Pocketgamer.biz: Trends in the Mobile Gaming Industry (Winter 24/25) - sponsored by Neon

Industry (mostly Western) speaks - for the market, budgets, and trends.

The newsletter sponsor is Neon - a high-performance direct-to-consumer solution built for games.

Respondents profiles

More than half of the survey participants are representatives of small companies (up to 30 employees). 21.7% of respondents work in companies with over 201 employees. Compared to previous years, there has been an increase in representatives from small/medium-sized businesses and large companies.

According to the 2024 survey results, 38.6% of respondents work in companies older than 10 years. The number of young companies (up to 5 years) has decreased compared to previous years.

A word from the newsletter sponsor

Neon is more than just another DTC provider for games. Our webshop, checkout, and merchant-of-record solutions are designed to attract players, increase conversions, and build long-term loyalty. The result is higher revenue and better profit margins. That’s why top studios like Metacore, PerBlue, and Space Ape choose Neon. If your direct-to-consumer strategy hasn’t come together or isn’t delivering the results you need, we can help. Visit Neon to learn more.

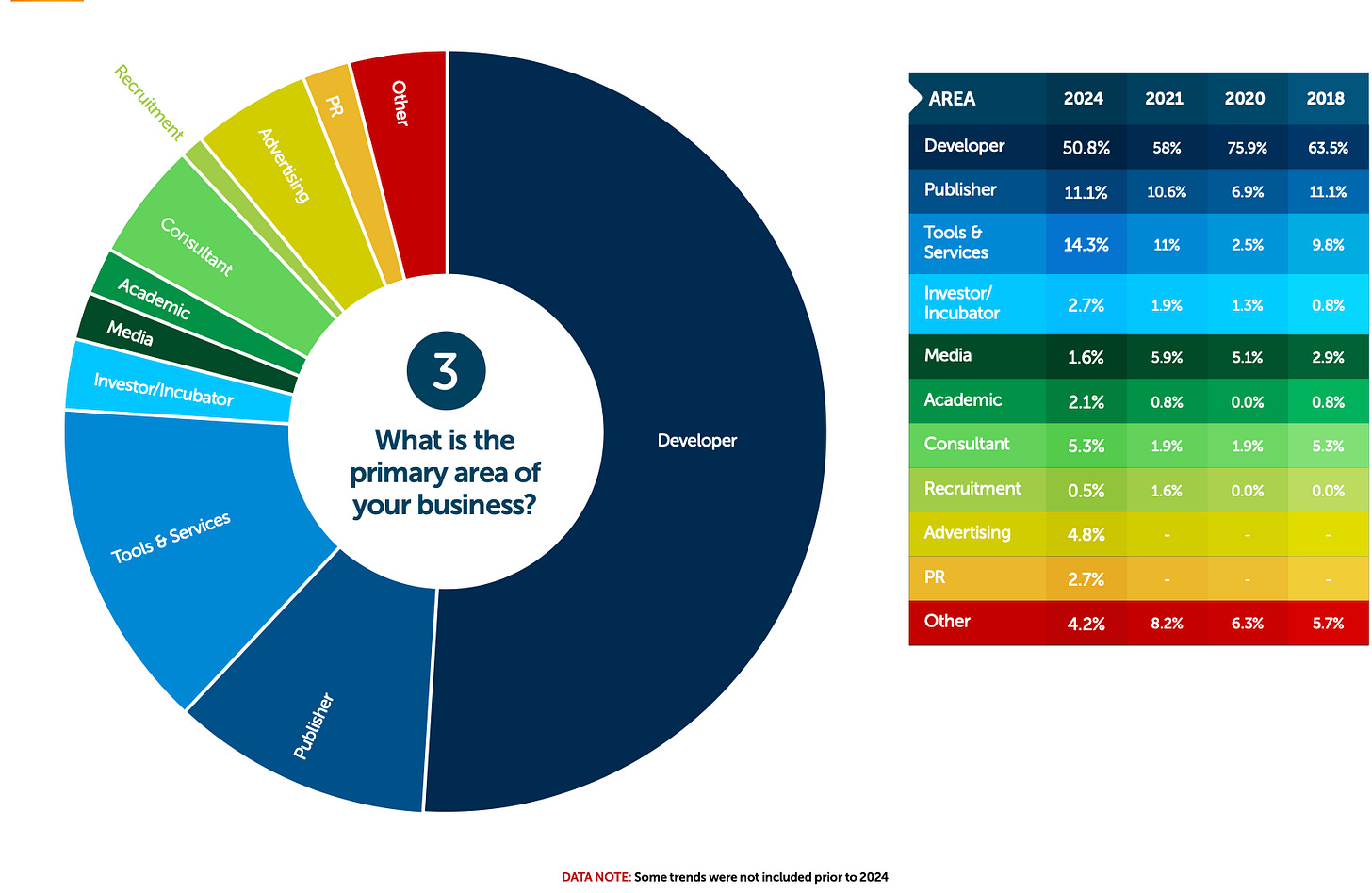

50.8% of all respondents represent gaming companies. Many respondents are from service companies (14.3%) and publishers (11.1%).

Although most respondents are from Europe, the UK, and the USA (78.9%), the sample is international. However, it should be noted that the survey results primarily reflect the Western gaming industry.

Platforms and products

Mobile platforms (Android and iOS) have become even more dominant platforms, according to feedback (which is logical given the survey's focus on predominantly mobile developers). Overall, interest has increased in almost all platforms except Mac devices.

Among those experimenting with new platforms, 53.3% are trying out innovations in cloud gaming or streaming services. 44.8% are working on XR/VR/AR projects, 35.2% on blockchain products, and 28.6% on CTV games.

❗️This question was optional, so the responses are not representative of all participants.

40.2% of developers did not release a single game in the past year. The number of such developers has significantly increased compared to, for example, 2018 but shows little difference from 2020-2021.

