% YoY).

North America has the highest annual ARPPU - $324.9. In Europe, it is $125.4, with Western Europe at $170, and Eastern Europe at $51.6.

Europe is growing faster than North America in the number of paying players. The average annual growth rate from 2023 to 2027 in North America is 1.1%, while in Europe it’s nearly three times higher, at 3.1% yearly.

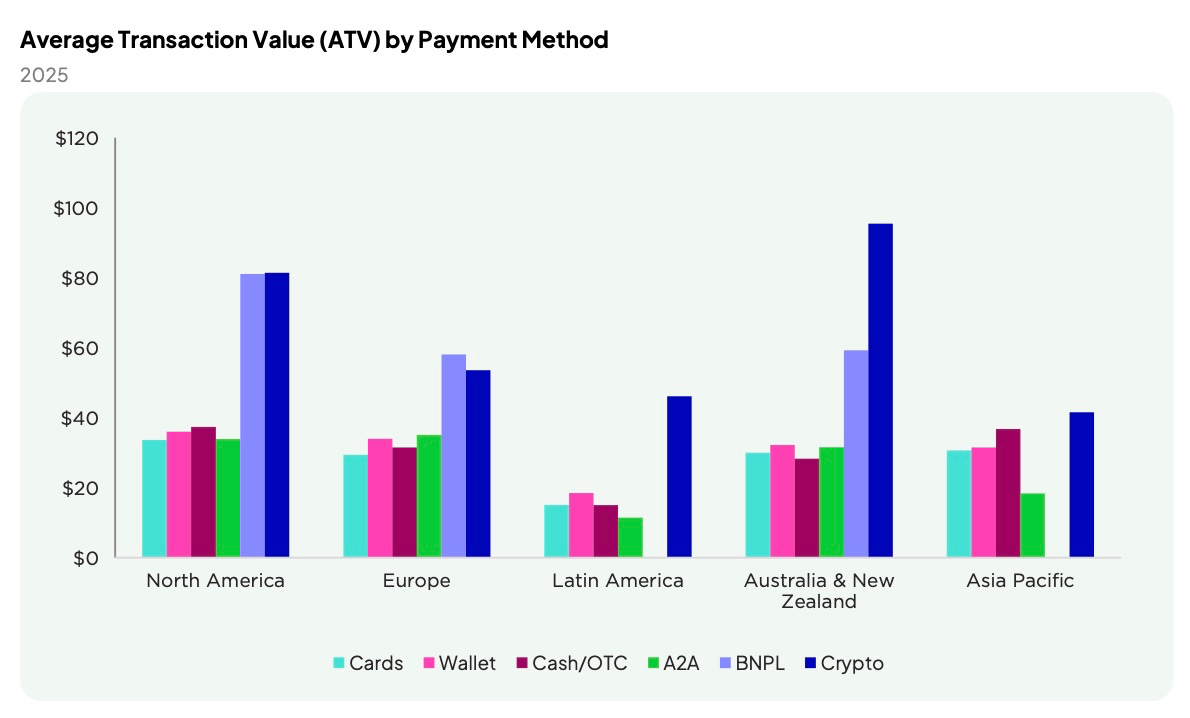

When looking at average transaction value ( ATV — total transaction volume divided by the number of transactions) for BNPL (buy now, pay later) & Crypto, North America, Europe, Australia, and New Zealand all have higher-than-average amounts compared to more traditional payment methods.

Speaking of payments. We at MY.GAMES passed $1M monthly revenue for Fable Town, our recent launch. Kudos to the MGVC Publishing team, our Mobile Publishing branch, and Reef Games, the developers. The game is now in the top 10 Merge-3 titles by Sensor Tower, and we’re steadily growing. Without crypto! 🙂

Users prefer different payment types. Tebex highlights BNPL and cryptocurrency payments. In Europe and North America, these methods have a higher ATV than card payments. However, the overall volume of such payments is still much smaller.

Among users who have used both cards and BNPL, there was no decrease in transaction frequency. The average monthly ATV in 2025 grew from $30 to $40. Most likely, this indicates that users, responding to inflation, prefer to buy more expensive, but more valuable items.

