Sensor Tower: Mobile App Market in Q2'25

Non-gaming apps exceeded games by IAP revenue for the first time in history.

Market Overview

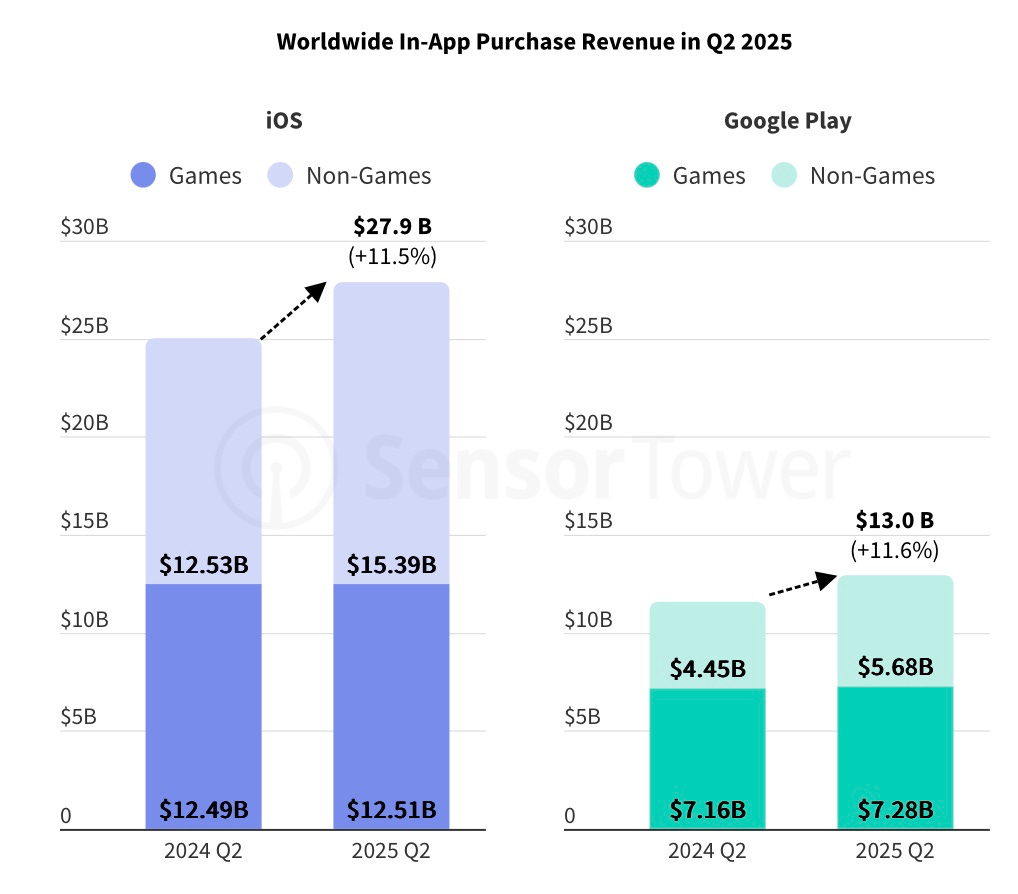

It happened – in Q2'25, for the first time in history, mobile users spent more money on apps than on games. The share of non-gaming apps in total IAP revenue in Q2'25 reached 52%. In Q2’19, it was 26%.

