Sensor Tower: Mobile gaming market in Southeast Asia in 2024

Downloads are increasing while revenue is declining.

Market Overview

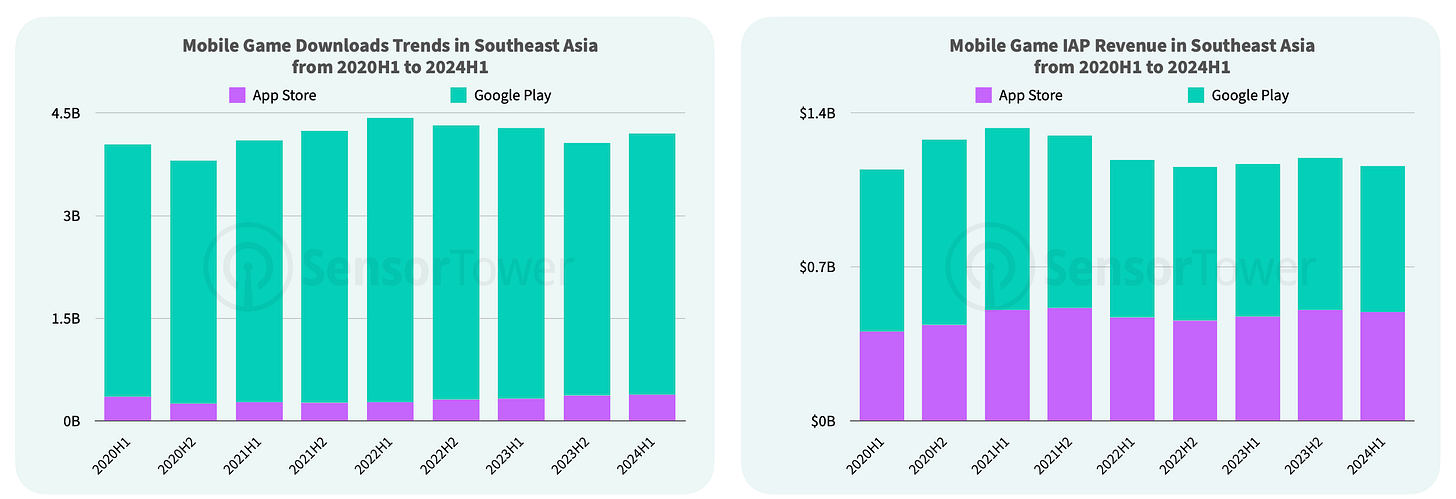

Game downloads in Southeast Asia increased by 3.4% in the first half of 2024 compared to the second half of 2023, though they decreased year-over-year. The total volume reached 4.2 billion installs, with 91% coming from Google Play.

Revenue declined by 3% compared to H2 2023, amounting to $1.16 billion—similar to the first half of 2020. Out of the total revenue, 57% was generated by Google Play.

Genres and Countries

From January to August 2024, downloads grew most in the strategy (+14% YoY), simulation (+11% YoY), RPG (+7% YoY), and shooter (+6% YoY) genres in Southeast Asia.

Sport games (+39% YoY) and puzzle games (+6% YoY) shown the largest revenue growth. Core genres declined, with strategy dropping by 3% and RPG by 9%.

Indonesia was the only Southeast Asian country to see download growth from January to August 2024, with a 10% increase, leading also in absolute installs.

