Sensor Tower: AAA Marketing in 2023

How corporations are spending money on marketing, and a case study for launches of Hogwarts Legacy; Diablo IV; Starfield & Call of Duty: Modern Warfare III.

50% of the advertising budgets in 2023 were spent on supporting new launches. In 2022, only 20% of the budgets were used for this purpose.

The largest launches of 2023 include Hogwarts Legacy ($33 million); Diablo IV ($26 million); Call of Duty: Modern Warfare III ($19 million); Star Wars Jedi: Survivor ($16 million); and Avatar: Frontiers of Pandora ($15 million).

The leader in advertising budgets was Fortnite - developers spent $57 million on advertising in 2023, according to Pathmatics, a service owned by Sensor Tower.

❗️I believe the actual marketing budgets for these projects are higher. Based on the budgets of projects I’ve seen, it's hard to imagine that Diablo IV's campaign, for instance, which included videos featuring Megan Fox and soundtracks by Billie Eilish, was all done for just $26 million.

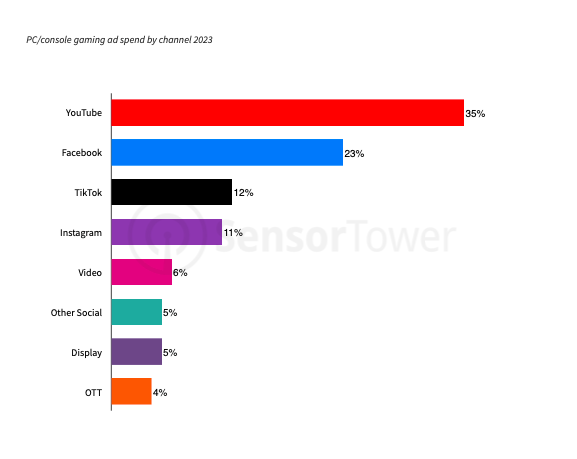

YouTube is the main channel for promoting PC/console games in the USA, accounting for 35% of all advertising budgets. Following it are Facebook (23%); TikTok (12%); and Instagram (11%). Sensor Tower estimates total advertising spending for PC/console games in the USA to be $600 million.

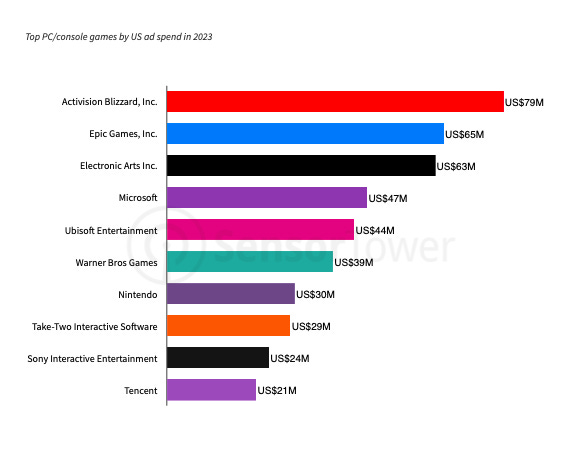

Activision Blizzard ($79 million); Epic Games ($65 million); and Electronic Arts ($63 million) spent the most on marketing in the USA in 2023.

❗️Considering that EA spent $978 million on marketing and sales in the 2023 fiscal year, I’m very skeptical that only 6.4% of the budget was allocated to promoting its PC/console games in the USA, one of the company's key markets.

Advertising for Live-Service, Cross-Platform, Transmedia, and Sports IP

Fortnite set a record for spending in Q4'23, with campaigns for Fortnite OG and LEGO Fortnite.

miHoYo ranked third in spending in May 2023 with their game Honkai: Star Rail, surpassed only by P&G and Amazon. Most of the advertising budget for Honkai: Star Rail in 2023, 95%, was allocated to mobile devices.

Madden NFL 24 on PC and consoles became the second-largest advertiser in the USA in the NFL segment, only behind the CBS Sports channel.

Case Study: Hogwarts Legacy - Q1'23

4% of the advertising budget went to promoting pre-orders; 45% on advertising before launch; 38% on post-launch advertising; 13% on launching on new platforms (PS4, Switch).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Hogwarts Legacy's marketing was adapted to different channels. For example, on TikTok, the focus was on short 15-second videos. On YouTube, most of the budget went to 30-second videos. And on Instagram - to Stories.

The marketing for the project on YouTube was relatively stable, while on Facebook and TikTok, peaks were associated with pre-launch campaigns.

Hogwarts Legacy marketers carefully tailored the creative content for each channel. It varied between Facebook, TikTok, and YouTube. The partnership with PlayStation was also heavily highlighted.

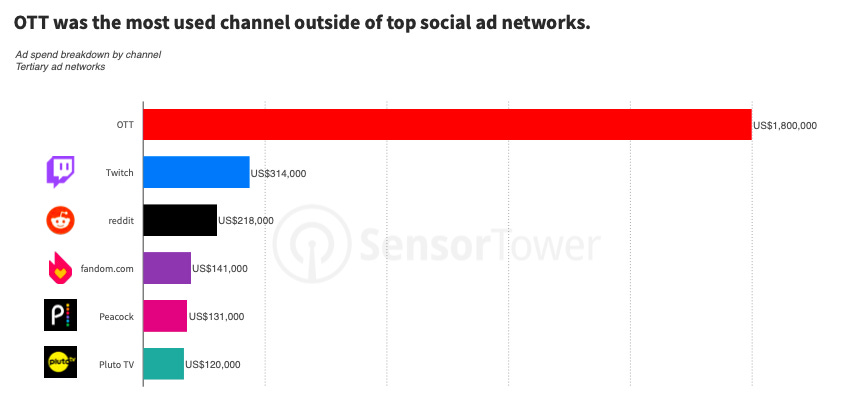

OTT became the most popular advertising channel outside the major social networks ($1.8 million). Interestingly, only $314,000 was spent on Twitch.