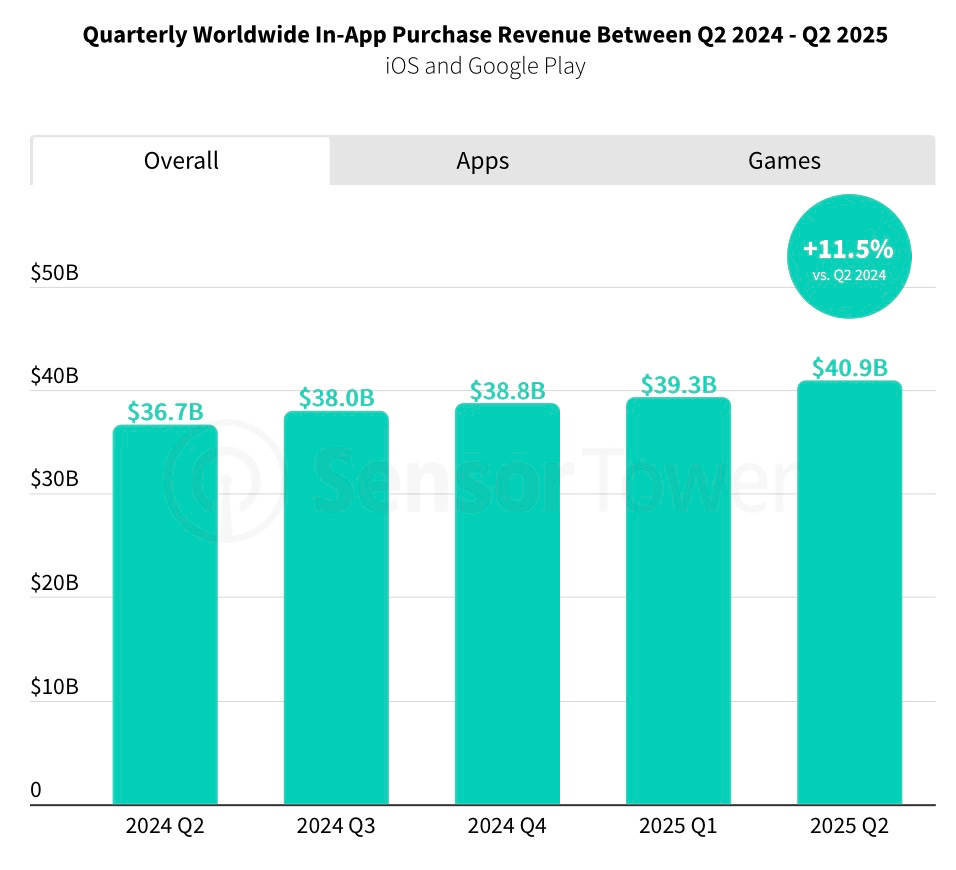

Total IAP purchases in Q2'25 amounted to $40.9 billion – an 11.5% increase over Q2'24.

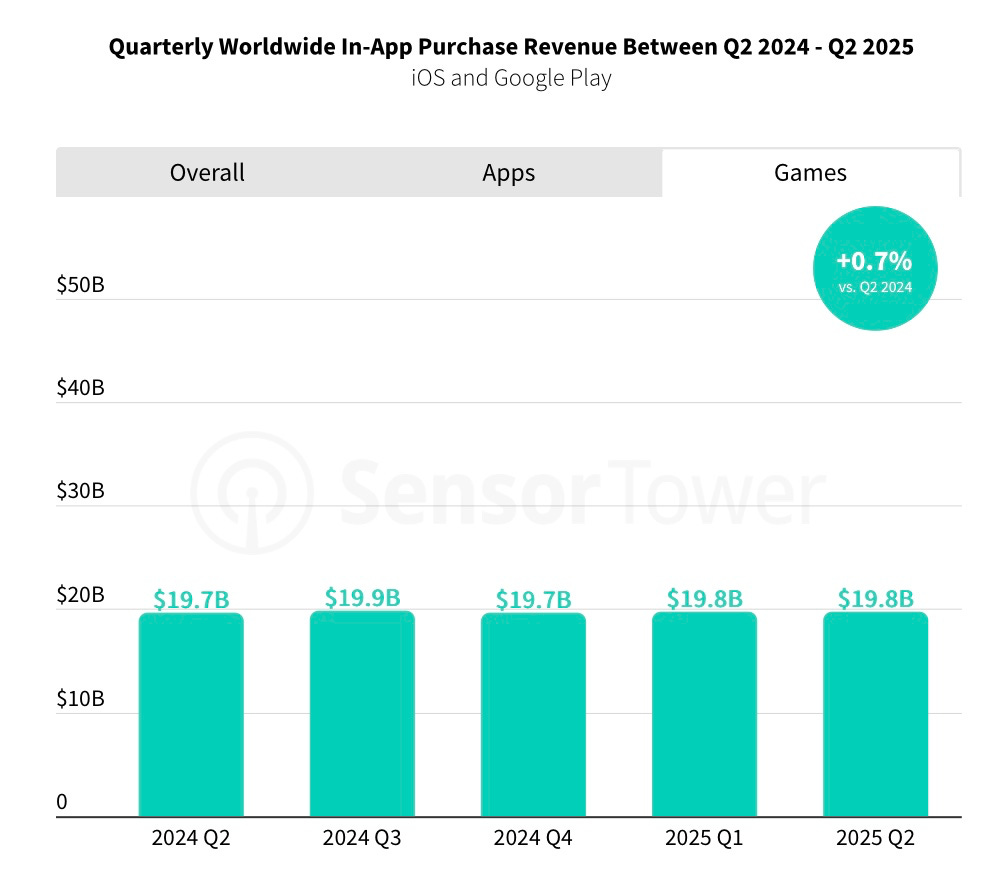

However, games made only a minor contribution to that growth. Game revenue in Q2'25 was $19.8 billion – up just 0.7% from Q2'24. The growth came from non-gaming apps.

