Niko Partners: The Gaming Markets of South Korea and Japan Grew to $30.1 Billion in 2023

Markets reached their maturity.

Japan and South Korea in Niko Partners' taxonomy are classified as East Asia.

Market Condition

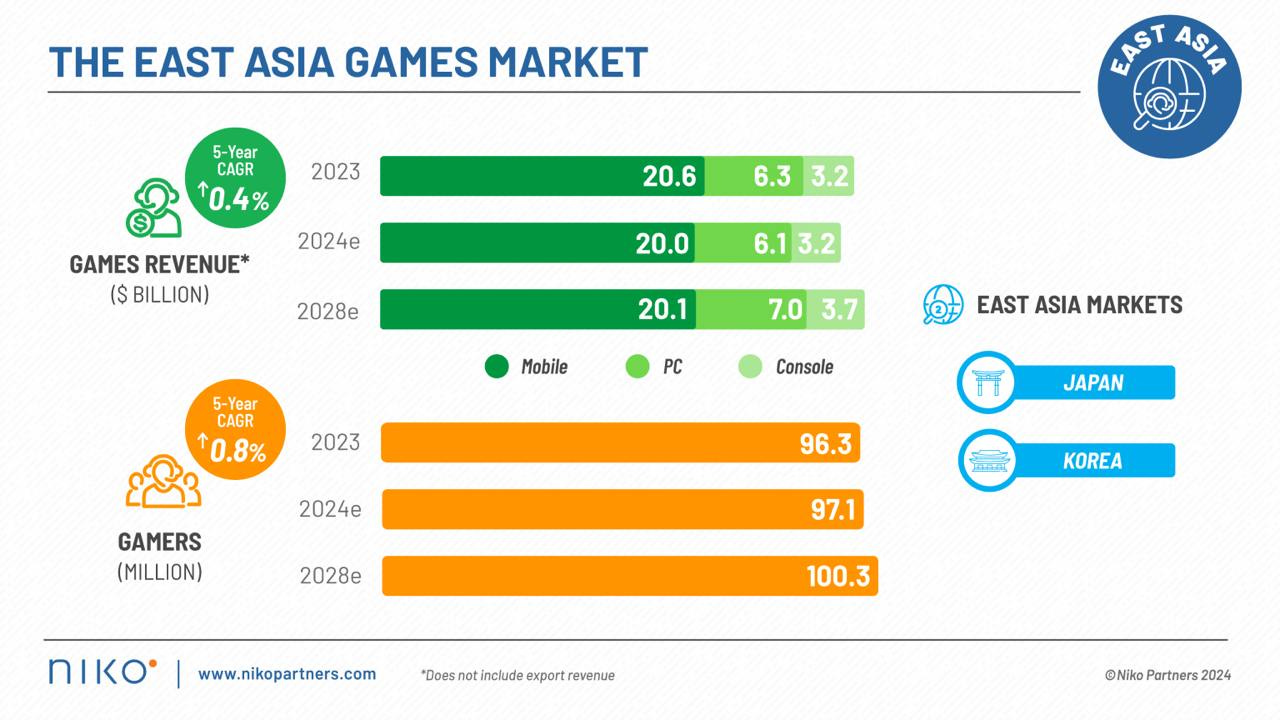

Growth compared to last year was 1%. However, Niko Partners expects a decline in 2024 by 2.9% to $29.2 billion.

The future outlook is conservative. It is expected that by 2028 the market volume will be $30.8 billion. The average annual growth rate will be only 0.4%. The markets have reached their maturity.

❗️Niko Partners notes that Japan is experiencing a correction after the rapid growth of the industry during the pandemic. Moreover, the weak yen exchange rate affects market forecasts in dollars.

Mobile remains the largest segment, accounting for 68.4% of the region's total revenue. However, over the years, this share will decrease. Consoles and PC will show growth.

In 2023, there were 96.3 million players in Japan and South Korea (+1.7% YoY). In 2024, the number will grow by another 0.8% to 97.1 million. By 2028, the number of gamers will reach 100.3 million (average annual growth rate - 0.8%).