Case Study: Diablo IV - Q2'23

In the advertising creatives, the company positioned Diablo IV as a “return to the dark atmosphere of Diablo II.”

The marketing budgets were distributed as follows: 4% of the total budget went to pre-orders; 21% to open beta advertising; 18% to pre-launch advertising; 50% to launch advertising; and 7% to post-launch advertising.

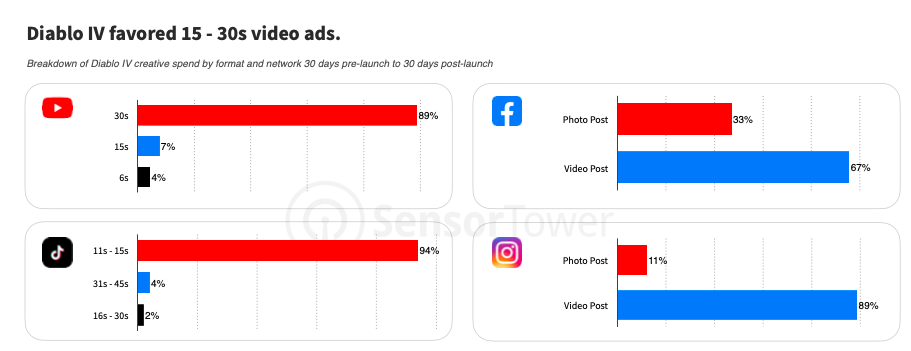

On YouTube, the preference was for 30-second videos; on TikTok, for videos up to 15 seconds.

A week after the release, Diablo IV marketers launched a campaign highlighting the project's acclaim from the press.

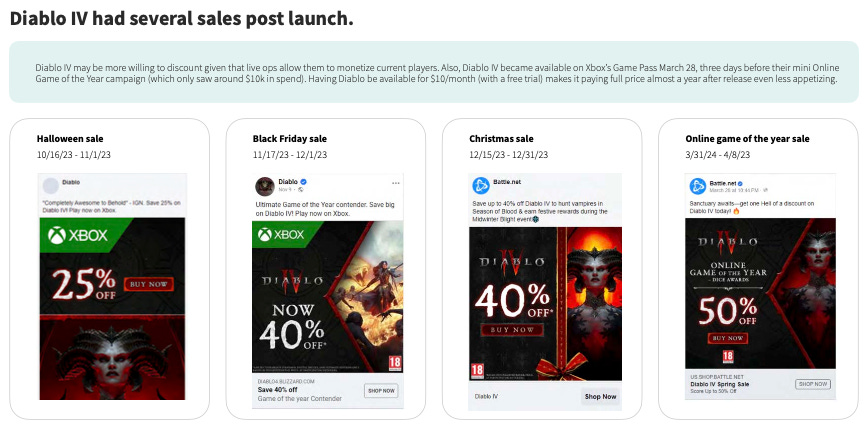

The game was actively involved in sales promotions after its release.

Case Study: Starfield - Q3'23

Advertising expenses for promoting the project were spread out over time. 20% of the budget was spent on the announcement in 2021; then in June 2022, 12% was spent highlighting a gameplay trailer. 9% of the budget went to pre-orders; 24% to pre-launch advertising; 32% to launch advertising; and 2% to post-launch advertising.

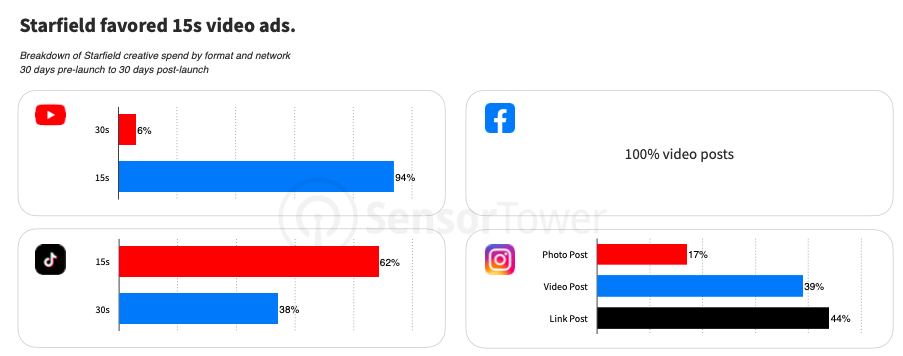

In advertising campaigns, Starfield focused on 15-second videos showcasing gameplay footage and live-action creatives. The Xbox brand was prominently featured.

Case Study: Call of Duty: Modern Warfare III - Q4'23

The advertising campaign for the project was very concentrated. 3% of the budget went to the early beta (1%) and pre-orders (2%). 13% was spent on the open beta; 16% on pre-launch advertising; 40% on launch advertising; and 20% on advertising during the holiday season.

Interestingly, there was no advertising campaign around the announcement of Call of Duty: Modern Warfare III.

While the marketing campaign for Call of Duty: Modern Warfare II heavily used celebrities, Modern Warfare III focused on eSports influencers.

The PlayStation branding was prominently used in the creatives.

Call of Duty: Modern Warfare III had the most creative collaborations among the cases considered. The project included a song by 21 Savage; collaborations with Dune: Part II; and premium watchmaker MVMT.