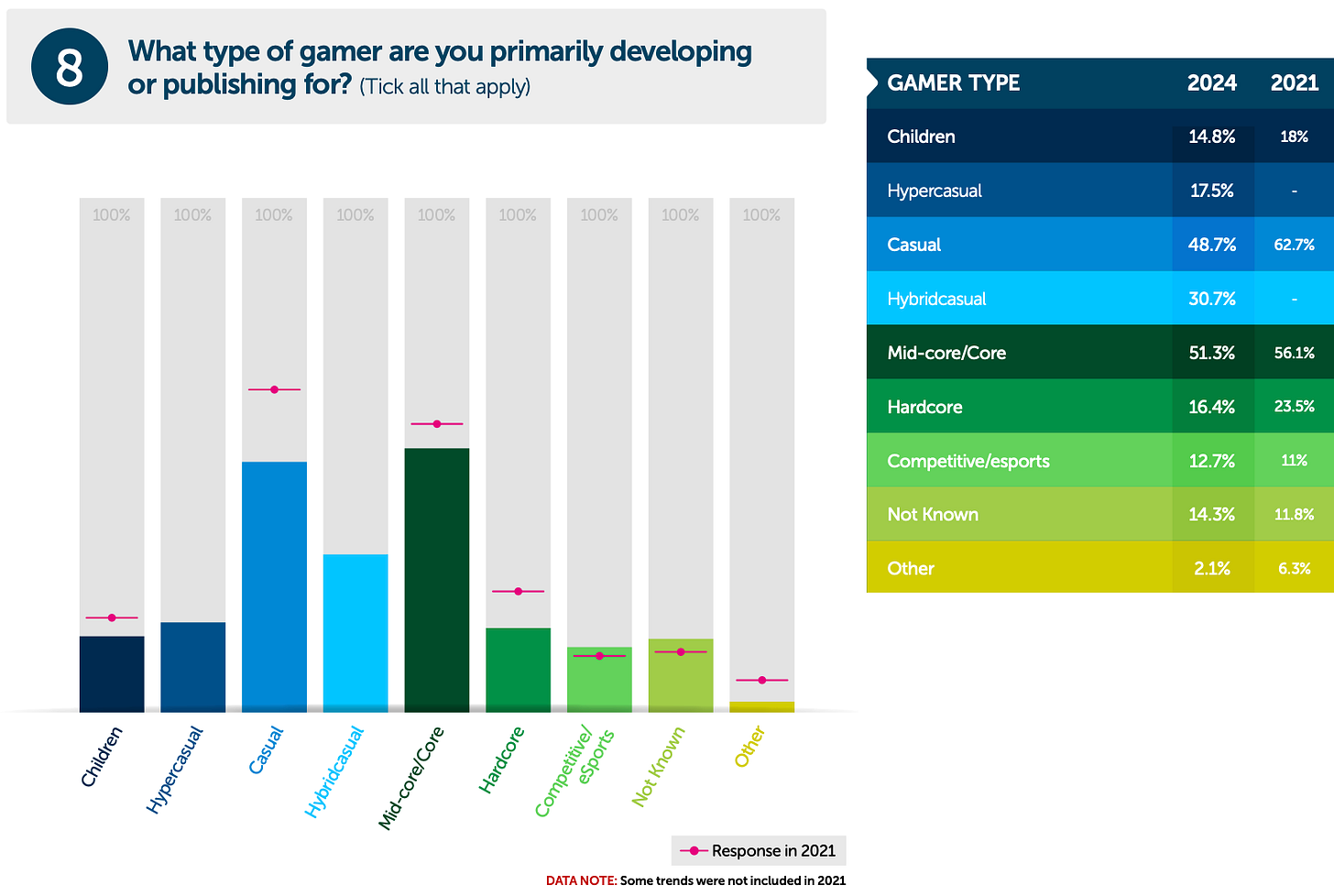

Compared to 2021, developers have been working less on casual projects and children's games. However, hyper-casual and hybrid-casual projects have taken a larger share, likely drawing some developers away.

