Sensor Tower: Japan Gaming Market in 2025

Japanese game market stays strong, yet showing no growth in IAP revenue.

The majority of the data is from August 2024 to July 2025 (12 months).

Japanese Mobile Gaming Market

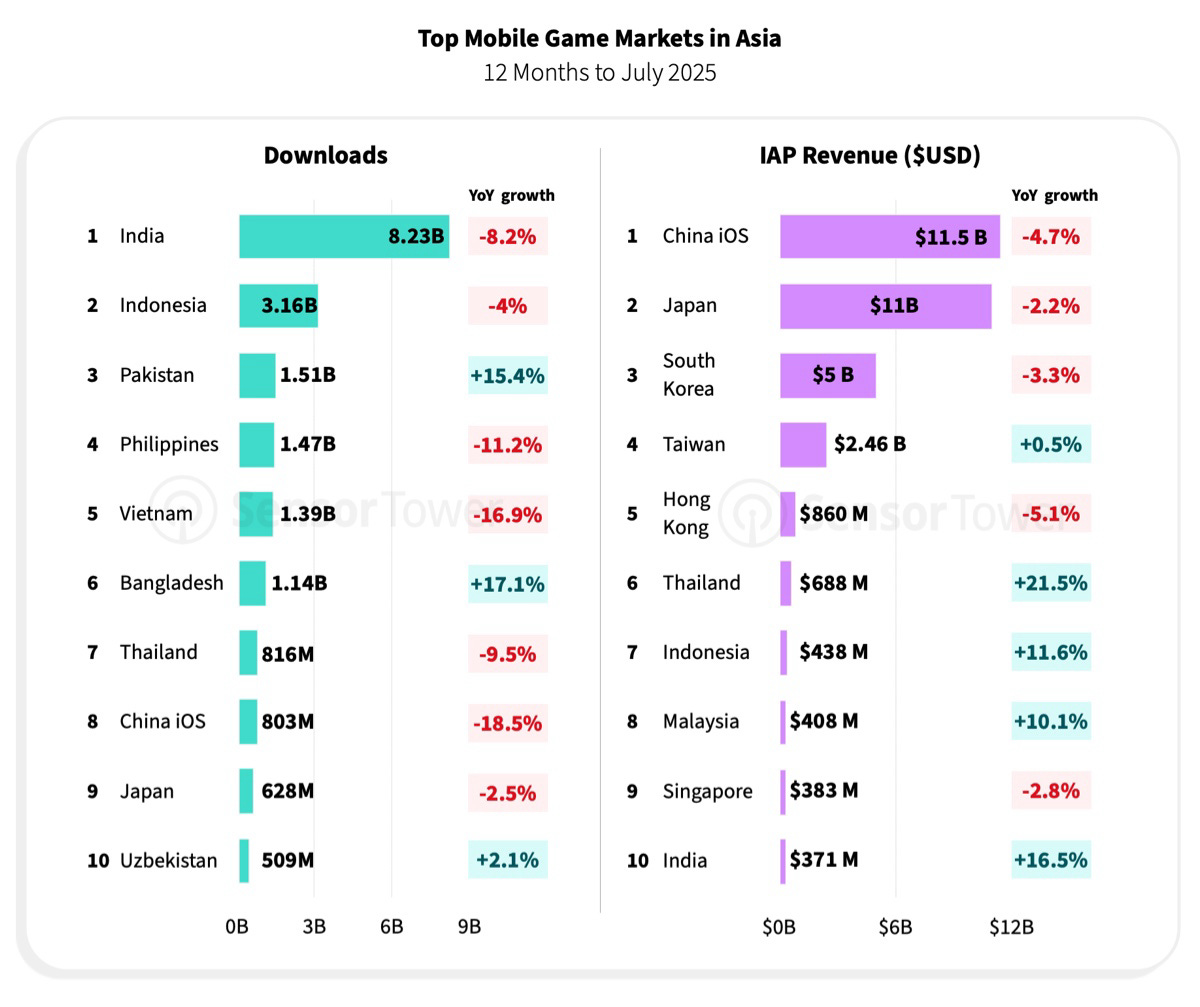

Over the past 12 months, the Japanese market generated $11 billion in revenue. This is the second highest in Asia, surpassed only by China on iOS ($11.5 billion). However, revenue dynamics are negative — for the same period in 2024, it was 2.2% higher.

Revenue growth in Asia is observed in Thailand ($688 million - +21.5%), Indonesia ($438 million - +11.6%), Malaysia ($408 million - +10.1%), and India ($371 million - +16.5%).

Japan ranks 9th in Asia for downloads - 628 million installs (-2.5% YoY). India leads with 8.23 billion installs (also down 8.2%).

Download growth in Asia is strong in Pakistan (1.51 billion installs, +15.4%), Bangladesh (1.14 billion, +17.1%), and Uzbekistan (509 million, +2.1%).

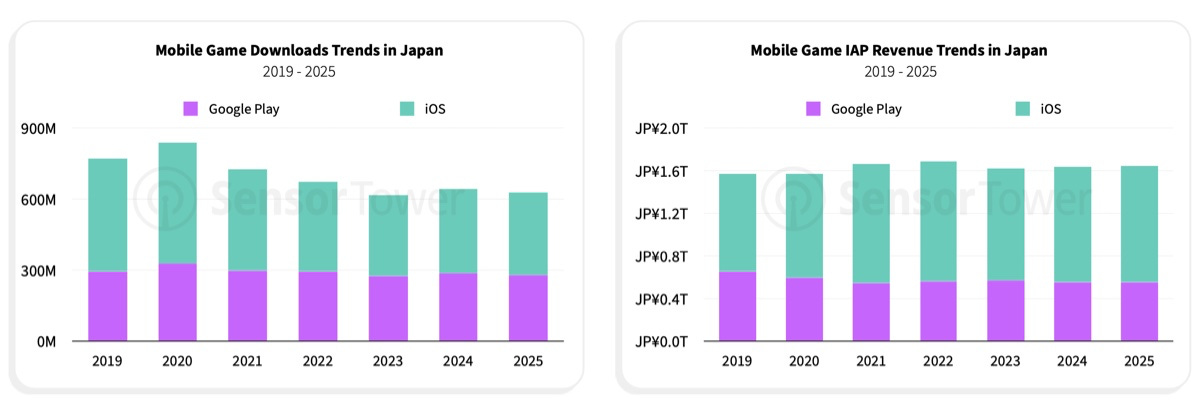

Game downloads in Japan dropped after the peak in 2020, but for the past three years have remained stable. Actually, a similar pattern is seen with revenue if considered in Japanese yen. In dollar terms, of course, there’s a decline, but this is mostly due to the worsening economic situation, not a drop in the popularity of games in Japan.

