Sensor Tower: Mobile Gaming Market in 2024 & beyond

The company's analytics projects a new era of stable growth.

All revenue figures are gross, including platform commissions.

Overall State of the Mobile Gaming Market

In 2023, IAP revenue from mobile games decreased to $76.7 billion (-2% YoY). The market has been declining since 2021, but it is still 22% higher than pre-pandemic 2019.

Sensor Tower expects growth in 2024, with revenues reaching $78 billion (+1.6% YoY). By 2028, mobile game revenues are expected to exceed $100 billion, with a compound annual growth rate of 6.8%.

The USA remains the largest market by IAP revenue, with Americans spending $22.2 billion on in-game purchases in 2023, which is plateaued compared to 2022 but 38% higher than in 2019. By 2028, IAP revenue in the USA is expected to reach $33.5 billion.

In 2022 and 2023, IAP revenue from iOS games in China amounted to $15.1 billion.

❗️Sensor Tower does not account for revenue from Android stores in China. In reality, the Chinese market is likely larger than the American one.

In 2023, IAP revenue in Japan fell to $12.5 billion (-13% YoY); in South Korea, it dropped by 7% to $4.8 billion.

❗️Sensor Tower also does not consider payments outside of platforms.

Sensor Tower forecasts that all key mobile markets will grow over the next five years.

Honor of Kings retained the top spot in revenue over MONOPOLY GO! in 2023. The game has earned over $15.5 billion in its lifetime, with over 99% of that amount coming from China. The fastest-growing projects are MONOPOLY GO!, Honkai: Star Rail, and Royal Match.

Genres

Revenue from casual games grew by 8% in 2023, reaching $28.6 billion. This accounts for 38% of the total market volume.

Hybrid-casual games grew by 30% in 2023, reaching $2.1 billion.

The share of mid-core game revenue has been declining over the years. In 2020, they accounted for 66% of the market, but by 2023, this had fallen to 59%. Revenue decreased by 9% in 2023, while all other categories grew. Hyper-casual projects grew by 8%.

The strongest growth was seen in card/board games, which grew by 18% (thanks to the success of MONOPOLY GO!); puzzle games showed significant growth (+10% YoY), largely due to the success of Royal Match.

Revenue from action games, sports games, racing games, and tabletop games grew by 7%.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The biggest declines were seen in shooters (-13% YoY); lifestyle projects (-11% YoY); RPGs (-10% YoY); and strategy games (-10% YoY).

Mobile Gaming Trends

In 2023, puzzles earned more than $10 billion from IAP purchases for the first time. The strongest growth was in Match-2 projects (+77% YoY); merge games (+36% YoY); Match-3 (+13% YoY); and hidden object games (+9% YoY). Only the blast games segment fell (-18% YoY).