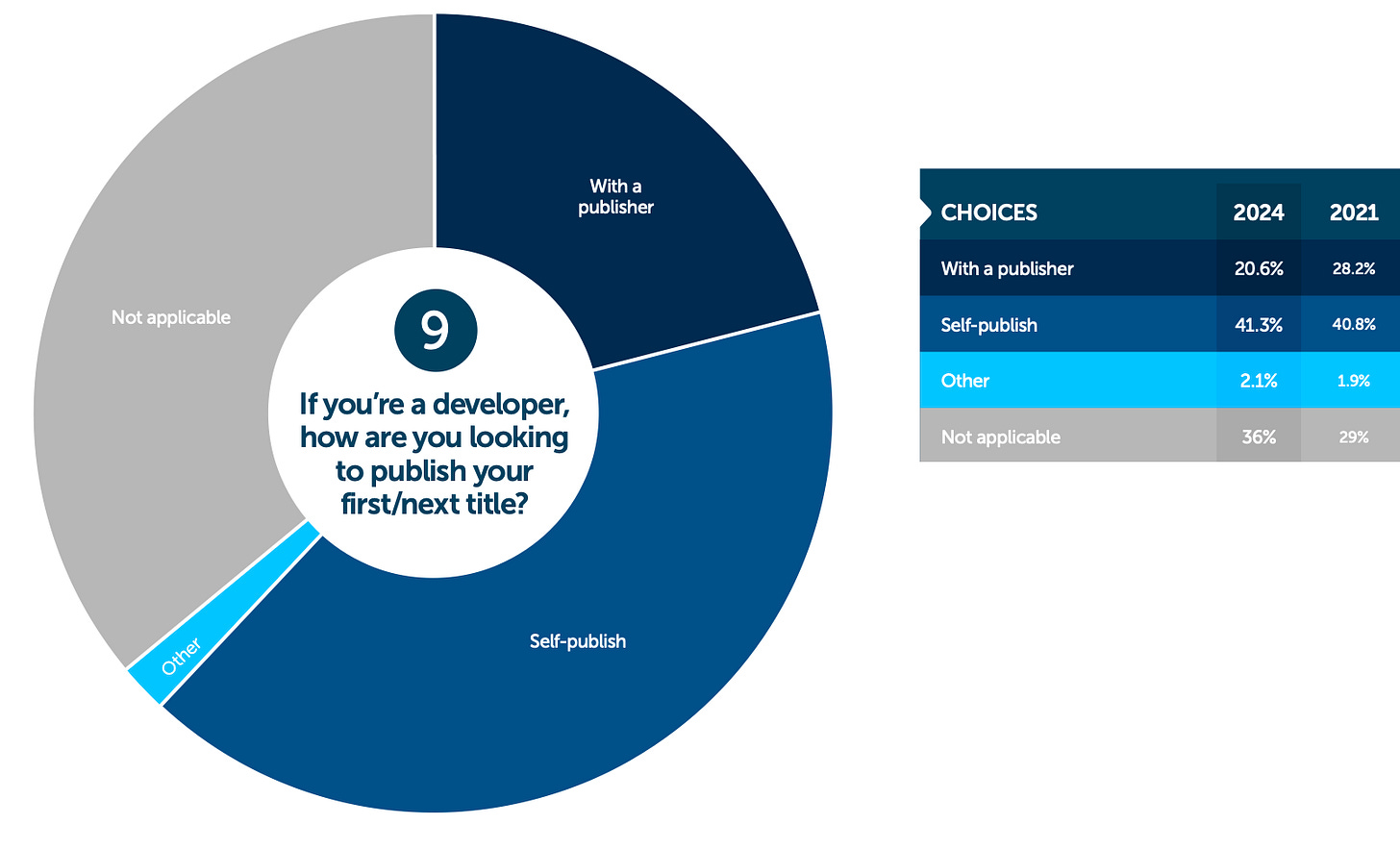

Developers have been working less with publishers compared to 2021. While one might assume that self-publishing has increased, the difference is minimal.

Business Models and Finances

59.3% of developers monetize through in-app purchases; 40.2% use rewarded video ads; 39.2% rely on video ads within games. These are the most popular monetization methods.

44.3% of developers have a development budget under $1M. 39.1% of respondents chose not to answer this question.

More than half expect profit margins below 20%. Meanwhile, 9.4% believe their company's profit margin will reach between 50% and 100%.

