Niko Partners: Asian and MENA Markets to Reach $96 Billion by 2029

Asia and MENA are responsible for more than half of the world's gaming revenue and user base.

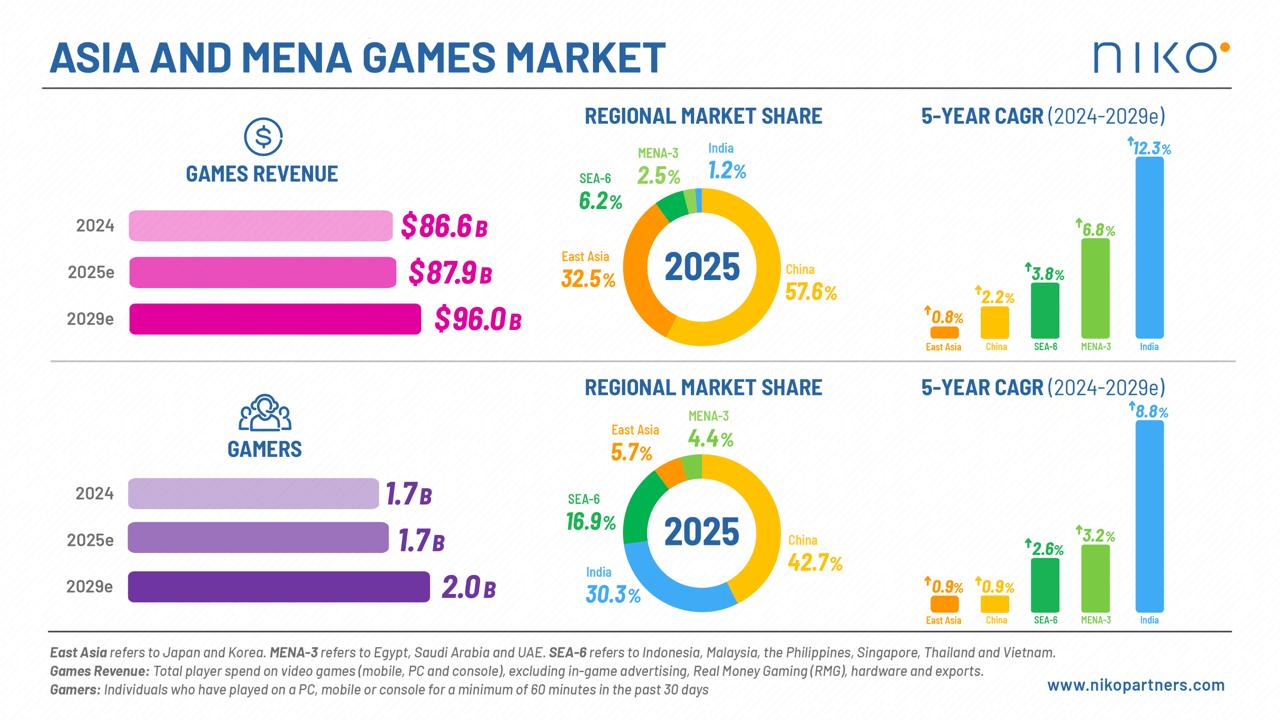

The total volume of the Asian and MENA markets in 2024 amounted to $86.6 billion.

Niko Partners forecasts an average annual growth rate of 2.1% through 2029. By the end of 2029, the market volume is expected to reach $96 billion.

Player numbers are also expected to grow—by 2029, there will be 2 billion players in these regions. This is more than the combined total of the rest of the world.

By the end of 2029, the largest Asian countries—China, Japan, and South Korea—are expected to account for 88.7% of the total revenue in the Asian + MENA regions.

India leads in forecasted average annual growth rate both in revenue (+12.3% YoY) and in player numbers (+8.8% YoY). Over the next five years, the country is expected to add 250 million new players, reaching a total of 724 million. In 2025, India will account for 30.3% of all players in the regions considered, but only 1.2% of revenue.

Thailand is the largest and fastest-growing market in Southeast Asia. By 2029, its volume will reach $2.4 billion.

The MENA-3 countries (Saudi Arabia, UAE, and Egypt) are projected to grow at 6.8% annually until 2029, according to Niko Partners. ARPU in the UAE is expected to surpass $100 in 2029.

The share of the female audience is actively growing in the markets under consideration. For example, in the MENA-3 region, the share of women has reached 37%, and in India - 40%. Previously, their share was less than 20%.

❗️Niko Partners notes that despite stagnation in 2024, the Asian and MENA markets are poised for development. The share of paying users is growing, the female audience is becoming more engaged, eSports activities are popularizing games, and the launch of new consoles may attract the traditionally mobile audience of these countries to the PC/console market.