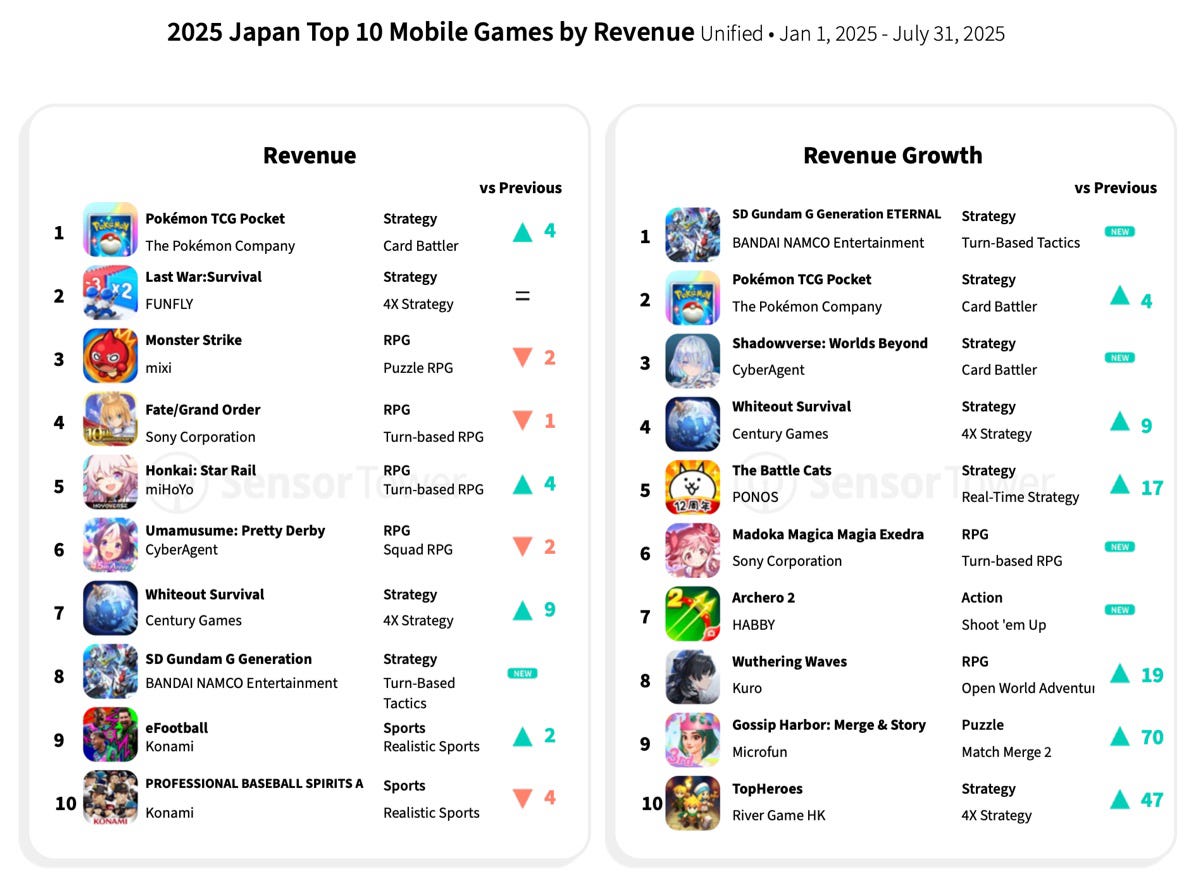

Top 10 projects in Japan from January to the end of July 2025 by revenue: Pokemon TCG Pocket, Last War: Survival, and Monster Strike. One new project entered - SD Gundam G Generation.

In terms of revenue growth, there are many more newcomers on the list. SD Gundam G Generation ETERNAL saw the largest rise in revenue from Japanese users over this timespan. Third place is Shadowverse: Worlds Beyond, sixth is Madoka Magica Magia Exedra, seventh is Archero 2.

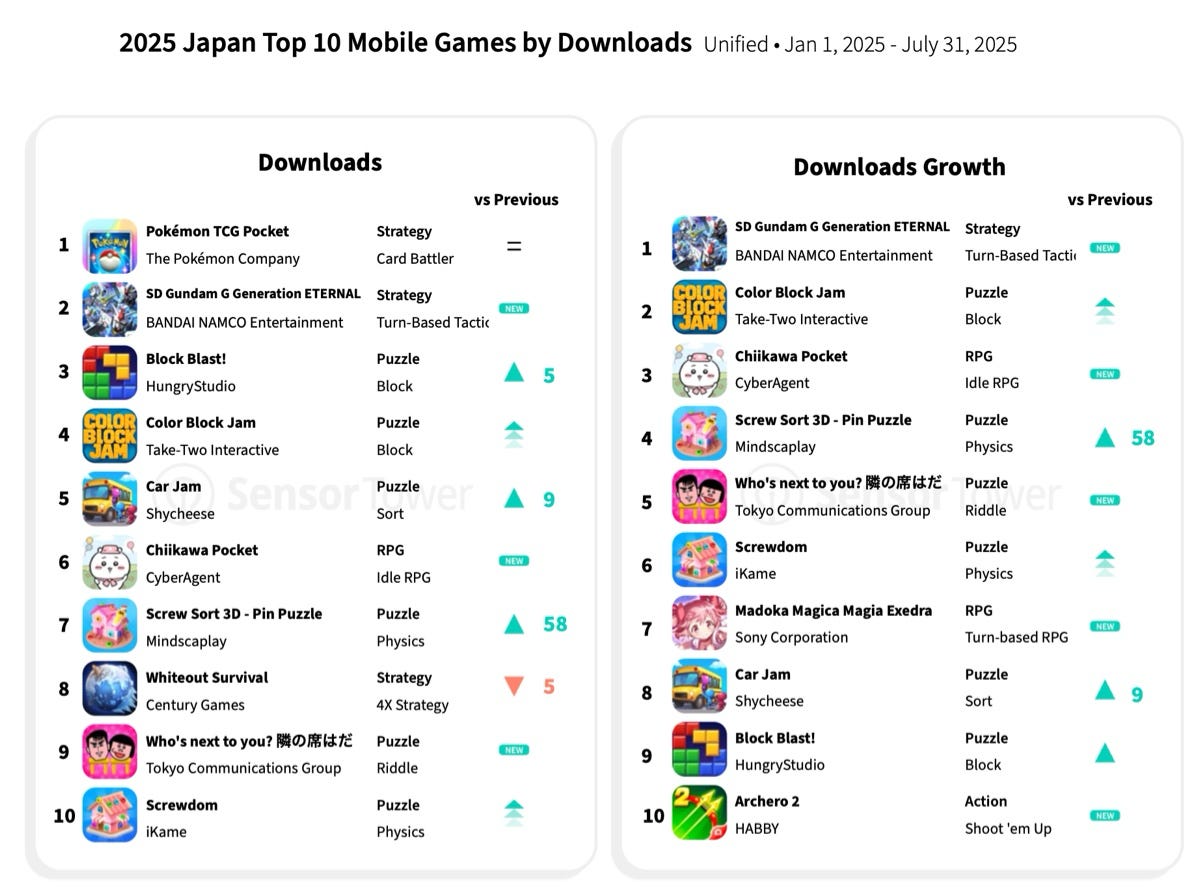

Japanese users remain loyal to their franchises - in 2025, top downloads are Pokemon TCG Pocket and SD Gundam G Generation ETERNAL.