Shooters, RPGs, and puzzle games are the highest-earning genres in the US. In Europe, sports games lead. The main revenue comes from microtransactions, DLC, and subscriptions.

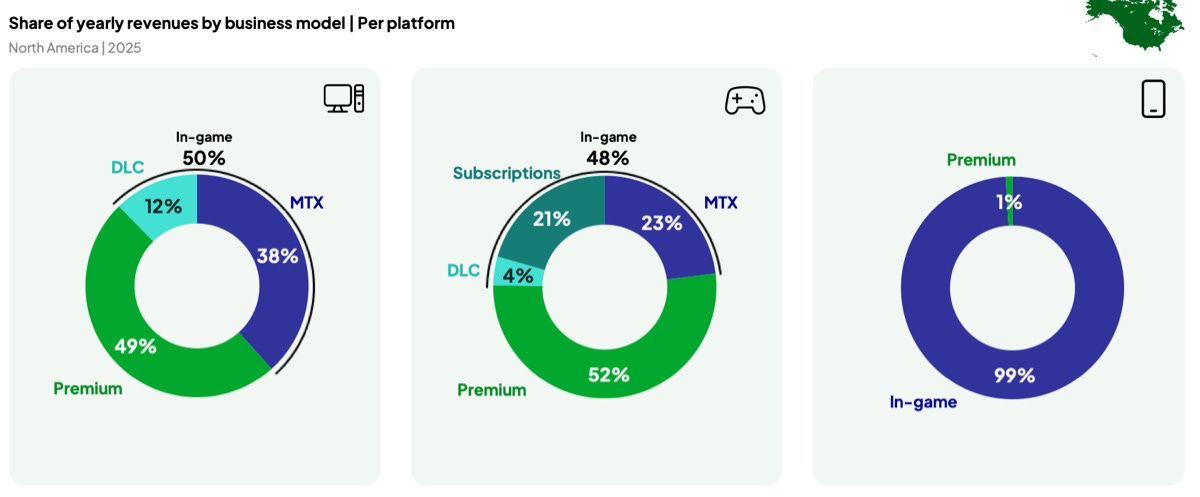

In the US, consoles have a unique source of revenue—subscriptions, which account for 21% of all spending. On PC and mobile, subscriptions are less common. Interestingly, despite subscriptions, more premium games are purchased on consoles (52%) than on PC (49%), even though theoretically those should be included in subscriptions.

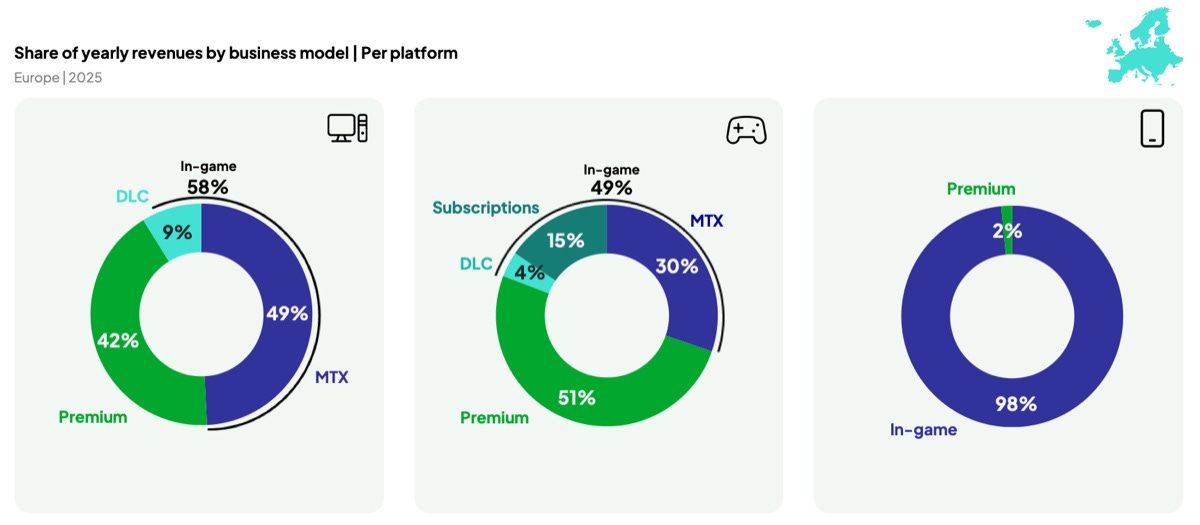

In Europe, things are similar to the US, but users are much more active with microtransactions on both PC and console.

