Sensor Tower: Mobile Market in Q2 2024

The market is growing, but gaming apps are behind non-gaming.

Revenue - IAP, Gross (before commissions and taxes)

Overall State of the Mobile Market

The total IAP revenue of the mobile market amounted to $36.2 billion in Q2 2024. Growth compared to Q2'23 is 11.7%. Non-gaming apps grew by 21.8% year-on-year to $16.5 billion, while gaming apps grew by 4% year-on-year to $19.7 billion.

Non-gaming revenue grew on both iOS and Android. However, gaming revenue grew only on iOS, from $11.97 billion in Q2'23 to $12.85 billion in Q2'24. On Android, gaming revenue fell from $6.97 billion to $6.84 billion over the same period.

Downloads in Q2 across all apps fell by 1.7% YoY to 37.7 billion. Non-gaming app downloads increased by 0.9% (to 21.1 billion), while game downloads fell by 6.4% YoY to 12.6 billion. For instance, downloads in the US reached their lowest level since 2018, indicating that the market has matured according to Sensor Tower.

iOS downloads dropped from 1.95 billion in Q2 2023 to 1.84 billion in Q2 2024. On Android, downloads decreased from 11.47 billion to 10.72 billion over the same periods.

Gaming Market State

For the first time since 2017, RPG is not the highest-grossing genre. It was overtaken by strategy games (up 12% YoY in Q2'24), while RPGs saw a 15% drop in revenue. Arcades (-24% YoY) and sports games (-8% YoY) also saw declines.

GameDev Reports Newsletter offers promotion opportunities to gaming companies. Reach out to learn more.

Revenue growth in Q2'24 compared to Q2'23 was seen in action games (+50%), lifestyle projects (+23%), casino games (+20%), and puzzles (+12%).

However, the download situation is less positive. Only strategy (+19% YoY), shooter (+3% YoY), and simulation games (+3% YoY) saw growth in downloads in Q2'24.

Most Successful Games

The leaders in Q2'24 by revenue were MONOPOLY GO!, Honor of Kings, Royal Match, Roblox, and Candy Crush Saga. Dungeon & Fighter, which was released in May, also made it into the top 10.

The leaders by downloads were Garena Free Fire, Pizza Ready!, Roblox, Subway Surfers, and Ludo King. Squad Busters also entered the ranking at 6th place.