The list includes many puzzle games, and among the fastest-growing downloads there are almost no midcore games except SD Gundam G Generation ETERNAL.

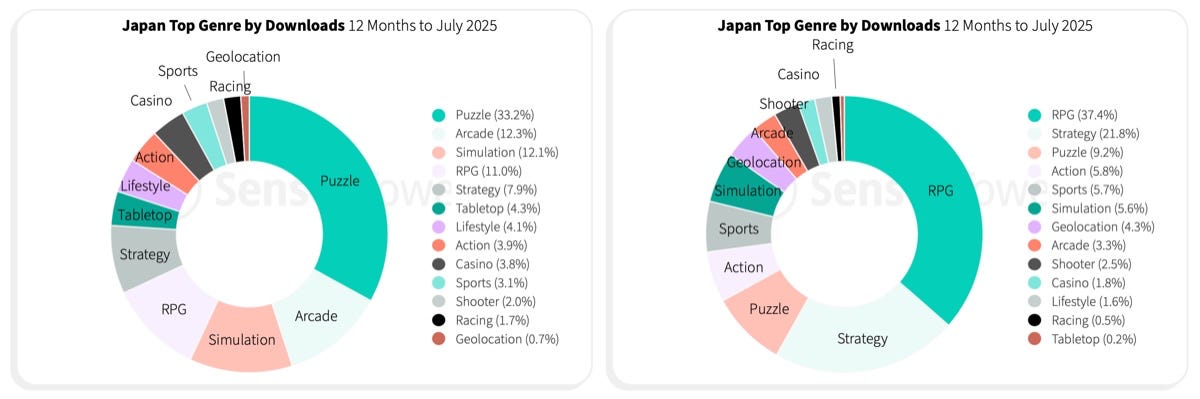

Puzzles (33.2%), arcades (12.3%), and simulators (12.1%) lead the Japanese market by downloads for the 12 months from August 2024 to July 2025.

By revenue (noting a typo in the original material), the leaders are RPGs (37.4%), strategies (21.8%), and puzzles (9.2%). In this regard, the Japanese market remains unique - the paying audience in the country prefers complex and deep genres.

However, dynamics by genres and subgenres show a decline in audience interest in RPGs. At least among the paying audience, interest is dropping. Year-over-year: squad RPGs down 21%, puzzle RPGs down 22%, turn-based RPGs down 14%, MMORPGs down 21%.

On the other hand, 4X-strategies have significantly increased revenue (+35% YoY); so have card battlers (+305% YoY, led by Pokemon TCG Pocket). Puzzle genres of all kinds add downloads.

For the first 7 months, top franchises in Japan are Pokemon, Fate, Dragon Quest. Among foreign franchises, only FIFA (via eFootball) and Disney make the top 10.

Top revenue projects: Pokemon TCG Pocket; Fate/Grand Order and Umamusume: Pretty Derby. For revenue growth: SD Gundam G Generation Eternal, Pokemon TCG Pocket, and Madoka Magica Magia Exedra.

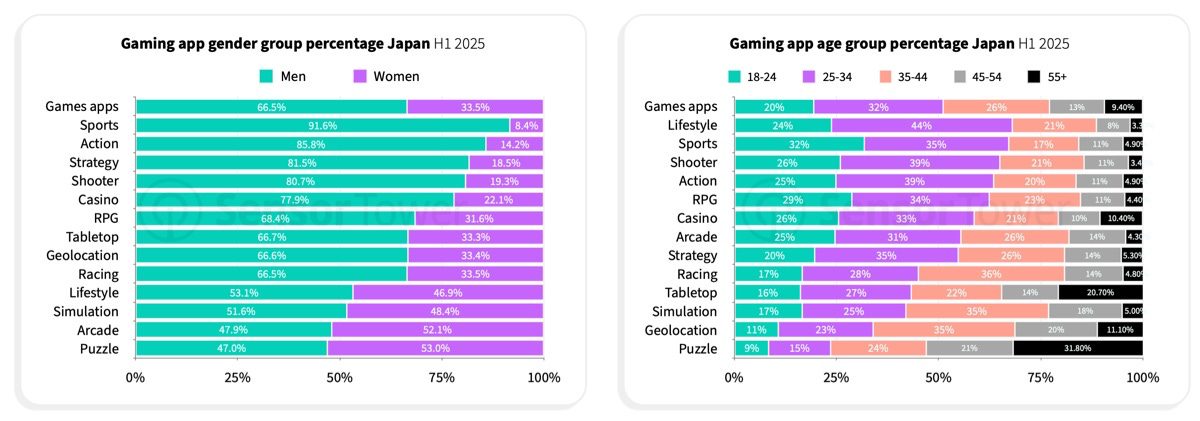

The majority of players in Japan are men (66.5%). As elsewhere, women more often prefer casual projects. Sports, action, strategies, shooters are dominated by the male audience.

A word from our partner

Take control of your webshop with Xsolla. It is fully integrated with all popular MMPs (AppsFlyer; Adjust; Singular), leaving no blind spots and full transparency for your monetization and analytics departments.

Plus, it’s headache-free - there is a way to build your own webshop with a no-code solution. Catalog will be syncing with your database in real time, and the admin panel has a streamlined JSON import.

Who said that webshops are difficult? Turn it on now!

Players aged 25–34 in Japan more often prefer competitive titles (sports, shooters, action, RPGs). The share of older players (35 and up) is higher in more casual projects.

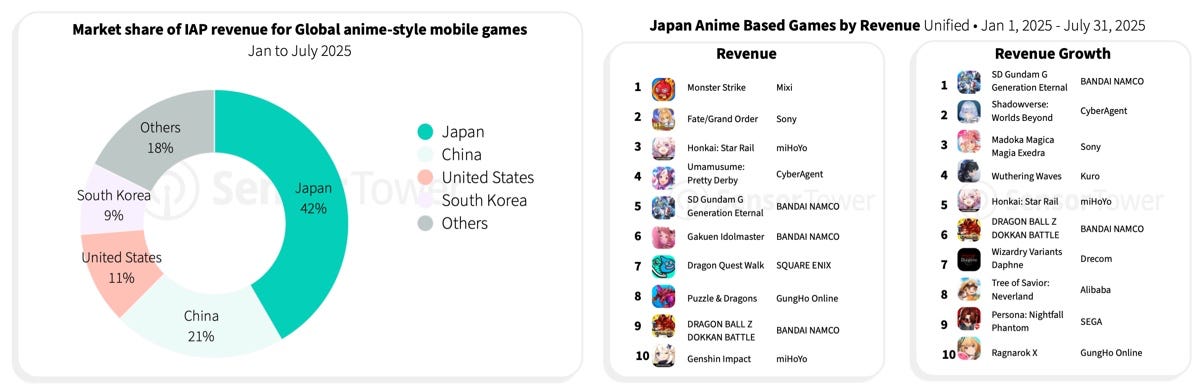

Japan is the home of anime, and Japanese games account for 42% of all global anime-style game revenue (from January to July 2025). Notably, the share of Chinese projects is half of this amount.