iOS still dominates in revenue. Of the $41 billion earned from IAP, iOS accounts for $28 billion. Even excluding China (where Google Play isn’t available), the platform gap is $10 billion.

At the same time, both platforms are growing at the same rate – 11.5-11.6% YoY.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

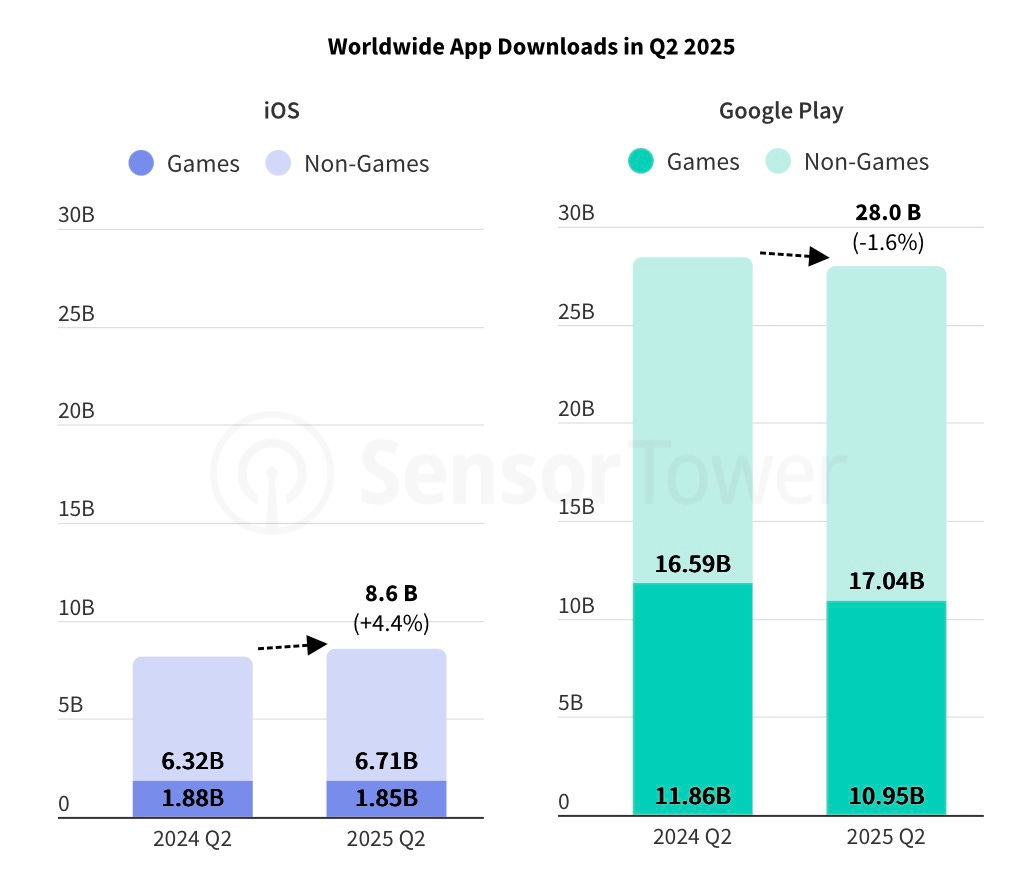

In terms of downloads, the market is static compared to Q2'24 – 36.6 billion installs.