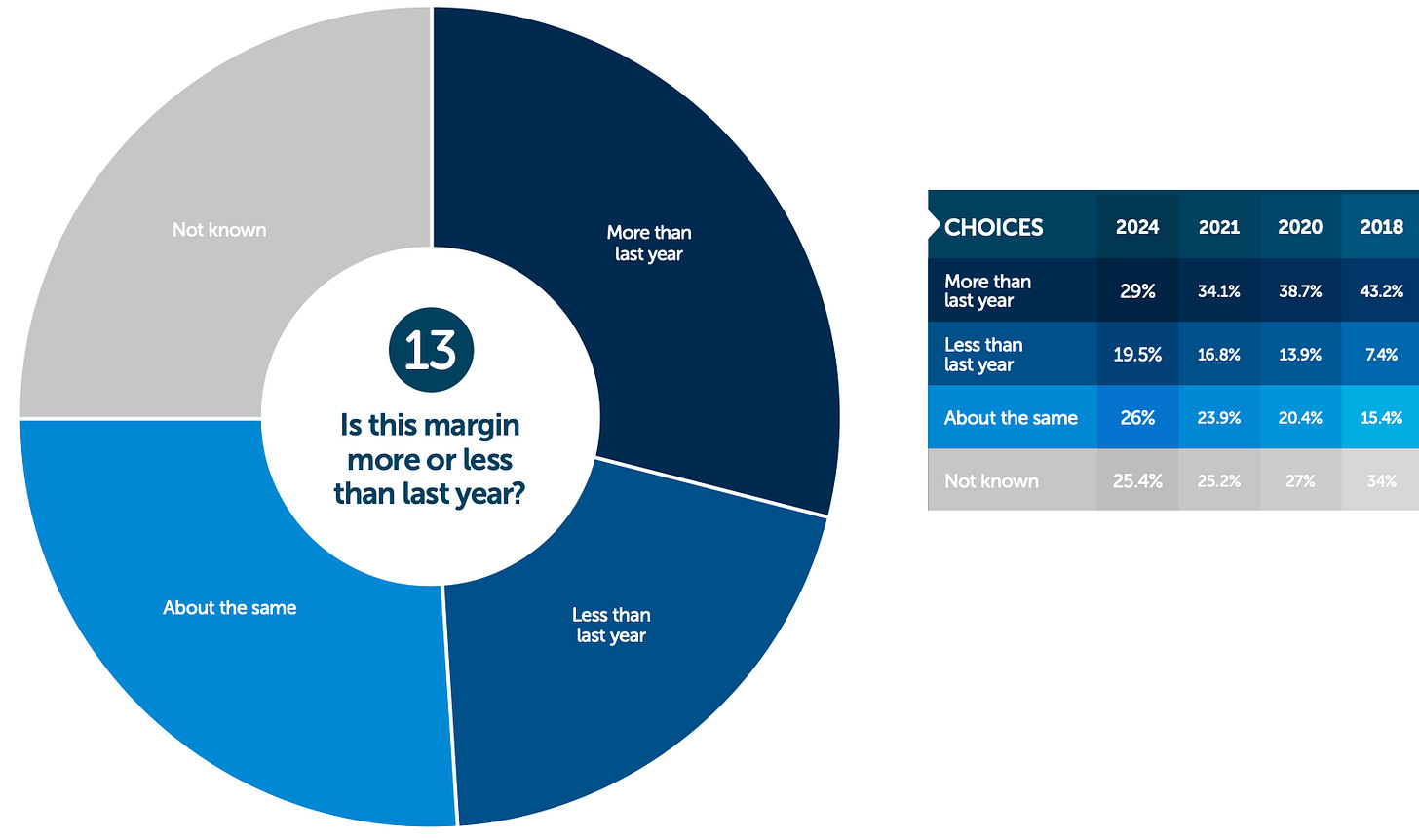

29% reported that their profit margins improved by the end of 2024. Another 19.5% reported a decline; for 26%, margins remained unchanged.

68.4% of respondents have an annual marketing budget below $500K. Only a small portion operates with significant marketing budgets.

Trends and opinions on the mobile gaming industry

Layoffs (56.7%), rising UA costs (52.2%), App Store regulation changes (41.8%)—these are key trends for mobile developers in 2024. In fourth place is Unity's monetization model change (36.6%).

Given that most survey participants are from Western countries, it is logical that they emphasized the importance of Western markets. Interestingly, there is little overall interest in Africa as a market, along with lower rankings for Latin America, India, and Southeast Asia.