Overall, the top titles by anime game revenue and growth correlate with the overall top performers.

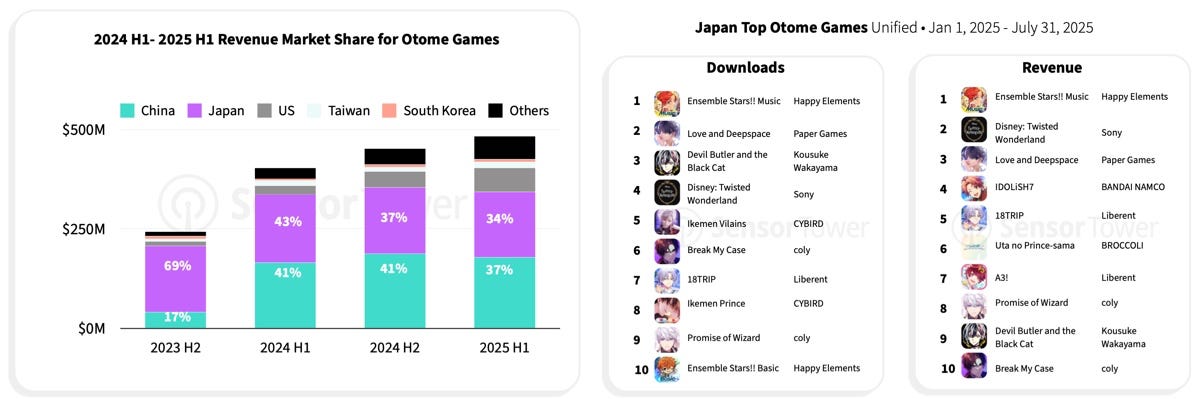

Sensor Tower notes that the Otome game market has been actively growing for two years. The top consumers are in China (share 37%), with Japan being second (34%).

Otome, according to Sensor Tower, refers to games primarily aimed at women, where the core gameplay is focused on building relationships with men. Top downloads: Ensemble Stars!! Music, Love & Deepspace, and Devil Butler and the Black Cat. Top revenue: still Ensemble Stars!! Music, plus Disney: Twisted Wonderland and Love and Deepspace.

SD Gundam G Generation ETERNAL Breakdown

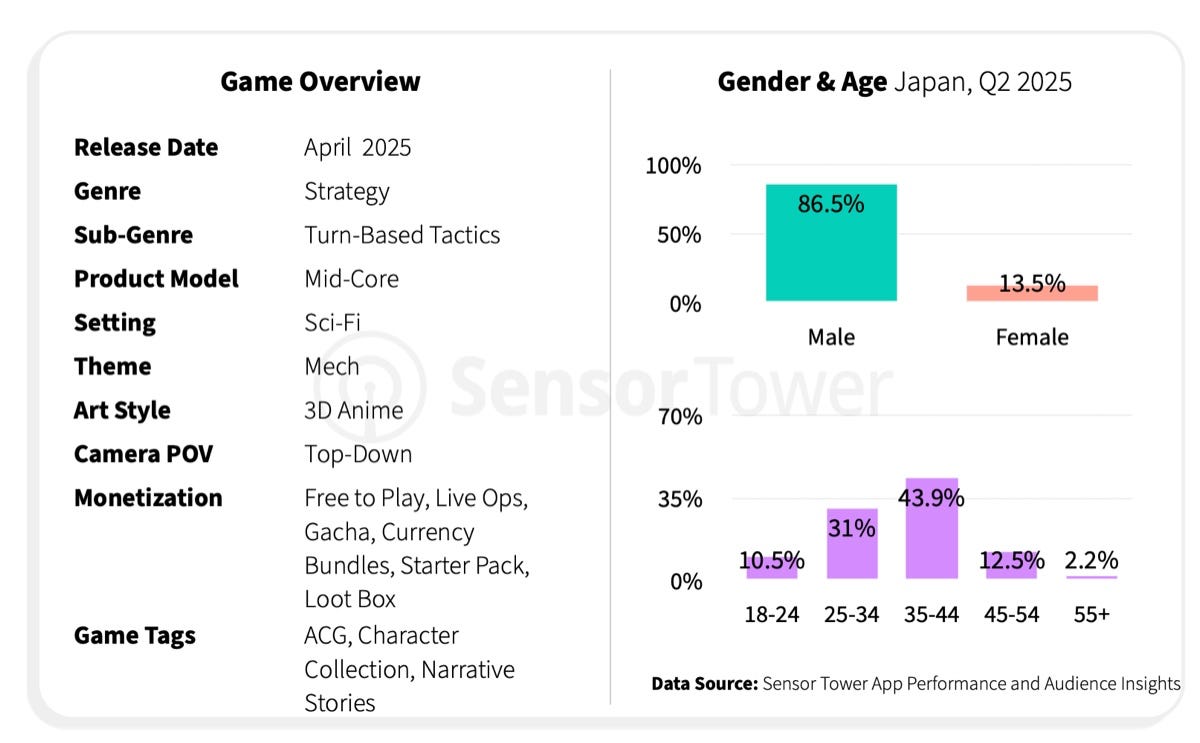

The game launched in April 2025 - it’s a turn-based strategy in a popular franchise. In Q2’25 the game drew an 86.5% male audience; the main age group was 25–44 (74.9%).