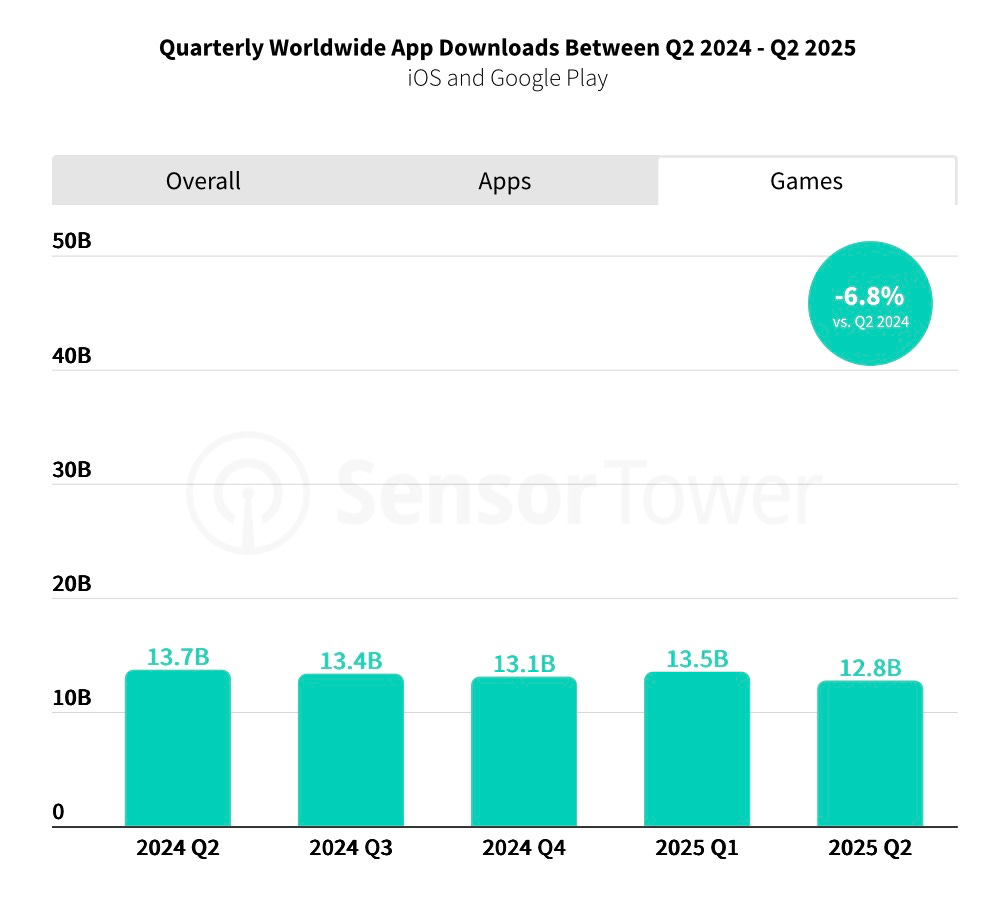

But non-gaming app installs grew by 3.7% (to 23.8 billion), while game installs dropped by 6.8% (to 12.8 billion).

Google Play leads by a significant margin in downloads, but its Q2'25 trend is negative. iOS, although much smaller in absolute numbers, is growing.