Japan and South Korea show astronomical ARPU figures - $312.71 in 2023. This figure is expected to decrease to $307.04 by 2028.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

User Preferences

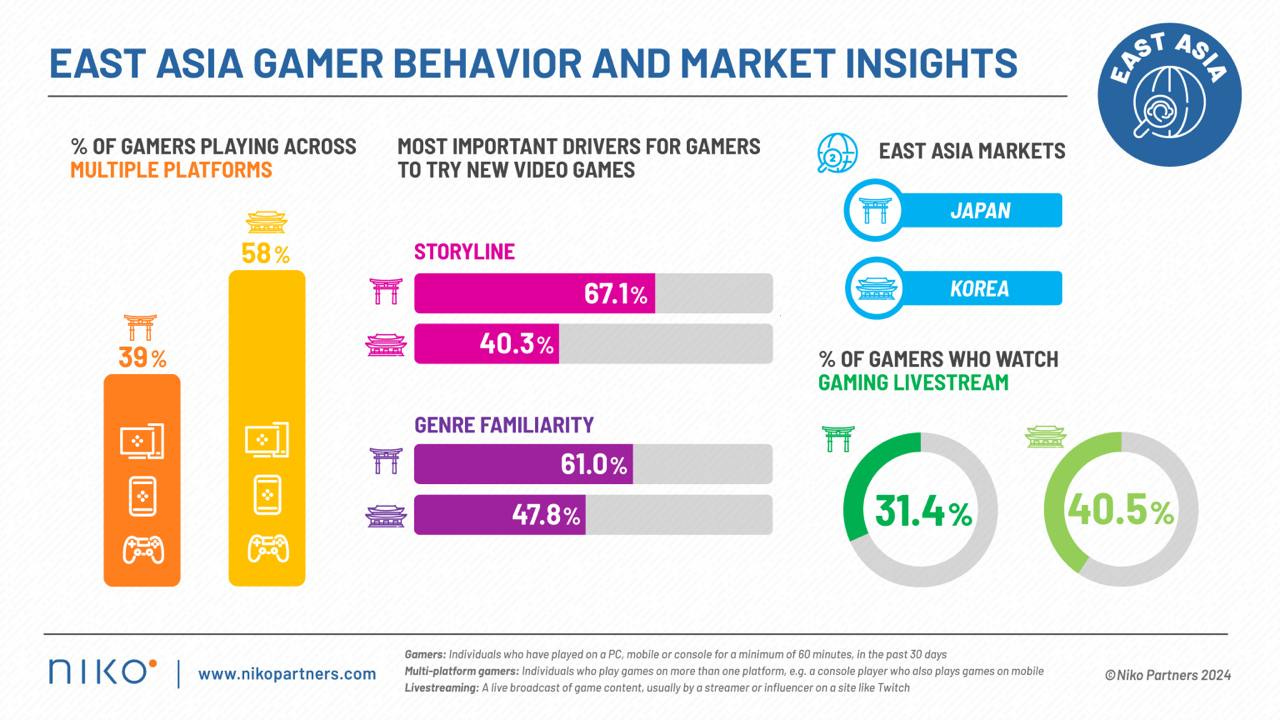

39% of Japanese and 58% of Koreans play on two or more platforms. Niko Partners notes a significant increase in the number of mobile gamers in Japan who have switched to consoles; their number has increased by 30%. In South Korea, PC users have started playing on other platforms more often.

Despite the stagnation of the Japanese market, Niko Partners expects an average annual growth of 8.8% in the PC segment and 2.5% in the console segment in the country over the next 5 years. In South Korea, the annual growth of the console market will be 3.4% over the next 5 years.

Japanese (60%+) and Koreans (40%+) want games in familiar genres and with a good storyline.

31.4% of Japanese gamers and 40.5% of South Korean gamers watch streams.

YouTube is the main channel for consuming gaming content, used by more than 90% of the audience in Japan and South Korea. However, it is important to consider local platforms - SOOP (AfreecaTV) in South Korea and NicoNico in Japan. They cover more than 20% of the gaming audience and are focused on gaming content.