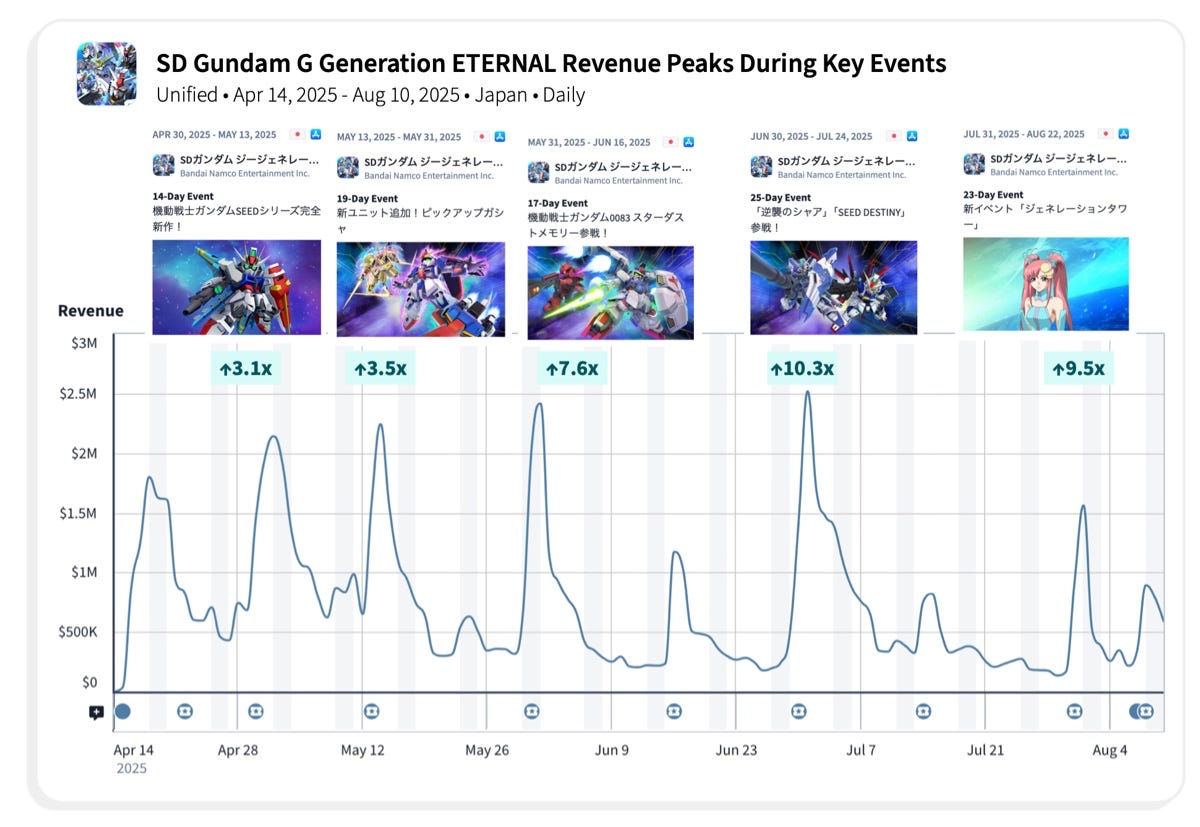

Project revenue closely follows its operations cadence. All peaks are tied to events, the biggest revenue surges in Japan reach 10.3x the base level.

Japanese Developers and Publishers

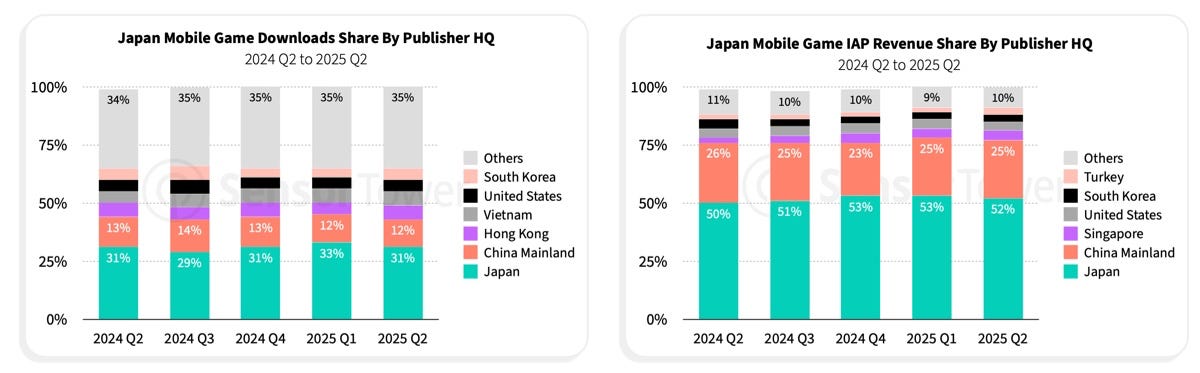

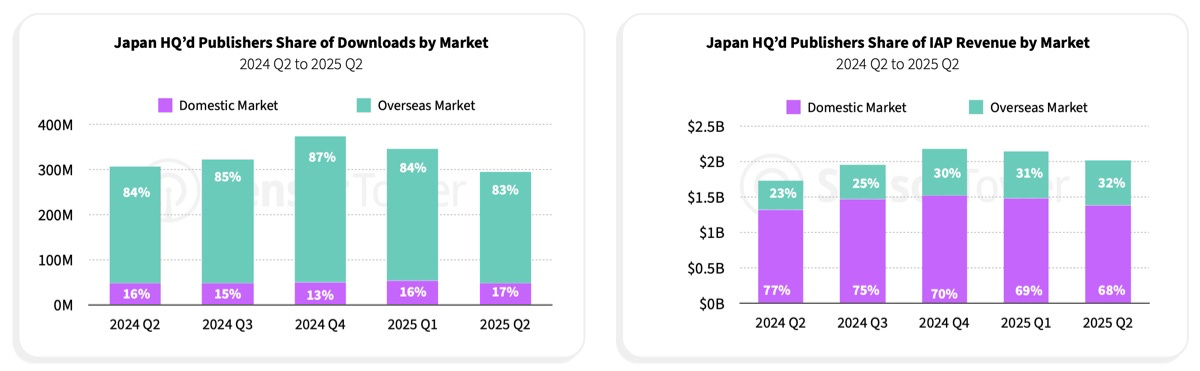

According to Sensor Tower, Japan-HQ’d publishers still mainly focus on their local market. At home they collect 29–33% of all downloads and more than 50% of revenue.

Excluding local developers, here’s the top-10 by revenue and downloads.

Chinese and South Korean developers dominate. Pokemon GO (developed by a U.S. studio) and Royal Match (from Turkey) stand out. Downloads rankings are more diverse.

Looking only at Japanese publishers, domestically they earn 68–69% of all IAP revenue (in the first two quarters of 2025), while accounting for just 16–17% of all installs.