Game Market

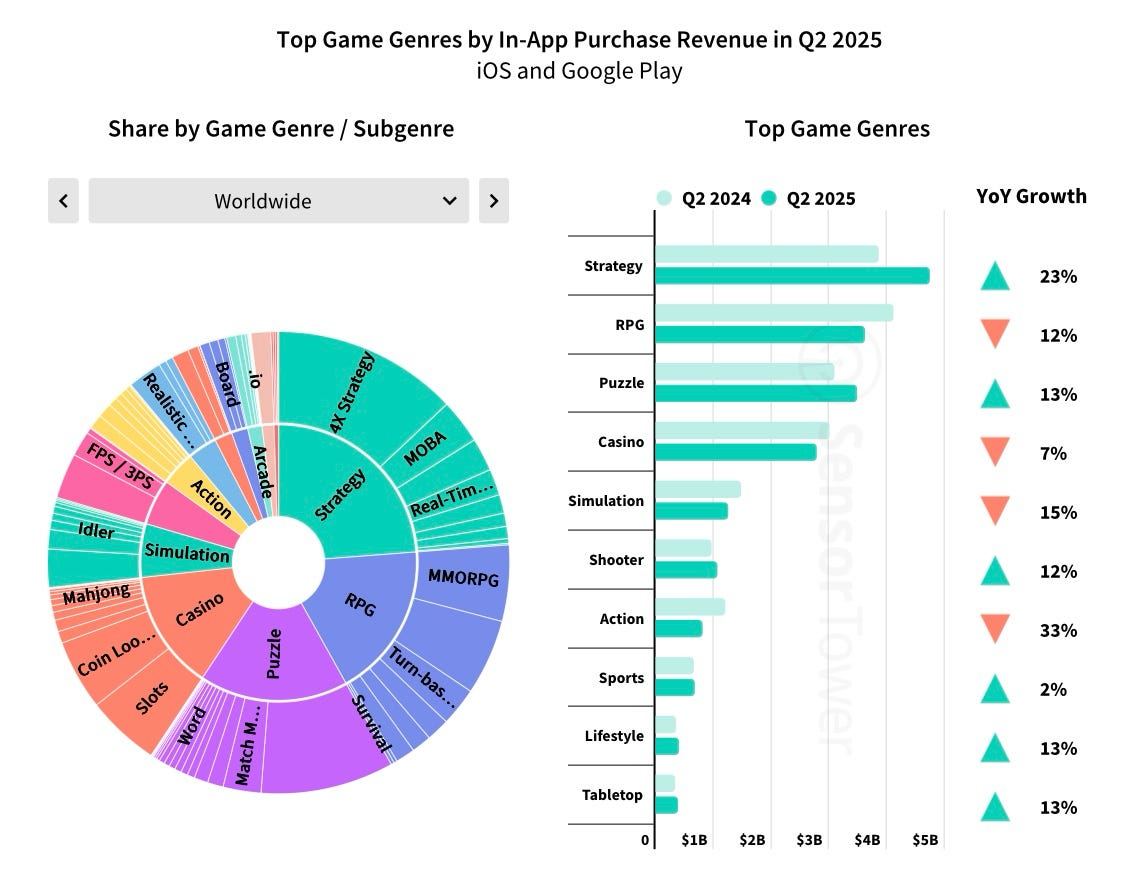

Strategy (+23% YoY), puzzle (+13% YoY), and shooter (+12% YoY) genres led Q2'25 in IAP revenue growth (measured in both absolute and relative terms).

RPG declined by 12% in Q2'25 – if the trend continues, puzzle will move up to 2nd place in revenue. Other falling genres include casino (-7% YoY), simulation (-15% YoY), and action (-33% YoY).