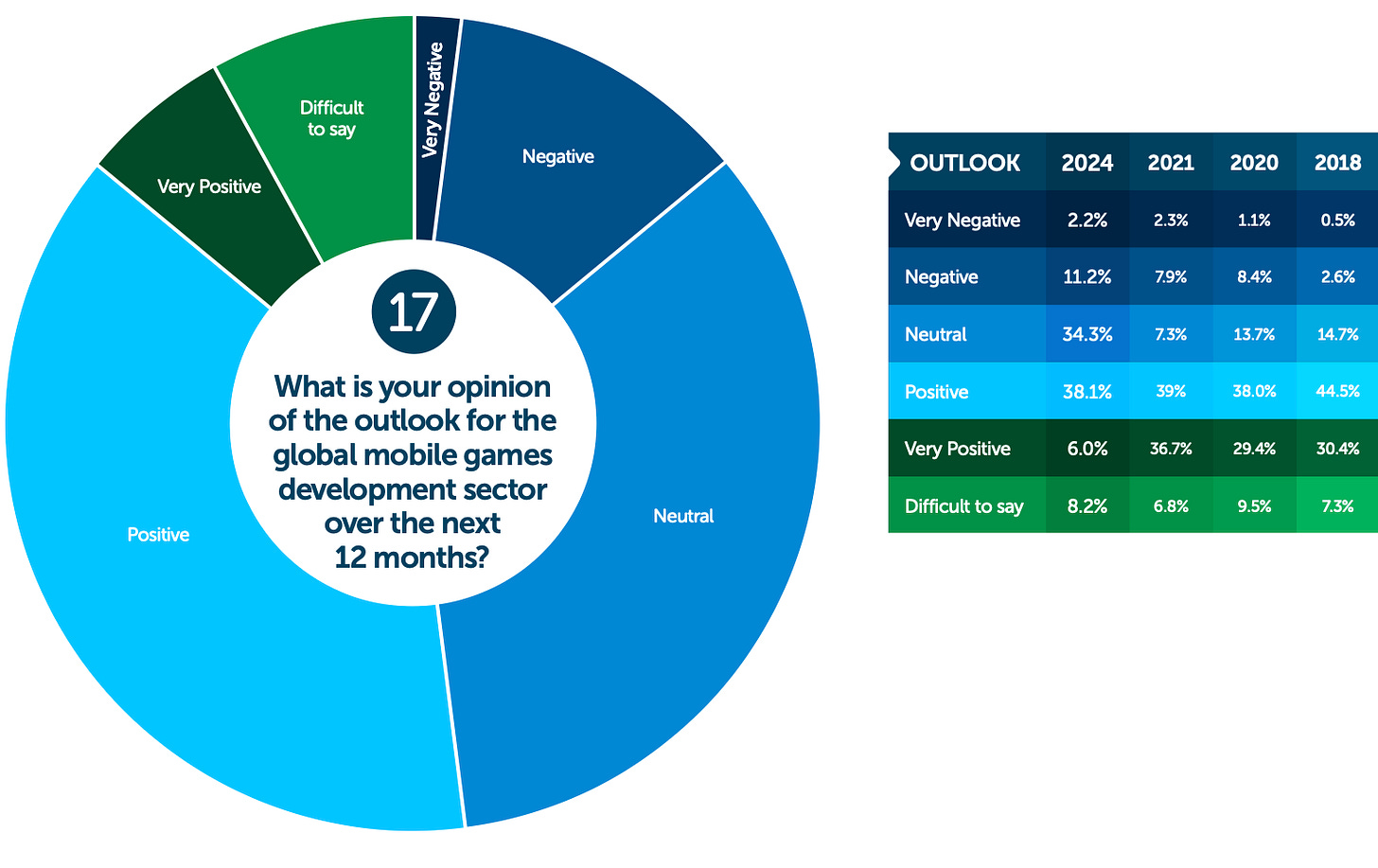

Respondents are generally optimistic about the future of the mobile market (44.1% believe changes will be positive).

The main threats to the mobile market are rising UA costs (64.2%), increasing marketing expenses (44.8%), and growing development costs (43.3%). In general, everything seems to be growing except revenue.