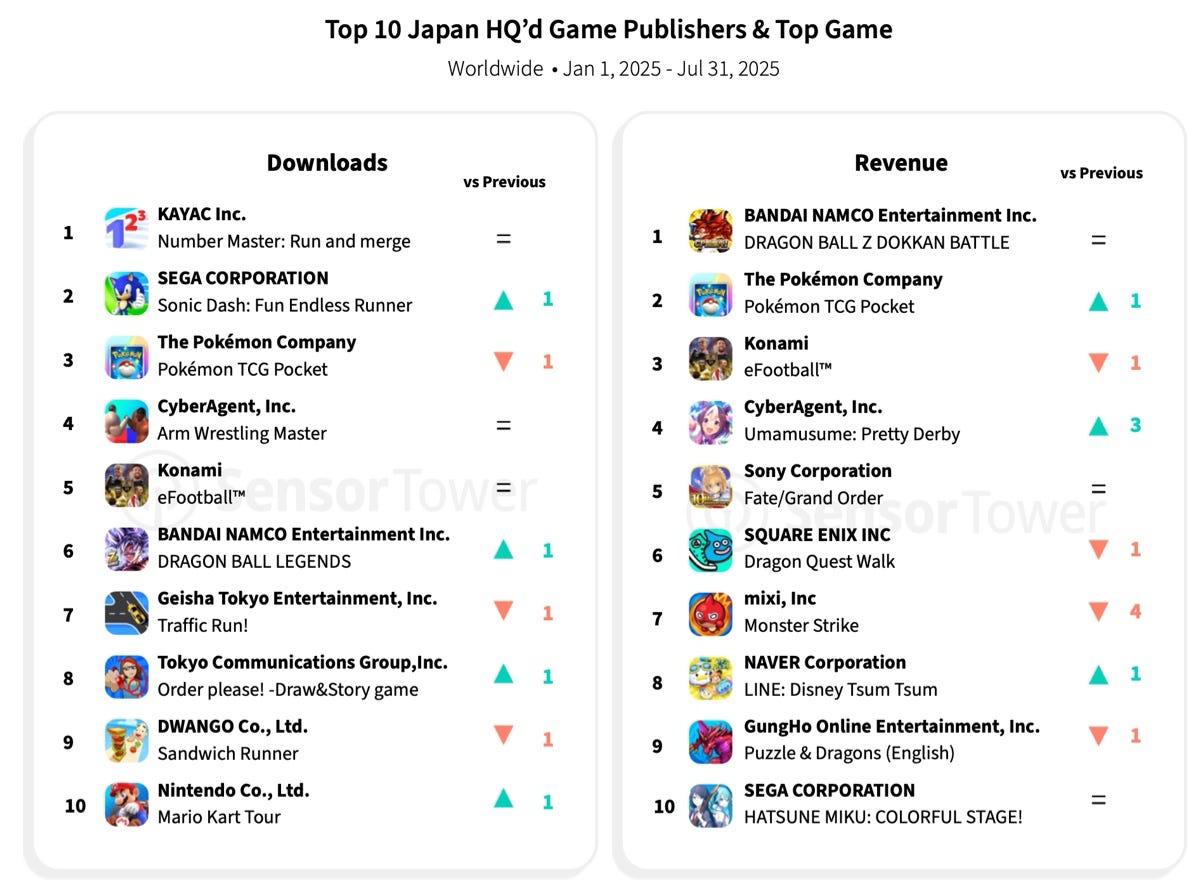

KAYAC Inc., SEGA and The Pokemon Company lead Japanese publishers by downloads. By revenue: Bandai Namco Entertainment, The Pokemon Company and Konami.

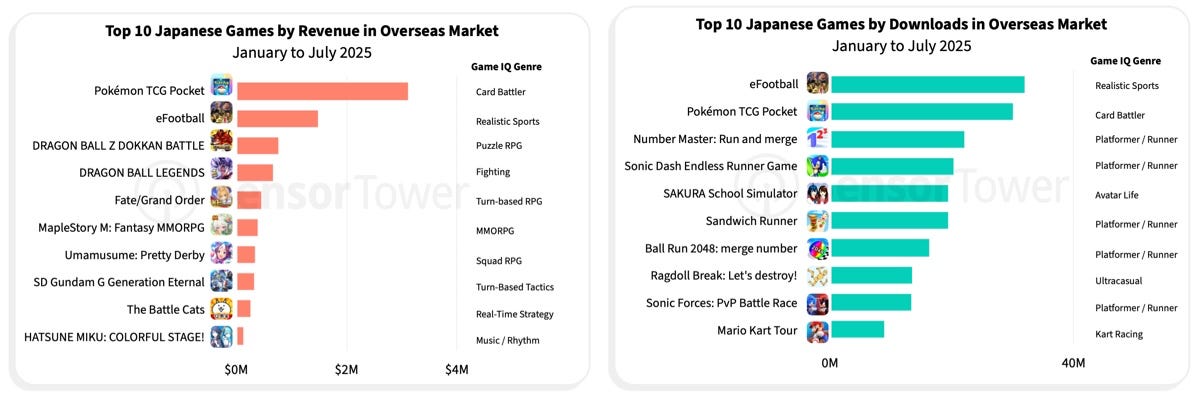

Pokemon TCG Pocket, eFootball and Dragon Ball Z Dokkan Battle are the top three earners from global markets for Japanese publishers. By downloads leaders are eFootball, Pokemon TCG Pocket and Number Master: Run and Merge.

PC/Console Market Status

Data as of August 22, 2025

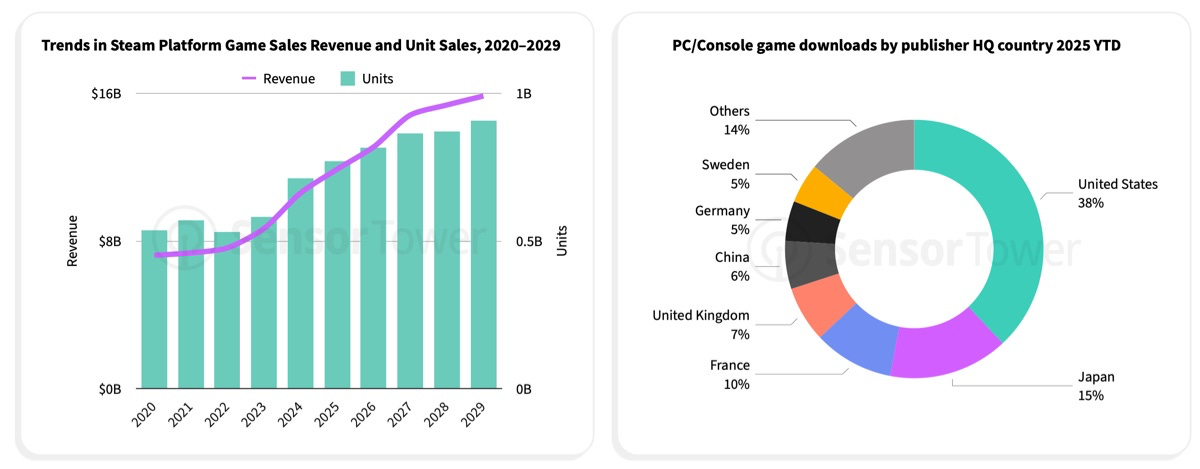

By the end of 2025, Steam revenue is projected to grow by 12% (to $11.9 billion), with units sold to grow by 8% (to 770 million copies). By 2029, these figures should reach $16 billion and 900 million, respectively.

PC/console developers with HQ in Japan generated 15% of all installs in the first 8 months of 2025. U.S. companies led with 38%.