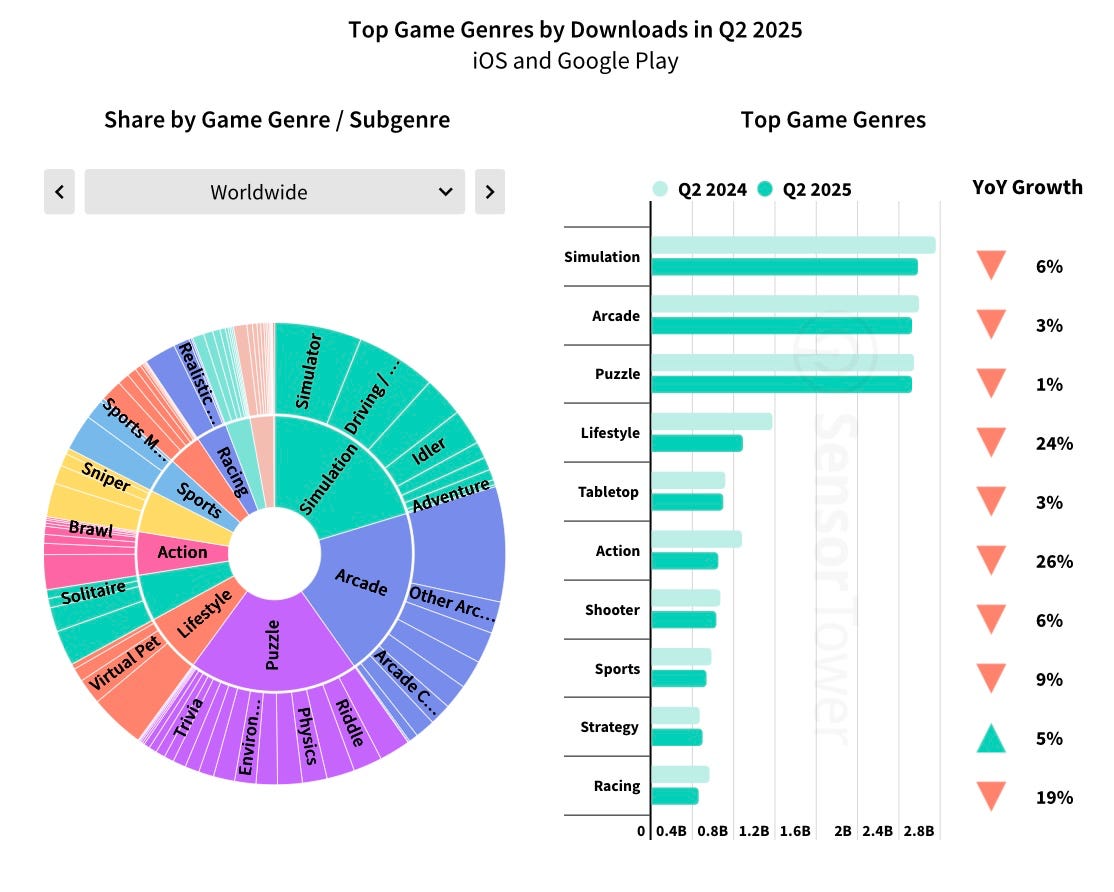

In terms of downloads, every genre except strategy saw declines in Q2'25. Strategy downloads grew 5% YoY, largely due to the aggressive scaling of Kingshot.

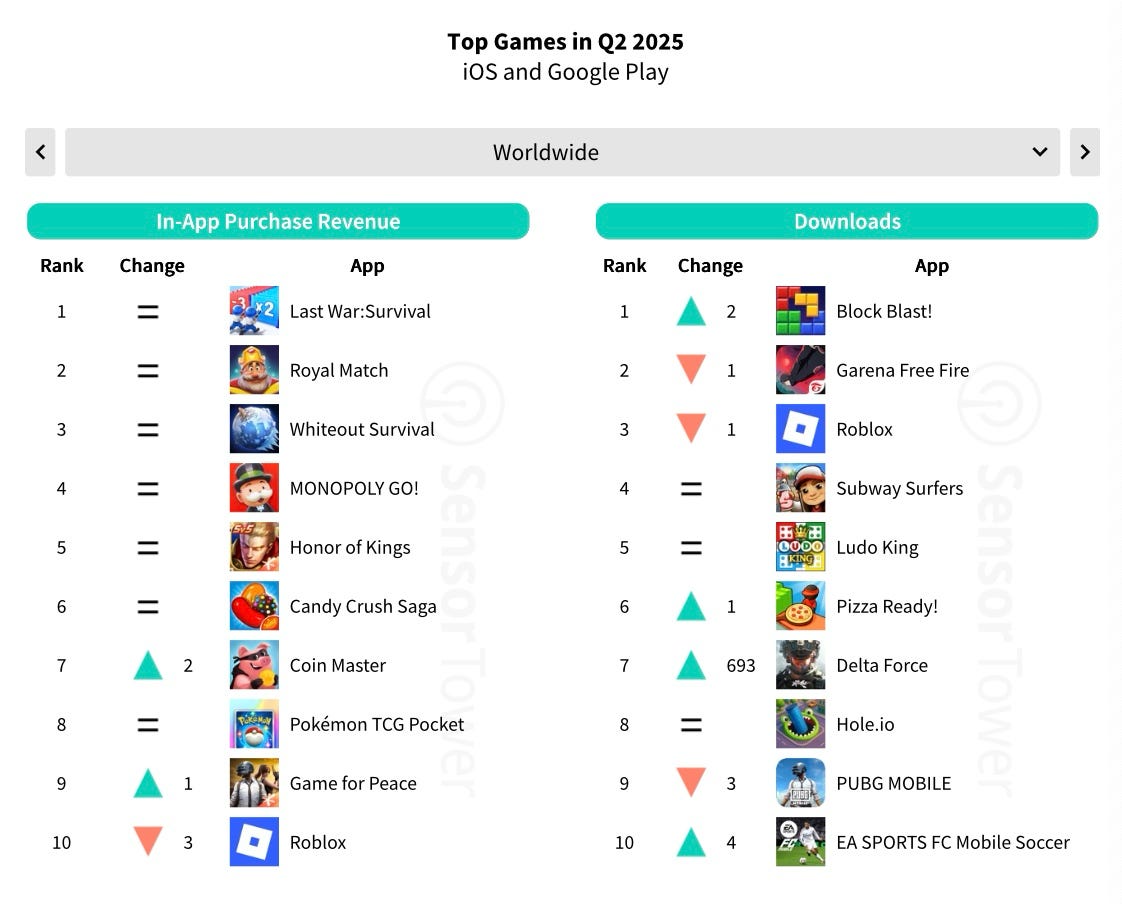

Last War: Survival, Royal Match, Whiteout Survival, MONOPOLY GO!, and Honor of Kings were the top revenue generators in Q2'25. No new titles appeared in the top 10.