Profile of Paying Users in North America and Europe

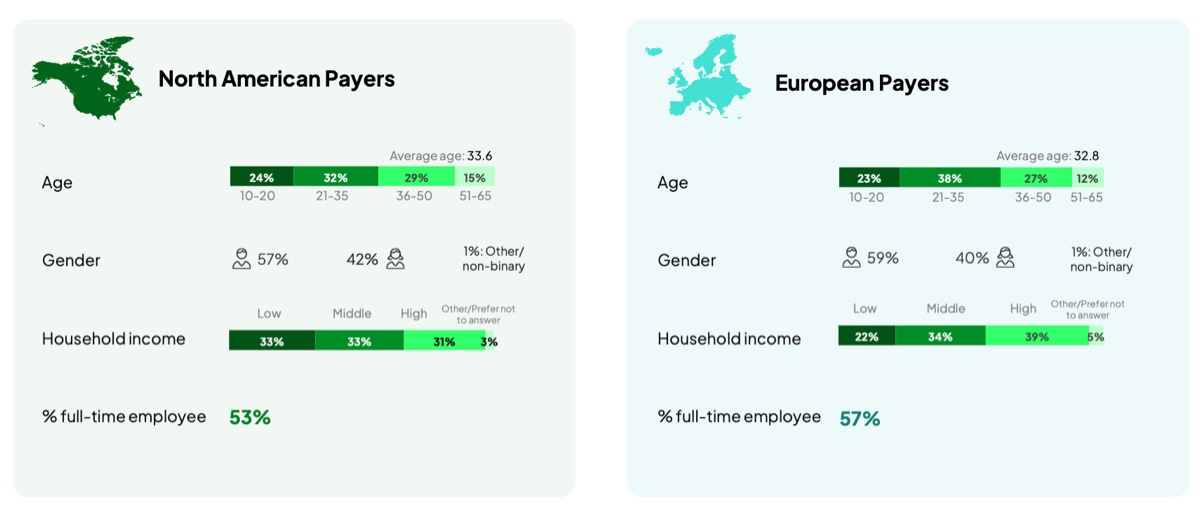

Newzoo surveyed 2,794 payers in North America and 10,713 in Europe. “Payers” refers to those who pay monthly in games, on all platforms.

The average American paying user is 33.6 years old, male (57% of cases), with a low or medium income (66% probability), and working full time (53%).

In Europe, the profile is similar. Slightly more males among respondents, and users report higher incomes.