For in-game revenue, Thailand (+10% YoY), Indonesia (+1% YoY), the Philippines (+3% YoY), and Cambodia (+6% YoY) showed growth, while Singapore (-14% YoY) and Malaysia (-8% YoY) faced significant declines.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Most Popular Games

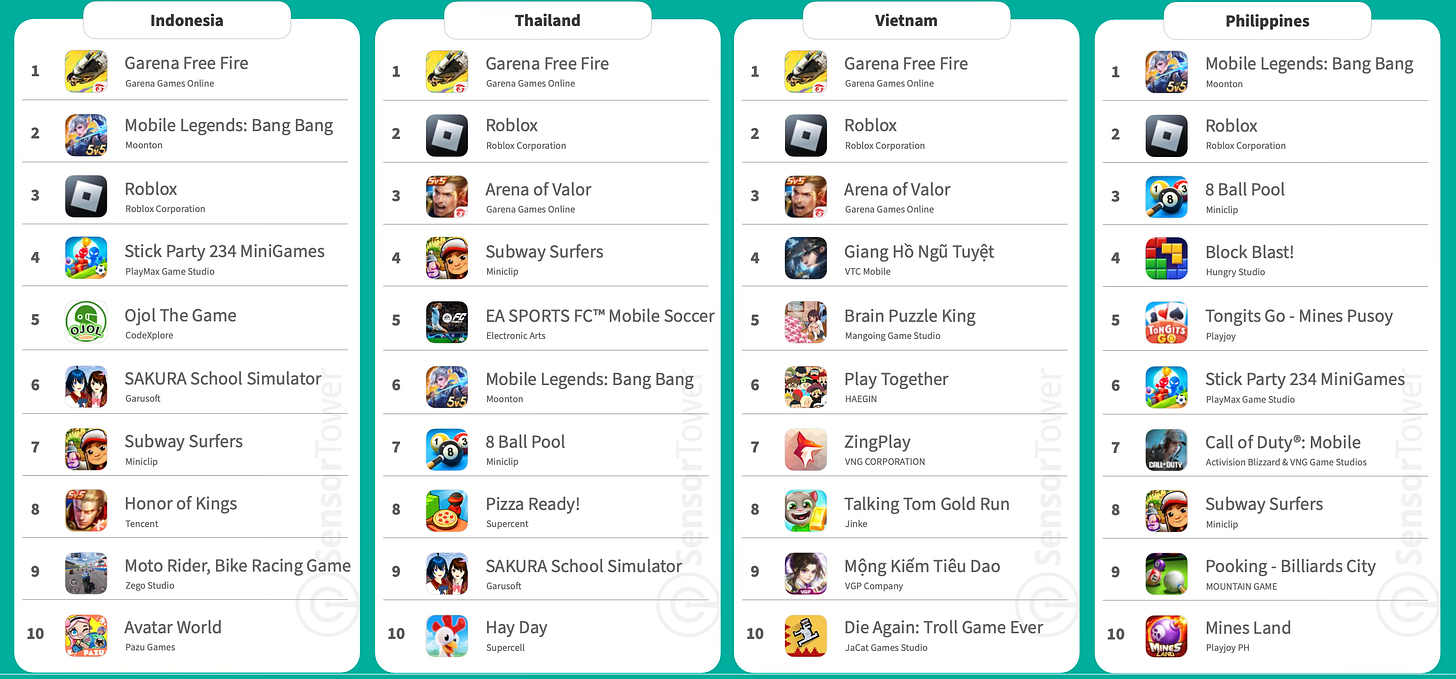

The top games by downloads include Garena Free Fire (+54% YoY from January to August 2024), Mobile Legends: Bang Bang (+45% YoY over the same period), and Roblox.

Leading in revenue are Mobile Legends: Bang Bang (+6% YoY from January to August 2024), eFootball 2024 (+90% YoY for the same period), and Garena Free Fire.

Legend of Mushroom is one of the top performers in revenue growth, earning $11 million in the region from January to August.

Examining download and revenue rankings highlights the diversity within Southeast Asia. While shooters and MOBA are popular throughout, there are unique preferences; for instance, Coin Master is a revenue leader in Vietnam, while two MMORPGs dominate in the Philippines.

Case Study: Honor of Kings

In mid-June, Honor of Kings launched a renewed push for global expansion, specifically targeting Southeast Asia. By July, it had become the most downloaded game in the region.

In July, 51% of the game’s downloads came from Indonesia, with an additional 11% from the Philippines. Marketing materials were localized for the region's countries.