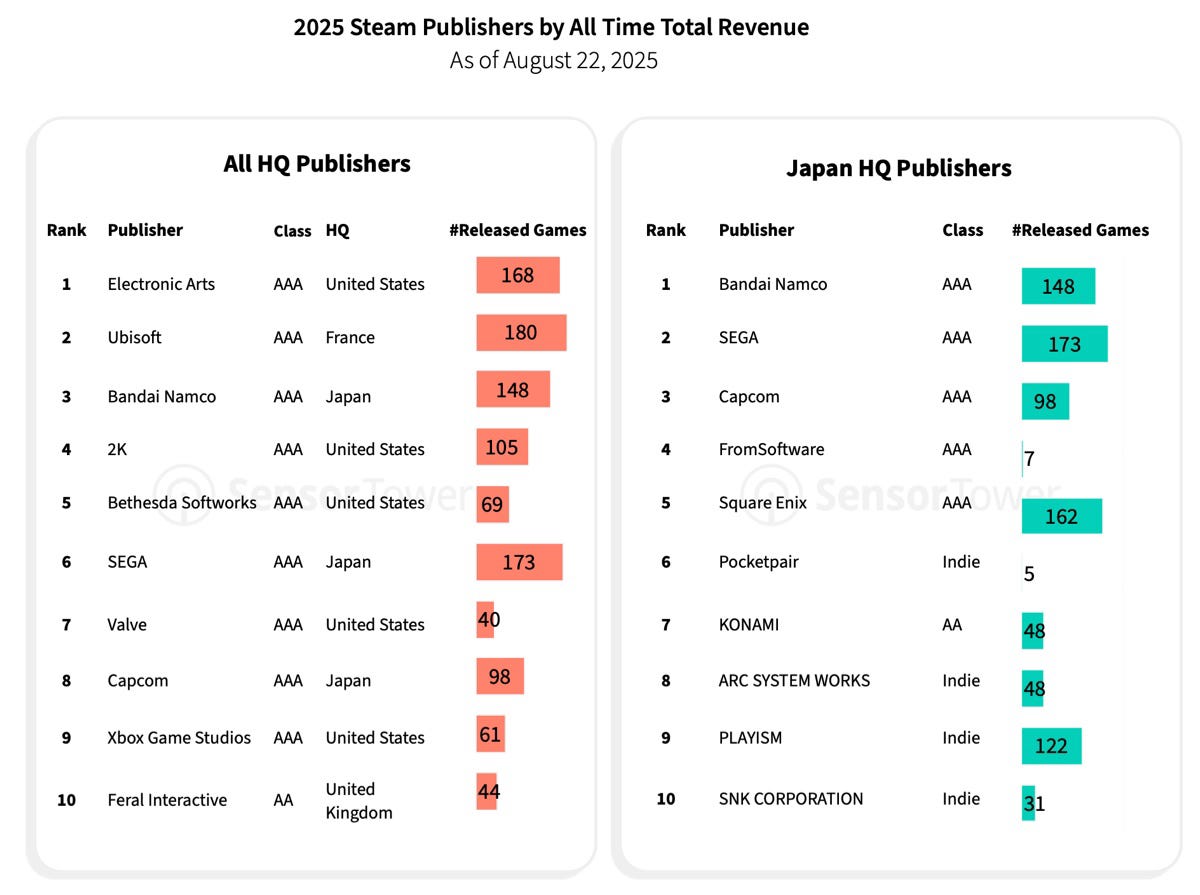

Japan has 3 companies in Steam’s top-10 by revenue — Bandai Namco, SEGA, and Capcom.

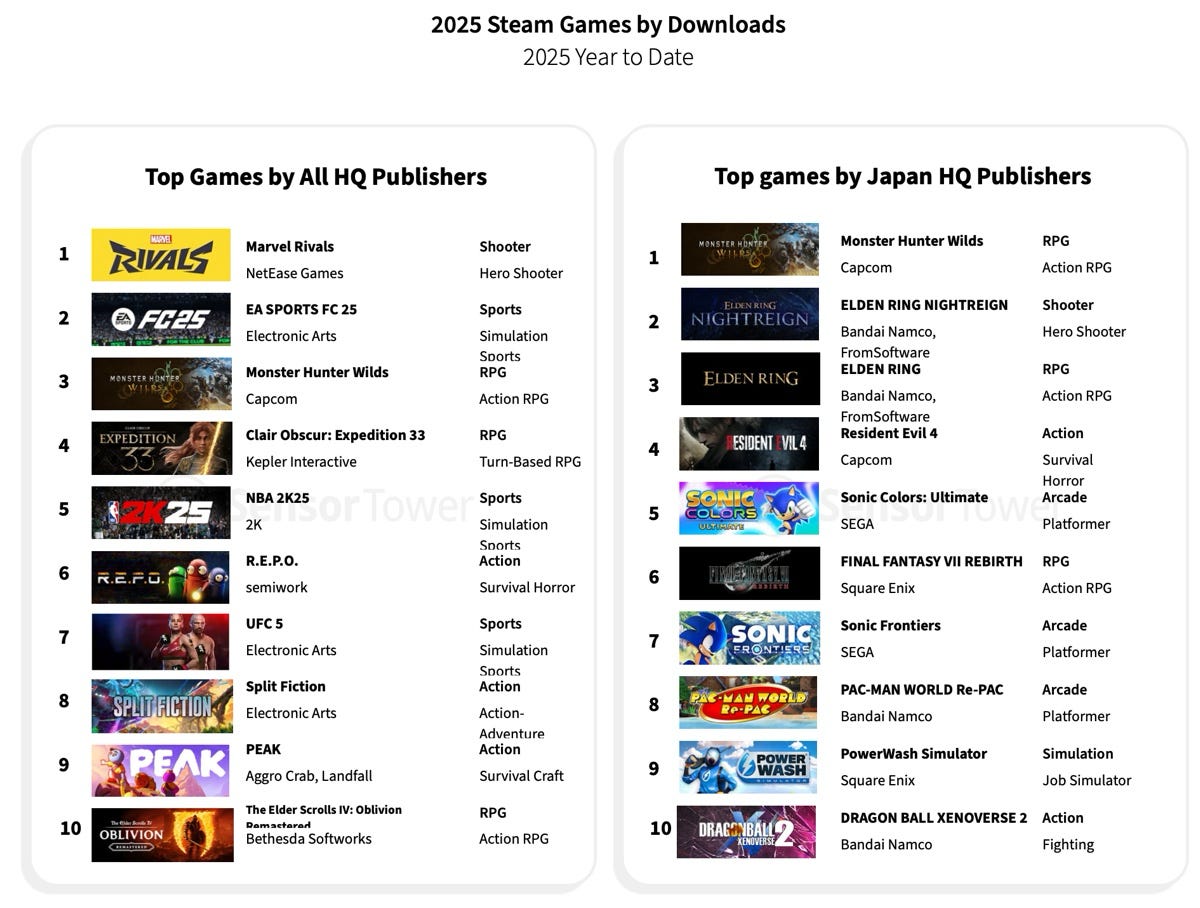

Japanese developers released one of 2025’s major hits — Monster Hunter Wilds.