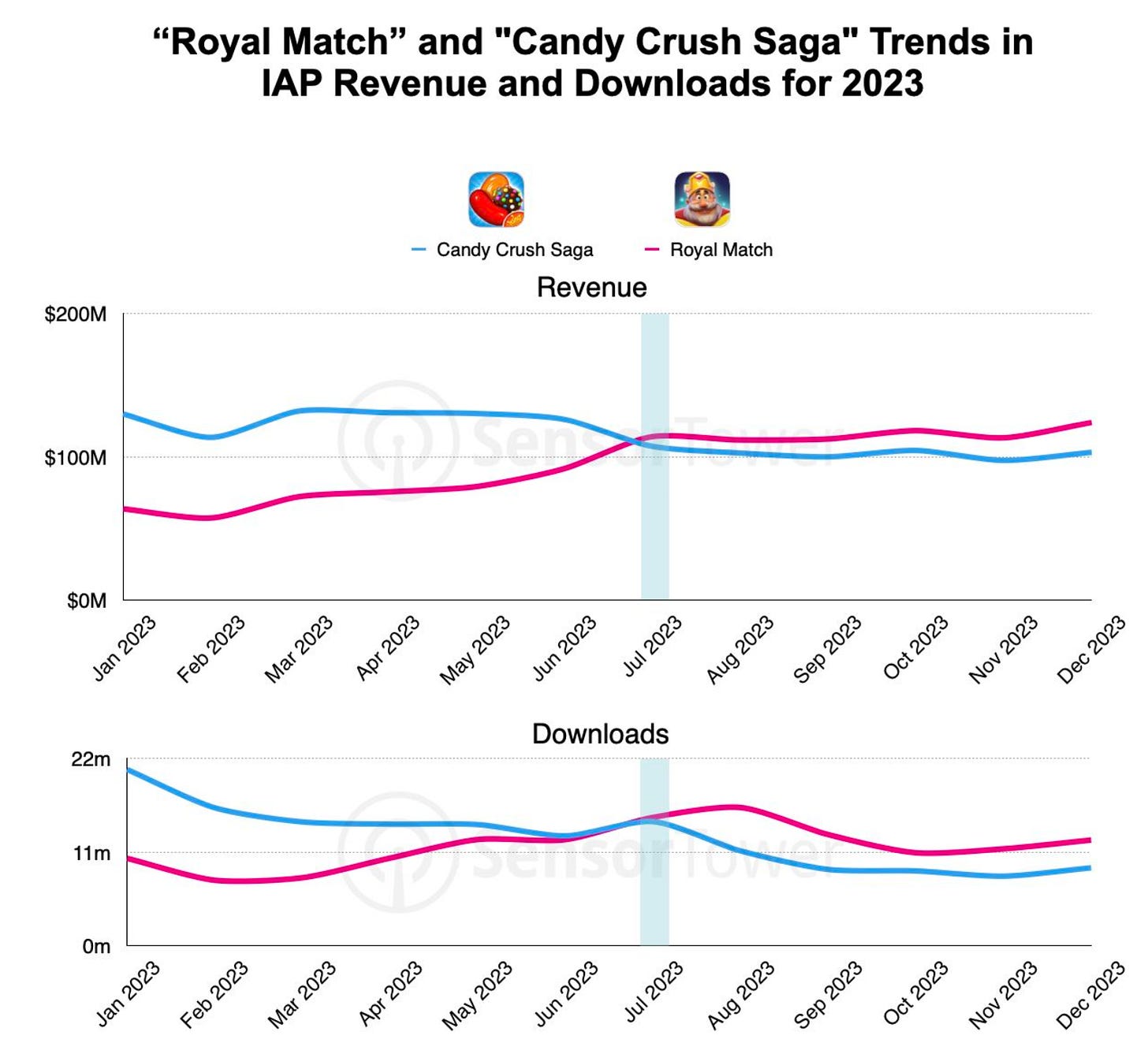

Royal Match surpassed Candy Crush Saga in revenue for the first time in 2023. Since June-July 2023, the game has also been leading in downloads.

MONOPOLY GO! boosted the board games segment, with the project's success allowing the genre to grow by 18% in 2023. In the USA, the genre grew by 21% YoY. The USA's share of the board games segment is 54%.

According to Sensor Tower, MONOPOLY GO! earned more than $1.2 billion from in-game purchases in 2023, with the project's MAU exceeding 17 million people.

❗️Hasbro recently reported that the game surpassed the $3 billion mark.

RPG revenue continues to decline for the second consecutive year. The 10% drop worldwide is largely due to a 17% revenue decrease in Japan (the main market for the genre). However, declines were also seen in South Korea (-11% YoY), the USA (-7% YoY), Taiwan, Hong Kong, and Macau (-7%). In China, the iOS genre remained flat, with a decline of only 0.2% in 2023.

Despite the decline in the RPG genre, many strong projects were released in 2023 - Honkai: Star Rail; Justice Online; Goddess of Victory: Nikke; Chang’an Fantasy; Night Crows; Pixel Heroes. These projects were among the top revenue growth leaders in 2023.