For downloads, note Delta Force, which climbed to 7th place. The top 5 were Block Blast!, Garena Free Fire, Roblox, Subway Surfers, and Ludo King.

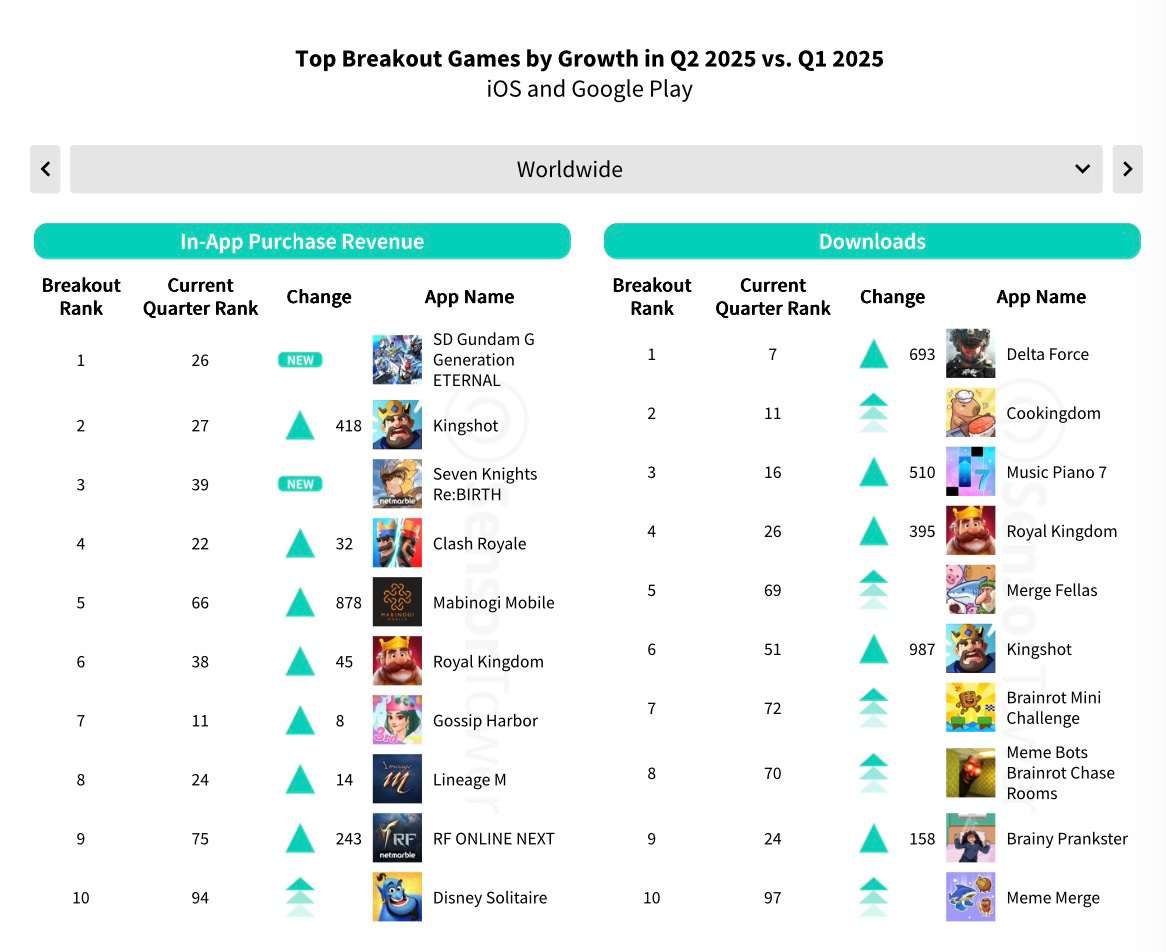

The best projects in Q2'25 by revenue growth over the previous quarter were SD Gundam G Generation Eternal, Kingshot, and Seven Knights Re: BIRTH.

By download growth (Q2’25 vs Q1’25), Delta Force led, followed by Cookingdom and Music Piano 7.