Advertising Market in Japan

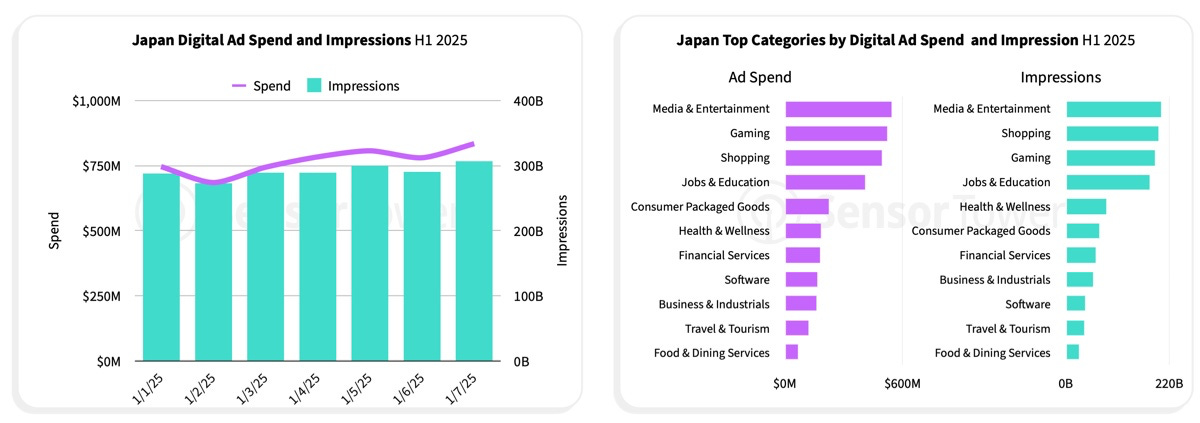

In the first half of 2025, digital ad spend in Japan was about $750 million per month. Games were second after media and entertainment in spend, and third by overall reach.

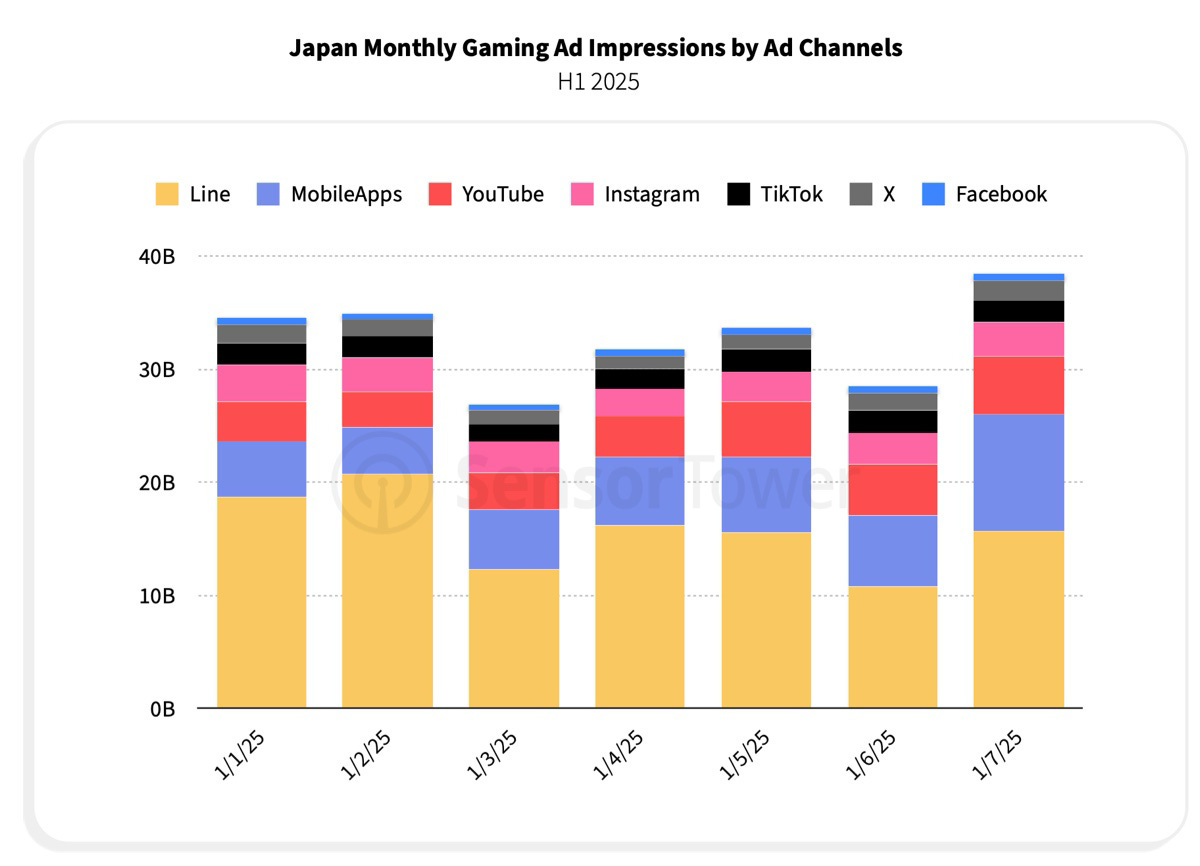

Line, other mobile apps, and YouTube were the main sources of game ad reach in early 2025.

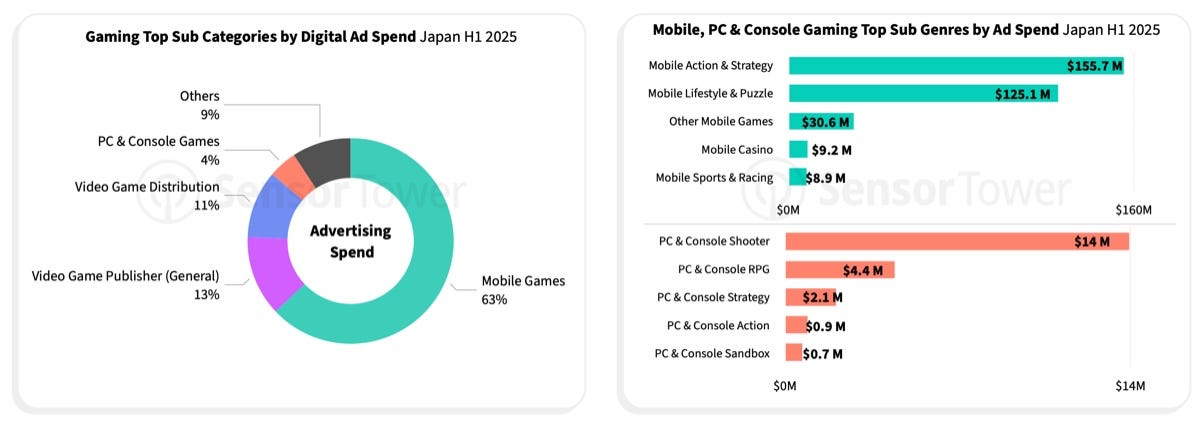

Mobile games lead ad spend (63% of the total). Among mobile projects, the highest ad spend went to action, strategy, puzzle, and lifestyle games. On PC and console, shooters dominate ad spending.