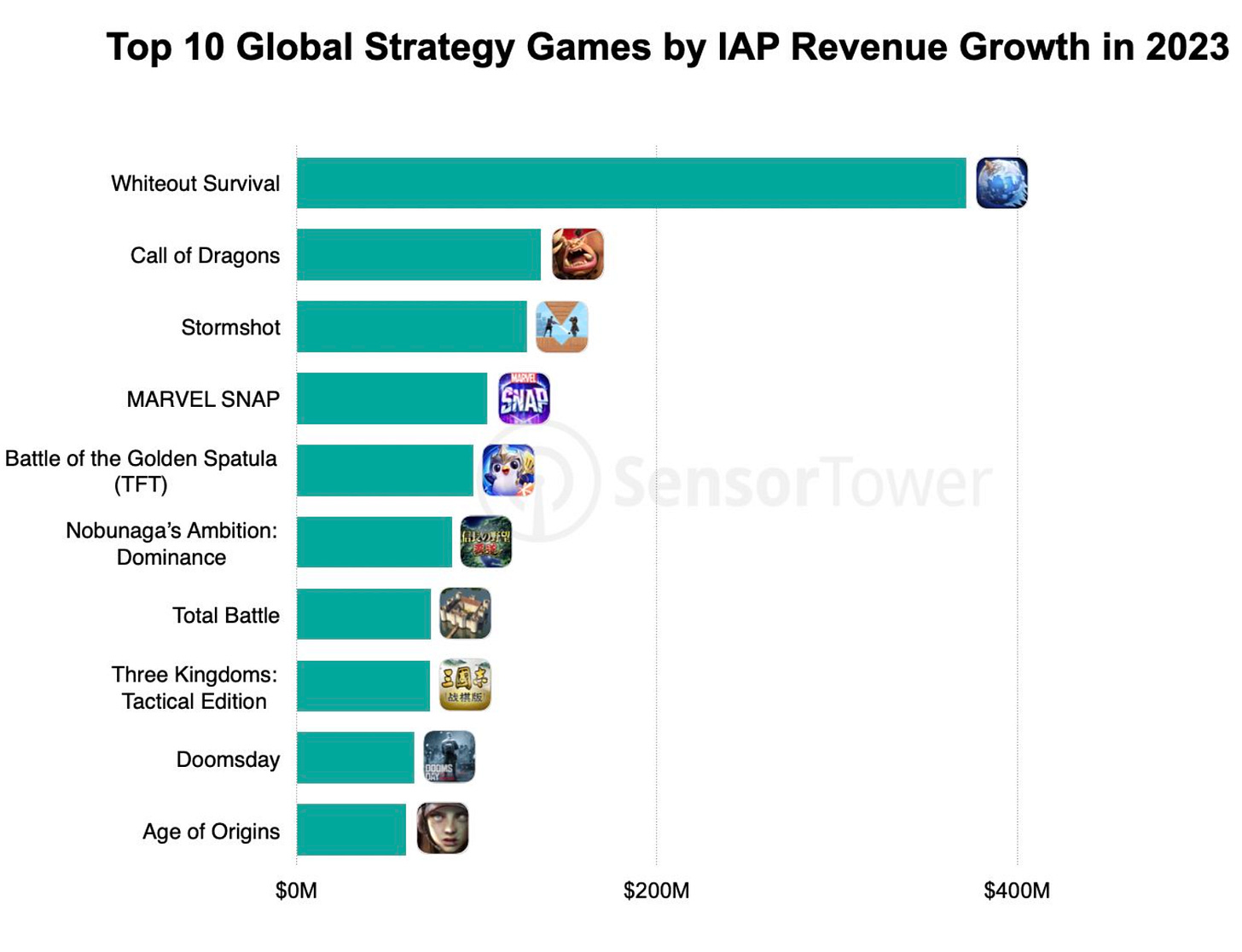

A similar trend is seen in strategy games. The genre fell by 10% in 2023, to $14.8 billion. However, its revenue is still 22% higher than in 2019. 4X strategy games account for 47% of the genre's total revenue ($7 billion in 2023, but a 14% decline compared to 2022). MOBA games fell by 2%; real-time strategies by 4%; card battlers by 5%; and build & battle games by 15%.

Whiteout Survival stands out among competitors. The game earned $370 million from IAP in 2023, making it the fastest-growing game in the genre.

Markets in Japan and South Korea

Monster Strike, Pretty Derby, and Fate/Grand Order are the top-earning games in the Japanese market. However, Honkai: Star Rail is the fastest-growing game in the country by revenue. Japan accounts for 21% of the game's total revenue, making it the largest overseas market for the game. Goddess of Victory: Nikke is in second place, with a revenue growth of 182% in 2023.

In South Korea, the top revenue earners are Lineage M; Odin: Valhalla Rising, and Night Crows. In 2023, MMORPGs in the country earned $1.9 billion, accounting for 40% of the total market. Night Crows was the fastest-growing project by revenue, earning $180 million.