Sensor Tower: IP in Games Landscape Report

A comprehensive material about IP usage in mobile & PC/Console games alongside case studies.

Overview

Mobile games based on IP earned $16 billion in 2023 from in-game purchases.

$5 billion of this amount came from gaming IPs (Pokemon GO; Call of Duty); $2 billion from anime and manga (Uma Musume Pretty Derby); $1.1 billion from sports franchises (EA Sports FC Mobile); $1 billion from board games (Monopoly); $400 million from comics (Marvel or DC); $320 million from television IPs (Star Trek).

In geolocation-based projects, the share of IP games is 95%. In sports projects - 37%; in RPGs - 30%; in action games - 29%; in arcades - 26%. IAP revenue for 2023 was considered. Less saturation in board games (17%); racing (16%); strategies (15%); shooters (14%).

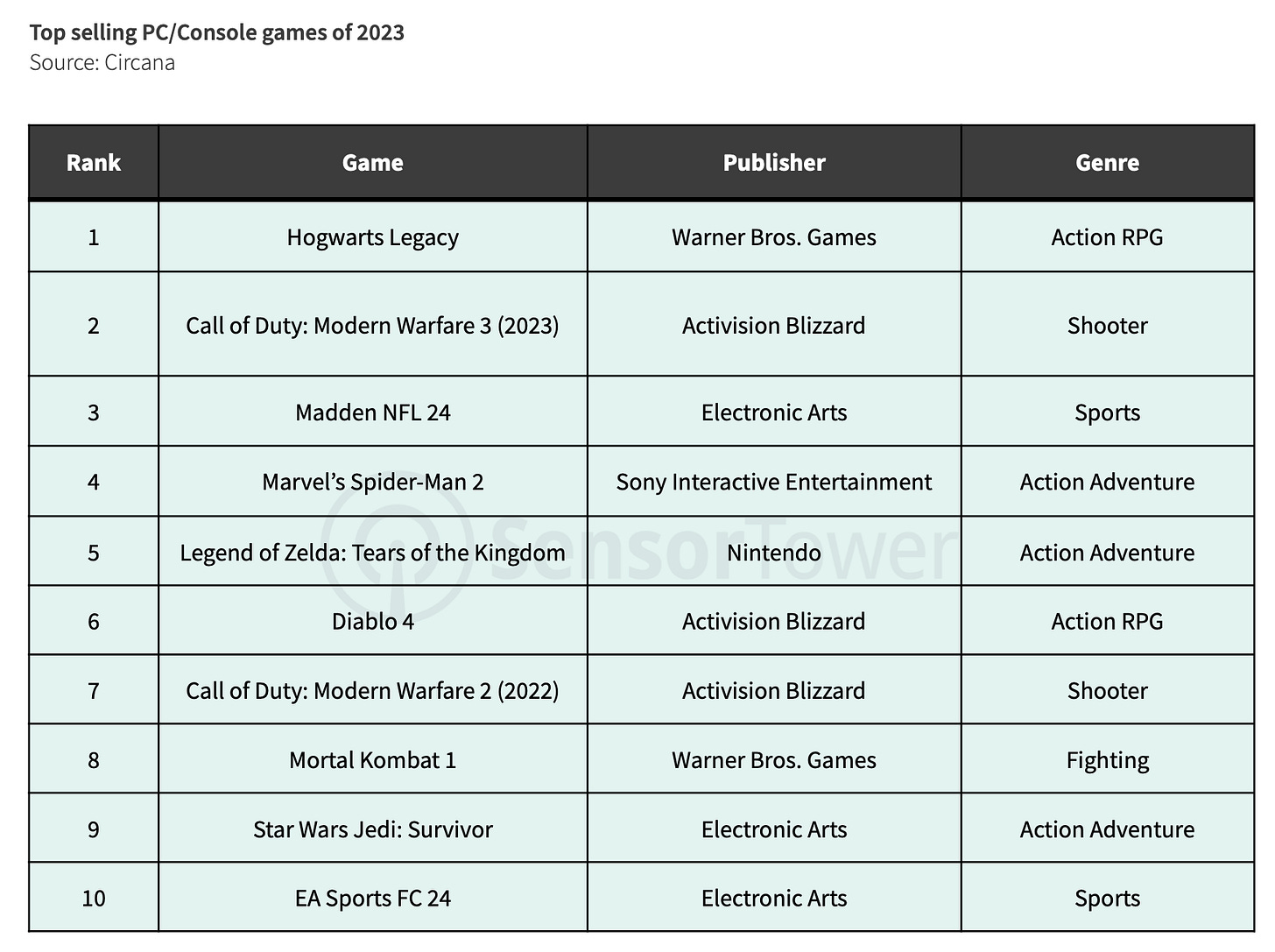

All major launches on PC and consoles in 2023 in the USA were either series continuations or IP games.

Successes of 2023

MONOPOLY GO! - the highest-earning mobile game in the world based on IP.

Hasbro - the highest-earning IP holder in the mobile market. According to Sensor Tower, Monopoly GO! earned $896 million net. Following were NCSoft (Lineage - $719 million); Nintendo (Pokemon - $628 million and other IPs); Hiotsubashi Group (One Piece - $273 million; Naruto - $218 million; Yu-Gi-Oh - $89 million); Disney (Marvel - $350 million; Disney animated films - $244 million; Star Wars - $96 million).

Thanks to the success of MONOPOLY GO!, Scopely became the largest revenue publisher of IP games. In 2020-2021, BANDAI NAMCO led due to Dragon Ball Z; in 2022, NCSoft took first place (Lineage).

IP Revenue by Genre and Country

RPGs account for 36% of all revenue from licensed IPs.

IP projects are most popular in Asia. This region accounts for 70% of all game downloads for licensed IPs.

In European countries, gaming IPs dominate revenue. Only France stands out - 31% of revenue from licensed games in this region comes from anime projects.

RPGs are the most popular (and profitable) genre for gaming or anime licensed projects.

The USA and Asia are the main regions for sports IP projects. Surprisingly, 37% of the audience for EA Sports FC is from South Korea; 20% from China; 10% from the USA. Germany and the UK, with their football culture, make up only 3%.

Hogwarts Legacy Case

Hogwarts Legacy surpassed its closest competitor (Call of Duty: Modern Warfare 3) by 5 times in terms of advertising coverage in the first 2 weeks after launch in the USA.

YouTube is a priority channel for PC/console games, which Hogwarts Legacy actively utilized.

Despite being available on PC and Xbox Series S|X, all advertising was exclusively branded for PlayStation.

The advertising campaign for Hogwarts Legacy was entirely focused on the first month after release. There was then a small activation upon the game's release on PlayStation 4 and Xbox One.

49% of the project's advertising budget was spent on 30-second videos.

IP Collaborations in Games

In August-September 2023, for example, Roblox held four events in a month. With Cirque du Soleil, K-Pop group BLACKPINK; Japanese show Takeshi’s Castle, and Paris Hilton. These events did not have a significant impact on revenue.

Another example is the collaboration Goddess of Victory: Nikke with NieR: Automata. Distributed over two stages, the event increased the project's daily revenue almost 10 times.

Hello DMITRIY Is it possible for you to share the source of the data utilized above? Thanks for your awesome insights.