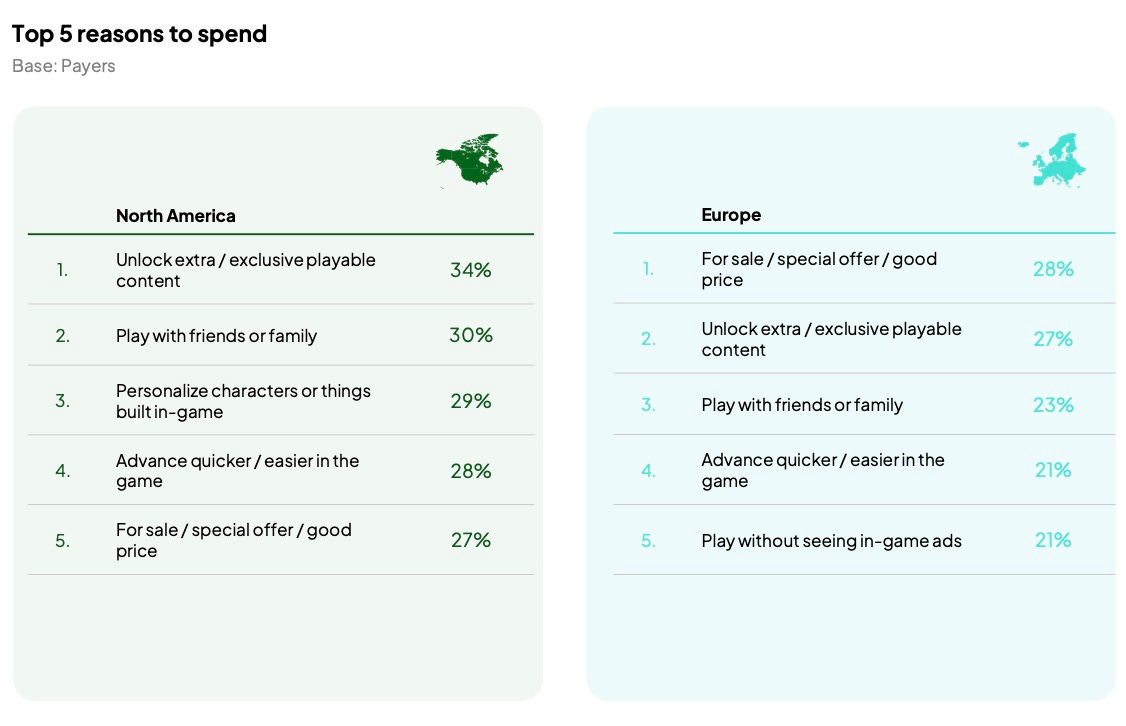

There are substantial differences in motives for purchases. In North America, they pay to unlock new content (34%), play with friends/family (30%), and personalize characters or build something in-game (29%). In Europe, there’s more focus on discounts and special offers (28%), and users are less tolerant of ads, often paying to remove them (21%).

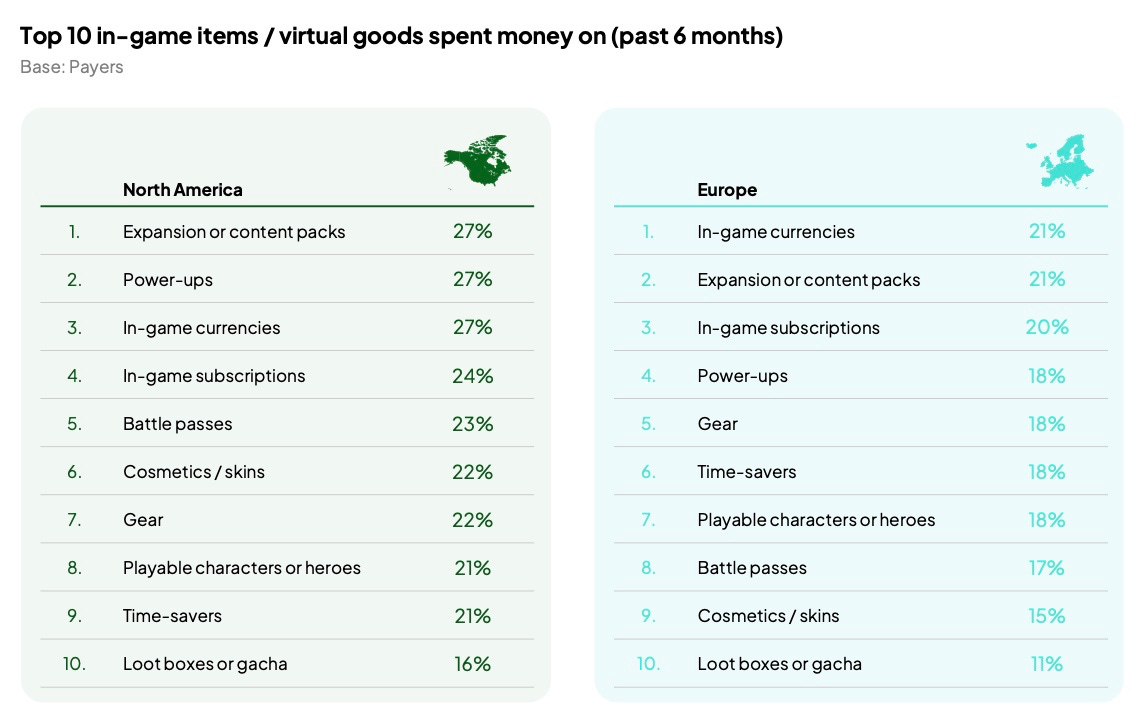

Users rarely purchase just one content type. Typically, it’s a mix of various kinds of content.