Sensor Tower: Mobile (Gaming) Market in Q1'24

In general, it's more positive with revenue growth (finally!) year over year. However, it's not so bright on the downloads side, and non-gaming apps are pushing.

Sensor Tower only accounts for iOS revenue and downloads in China. Revenue figures are Gross, meaning they include commissions, taxes, etc.

Overall Mobile Market condition

The mobile market has been steadily growing since the second quarter of 2023. In Q1’24, it reached $35.8 billion, showing a year-over-year (YoY) growth of 9.5%. Non-gaming apps experienced a YoY increase of 19.4%.

The total number of downloads decreased by 3.5% compared to Q1’23, falling to 34 billion. Non-gaming apps saw a slight decline of 1.3%.

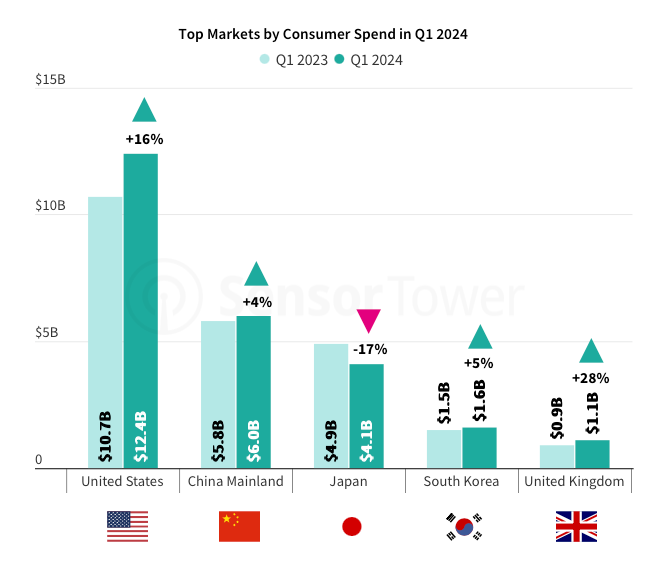

The largest mobile markets by revenue in the first quarter of 2024 were the USA ($12.4 billion, +16% YoY), China ($6 billion, +4% YoY), Japan ($4.1 billion, -17% YoY), South Korea ($1.6 billion, +5% YoY), and the UK ($1.1 billion, +28% YoY).

In terms of downloads, the top markets were India (5.93 billion, -9% YoY), the USA (3.06 billion, -4% YoY), Brazil (2.05 billion, -2% YoY), Indonesia (1.83 billion, +3% YoY), and China (1.76 billion, +2% YoY).

GameDev Reports Newsletter offers promotion opportunities to gaming companies. Reach out to learn more.

Gaming Market

The mobile gaming market in Q1’24 reached $20.3 billion, the highest figure in a year, representing a YoY growth of 2.9%.

User spending on iOS games increased from $12.3 billion in Q1’23 to $13 billion in Q1’24. Conversely, Google Play saw a decrease from $7.4 billion in Q1’23 to $7.3 billion in Q1’24.

Game downloads are decreasing faster than the overall mobile market, with a YoY decline of 6.8%. In Q1’24, games accounted for 12.8 billion downloads. However, this is the first quarter in a year showing positive quarter-on-quarter dynamics.

The decline in game downloads is solely on Android, dropping from 11.8 billion in Q1’23 to 10.8 billion in Q1’24. The situation on iOS remains stable.

❗️ The overall trend of non-gaming apps capturing user attention from games continues. This trend is slightly masked by the success of MONOPOLY GO!.

Gaming Genres by Revenue

Top growth: Lifestyle games (+36% YoY to $420 million in Q1’24), casino games (+34% YoY to $3.025 billion in Q1’24, largely due to MONOPOLY GO!), and puzzle games (+17% YoY to $2.912 billion).

Top declines: Arcade games (-22% YoY to $500 million in Q1’24), sports games (-15% YoY to $670 million in Q1’24), and action games (-15% YoY to $469 million in Q1’24).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

In absolute terms, RPGs saw the most significant decline, falling by 13% in Q1’24 compared to the previous quarter, dropping from $5.25 billion to $4.57 billion. Revenue for this genre fell by 24% in Japan, 10% in the USA, 9% in China, and 3% in South Korea.

Gaming Genres by Downloads

Top growth: Racing games (+11% YoY), shooters (+9% YoY), and strategy games (+5% YoY).

Top declines: Arcade games (-17% YoY), sports games (-16% YoY), and Lifestyle games (-15% YoY). It's important to note that the top four genres in terms of downloads are declining.

Most Successful Games in Q1’24

MONOPOLY GO! set a record for mobile games in terms of quarterly revenue, earning $770M. The previous leader was Honor of Kings with $765M in Q2’21. No other mobile game has crossed the $600 million mark in a quarter, and only seven projects in history have earned more than $500 million in a quarter.

❗️ When discussing Honor of Kings' revenue, we do not count Android stores. Similarly, MONOPOLY GO!'s full revenue is not visible, as some of the money comes to Scopely via off-store methods.

Garena Free Fire secured the top spot for downloads in Q1’24. Wood Nuts & Bolts Puzzle and Pizza Ready! saw significant rises in the rankings.

Last War: Survival Game, Legend of Mushroom, and CrossFire: Legends were the fastest-growing projects by revenue in Q1’24.

In terms of downloads, the most significant gains were made by Wood Nuts & Bolts Puzzle, Pizza Ready!, and Help Me: Tricky Story. Call of Duty: Warzone Mobile started at the 4th place in the growth rankings and ended up at the 23rd place in the overall download rankings.

Digital Advertising Spend

In Q1’24, advertising spend increased in North America, Latin America, and Western Europe, with growth rates of 15-30% compared to Q1’23, depending on the market.

However, spending on game advertising fell in the USA and Canada by 19% and 24% respectively.

❗️ The decline in advertising spending in the USA in Q1'24 will impact future gaming revenue.