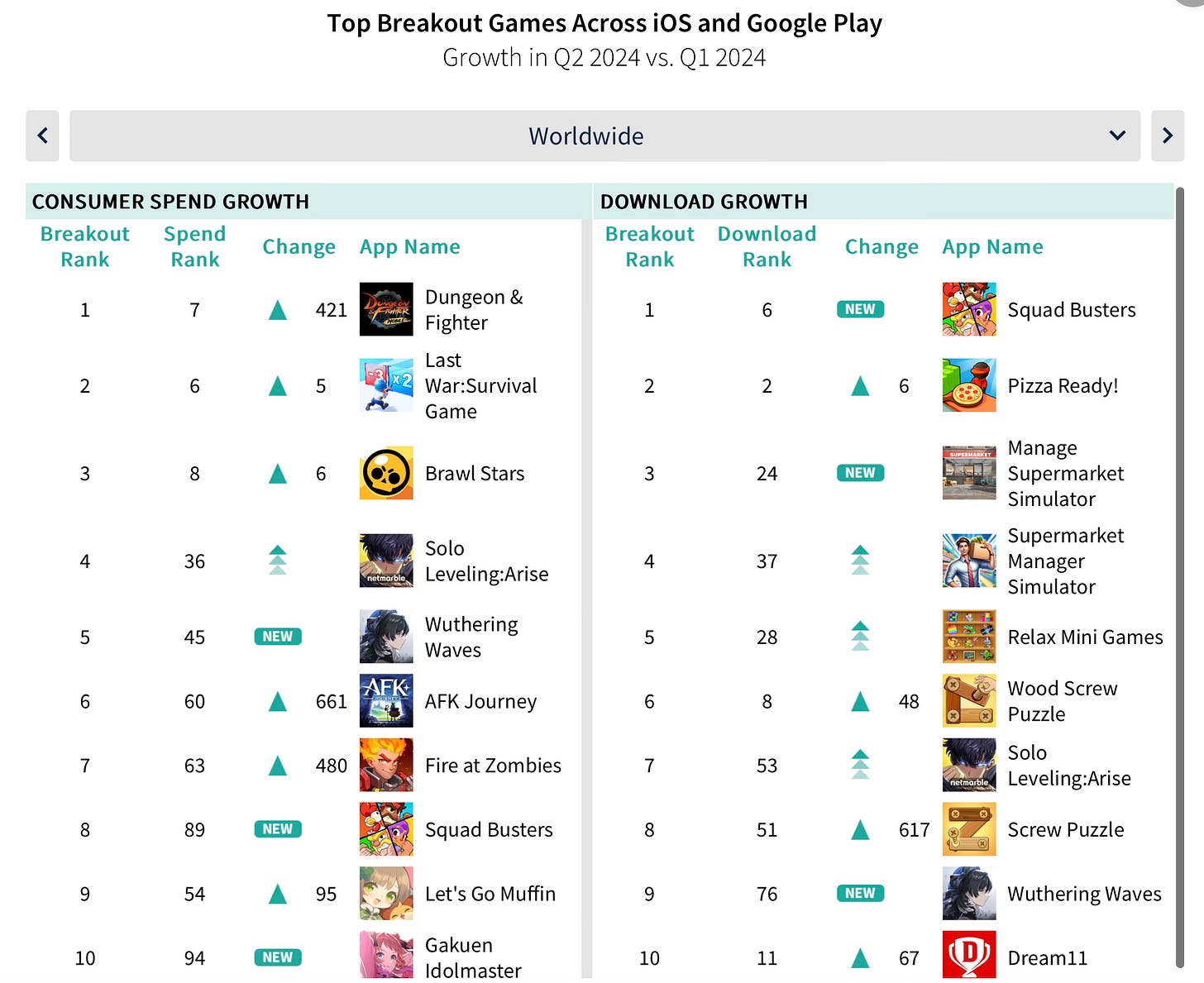

The leaders in revenue growth for the quarter were Dungeon & Fighter, Last War: Survival Game, Brawl Stars, Solo Leveling: Arise, and Wuthering Waves. In terms of downloads, the leaders were Squad Busters, Pizza Ready!, Manage Supermarket Simulator, Supermarket Manager Simulator, and Relax Mini Games.

Advertising Market Overview

Digital advertising spending grew by 10-25% in North America, Europe, and Latin America in Q2 2024.

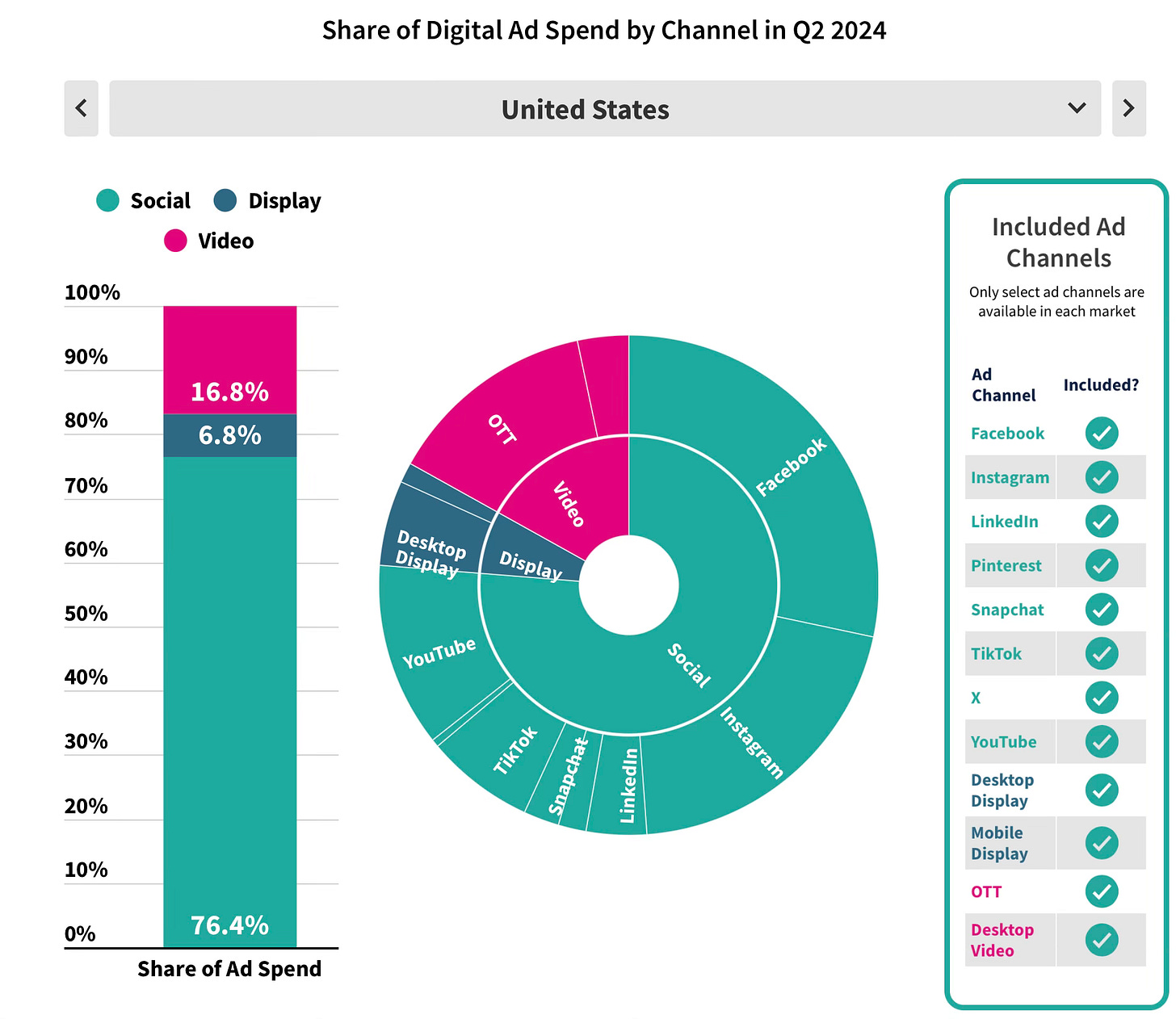

Social networks account for 3/4 of marketing spending in the US, Latin America, and Europe.

Meta's products dominate the advertising market in the US. However, TikTok showed an impressive 28% growth when comparing Q2'24 with Q2'23. The video advertising segment, especially OTT, grew significantly, up 35% over the same period.

The only platform that saw a decrease in ad volume in Q2'24 was X (Twitter), which fell by 35% YoY.

The growth in spending is driven by non-gaming apps. Spending on gaming apps is falling in North America, Latin America, and Europe.

Noteworthy is the case of Squad Busters. Supercell's large-scale advertising campaign allowed Tencent to become the leader in advertising growth in Q2'24. More than 70% of the advertising spending for the Squad Busters campaign was on YouTube. Supercell also actively invested in advertising for Brawl Stars.