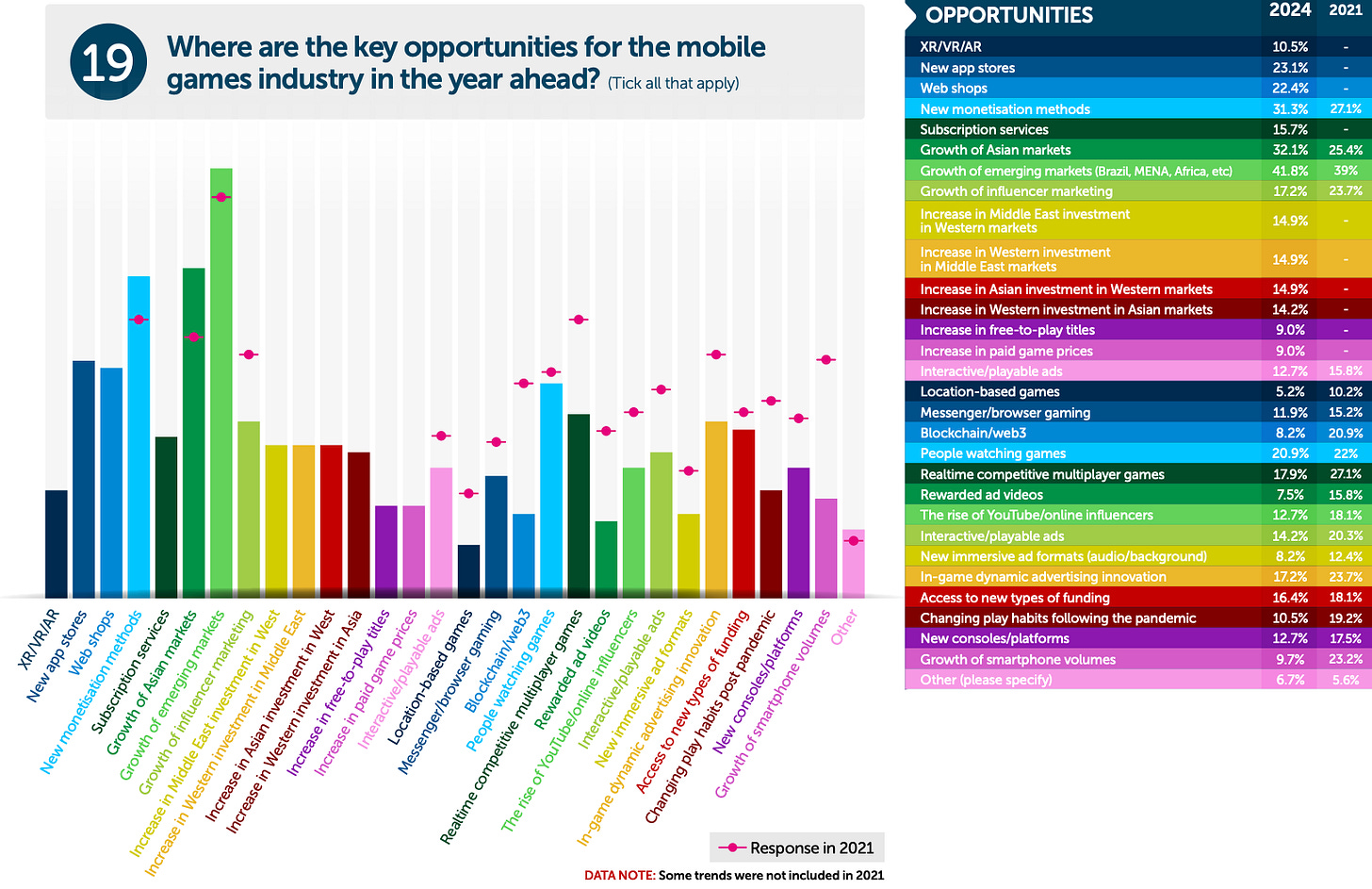

In this challenging situation, most developers see opportunities in emerging markets (41.8%), growth in Asian markets (32.1%), and new audience monetization methods (31.3%).

Compared to 2021, developers now place greater emphasis on game quality.

56% identified revenue as the primary KPI for their mobile products over the next year; for 50.8%, it is retention; for 47.8%, DAU is key. Notably absent from the list are ROAS/ROI metrics.

A word from the newsletter sponsor

Neon is more than just another DTC provider for games. Our webshop, checkout, and merchant-of-record solutions are designed to attract players, increase conversions, and build long-term loyalty. The result is higher revenue and better profit margins. That’s why top studios like Metacore, PerBlue, and Space Ape choose Neon. If your direct-to-consumer strategy hasn’t come together or isn’t delivering the results you need, we can help. Visit Neon to learn more.

Social media (70.9%), paid UA (55.2%), and influencer marketing (52.2%) are among the most interesting channels for developers looking to grow their audience in the coming year.

65.7% of respondents use Unity; 22.4% use Unreal Engine. It can be confidently said that despite controversial monetization decisions, Unity remains a market leader.

People attend industry events primarily for networking (88.3%), attending talks (53.1%), and seeking partners for investments or publishing deals (~31%).